Kraken Down on Custodial Staking

Key Takeaways

- Kraken agreed to close its retail staking operations in a settlement with the SEC, exacerbating an ongoing drawdown in crypto prices. The regulatory implications of this will hurt consumers and centralized exchanges but will be a non-event for the underlying networks and potentially a windfall for Liquid Staking Service Providers such as Lido (LDO) and Rocket Pool (RPL).

- Despite it seeming like it was the SEC that damaged markets, crypto prices were already on uneasy footing this week following the US Labor Department's January jobs report. We witnessed a sharp increase in the expected fed funds rate and a pick-up in premiums paid for short-term puts in the crypto market as investors manage risk ahead of a large CPI print.

- The recent regulatory crackdown on crypto-related companies in the US may discourage some business owners and slow down the inflow of new capital into the crypto economy, but it shouldn't necessarily lead to lower token prices as there is ample precedent of regulatory actions having no effect on underlying asset prices.

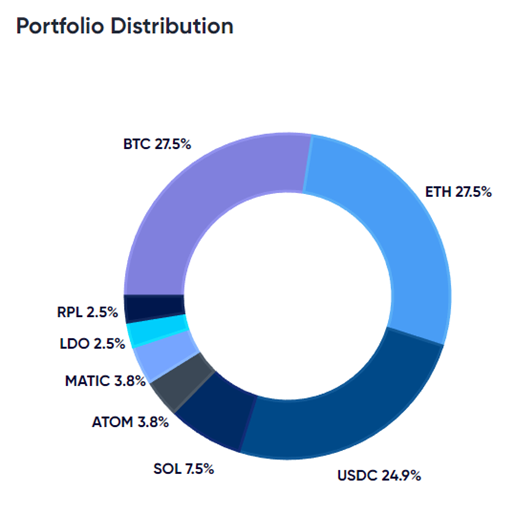

- The market needed some consolidation. The asymmetry from here remains to the upside in 1H, and this dip is worth buying, but given the weakness displayed in the market in the latter half of this week, it is possible a better rebalancing opportunity awaits us next week.

Kraken Down on Staking as a Service

On Wednesday, Brian Armstrong, the CEO of Coinbase, tweeted that he heard rumors that the U.S. Securities and Exchange Commission (SEC) might ban retail investors from engaging in cryptocurrency staking. In his tweet, he expressed concern about this possibility and said that he believes it would be a terrible path for the U.S. if that were to happen.

Then on Thursday, Kraken, another crypto exchange, agreed to close its retail staking operations in a settlement with the SEC. The settlement came after the SEC Chairman, Gary Gensler, stated that staking through intermediaries, such as Kraken, could meet the requirements of the Howey Test to be considered a security under U.S. law. After the announcement, the crypto markets fell, with ETH -1.89% dropping by 5.0% in a matter of minutes.

There is much to unpack here regarding whether the SEC has a legitimate gripe. Some of our thoughts on the matter:

- Not all staking is created equal. While networks like Ethereum require a user to make an economic sacrifice to help secure the network and participate in consensus, other networks such as Aptos do not even rely on Proof-of-Stake to validate transactions but still allow users to receive additional tokens in exchange for locking up their holdings. The economics of these two scenarios (one pool of capital is at risk of being slashed, while the other seems more akin to a typical loan) are completely different, and the SEC should consider these differences when contemplating whether a staking service is an investment contract.

- We need to consider who owns the assets. When assets committed to a centralized exchange are not held directly by the exchange but instead retained by the user, the exchange only provides the computing infrastructure. Conversely, if the exchange assumes ownership, this puts the relationship between the customer and the exchange in murkier water. The SEC is likely concerned with this being deemed a debt-like investment contract – you lend your assets to the exchange; the exchange does something with those assets and promises the user a return (coupon) in exchange. If that lending process never takes place, the parallels between staking service and debt instruments cease to exist.

