Part 6

Bitcoin as a Store of Value

The internet had very few users in the early 90s. We think investing in Bitcoin now is like getting exposure to the internet then. Those few users, in its early stages were associated with low stock prices of names that are now the bluest of the blue-chips. We did an in-house study to determine what was behind the rise of the best performing stocks on the market like the FAANGs. We surprisingly determined that about 75% of the gains from those stocks actually has very little to do with company management, new features or the like and more simply to do with the global adoption of the Internet. In other words, the growth that you are getting exposed to in the best of the growth stocks is network growth; the growth of the internet users, by being monetized, is what outperformed wider economic growth. Investing in Bitcoin has paid off to those willing to brave the price swings.

In the early 1990s the internet had tens of millions of users and today it has 4 billion. This is why those companies went up so far in value. They held valuable digital ‘real estate’ in a new economy at the dawn of the information age. If you bought exposure to the internet you did well. Bitcoin’s platform is currently dominated by a first generation of users, that will change. As long as human beings are consistently using computers, Bitcoin is more permanent than anything including seemingly mighty political orders and values. Investing in Bitcoin is investing in decentralized internet finance, the internet economy if you will. The intrinsic value of a de-centralized ledger that creates enormous potential for new economic efficiencies is what we are buying. The network effects that benefitted the FAANGS will also benefit Bitcoin, because it is a proven protocol that works. Privacy is diminishing and the premium on privacy for legitimate and illegitimate reasons will persist and increase.

Like SWIFT, Bitcoin is the first, and like SWIFT we believe that there’s a lot of value to being the first in the situation at hand; where network effects drive returns. One key characteristic that they share is that even though technology exists to have a better process than the monopolized payments system in the US (you can transfer money instantly from phone to phone in Somalia), the network effect gives continued relevance and value to the platform. Given the magnitude of the problem that Bitcoin solves, and the changing dynamics of whose and what economic activity goes in and out of favor with the state over time, and which currencies fall and so forth, there will always be a need for Bitcoin, and there will always be a community of people who will find and store value in it. Investing in Bitcoin should only be done because you think it has value. We do.

-

Bitcoin Investing: Is Bitcoin a Good Investment and How Much Should I Invest in Bitcoin?

-

What is All The Hype About Bitcoin?

-

Bitcoin compared to other assets

-

Bitcoin and inflation, how is Bitcoin related to inflation?

-

Cryptocurrency Investing in Modern Portfolios

-

Bitcoin as a Store of Value

-

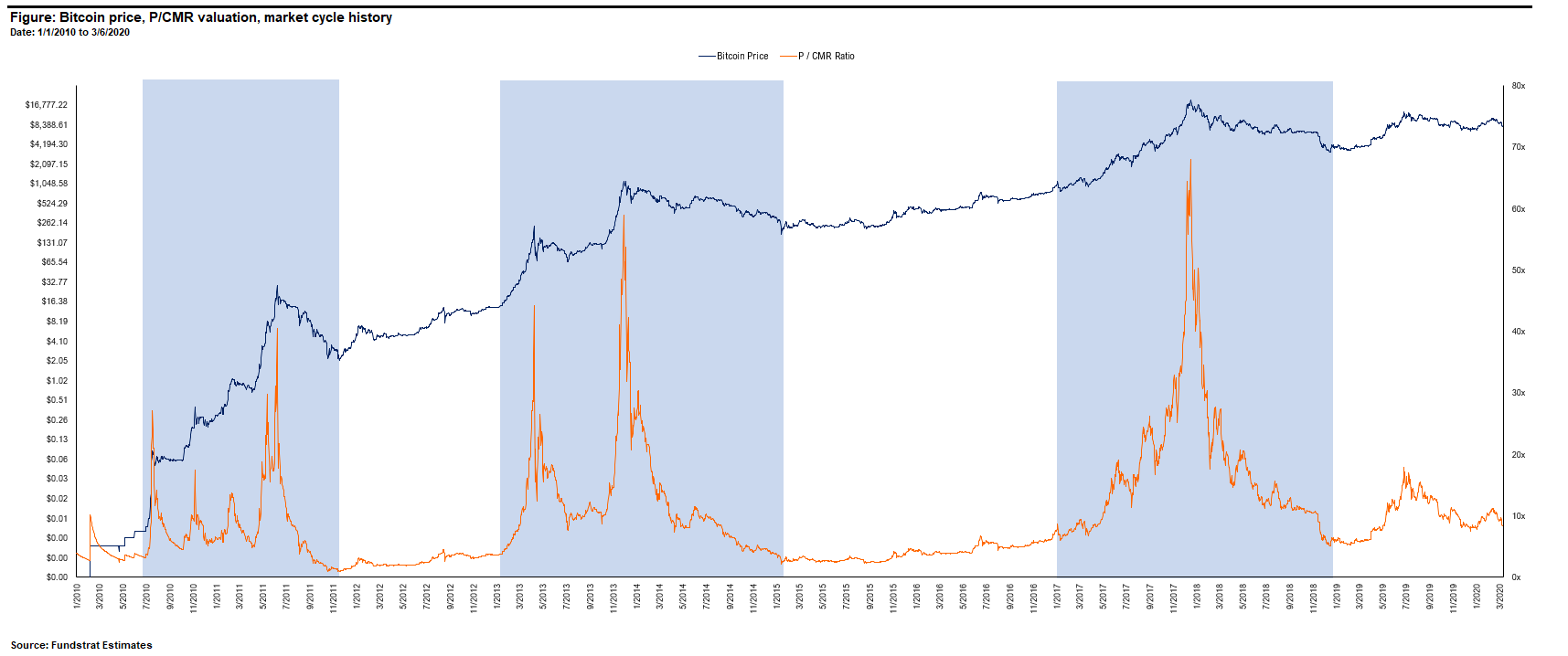

The Bitcoin Halving and its impact

-

Is Bitcoin a Risk On Asset or is Bitcoin a Risk Off Asset?