The Fog of Trade War (Core Strategy Rebalance)

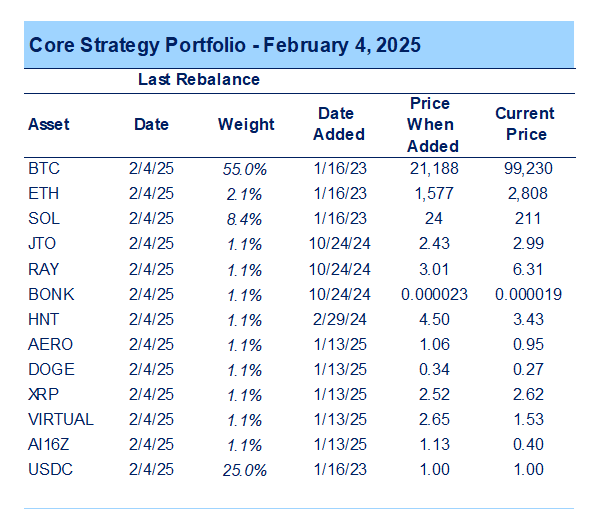

Core Strategy

With the looming threat of an escalating trade war and economic data robust enough to discourage a more dovish Fed stance, we believe the upside risk for the DXY and yields has increased in Q1. Moreover, the market remains highly volatile and headline-driven, inhibiting the crypto market from gaining meaningful momentum. While regulatory developments are a key medium- to a long-term tailwind for crypto, it is unlikely that any incremental “good news” will be announced in the near term.

To be clear, we still anticipate that crypto will outperform this year. However, we believe it is prudent to manage downside risk in the near term (1-2 months) and consider raising cash/reducing altcoin exposure (plan for BTC dominance higher). We will discuss some of the things we will be looking for to turn more constructive in our note below.

Tariffed

On Friday afternoon, we received word that the Trump administration was considering imposing tariffs on Mexico and Canada, with details to follow the next day. On Saturday, those details were released: a 25% tariff on Canada and Mexico, along with a 10% tariff on China. An exemption was made for Canadian energy imports, which would be taxed at 10%. In response, Canada imposed a 25% tariff on all goods valued above $100B.

By Monday afternoon, both President Sheinbaum and Prime Minister Trudeau had reportedly relented, agreeing to contribute to efforts aimed at stopping the flow of fentanyl and undocumented immigrants across the southern and northern borders. We have yet to hear whether President Xi will reach a compromise with President Trump, but the key takeaway is that there are many rapidly moving parts in this evolving trade war.

The initial tariffs were significantly more substantial and abrupt than most people anticipated, marking a major departure from what key economic advisors had recommended—namely, introducing large tariffs gradually to avoid sudden shocks to the system. This shift was reflected in crypto price action over the weekend, as well as in the outsized moves in equity futures and the DXY on Sunday night. In total, the crypto market witnessed over $8–10 billion in liquidations across all crypto assets, setting a single-day record. Since then, the market has enjoyed a bounce off the lows. It appears that much of Sunday’s price action was driven by forced selling.

Weaponizing the U.S. Dollar

On Friday afternoon, as risk assets took their initial hit, we noted that the political nature of these tariffs might render them more ephemeral than typical tariffs. Implemented via emergency powers, they were intended to compel our neighbors to the north and south to support U.S. efforts to combat fentanyl smuggling and illegal immigration.

However, given the magnitude of these tariffs, the manner in which they were introduced, and the possibility of additional tariffs on the EU, there appears to be another angle: these tariffs, ostensibly aimed at narcotics and illegal immigration, may simply be a way for Trump to showcase the “USD wrecking ball.”

Heading into this year, our crypto team believed that the strong dollar—and the pain it inflicted on emerging markets (particularly China)—provided sufficient leverage for Trump to negotiate favorable trade deals without resorting to punitive tariffs. It now seems that he is not leaving anything to chance and may be willing to accept higher inflation and lower growth in pursuit of an even stronger negotiating position.

In other words, the U.S. has long held a “loaded gun” in the form of the global reserve currency – Trump is merely choosing to fire it a few times to remind our trade partners of its power.

