Crypto Climbing the Wall of Worry, Flows Suggest There is Still More Work to Do

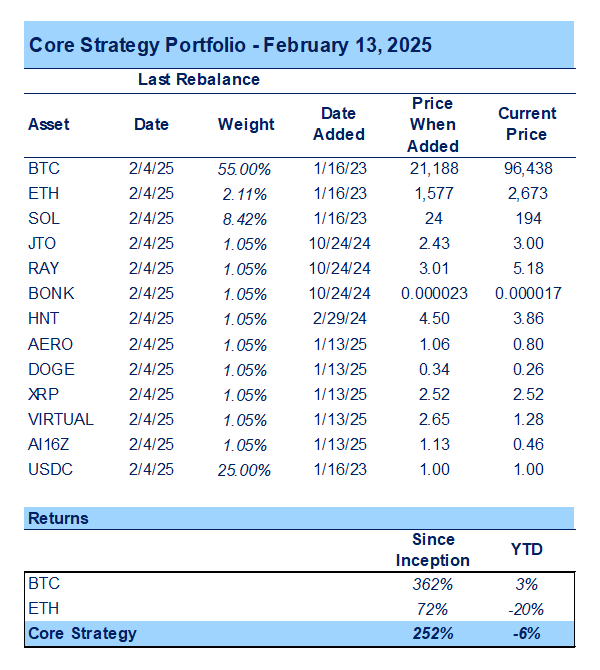

Core Strategy

With lingering trade war talks and robust economic data dissuading a dovish Fed pivot, we think the potential for downside volatility remains elevated. While regulatory developments and institutional adoption continue to bolster the medium- to long-term outlook, no immediate “good news” seems likely. Nevertheless, we still expect crypto to outperform this year. Until we see flows return to crypto, raising cash/trimming altcoin positions appears prudent (BTC dominance higher).

The Semi-Good News

Clients know that, as of late, we have taken a tactically conservative view on the crypto market since the specter of a prolonged trade war arose at the start of the month. We deemed current conditions appropriate for raising some cash and avoiding over-allocating to long-tail altcoins. This stance has been driven by increased risk around tariff discussions, along with stronger economic data suggesting that the Fed is less likely to adopt a dovish posture in the immediate term. Furthermore, while we are excited about potential regulatory developments and the adoption of state-level SBRs, it is unclear whether any of these initiatives will become effective within the next month or two.

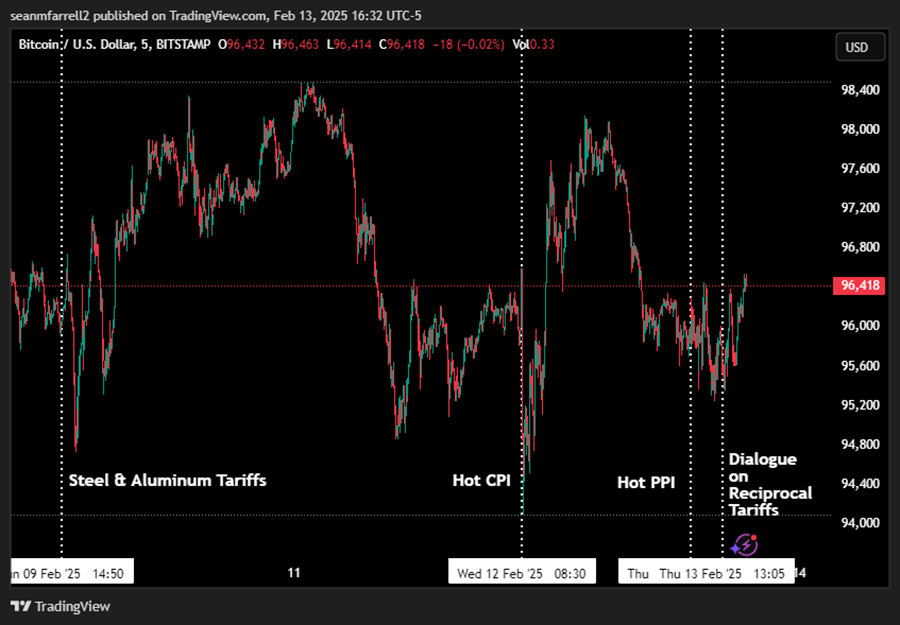

Despite this tactical conservatism, there was some encouraging price action this week worth noting. In several instances, the market absorbed negative news with relative ease:

- Announcement of steel and aluminum tariffs on Sunday evening

- Hot CPI on Wednesday

- Hot PPI on Thursday

- Increased tariff dialogue on Thursday

The crypto market’s ability to start climbing a wall of worry is a good sign, suggesting that higher inflation and some additional tariff implementations may already be priced in.

