Good Price on Bad News is Good News

Key Takeaways

- The crypto market rallied this past week despite an onslaught of bad news. This is an encouraging sign that the cycle lows may be in.

- In the immediate term, there are still reasons to show caution. Major hurdles next week include key tech earnings and a critical FOMC meeting. It is possible Jerome Powell lays on the hawkish language in response to this mini risk-on rally.

- Ether stole the show this week. We examine its outperformance and provide updates on the Merge trade.

- The recent rally coupled with prevailing market narratives and miner dynamics suggest it might be wise to be overweight large cap altcoins in the medium term. We discuss our rationale in greater depth.

- Strategy – We are long BTC 5.22% , ETH 7.34% , and SOL into year-end but see value positioning cautiously into a big week of tech earnings and FOMC action. Long and medium-term investors should look to use any dips as buying opportunities.

Good Price on Bad News is Good News

Last week, we discussed the piping-hot inflation print and expected additional volatility around this data point. On the contrary, markets behaved resiliently, with legacy markets and crypto rallying hard from last Thursday to today.

The market had what seemed to be its first winning week since March as BTC 5.22% surged 18%, while ETH 7.34% left the rest of the market in the dust on the back of increased interest in the Merge trade (more on this below), rocketing nearly 50% over the same period.

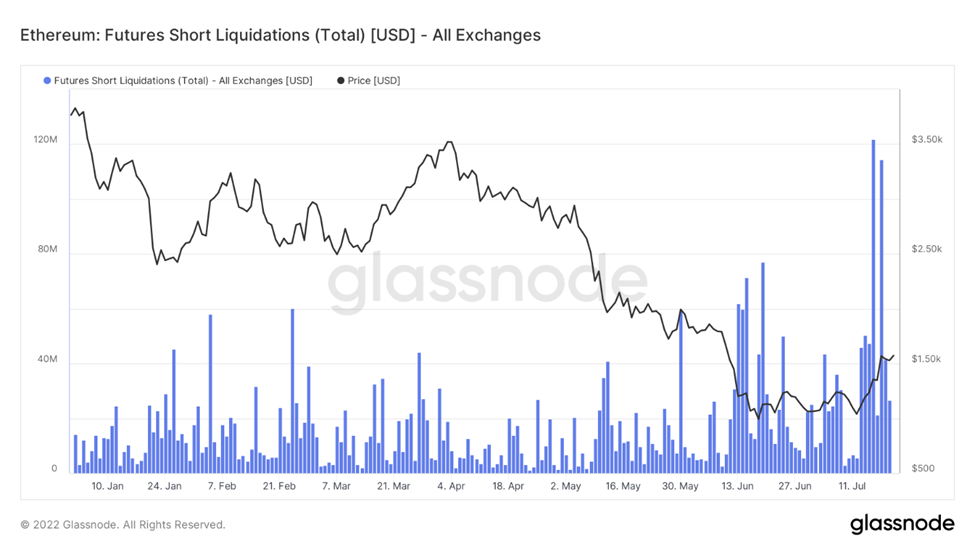

To get right down to brass tacks, we find this week’s price action incredibly encouraging. While considerable short liquidations undoubtedly exacerbated the bullish moves, we saw significant spot volume in both BTC and ETH markets, and derivatives exchanges witnessed a sizeable increase in OTM calls for September and December. Further, bullish price action on the back of bad news is always a fairly reliable sign of a market bottom.

In addition to the rough inflation data, crypto markets have steadily climbed despite headlines that include:

- Tesla sold its bitcoin.

- The DOJ arrested a former Coinbase employee for wire fraud.

- The SEC filed a civil case parallel to the DOJ, accusing the Coinbase employee of insider training, thus implying that several cryptoassets traded on the exchange are securities.

- Vauld, another crypto lender out of Asia, went belly-up.

- Zipmex, a leading exchange in SE Asia, needed to halt withdrawals.

