Initial Takeaways from the Implosion of FTX

Key Takeaways

- We break down the events of the past several days, culminating in Binance’s LOI to acquire beleaguered crypto exchange FTX.

- There is sufficient reason to believe the risk of further contagion remains due to defaults on loans to Alameda.

- From a strategy perspective, we think it is wise to reduce exposure to Solana (SOL 7.09% ) in the near term.

- Further, given the current unknowns, it may be prudent to raise some cash in the event of additional drawdowns across other major cryptoassets.

SBF vs. CZ

As we addressed in our daily note on Monday, one thing few can argue is that crypto always keeps things interesting.

As many know by now, two industry giants, FTX CEO Sam Bankman-Fried (SBF) and Binance CEO Changpeng Zhao (CZ), sparred over the weekend following circulating rumors that FTX was on the verge of insolvency.

To recap recent events:

- Rumors initially emerged from a Coindesk report last week implying that a large percentage of SBF’s trading firm Alameda’s assets were denominated in FTT. FTT is the exchange token of SBF’s crypto exchange FTX.

- The prevailing logic was that the degrading health of the FTT token might result in the inability of FTX to fulfill customer withdrawals due to the co-mingling of funds between FTX and Alameda.

- CZ, seeing an opportunity to pounce on a competitor, took to Twitter to publicly announce that the leading Asian crypto exchange would be selling its sizeable FTT holdings to the market. This caused downward price pressure across cryptoassets on Sunday, particularly for FTT and SOL 7.09% , another asset held in size by Alameda.

- In response to the aggressive tactics employed by CZ, current Alameda CEO Caroline Ellison tried to dispel concerns over Alameda’s liquidity and offered to purchase all of CZ’s FTT to reduce market impact.

- Similarly, SBF announced that the concerns over FTX solvency were supposedly unfounded and that the exchange had enough assets to meet all customer liabilities. We further noted the possibility of an OTC deal taking place, which would have mitigated the market impact on the FTT price. Later yesterday afternoon, however, CZ removed this as a possibility, putting additional sell pressure on FTT.

- As time wore on, the bank run that had been spurred on by CZ started to intensify.

- Last night, FTT broke through the $22 threshold that became a critical psychological level for many (It is now trading MUCH lower than $22).

- Fast forward to this morning, and all withdrawals were paused across FTX International. In a shocking turn of events,SBF took to Twitter to announce that Binance would be acquiring FTX (US entity not included).

Risk of Further Contagion

First, from a practical perspective, those with funds on FTX US should be fine. Withdrawals were never paused on the domestic exchange, only the international entity. Thus, for those operating in the US, your funds can likely be accessed immediately. That said, given the potential for additional contagion, it might be considered wise to migrate those funds elsewhere until there is more clarity on the situation.

Second, based on the facts and circumstances made available to us today, there is clearly a sizeable hole in customer liabilities on the FTX International level. This shortfall will need to be plugged expeditiously by FTX (presumably with the help of Binance). The key questions that remain are:

- What is the relative magnitude of FTX’s shortfall?

- How did that hole in the balance sheet appear in the first place?

The answers to both of those questions remain unclear based on the information confirmed to us thus far. However, it is reasonable to assume that some mix of the following took place:

- FTX lent Alameda USD loans collateralized by FTT.

- Alameda used those funds to either make ill-advised or simply very illiquid bets across the crypto market.

- The ensuing bank run caused widespread selling pressure in the FTT collateral, essentially sending the collateral to 0.

- There likely exists a shortfall in assets required to meet customer liabilities, the size of which is unknown, but many speculate to be in the billions of USD.

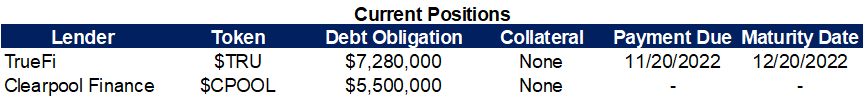

Alameda is not part of the proposed Binance acquisition, so it is unlikely that they will make it out on the other side of this. They will, however, be scrambling to liquidate assets on their books to meet any debt obligations, of which there are many. In addition to the loans owed to FTX, Alameda is also an active participant in DeFi. Below are some of their known outstanding DeFi obligations.

The Takeaways

Based on our conversations, most industry participants are shell-shocked by this event. SBF was widely seen as untouchable and the poster child for consumer protection in crypto. Thus, there is still a lot to process and perhaps a few more shoes to fall. Key uncertainties that persist:

- How much contagion remains? Either Alameda or the lenders to whom they defaulted will presumably be forced sellers. Among the assets owned by Alameda, $1 billion was in the form of both locked and liquid Solana.

- How much appetite will there be to create credit in the near term, given what has transpired?

- Will the deal even go through? The deal proposed by Binance and FTX was non-binding and pending diligence and, therefore, might not even go through. There are also already concerns over anti-trust regulations in Europe. This could cause further turmoil among crypto investors.

- What are the regulatory considerations? While our team and many in the industry disagreed with SBF on his approach to regulation (he was more heavy-handed towards crypto), he was the source of a lot of lobbying money going to Capitol Hill to fight on behalf of crypto market participants. This is likely more of a longer-term concern.

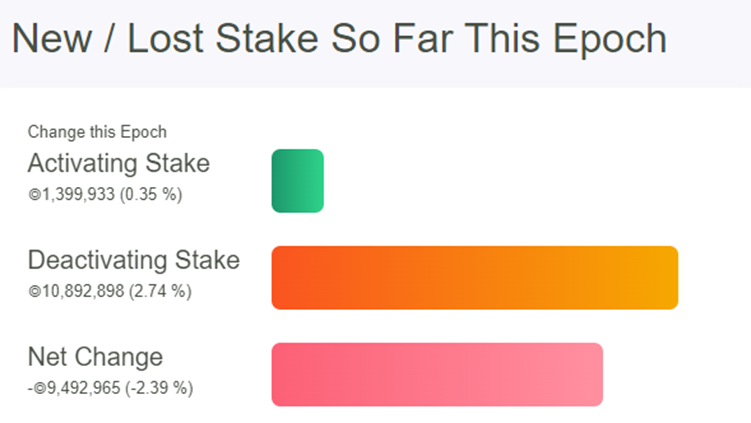

In addition to the supply overhang from Alameda, there is evidence that other market participants might be moving to reduce allocation to Solana in the immediate term. Below we see that this epoch has seen a considerable net reduction in SOL staked.

A reduction in the amount of SOL staked might indicate that investors are looking to sell all or part of their position. Due to these factors, we think it is wise to reduce exposure to Solana (SOL 7.09% ) in the immediate term.

We believe there is an ability for the Solana ecosystem to eventually recover and remove itself from Alameda’s shadow, but the current liquidity overhang is quite substantial.

Further, given the current unknowns, it may be wise to raise some cash in the event of additional drawdowns across other major cryptoassets. To be clear, the underlying fundamentals, coupled with the potential for a favorable macro setup, should still be constructive for crypto. However, merely based on the number of unknown skeletons that could still be hiding, it is prudent to proceed with caution.

We will continue to analyze the situation as more data becomes available.