However, there are a few caveats to consider:

- The steel and aluminum tariffs were not the broad-scope tariffs briefly implemented against Mexico and Canada at the start of the month. They were focused on specific imports and are unlikely to have a large impact on overall price levels in the United States.

- While topline CPI and PPI numbers were both elevated, the primary drivers of CPI were imputed shelter costs and autos. Additionally, the components within these indexes that feed into PCE (the measure most important to the Fed) remained relatively tame. In other words, CPI and PPI were hot enough to keep the Fed from turning dovish, but not so hot as to suggest that crypto just weathered a MAJOR storm.

- Trump’s “announcement” regarding reciprocal tariffs was more akin to an announcement of a future announcement. There were few specifics on which countries would be targeted or how large the tariffs might be. Complicating matters further is the consideration of non-tariff barriers (e.g., VAT taxes) as “tariff-like.” As a result, we have yet to see which countries or regions will be affected most severely and how they might respond.

In summary, it is certainly a positive that BTC remained relatively unchanged this week, indicating some progress in climbing the proverbial “wall of worry.” However, I remain skeptical that we have scaled the entire wall.

Friday Fear

It might seem odd, but I believe a positive day of price action tomorrow (Friday) would be significant for investor sentiment.

The past three Fridays have been deeply negative for both equities and crypto, either due to adverse headlines or a general unwillingness to hold risk over the weekend. A green candle tomorrow could signal that investors are more comfortable with the current level of headline risk from the Trump administration.

The Bad News

As noted above, two major reasons to remain cautious in the immediate term include the lingering uncertainty around tariffs and the Fed’s lack of incentive to pivot toward a more dovish stance.

Another factor is that absent an unforeseen catalyst, crypto is likely to struggle to achieve significant momentum until a comfort around the DXY, 10Y, and tariffs is reached.

In a market with ample downside headline risk (e.g., China threatening to escalate the trade war, hawkish Fed commentary, etc.), capital is less likely to venture as far out on the risk curve as crypto.

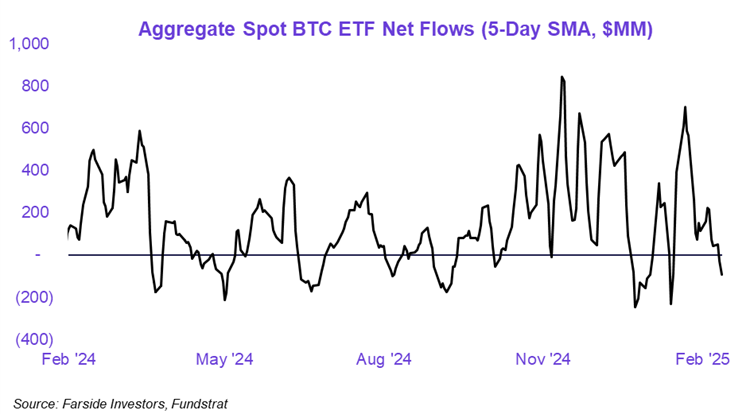

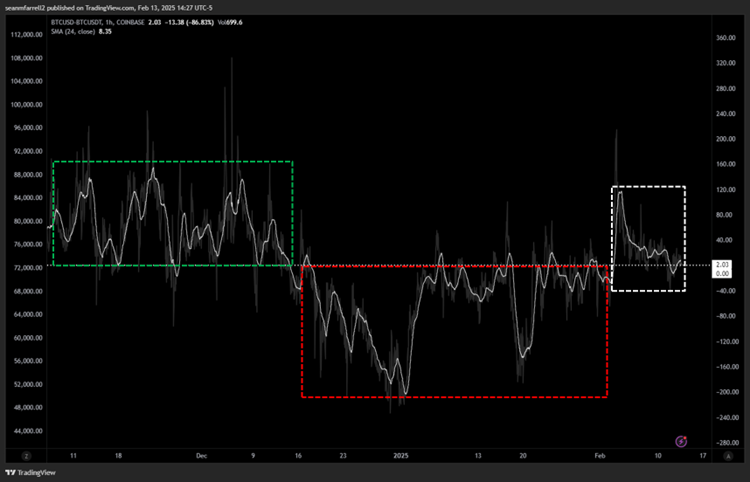

Subpar flows, even amidst this week’s rebound in major equity indices, reinforce this view:

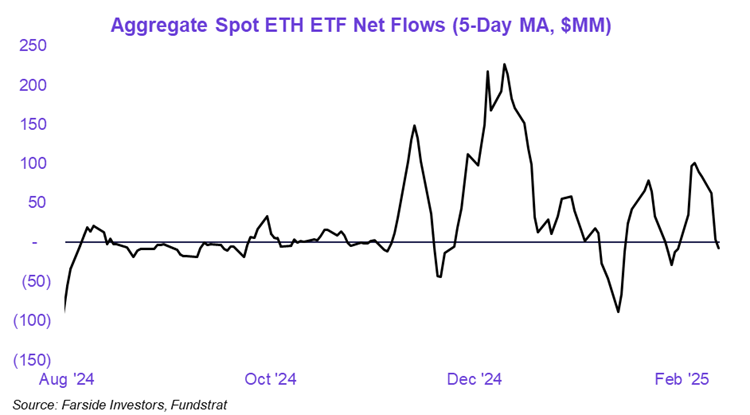

- We have seen outflows from ETFs over the past several days.

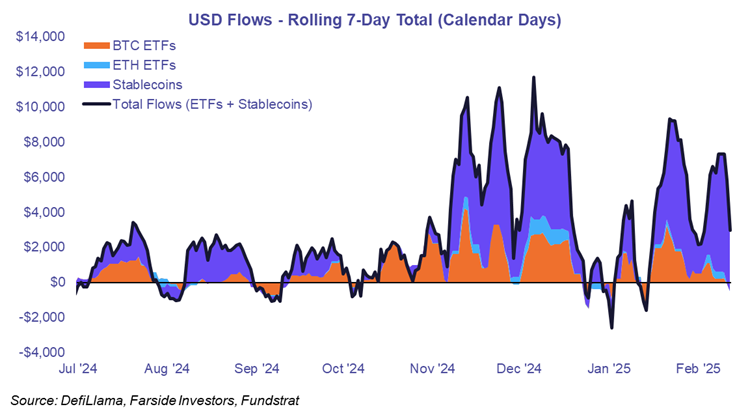

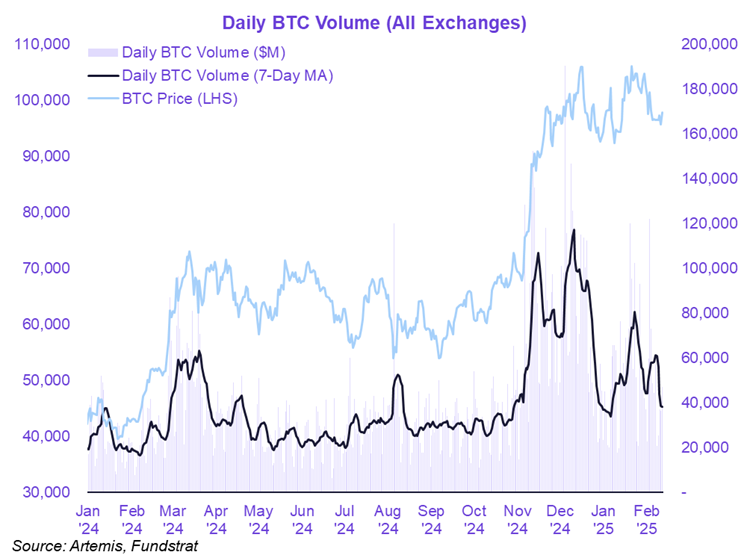

- Stablecoin flows have been ample and consistent, but with volumes now turning lower, it’s possible much of this stablecoin growth is channeled into market-neutral strategies rather than leveraged long positions.