When viewed in conjunction with the two very considerable market flushes thus far this year (LUNA and 3AC), we are starting to gain confidence that a longer-term bottom could be in.

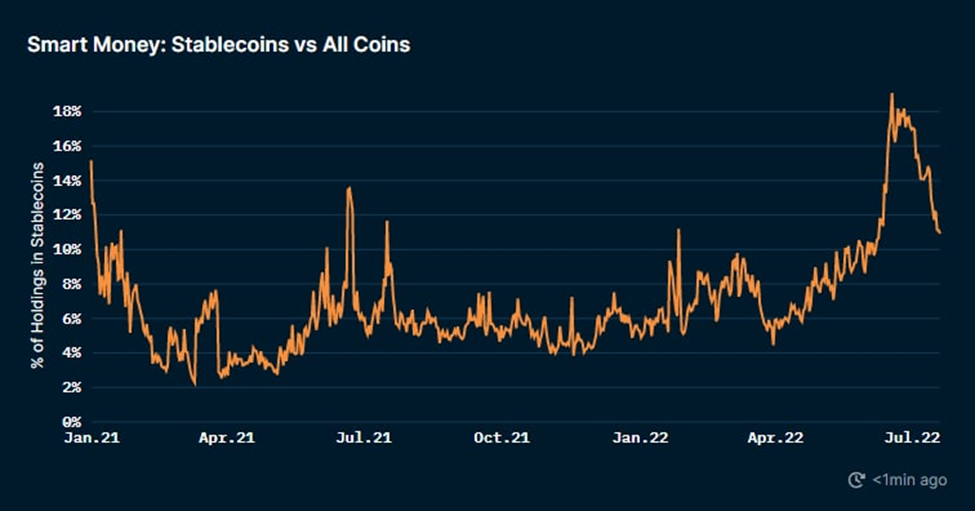

Further, based on smart money data provided by Nansen, funds are starting to add exposure to cryptoassets, reducing their relative exposure to stablecoins. Below we can see a reduction in relative stablecoin exposure over the past several weeks that has outpaced asset price appreciation (which could also influence this metric). I will concede that there is some opacity here as it pertains to how Nansen determines which wallets are “smart,” but this is likely directional symbolic of an underlying behavior in which larger players are starting to get back into the market.

Strong spot volumes renewed smart money interest, and strong performance on bad news suggests that an absolute long-term macro bottom could be in for crypto.

However, for those positioning around the immediate term (next 2-3 weeks), we are still hesitant to bet the farm due to critical events slated for next week that include key earnings releases from tech giants (Google, Microsoft), as well as the most consequential FOMC meeting to date, out of which the market anticipates 75 bps rate hike. It is likely that given the recent rally in risk assets and the inability for longer-term rates to remain elevated, Jerome Powell will resume his hawkish dialogue.

Significant Progress on The Merge

Now to provide an update on a key catalyst we highlighted in our annual outlook, the transition of Ethereum from a proof-of-work (PoW) to a proof-of-stake (PoS) network. We have discussed the implications in prior notes but the key implications of the Merge from a markets perspective are: (1) the Merge is a strong narrative in a market bereft of bullishness, and (2) despite a debate over whether the Merge is necessary from a technical perspective, it undoubtedly creates a supply constraint upon its completion, which, depending on the macro situation at the time, could lead to parabolic price performance.

As mentioned above, ETH has led the market higher this week, following a leak out of the core developer community, the tentative date to complete the Mainnet Merge is September 19th.

