Part 4

Bitcoin and inflation, how is Bitcoin related to inflation?

We think that anyone who is investing in Bitcoin should divorce themselves from political affiliations, preconceived notions and biases and treat it as a simple asset that is subject to the laws of supply and demand, and which we think will enjoy enormous beneficial network effects. The ability of Bitcoin to decentralize commercial transactions is a profound invention that many people may not appreciate. That why to us investing in Bitcoin is more like a growth investment, or investing in companies that made cloud work first.

There is no doubt that Bitcoin started out as a political statement and many initially viewed it as closer to a toy than a store of value early in it’s history. While investing in Bitcoin may have been a political statement, now it something that has made many people rich. The easiest way to describe it would be in the context of a class of stocks we’ve been recommending on the equity-side, casinos. These were out of the risk-tolerance of many in March, but those who took our advice profited handsomely if they purchased them.

Now imagine the entire economy is a casino company. What would happen to the economy, and the operating leverage of the company, if the chips kept track of themselves? The Bitcoin White Paper authored by a pseudonymous author who referred to himself as Satoshi Nakamoto, was a modern-day economic equivalent to when Martin Luther nailed his Ninety-Five Theses to The All Saints Church in Wittenburg on the 31st of October, 1517. Once nailed, it could not be undone and the consequences for human society could not have possibly been comprehended at the time. Thesis number 86 was stated, when translated into English as the following: “Why does the Pope, whose wealth today is greater than the wealth of the richest Crassus, build the basilica of St. Peter with the money of poor believers rather than his own?”

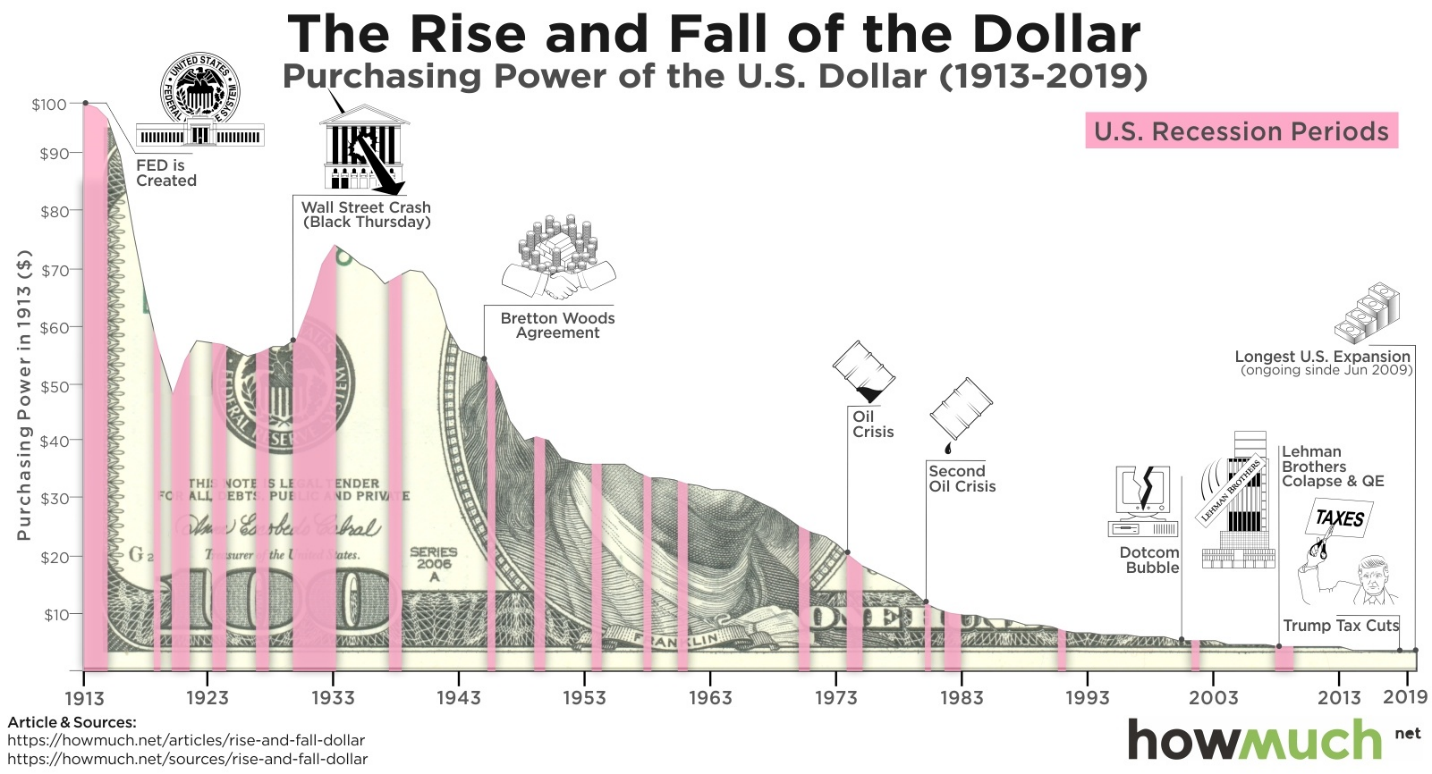

The primary practice that provoked this first act in one of the greatest ideological transformations in human history was the unseemly practice of the Church charging indulgences to poor parishioners in exchange for their ‘assistance’ in getting God to move the souls of their loved ones from purgatory to the eternal Kingdom of Heaven. Many see a similarity between the obviously corrupted incentives in this arrangement and the incentives of the state with a limitless printing press. Governments have tended to inflate away their debt, at the expense of the lower income quintiles, with the alchemical Central Bank power that seems to flout the incontrovertible law of scarcity.

Hence the employment of Luther’s 86th thesis in our description of Bitcoin, and what it was created to achieve. Unlike fiat currency which can be magically shifted from ‘purgatory’ or the Fed’s balance sheet, to member banks and inflated and printed with abandon, Bitcoin is inherently scarce (by virtue of it’s innovative design) and is deflationary. This means, as long as users continue to go up and there is consistent demand, compared to most demand assets it’s pretty easy to determine what the long-term path of Bitcoin will be; up. Investing in Bitcoin is by no means easy, however, we do think it will be incredibly profitable for those willing to brave the risk.

-

Bitcoin Investing: Is Bitcoin a Good Investment and How Much Should I Invest in Bitcoin?

-

What is All The Hype About Bitcoin?

-

Bitcoin compared to other assets

-

Bitcoin and inflation, how is Bitcoin related to inflation?

-

Cryptocurrency Investing in Modern Portfolios

-

Bitcoin as a Store of Value

-

The Bitcoin Halving and its impact

-

Is Bitcoin a Risk On Asset or is Bitcoin a Risk Off Asset?