- All things being considered, the way in which Kraken marketed its services and the custodial nature of these services lends itself to a solid argument that it was offering an investment contract to retail customers without proper disclosures. To be clear, the SEC is not saying that PoS tokens are securities. They are merely stating that the services being rendered by the exchange resemble an investment contract.

Beyond the regulatory implications, this act by the SEC will mean more to the exchange business than to the crypto ecosystem. After all, our desire should be for distributed networks to be secured outside the influence of powerful centralized entities.

Thus, while it might hurt consumers to remove this service and also harm centralized exchanges, we think it would ultimately be a non-event for most underlying networks and possibly be a boon for Liquid Staking Service Providers such as Lido (LDO) and Rocket Pool (RPL), which are both featured in our Core Strategy portfolio and performed impressively following the enforcement measures on Kraken.

More Enforcement Coming (Not Necessarily a Bad thing)

It is clear that regulatory agencies are retroactively trying to save face in a post-FTX world, bringing lawsuits against entities that lack the resources to fight, especially during this bear market.

- A couple of weeks ago, Custodia Bank was denied a banking charter after what seemed like a legitimate effort to bring a solid risk management framework to crypto banking.

- A few days ago, Binance was forced to suspend USD bank transfers entirely.

- Shortly after the Kraken news broke, we learned that Paxos is also facing heat from regulators.

A common refrain throughout the industry now is something along the lines of “careful out there, the regulators are out in full force and will not stop until asset prices are at zero.”

However, while regulatory angst against the industry certainly slows down the smaller players in the space, it should have little effect on asset prices moving forward. The reasons are two-fold:

- The market was showing some near-term weakness prior to yesterday’s drawdown. Thus, it is not right to assume that it was the regulatory actions that led to a red candle this week.

- There is ample precedent of regulatory actions wrought against centralized entities in the space having no effect on underlying asset prices.

Jobs Report Caused Underlying Weakness

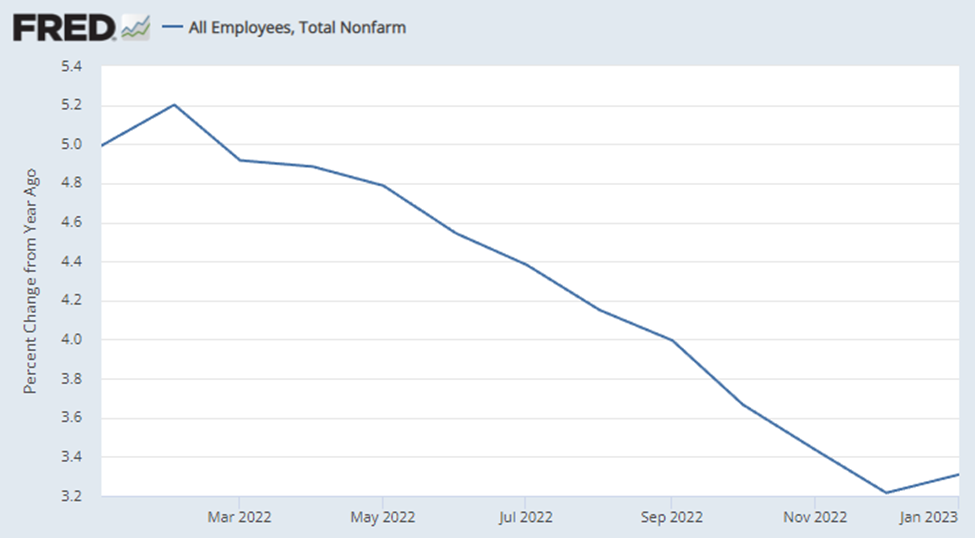

The January U.S. Labor Department jobs report, released on February 3rd, revealed a notable increase in nonfarm payrolls of 517,000, surpassing the estimate of 187,000 and December’s increase of 260,000. The unemployment rate dropped to 3.4%, the lowest level since May 1969, and the labor force participation rate increased to 62.4%. The household survey also recorded an increase of 894,000, while average hourly earnings rose 0.3% with an annual growth of 4.4%.