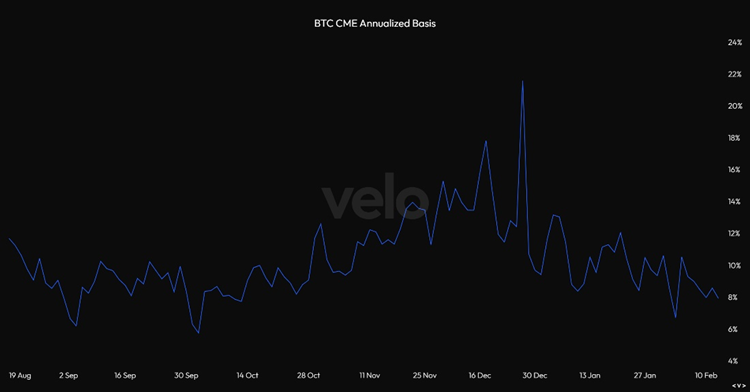

- CME futures basis has dwindled to pre-election levels.

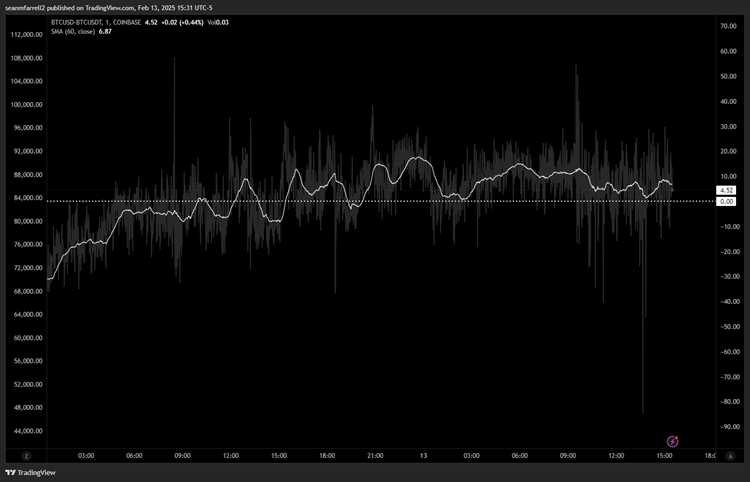

- The Coinbase/Binance spread has oscillated between slightly negative and slightly bullish, signaling more apathy than a strong bullish or bearish conviction.

BTC ETF Outflows:

ETH ETF Outflows:

Stablecoin Flows Are Solid:

But Volumes are Lower:

Not Much Excitement on the CME:

Slight Coinbase Premium Today:

But Trend is More Apathetic than Bullish or Bearish:

A Parallel in Equity Markets

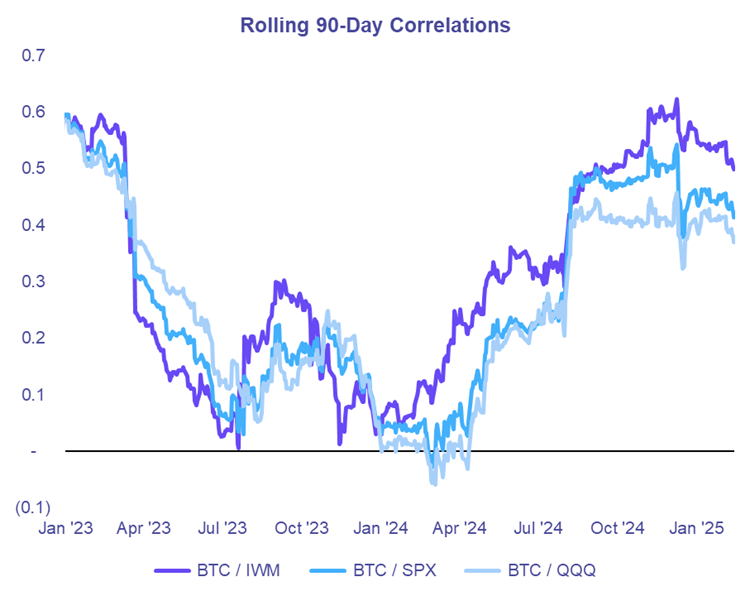

A similar dynamic is taking shape in equity markets regarding risk appetite. Investors have once again taken refuge in large-cap stocks, while small caps and the equal-weight S&P 500 continue to move sideways.

