What Are the Risks?

(Please note that our senior digital analyst David Grider, who writes our weekly crypto column, is sitting in for Tom Lee for this particular note. This is part three of a three part series. Tom will return to writing Tom’s Take shortly) Part 1 is available here. Part 2 is available here.

What are the Risks?

Following March lows, the global macro picture has improved, and crypto prices have risen by nearly 55% in tandem. Our calls for bullishness near the market bottom came with the recognition of current uncertainties at the time, but our caution in several of those areas has since diminished. But risks remain and we’re are keeping an eye on them.

In terms of market structure:

(1) crypto remains afflicted with lower but improving liquidity for now, compared to levels of February and early March. According to Coinmarketbook, Bitcoin buy support within 10% of the orderbook has risen to $160 million from mid-February lows of $55 million but remains off the $225 million to $500 million levels seen in the month prior to the sell off. Bid/offer liquidity on futures contracts paint a similar but somewhat better picture, with spreads well off March highs and almost back near prior levels, according to Skew.

(2) Crypto miner capitulation risks have abated now that prices have risen. We’ve seen data suggesting miners were selling more than they were mining during late March. It’s possible the sell-off marked the flush out of miner coin inventories that was needed to put markets on healthier footing. But this does not mean investors should assume the risk is gone entirely.

The Bitcoin block reward halving in two weeks will mark an important test indicating the financial health of the mining ecosystem. On the surface, we expect the new supply reduction to be bullish for coin prices over the long run. While we lean towards optimism, we are keeping an eye on how the medium-term picture immediately following the halving will play out once miner revenue has been cut in half.

If Bitcoin prices show any prolonged weakness following the halving, it may cause unprofitable miners to shut down. This poses a further risk to coin prices if those same miners have material balance sheets of coins that then must be liquidated in that process. This could cause selling pressure from existing supply to increase more than the offset of new supply reduction temporarily. The open question in our mind- is there still a material segment of the mining market exposed to this risk or were they flushed out last month while those remaining are hedged?

Additionally, there is always the concern of possible regulatory crackdowns, whether through (1) U.S. Treasury action; (2) Exchange crackdowns, (3) a tax response from the IRS; manipulation accusations from the CFTC; and SEC moves on ICOs. Privacy issues remain as well.

The so-called known unknowns of possible events include serious hacking; a destabilizing code bug; and an old-fashioned systemic shock.

The big money question, of course, is how should investors position themselves in this environment?

My broad market view continues to be that crypto is in the second or third inning of a prolonged recovery following the bottom December of 2018, despite the recent bumps and volatility we’ve seen.

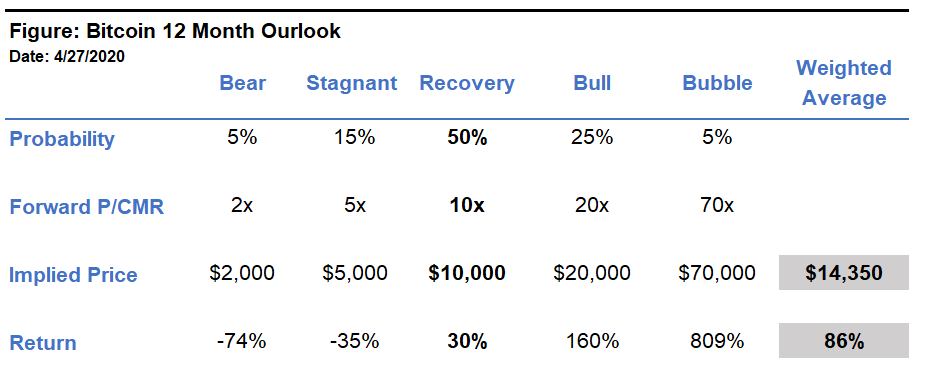

The near-term future seems positive but that’s not a certainty, and no one knows with 100% accuracy what will happen next. However, what can be said is that crypto valuations look reasonably cheap. That said, while I don’t think it’s likely we go back to the mid-March levels, it doesn’t mean they can’t get cheaper. If they do, I’d view it as an opportunity to get more aggressive as prices become more attractive. The risk/reward looks attractive to me over next 12 months.

Recommendations

- Portfolio Allocation—overweight crypto assets at 1% to 2% of portfolio exposure vs their market weight at 0.01% for the next three to five years and increase/ decrease exposure as valuations become more attractive or stretched respectively.

- Size Positioning—favor the larger cap, blue chip crypto names over smaller cap and more speculative ones over the medium term until we have greater certainty following the Bitcoin halvening.

- Defensive vs Cyclical—favor more defensive proof of work (PoW) monetary commodity names over more cyclical proof of stake (PoS) names near term, again until we have greater certainty following the Bitcoin halving.

- Asset Selection—Overweight Ethereum relative to Bitcoin during the next six to 12 months. Underweight Ripple relative to market.