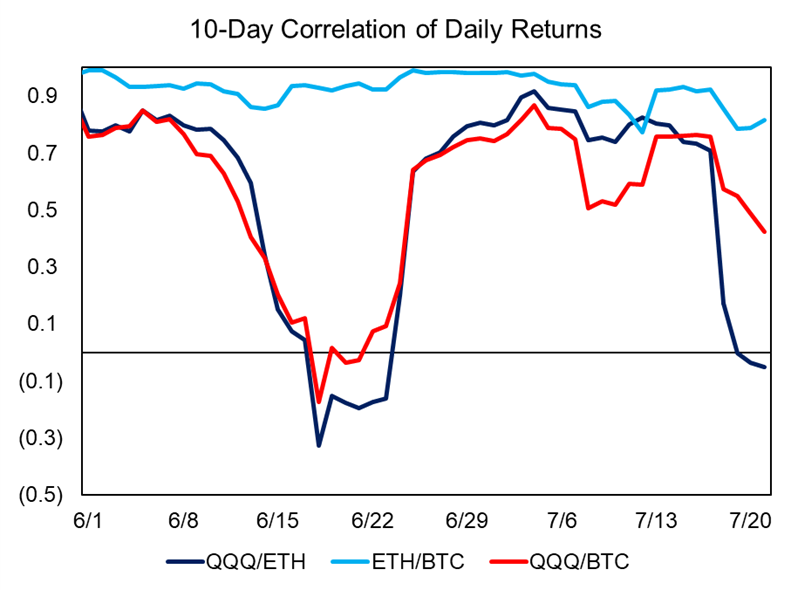

Despite all risk assets outperforming, it seems clear that ETH benefitted from a bit of an idiosyncratic uplift as investors started to pile into the Merge trade. This divergence to the upside is displayed through short-term correlations. Below, we can see that despite often serving as a beta to tech stocks, ETH actually decoupled this past week to the point that its 10-day correlation with QQQ 0.13% went into negative territory. At the same time, BTC remained convincingly positively correlated with the index.

If one needed further convincing that the ETH outperformance stems from the Merge news, we could look at the Lido (LDO) chart below.

For the unengaged, Lido provides a valuable service that allows Layer 1 token holders to lock up their tokens and earn staking rewards. Its most popular implementation of this service is on the Ethereum network. Lido users are issued a derivative token ($stETH) which can be used as collateral in various DeFi applications. Ultimately, the token provides holders the right to redeem 1 ETH upon the completion of the Merge and the eventual unlocking of ETH committed to the Beacon Chain.

While it has been a valuable addition to the DeFi ecosystem, it has sometimes caused headaches for those using it as collateral since the price of stETH can diverge from the price of ETH due to the inherent risk of Merge delays and the potential for slashing.

The Lido governance token has surged recently, likely coinciding with increased confidence in the Merge being completed before the end of this year.

As an interesting side note, the chart below speaks to how bearish the futures market was positioned heading into the CPI print last week, as short liquidations were abundant.

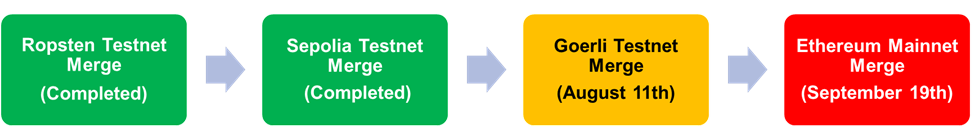

Below is our updated timeline of the Merge, first featured in our note a few weeks ago upon completing the Sepolia Testnet Merge.

The next critical step in the Merge schedule is the third and final testnet merge set to take place in early August. Should this testnet merge be executed without a significant hiccup, it would clear the way for the Mainnet Merge on September 19th.

Considering the increased confidence that we are nearing a macro bottom and the apparent successes in the testnet merge, we think it is wise for investors to use dips to build an overweight position in ETH into the merge.

Bitcoin as Beta to QQQ But Likely to Underperform Leading Alts in 2H

A topic alluded to above, as well as one that I mentioned on our all-hands Roundtable this week, was the prospect of altcoin outperformance out of this bear market. The core rationale for this thesis:

- No spot ETF, no new nation-state adoption, a positive correlation with QQQ 0.13% , and no near-term halvening leave BTC without a straightforward market narrative that can drive price independent of fundamentals.