This data poured water on the market for risk assets after they had experienced a red-hot start to the year as financial conditions eased. The concern stems from the Federal Reserve’s efforts to slow down the economy and control inflation, which many think might be disrupted by the strong job market.

The bond market acted as one might expect, with the 2-year pushing considerably higher.

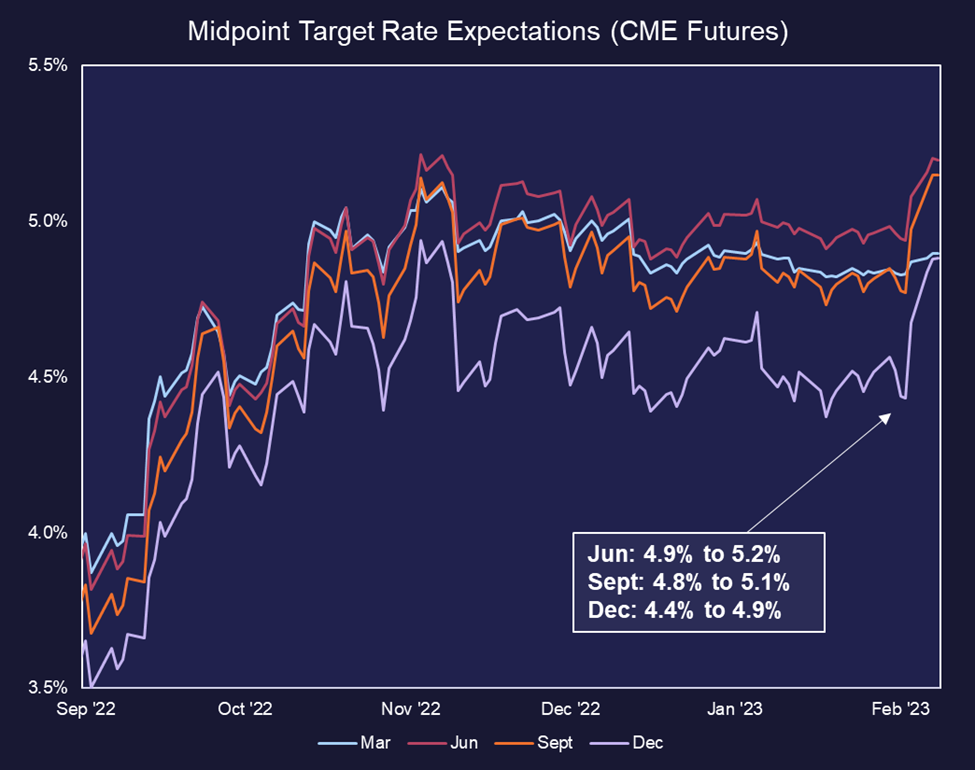

In a similar spirit, the fed fund futures market showed a massive increase in expected fed funds rate, signifying that the market is now (1) respecting the “high for longer” mantra touted by the Fed and (2) pricing a lower risk of recession-induced rate cuts.

Thus, while negative headlines may have exacerbated the drawdown on Thursday, the writing was already on the wall, as evidenced by the charts above.

