Crypto Research

257 Results

FOMC RECAP This week, investors were provided with one of the bigger “head-fakes” in recent history. The May FOMC meeting took place on Tuesday and Wednesday, after which Jerome Powell announced a 50-bps rate increase to the target Fed Funds rate and plans to commence with the balance sheet runoff less than a month from today. While these measures were largely priced in, his statements did take the risk of...

WEEKLY RECAP This week’s price action left much to be desired by those trading in either direction as most major cryptoassets continued to exhibit sideways price action. After briefly falling below $38k on Tuesday, BTC found a bid and has since recovered, sitting around $40k at the time of writing. Similarly, ETH is below $3.8k but recovered alongside bitcoin and is once again challenging the $3k level. The rest of...

WEEKLY RECAP Outside of a Sunday-night dip, cryptoassets have performed robustly, with bitcoin reclaiming the $40k level and ether reestablishing its perch above $3k. This week, crypto investors ventured further out on the risk curve as DeFi and Web3 sectors outperformed currencies. Interestingly, the privacy sector recorded another green weekly candle, as privacy-focused names including Monero (XMR), Zcash (ZEC), and Decred (DCR) each increased more than 15% over the last...

WEEKLY RECAP It was yet another choppy, risk-off week for crypto, as investor concerns over inflation and the impending Fed response grew. Last week, we discussed how the March FOMC meeting minutes discussed an expeditious plan for rate hikes and a roadmap for quantitative tightening starting as early as May. This clearly reverberated throughout both traditional and crypto markets over the past week. On Tuesday, March CPI figures were released,...

Meeting minutes from the March FOMC meeting were released today. The Fed’s posture leaned decisively hawkish as they introduced the prospect of QT starting as early as May.Despite the resurgence of macro headwinds, the bullish trend upwards for realized cap continued this week, indicating renewed demand for bitcoin.We revisit our LFG model from last week and adjust inputs for LFG’s recent purchasing activity.Staked ETH continues to march higher as confidence...

WEEKLY RECAP It was another week of green candles across the crypto ecosystem as bitcoin flirted with its 200-day moving average for the first time in several months. Like last week, the more speculative sectors outperformed the prior 7-days, with the once-beleaguered DeFi sector continuing to turn some heads. _Source: Messari_ Below we examine some of the reasons we think that this relief rally mirrors those seen in late 2021...

WEEKLY RECAP Cryptoassets performed strongly for the second consecutive week, as prices have seemingly become less responsive to negative headlines surrounding the war in Ukraine and the risk of excess hawkishness from the Fed. It was another “risk-on” week within crypto as smart contract platforms performed the best on a size-adjusted basis out of any other sector. Much of this outperformance stems from the recent optimism surrounding Ethereum’s merge and...

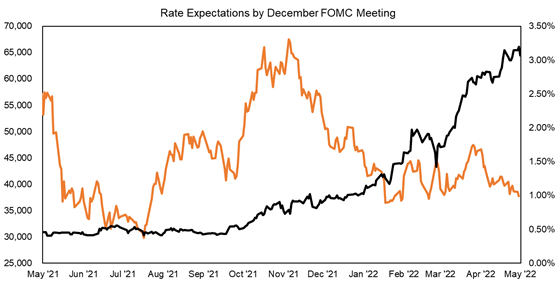

WEEKLY RECAP For the first time since December 2018, the Fed announced a benchmark interest rate hike of 25 bps and signaled for six more hikes this year. It is apparent that the market had priced this in (discussed further below) and is content with the lack of increased hawkishness despite rampant inflation. Bitcoin and ether increased in lockstep with equities but remain largely range-bound, currently straddling $40k and $2.6k,...

WEEKLY RECAP The global crypto market continues to exhibit a range-bound choppiness, waxing and waning on the latest headlines. We saw ETH and BTC start the week above the $43k level after benefitting immensely from Russian sanctions and the narratives surrounding them. Since then, markets have retreated as commodity prices skyrocket – oil hit $130 per barrel, wheat prices reached a 14-year high, and a metal exchange had to roll...

We continue to focus on the key narratives surrounding bitcoin and assess recent adoption trends driven by Russia’s invasion of Ukraine.We review on-chain data (realized cap, STH SOPR, and wallet addresses) to determine whether there is a sustained level of organic demand supporting the recent uptick in bitcoin’s price.Recent price action gives us some confidence that there will be buyers that step up in the $34k-$35k area should we witness...

Markets continue to experience turbulence in the face of growing geopolitical tensions and full-scale war between Russia and Ukraine.We examine recent growth in spreads on major exchanges, highlighting a persistent low-liquidity environment.Option volumes point to the likelihood that many investors are maintaining long positions while hedging risk with derivatives.The market is already questioning the ability of the Fed to raise rates as indicated by a decline in projected rate hikes.We...

GEOPOLITICAL NOISE After briefly eclipsing $45k and $3.2k, both bitcoin and ether tumbled on Friday afternoon following indications from the US government that a Russian invasion of Ukraine was imminent. On Tuesday, these fears were quelled when reports surfaced indicating that troops were being removed from the Ukrainian border and crypto rebounded alongside equities. At the time of writing, the global crypto market is slightly lower on the 7-day chart,...