Part 5

Cryptocurrency Investing in Modern Portfolios

Cryptocurrency investing is not for the faint of heart, or at least it hasn’t been in the past. Investing in Bitcoin is hard and is largely uncharted waters for many market participants. While at times it has been correlated to mainstream investment assets, at other times it hasn’t. This is why we advise investors to think of crypto-investments and Bitcoin in particular in the long-term. We treat it like a stock you want to own, or an emerging market you want to invest in; after all we are well-established equity analysts. If you are used to investing in equities, our rules and analysis will make sense to you and we also think that a lot of our crypto analysis dovetails nicely with our wider macro-analysis.

Many people ask us how we can be bullish on US Equities and Bitcoin at the same time. Isn’t Bitcoin a countercyclical hedge, like gold? We think investing is Bitcoin is much more than this. While a similar relationship has been observed during some past market conditions, one of the benefits of Bitcoin as an asset is that it is not highly correlated to other major asset classes, making it an excellent diversifier in portfolios that provides a lot of upside. We have developed proprietary valuation models for Bitcoin that we believe approximates it’s fundamental value in a way equity investors can understand. We certainly wouldn’t want to invest in the crypto market without the tools we’ve developed.

We are bullish on Bitcoin and think the US dollar will maintain its reserve currency status.

We are bullish on US equities for other reasons we won’t elaborate on too much here, but we will say that we believe investing in Bitcoin is a generational trade. You may hear through media coverage or other crypto sources that adoption is way higher than we think it is. We think about half a million people trade cryptocurrency regularly, which is quite a nascent market. We can offer investors wishing to learn about and invest in the space better tools, capabilities, and analysis than any other service.

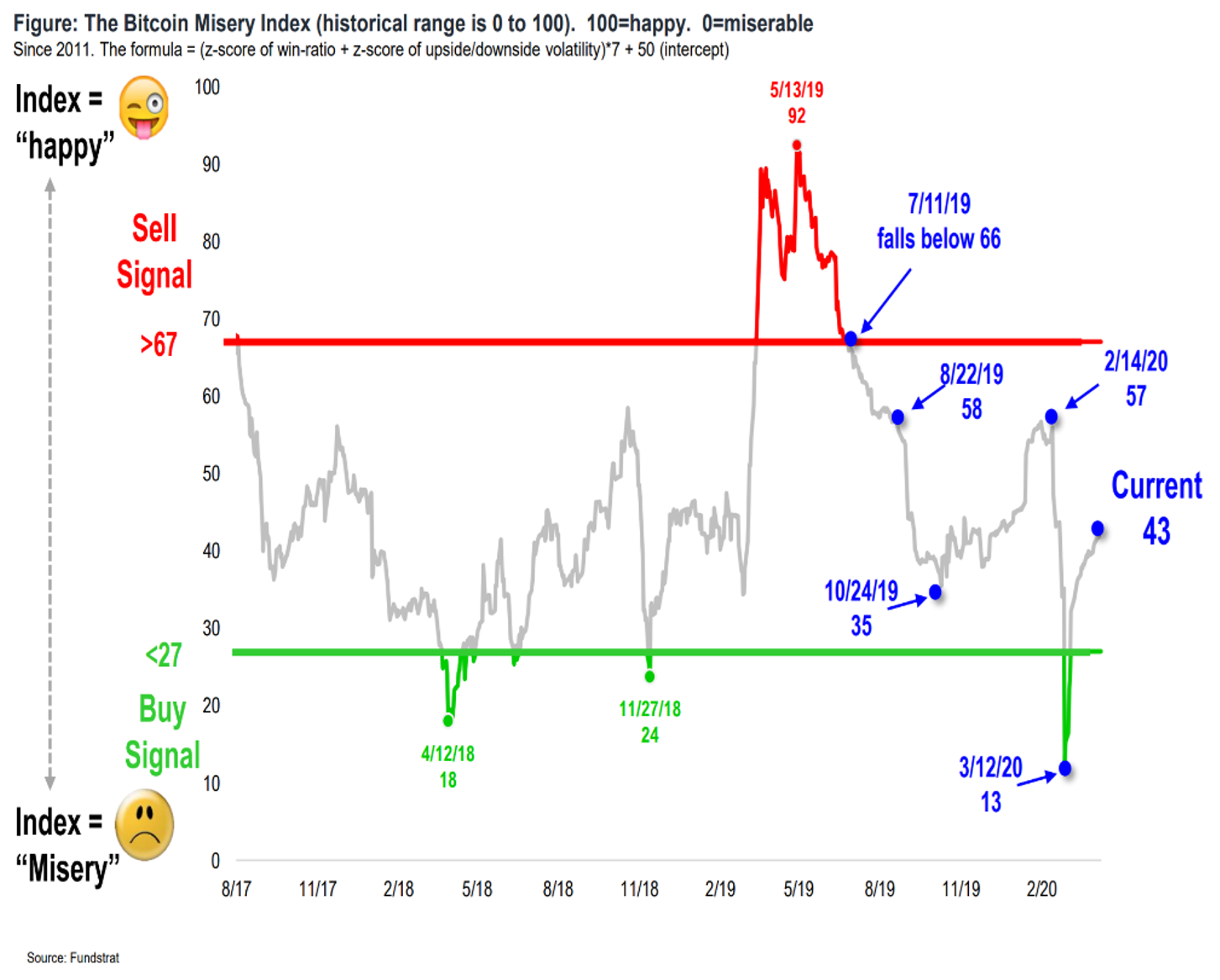

We also have Tom Lee’s 10 Rules Of Investing In Bitcoin which is the first quantitatively informed roadmap investors can use as a firm and actionable guide when investing in Bitcoin and other cryptos. Additionally, some of our proprietary tools like our Bitcoin Misery Index are only available to our members. Our Senior Crypto-Research Analyst David Grider has also developed a proprietary valuation model for Bitcoin that we think will be particularly useful for veteran equity investors.

-

Bitcoin Investing: Is Bitcoin a Good Investment and How Much Should I Invest in Bitcoin?

-

What is All The Hype About Bitcoin?

-

Bitcoin compared to other assets

-

Bitcoin and inflation, how is Bitcoin related to inflation?

-

Cryptocurrency Investing in Modern Portfolios

-

Bitcoin as a Store of Value

-

The Bitcoin Halving and its impact

-

Is Bitcoin a Risk On Asset or is Bitcoin a Risk Off Asset?