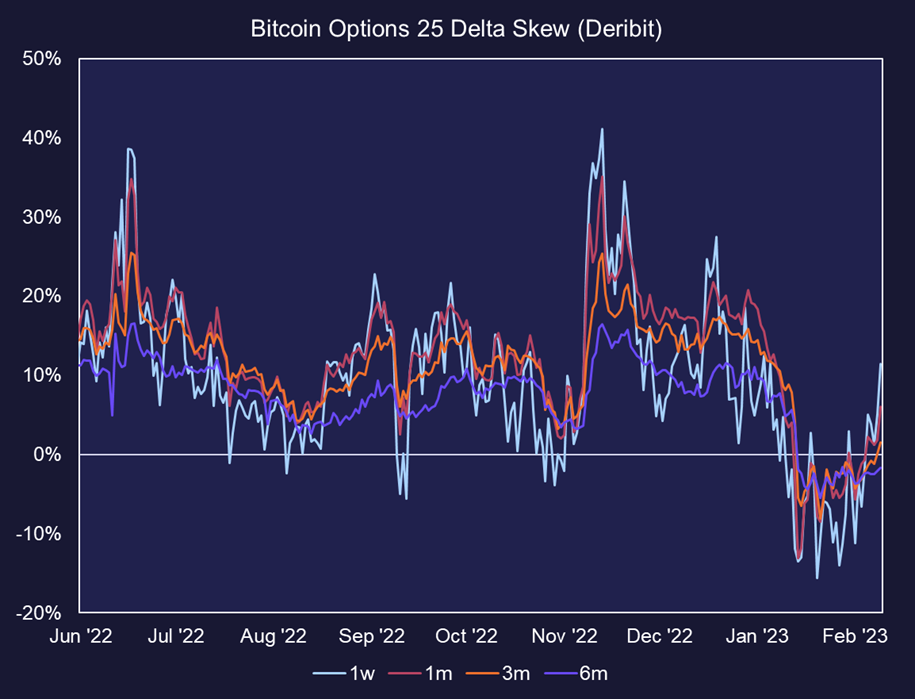

Fortunately, crypto investors respected the change in risk appetite in legacy markets. Below we see a pick-up in premiums paid for short-term puts. This suggests that traders are reacting to the potential increased hawkishness from the Fed. It is also possible that this is a function of managing risk ahead of the massive CPI print next week.

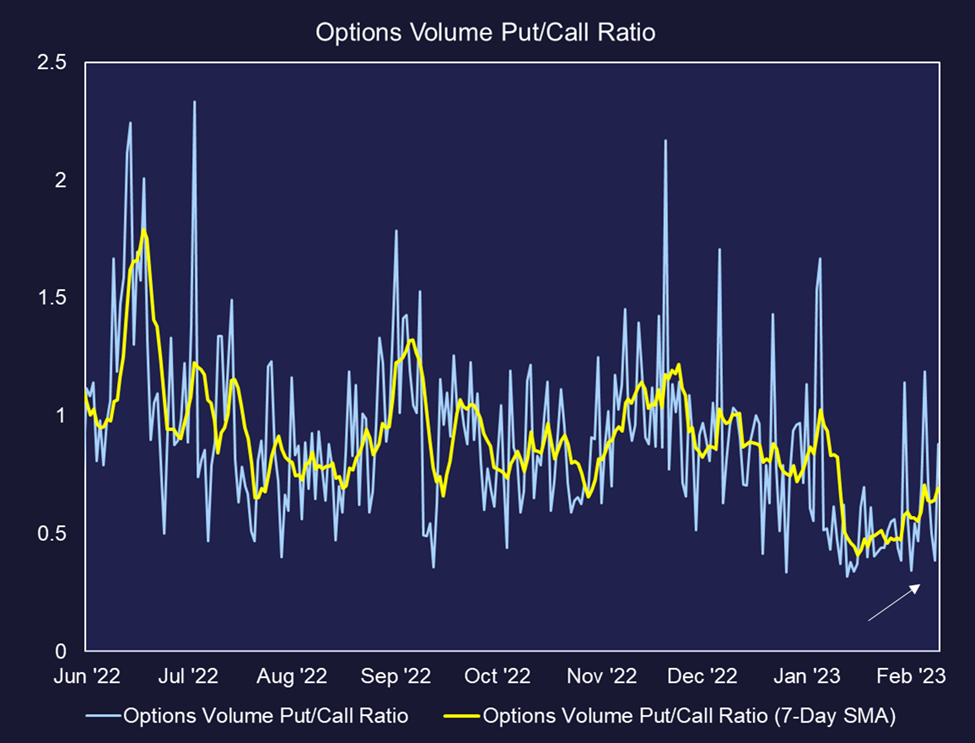

Another view of this increased risk aversion is in the put/call volume data. This metric turned sharply higher about a week ago.

