Bitcoin Reachs 200 day moving average, bull case for BTC strengthened

January 29, 2020

One of the biggest asset class surprises last year was the 92% gain in Bitcoin (BTC). Twelve months ago, few besides our shop would have credited such an outcome. So far in 2020 the cryptocurrency is continuing to roar ahead.

Though it’s early in the year, BTC is up 26% YTD, already the best showing of any major asset class, and building on that big 2019 move. The case for owning Bitcoin has strengthened even since the start of the year, as two additional tailwinds recently emerged (see below), bringing to five the positive convergences I envision for BTC this year.

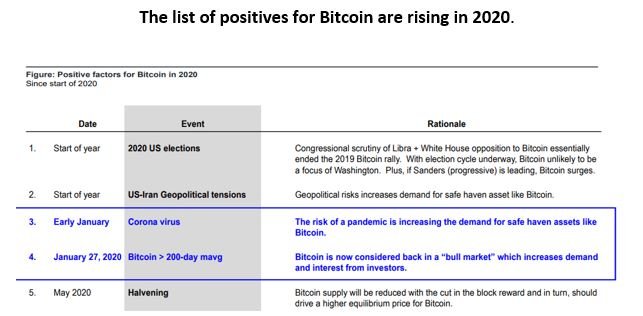

The list of positives for Bitcoin are rising in 2020.

1 The coronavirus outbreak, and the associated uncertainty both in terms of disease spread and of economic impact is increasing demand for “safe haven” assets. Thus, gold and Bitcoin are both up sharply since then. In fact, Bitcoin’s correlation to the S&P 500 has flipped in the last 3 months from +13% to -10%—a pretty meaningful swing.

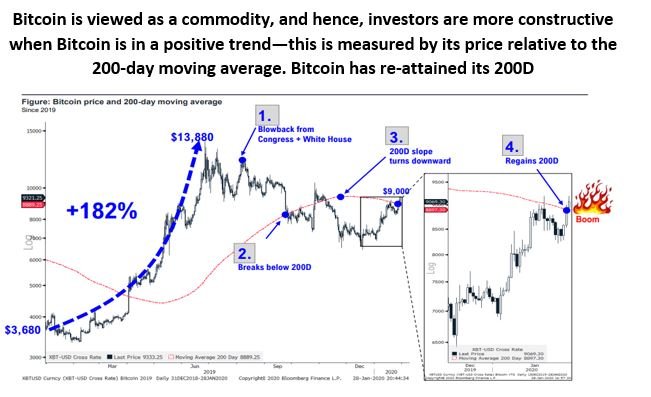

2 On 1/27/2020, BTC traded above its 200-day moving average for the first time since October 2019. I believe that moving above the 200-day is validating that Bitcoin is back in a “bull market.” The data supports this. Since 2010, when Bitcoin is above its 200 dma, the six-month forward return averages 193% and up 80% of

Bitcoin is viewed as a commodity, and hence, investors are more constructive when Bitcoin is in a positive trend—this is measured by its price relative to the 200-day moving average. Bitcoin has re-attained its 200D

the time, while when BTC is below the 200 dma the average gain is only 10% with a 36% win rate.

The total number of positive convergences/tailwinds now numbers five in 2020 with the other three being: (i) heightened geopolitical tensions US-Iran; (ii) US election cycle in 2020 (shifts Washington focus away from crypto); (iii) Bitcoin halvening. Plus, if Sanders (leftist ) is leading, Bitcoin surges.

● What could go wrong? The biggest risk, in our view, is that Crypto demand weakens for retail investors. This is not the case, at the moment, but our thesis remains that Bitcoin and crypto is largely a retail story over the next 3-5 years.

Bottom line: 2020 looks to be strong for crypto. The leadership is broadening. In the past four months, the best performing crypto platform is BSV, up 258% and privacy coins are leading (+35%). Privacy leadership makes sense given heightened geopolitical risks and also the coronavirus risks.

.

A Large List of Things can G o Wrong

Cryptocurrencies, by nature, derive their value from network value/ adoption—this is the same basis for the valuation of USD or gold. Hence, the risks to crypto are impediments to adoption growth or a reduction in the utility value of digital assets. Below is a list of risks.