- A shift in mining behavior could be in the works. While late 2020 and all of 2021 saw both public and private miners turn to diamond-handing their BTC, decreasing the liquidity entering the market each day, the current margins are much less impressive. They might lead to additional miners selling into any rallies. This does not necessarily mean that price won’t still perform as a beta play on Nasdaq, but the prospects for parabolic growth do not seem as plausible in the immediate term.

- There is an emerging tailwind in the altcoin market (ETH Merge).

- This bear market is much different from prior bear markets. The market in 2018 and 2019 did not have real applications being developed with tangible use-cases and certainly did not have as many investors and developers remaining interested in the space as there are now (Hence why we would never call what we are experiencing currently a “winter”). Therefore, we could see alts with fundamental use-cases and key technical developments move off the bottom faster than bitcoin, which is more of a known quantity.

Below we examine a few charts that lend credibility to our thesis of being overweight established altcoins on the way up.

First, we see large bitcoin holders fading during this recent rally. The most liquid asset in crypto had several underwater positions established over the previous 12 months that will face considerable sell pressure on any rallies. Long-term holders used the strength in this week’s price action as exit liquidity. While we would agree that long-term holders are known to sell into strength, the sustained strength that long-term holders sell into during bull markets is characterized by increasing demand in wallets and transaction growth – something we have not seen on the bitcoin network over the previous two weeks.

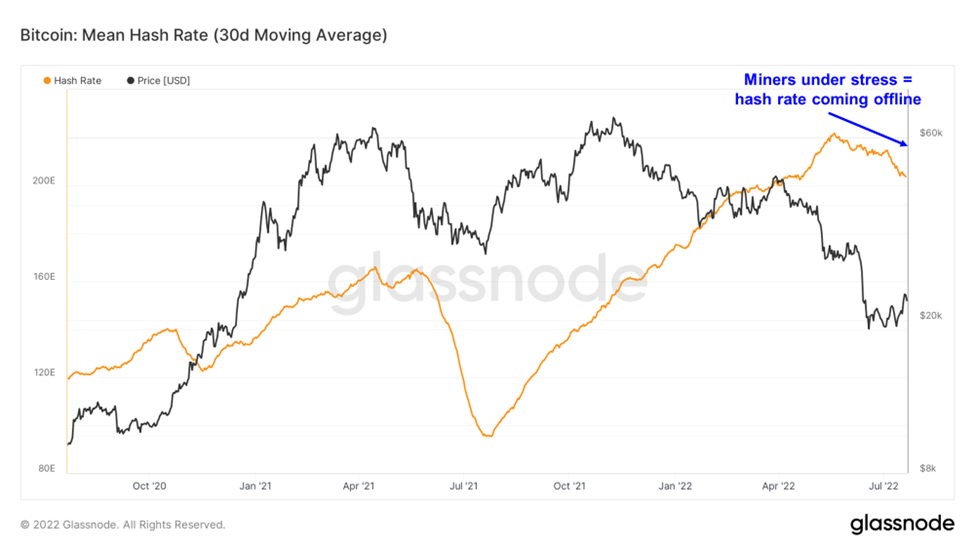

Per our second point above, miners continue to come under pressure. For the first time in a year, we are witnessing a considerable decline in computing power dedicated to securing the Bitcoin network. We think this has to do with declining margins (expanded on below) and has been exacerbated by a recent summer heat wave that has forced miners to power down some of their ASICs to provide relief to the electricity grid.