Managing Risk

The events of the past few days have prompted us to adjust our near-term outlook slightly. We still believe this year will offer compelling upside potential, but our near-term (1–2 months) view is more cautious. Below is a summary of our perspective and our increased near-term risk aversion:

- Near-Term Bullish Thesis Under Pressure – A major reason we were bullish on crypto in the short term was the expectation that yields and the DXY would fall as tariff concerns receded post-election.

- Recent Tariff Developments – The unexpectedly blunt nature of Trump’s recent tariff announcements—along with the potential for new tariffs on the EU and uncertainty around China—introduces more upside risk for the DXY and yields in Q1.

- Strong Economic Figures – Monday’s ISM Manufacturing PMI rose above 50 for the first time in two years. While this may be a result of companies front-running tariffs, it will likely deter the Fed from turning dovish. We also expect Services PMI to remain robust on Wednesday.

- “Stagflation” Risk – If tariffs are enacted and persist (or if markets believe they will), investors may begin pricing in a stagflationary environment where inflation spikes while real growth slows. This scenario, similar to what we saw in 2022, tends to be unfavorable for crypto.

- Headline-Driven Market – Markets are moving in response to trade-related headlines throughout the day. Eventually, participants may become desensitized to these news events, but in the meantime, such volatility hinders crypto’s ability to gain sustained upward momentum.

- Regulatory Updates Likely Months Away – While certain regulatory tailwinds, most notably the SBR, could be beneficial, it’s unlikely we’ll see any significant resolution at either the state or federal level over the next couple of months.

- Longer-Term Bullish Setup – Despite short-term challenges, the ongoing trade war and the “weaponization” of the U.S. dollar remain pivotal to watch. Ultimately, these forces may set the stage for a powerful Bitcoin bull run once this period of uncertainty subsides.

What could change our views? A clear path toward resolving tariffs, something “breaking,” the Federal Reserve turning more dovish, the end of quantitative tightening, and/or meaningful progress on state or federal Bitcoin reserve initiatives.

Long-Term Bullish Implications

Stephen Miran, the Chair of Trump’s Council of Economic Advisors, published a paper last November (prior to his appointment) outlining how he would reform the global trading system to reduce America’s trade deficit. In that paper, he discusses a strategy to revalue the U.S. dollar in order to make the country a more attractive place to manufacture goods.

He notes that the first step in this process might involve establishing negotiating leverage through tariffs. Although Miran likely would have preferred a more measured tariff rollout than what we are currently seeing, he still views tariffs as a tool to bring other countries to the negotiating table.

Then, via a Plaza-Accord-like agreement between the likes of Europe, Japan, China, and the US, there would a concerted effort to devalue the dollar vs global currencies. The details of which are to be determined, but it would probably entail an overall reduction in US treasury holdings by these countries and a shift in maturity composition towards longer dated securities.

If the Trump administration executes this plan, then it will be massively bullish for BTC. You will have a US-induced move towards multi-polarity in which the USD is lessening its role in trade. This is an environment in which the demand for non-state-affiliated bearer assets increases.

Concurrently, you will have an environment in which the dollar is weakening due to a manufactured reduction in demand and a lower interest rate environment due to a manufactured increase in demand for long-term US treasuries. There are many who are scratching their heads, wondering why the US would want to exchange dollars for Bitcoin, and the plan outlined above is why.

So despite our caution in the near term due to potential risk-off behavior around these tariffs, we encourage those with a more long-term view to be emboldened by any sharp drawdowns as this is part of a process in which BTC will assume a more important role in the global economy.

Tickers in this report: BTC 2.79% , ETH 4.20% , SOL 5.55% , JTO 1.05% , RAY 5.98% , BONK 1.63% , HNT 6.30% , AERO 14.96% , DOGE 0.94% , XRP 2.29% , VIRTUAL 12.42% , AI N/A% 16Z, USDC 0.01% , MSTR 0.75% , SMLR, GDLC, BITW -1.19% , COIN 1.44% , HOOD 2.12% , BRPHF, MARA 1.97% , RIOT 5.24% , WGMI 7.42% , CLSK 5.30% , WULF 11.16% , IREN 7.22% , CORZ 5.39% , BTDR 5.99% , BTBT 1.20% , HUT 9.68% , HIVE 5.15% , BITF 9.80% , CIFR 12.02%