Crackdown Doesn’t Mean Prices Must Fall

As alluded to above, many are now fearful about further action being taken by regulatory authorities and the impact that might have on their portfolio. While it is essential to understand and manage risks that are idiosyncratic to crypto, the systemic deleveraging risk we saw last year is not the same as the regulatory risks we are witnessing now.

The actions being taken by the regulatory bodies in charge aim to reel in the on/off-ramps of crypto. While this is discouraging for business owners developing infrastructure to serve the crypto economy, this should not necessarily translate to lower token prices.

We already have ample precedent of substantial fines and shutdowns of crypto-related companies (pictured below). None of which were closely correlated to a drawdown in digital asset prices.

At worst, these actions partially impede the inflow of new capital into the crypto economy, specifically from the U.S. Fortunately, as we discussed last week, there is still plenty of capital being maintained within the crypto ecosystem in the form of stablecoins. Further, there are still many well-functioning on/off ramps that should reasonably service any increase in demand to hold or use cryptoassets.

Reiterating Bull Case for LDO and RPL

Out of the names within our Core Strategy, Lido (LDO) and Rocket Pool (RPL) have been the standouts. Each name has at least doubled since the start of this year, and RPL is up a whopping 42% since the launch of our Core Strategy.

We have discussed Liquid Staking several times in our research. As a brief recap, services like Lido, RocketPool, and Stakewise allow users with less than 32 ETH without the proper infrastructure to commit their assets to a node operator. Users are then provided with a liquid staking derivative (LSD) token, which allows the holder to earn yield, can be used throughout DeFi, and ultimately allows for the holder to redeem the underlying assets staked to Lido (Lido’s LSD is $stETH).

LDO is Lido DAO’s governance token. Governance tokens are another way to gain exposure to liquid staking. These tokens vary in value accrual mechanisms but broadly allow holders to vote on governance issues. There is also speculation that at some point, respective LSD DAOs will enable token holders to receive some of the revenue from staking services provided. Thus, these tokens are likely beneficiaries of the impending Shanghai upgrade.

RPL is the governance token for the Rocket Pool staking service. But, in addition to governance, there is an interesting nuance in which one must stake 10% (in USD terms) of your ETH stake in RPL when spinning up a validator. The RPL token then serves as collateral for slashing penalties, thus creating underlying demand for the token and implementing a theoretical lower bound on the token’s price since, under this model, the total RPL staked must be worth at least 10% of the total ETH staked in Rocket Pool.