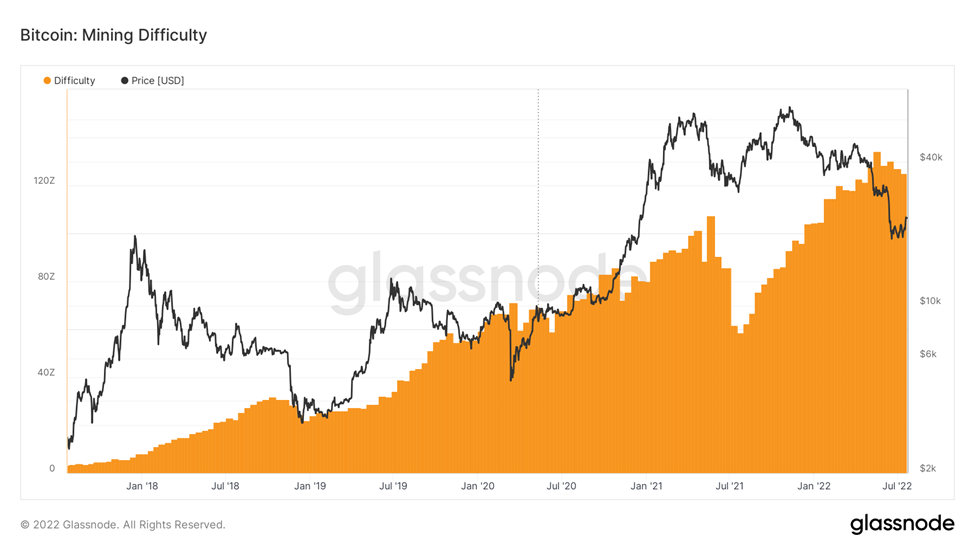

As a result of this decline in hash rate, we have also seen mining difficulty come down. This week the network will experience its most significant percentage decline in mining difficulty (-%) since July of last year.

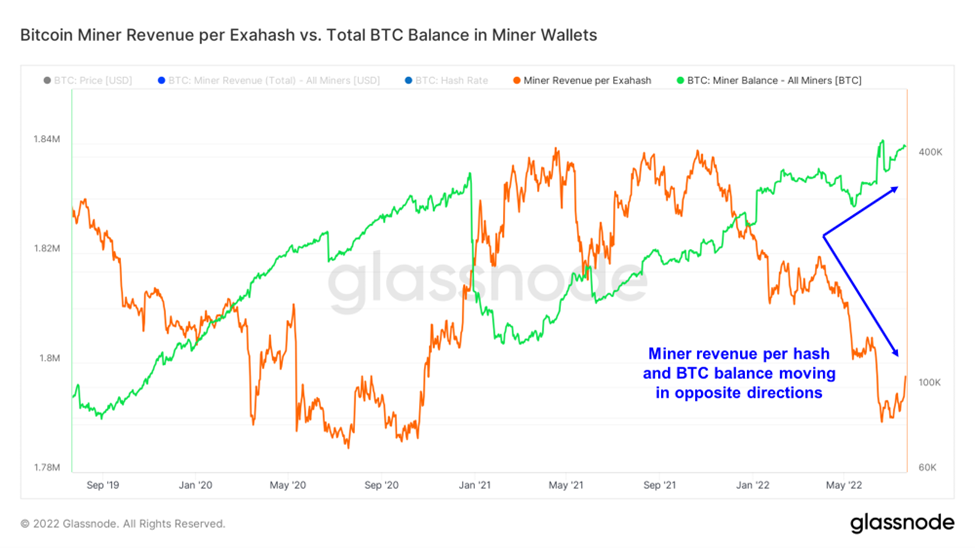

As mentioned above, we see that miner margins are likely being compressed. Below we can chart the miner revenue per exahash, which provides a good proxy for profitability relative to historical levels. We are probably seeing a lot of older, less efficient ASICs being turned off. We have yet to see a substantial decline in the miner BTC balance. It is reasonable to assume that should prices range for a while longer around current levels, we could see further capitulation from less well-capitalized bitcoin miners. However, even if we do not see immediate-term capitulation, there is a higher likelihood that, given the events of the past eight months, those miners sell into any significant rallies in BTC price, which might cause bitcoin to fade faster than its counterparts on any crypto market rally.