Bitcoin Proving to Be a Macro Hedge…

March 6

Fair Value: $13,000-$15,0000

If ever the view that “crypto is a macro hedge” is to be put to the test, then 2020 would seem to be that time. Thanks to the fear and loathing created by the outbreak of the coronavirus, the ripple effects of COVID-19, as it’s known, is far reaching.

We are seeing pure havoc in fixed income markets (the yield on the U.S. Treasury 10-yr note at historic low); turmoil in equities (U.S. stocks down 12% from highs) and, to top it off, panic buying of toilet paper and hand sanitizer. Bitcoin (BTC) was created after the 2008 Great Recession and no event, until COVID-10, stressed both the real and financial world in this way.

In 2020, Bitcoin is proving to be the best hedge against current macro risks, up 27% , surpassing gold ,+10%, and even rallying long bonds,+23%. Even as there’s been a stampede into bonds and gold, Bitcoin has outperformed both. And this is all the more impressive considering that BTC was the best performing asset in 2019, up +92%.

Indeed, crypto as a whole is actually doing very well so far this year, with many digital assets outpacing Bitcoin: Chainlink +167%, Bitcoin SV +148%, Tezos +129% and even Ethereum +77%. In other words, despite the calamity and disruption in financial markets, crypto assets are doing well and providing a hedge.

With rollercoaster equities market, one might ask why is Bitcoin and Crypto beating other asset classes? There are a number of reasons for this. At the fundamental level, however, our view remains that digital assets are ‘network value’ based. Hence, increasing the user base grows the value of the platform.

I estimate that less than 500,000 people use crypto today. Thus, the future growth is not only orders of magnitude faster than overall world GDP, but more importantly, future crypto growth is largely ‘uncorrelated’ to future GDP growth. Hence, it should be a macro hedge.

In other words, it is not the ‘store of value’ argument, but rather crypto is proving to be useful here. With interest rates in the U.S. reaching remarkably low levels, it is causing US bank equities to weaken – U.S. banks are the worst performing sector this week. Thus, digital assets are more useful.

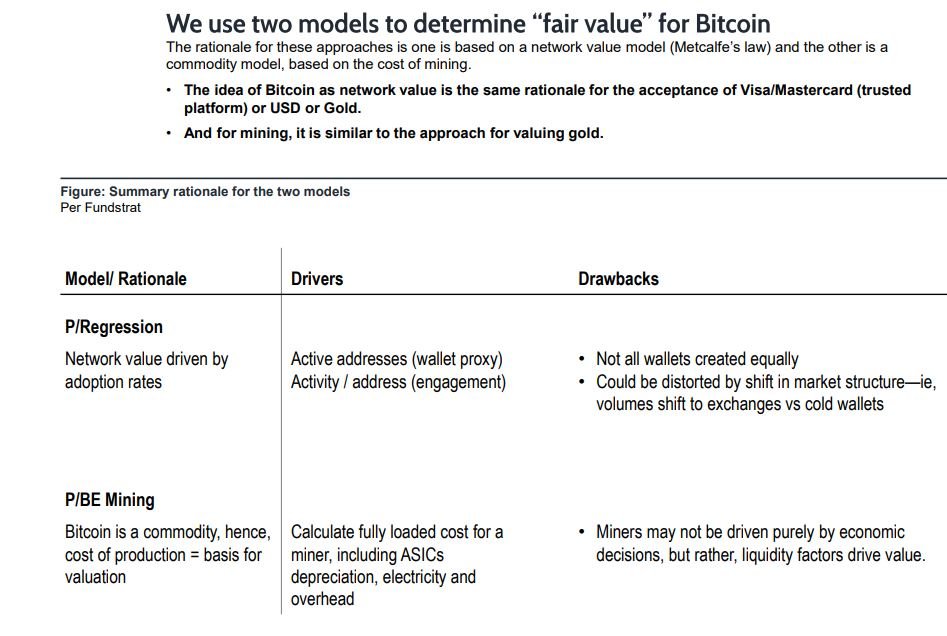

Where is fair value? About $15,000 based on P/Regression and $13,000 based on P/BE mining. Our 2-variable price regression model (see nearby chart) has done a good job of explaining Bitcoin’s fair value of the past few years, It signaled Bitcoin was overvalued on July 2019 (near the top) and last October flashed Bitcoin was undervalued (near the bottom). Currently, Bitcoin has substantial upside implied by these models.

What could go wrong? Bitcoin and crypto are outperforming because, in our view, they are largely uncorrelated to macro. But the heightened hysteria that is fueling further distrust of traditional financial institutions is also fueling crypto demand, in part, as well.

Thus, the greatest risk is financial institutions see fiat flight and try to limit fiat to crypto on-ramps. Absent this, however, crypto has room to rise.

Bottom line: I have stated that we believe 2020 returns for Bitcoin and crypto should exceed the +92% rise seen in 2019. The halvening is in 2 months, and I see this as another positive catalyst.

Thus, I recommend adding crypto exposure. For those with constraints and can only buy listed entities, the following are listed crypto in the US: GBTC (Bitcoin), ETHE (Ethereum) ETCG (Ethereum classic).