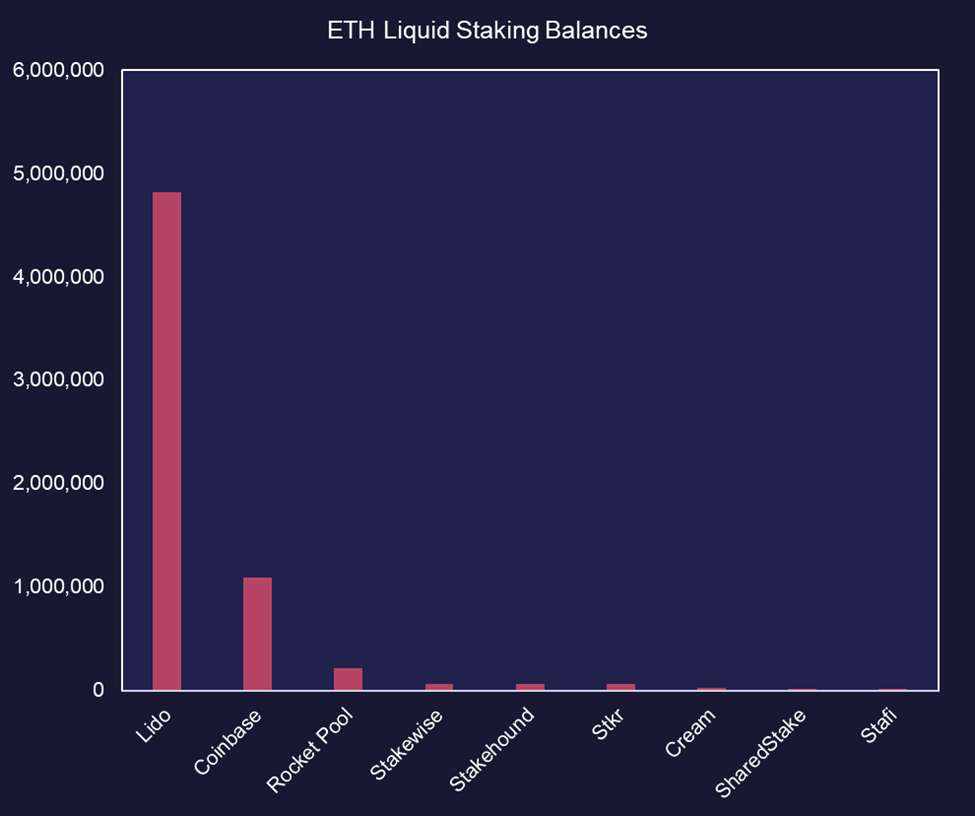

Below are the current liquid staking balances across liquid staking providers.

As noted above, LSD tokens spiked following the news that Kraken would be required to wind down its custodial staking service. This rationale makes sense for two reasons:

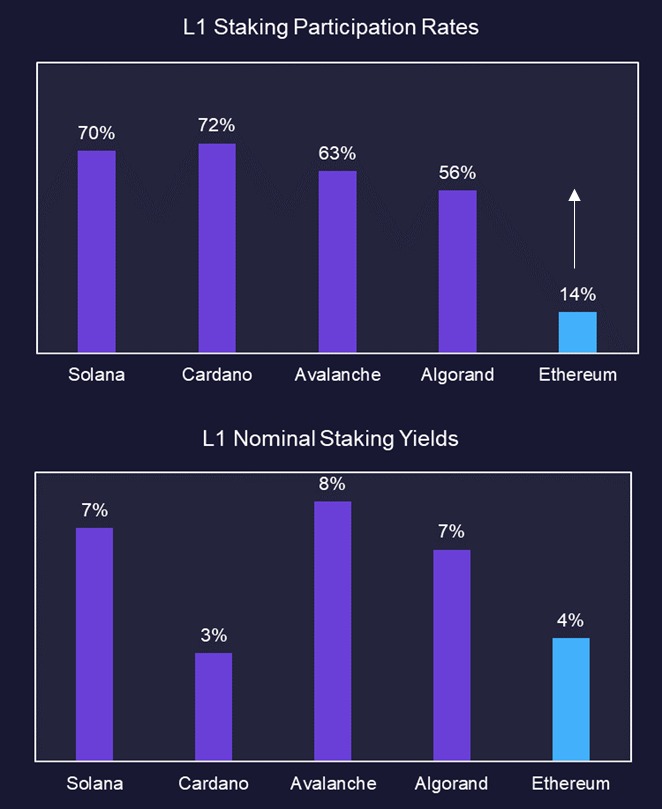

- The Shanghai upgrade is right around the corner. By the end of March or the beginning of April, it is expected that stakers will be able to unstake their ETH. While on its surface, this seems bearish, the risk of excess liquidity is overblown, and the net result will be a de-risking of staking, and the demand for staking ETH should increase. Further, since the risk of stETH (or any other LSD) de-pegging will be mitigated with the ability for redemptions enabled, we may see increased demand from institutions to utilize LSD providers like Lido and Rocket Pool. As we can see below, ETH’s current staking ratio is well below the ratio for other L1s.