Of note, some have commented on the dislocation between QQQ and BTC, but that correlation is not as strong as many believe. A more relevant equity benchmark for BTC appears to be IWM, with which BTC maintains a closer relationship.

Staking ETFs

On Wednesday, the Cboe BZX Exchange filed a proposal to allow staking for the 21Shares Core Ethereum ETF. In a Form 19b-4 posted on Wednesday afternoon, the exchange proposed permitting the staking of Ether and now awaits the SEC’s response.

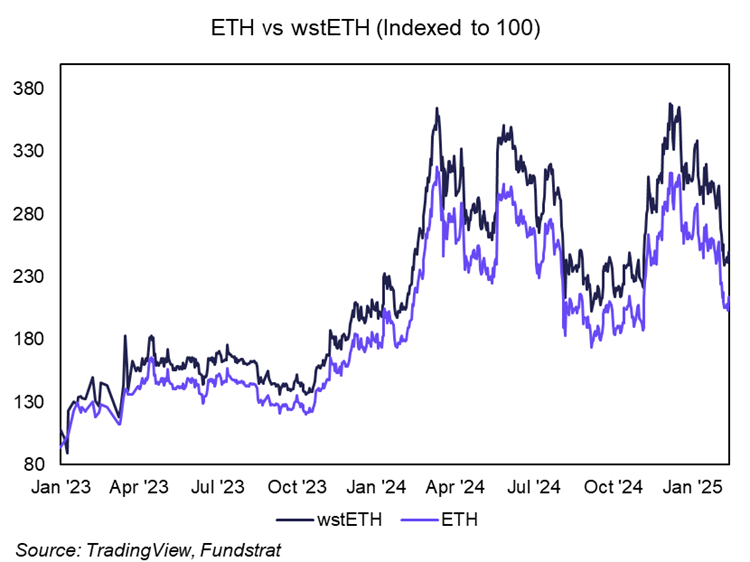

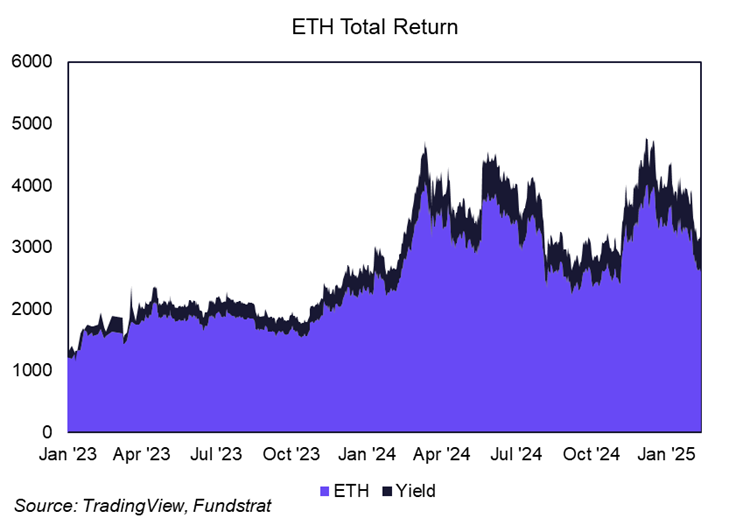

Prior to this year, we viewed staked ETFs as a potential tailwind for ETH. While this does not alter our near-term “underweight” view on ETH, it does marginally improve the flow outlook for ETH ETFs. If allocators decide to invest in ETH ETFs, the ability to stake certainly makes these products more appealing. While it is unlikely that an investor would buy ETH solely for a 3% yield on an extremely volatile asset, that yield nonetheless adds a non-negligible amount of performance over the long term. For instance, consider the performance comparison between ETH and wstETH—an asset representing a wrapped, staked version of ETH whose price reflects total returns, including yield. From wstETH’s initial price quote in 2022, it outperformed ETH by 36% over the observed timeframe.

Allowing ETH staking in an ETF would effectively grant investors access to the total return of ETH within their brokerage accounts. It could also improve liquidity as demand grows for basis trades with a positive carry, enabling traders to earn yield on both the long and short sides of the trade. Although net flows for this strategy might be neutral, higher volumes could improve ETF liquidity and, at a minimum, attract attention to the product.