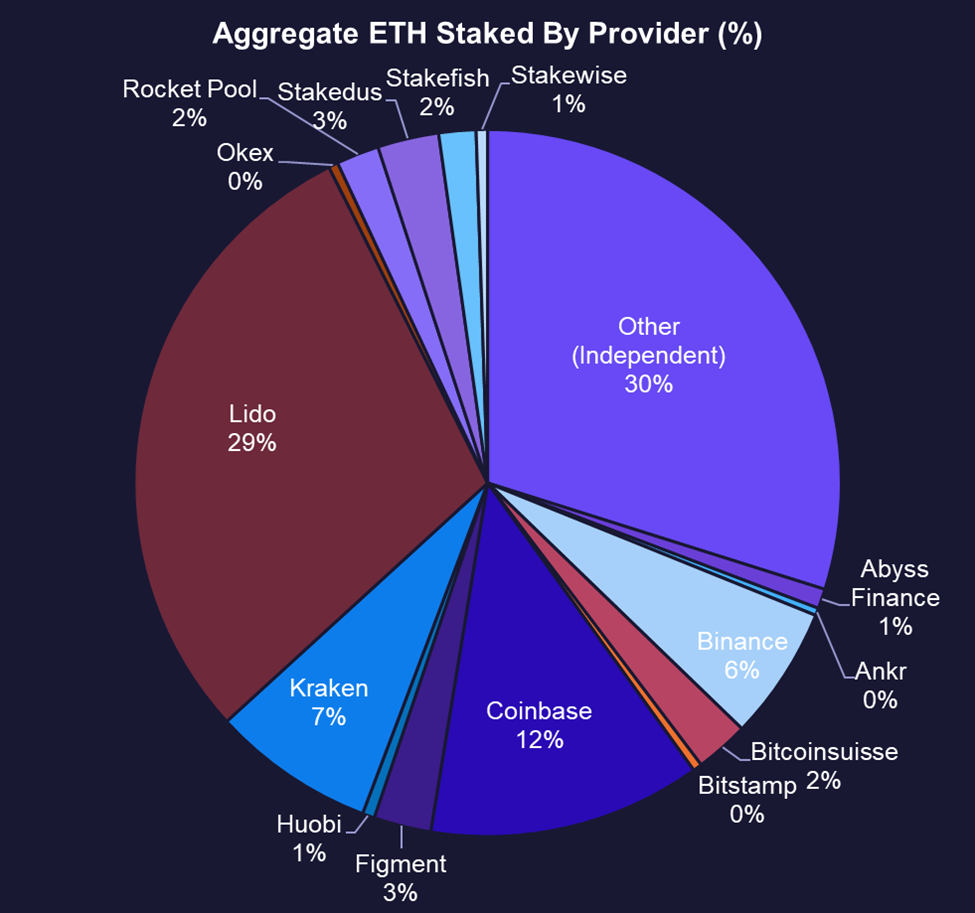

2. Coinbase and Kraken together accounted for about 20% of the total ETH staked. While not all of this is ETH staked by retail (accredited investors will be able to remain staked), we expect that at least a portion of this supply should find its way to the liquid staking arena, increasing demand for the native tokens of these protocols.

In summary, considering that (1) Shanghai is around the corner, which should lead to increased overall demand for staking on Ethereum, and (2) custodial staking services offered by exchanges will likely cease to exist in the U.S., leading to at least a portion of this value to be siphoned off by these LSD providers, we think it remains right to be constructive on both LDO and RPL in the near-term.

Core Strategy – Latest Rebalance as of January 27, 2023

The market needed some consolidation. The asymmetry form here remains to the upside in 1H, and this dip is worth buying. Still, given the weakness displayed in the market in the latter half of this week, a better rebalancing opportunity may await us next week.