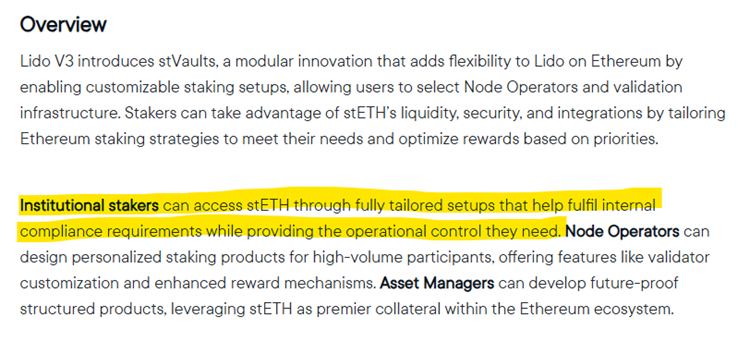

If staked ETH ETFs are approved, SOL-based ETFs with staking are likely to follow. Thus, the same tailwinds potentially benefiting ETH would also apply to SOL. Additionally, we may see increased speculation around liquid staking providers ahead of any staked ETF launch. It is unclear whether these funds would leverage these services, but it is noteworthy that Lido launched its v3 plan—aimed at providing compliant access to stETH—just one day before this application.

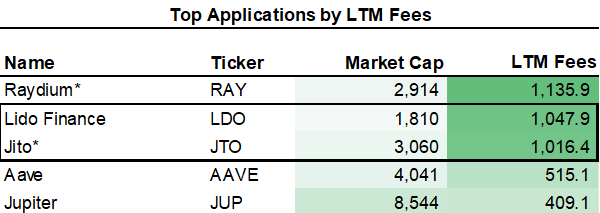

Upon approval of any staked SOL ETF, Jito, the leading liquid staking provider on Solana, could potentially benefit. Of note, both Lido and Jito rank among the top five fee-generating applications, according to data from Artemis.

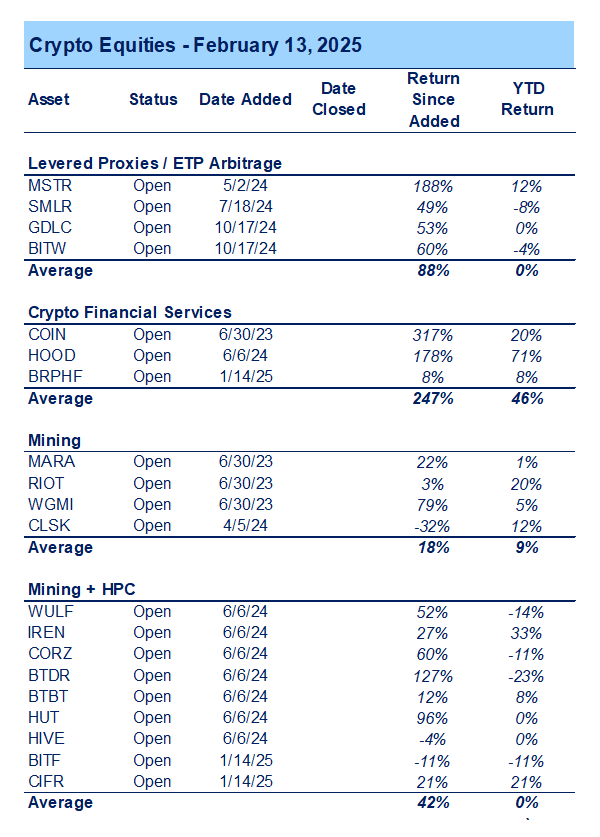

Tickers in this report: BTC -1.93% , ETH -2.56% , SOL -2.30% , JTO -8.45% , RAY -4.27% , BONK -6.32% , HNT -8.58% , AERO -3.91% , DOGE -2.61% , XRP -2.34% , VIRTUAL -4.50% , AI N/A% 16Z, USDC -0.01% , MSTR -2.92% , SMLR, GDLC, BITW -3.13% , COIN -2.76% , HOOD -4.53% , BRPHF, MARA 6.51% , RIOT -4.81% , WGMI -5.43% , CLSK -4.69% , WULF -9.62% , IREN -7.44% , CORZ -5.45% , BTDR -3.27% , BTBT -6.18% , HUT -2.90% , HIVE -5.70% , BITF -5.15% , CIFR -5.63%