Hot things: CPI and Solana

Key Takeaways

- The latest CPI print surprised to the upside, leading markets to price in a 100 BPS rate hike at the next FOMC meeting. Risk assets performing well following the CPI print was an encouraging sign.

- We examine the recent network activity on Solana (SOL 6.11% ) and discuss why we think it presents one of the better risk/reward opportunities on the other side of this bear market.

- Strategy – We are still constructive on cryptoasset prices in 2H but likely have some residual macro murkiness to navigate through in the near term. That said, we think this is the time for medium and long-term investors (1+ year) to consider allocating to bitcoin more aggressively.

CPI Still Hot

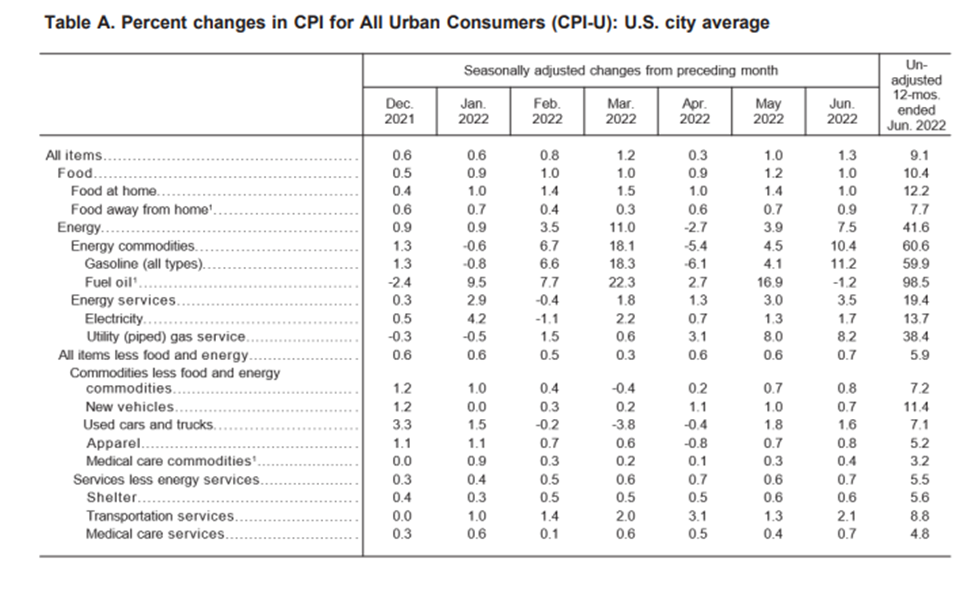

Despite oil prices falling and inventories growing, lagging CPI data came in hot this week. It was expected to be an eye-popping 8.8% but still managed to surprise to the upside. The CPI print of 9.1% was the highest in four decades as gas prices soared 11% month-over-month.

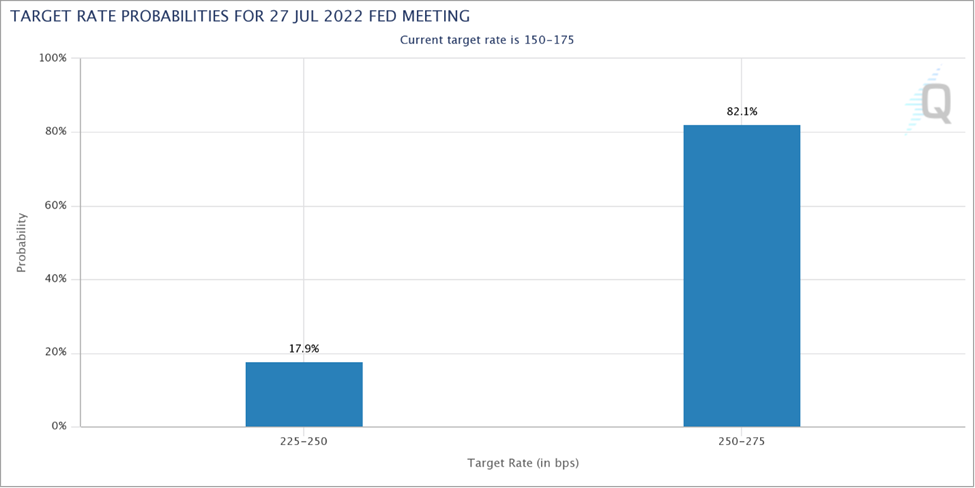

Due to the perceived lack of inflation relief, markets immediately reacted to the news, upping the consensus Fed Funds target for the next FOMC meeting by 25 BPS. At the time of writing, the futures market is pricing in a 100 BPS hike in two weeks.

The yield curve also promptly inverted, as inflation concerns are now compounded by recession fears. This was the second time this year that the yield curve inverted in the traditional sense and the third time since 2019. Interestingly the yield curve inversion in 2019 closely preceded a reversal of the last Fed tightening regime.

This might seem bad, but the day’s events had a clear silver lining. Overall, risk assets did not experience the same gap down in prices that they were victims to following the CPI report in June. Following a pre-market sell-off, both the QQQ 1.17% and BTC rallied back to finish the day of trading in the green.

While we think it is prudent to see how the Fed plays its hand in the coming weeks, this could mean all the hikes required to get the economy back to neutral are priced in.

Solana Summer 2.0

A common and fair criticism of crypto in its current state is that it is inherently more popular when token prices are elevated. In bull markets, the longing for outsized capital gains attracts mercenary dollars, which are put to work in applications that sometimes employ customer acquisition schemes that are remarkably unsustainable (see: Anchor).

Crypto skeptics are quick to point out that when asset prices come back to earth, many of the crypto tourists exit the industry, and very few platforms/apps retain a sizeable user base. Of course, the skeptics will ignore the fact that 90% of startups fail, and very few become profitable investments for venture capitalists.

Regardless of the double standard, as the industry matures and we look forward to a macro environment more constructive for risk asset prices, we should look for platforms and applications that acquire and retain users, irrespective of cratering prices.

With that in mind, we turn our attention to Solana (SOL 6.11% ), the Proof-of-Stake smart contract platform that prides itself on scalability (transaction costs are less than $0.01 on average) and faster block times (reported at 400 milliseconds). For the unengaged, Solana was founded in 2017 and launched in early 2020. It combines PoS mining with a unique consensus mechanism known as Proof-of-History (PoH) to allow for high performance at the base layer. At a high level, this differs from most other modular blockchains, which scale using layer 2 solutions. We won’t wade too much further into the technical details at this time but may address these elements further in subsequent notes, if necessary.

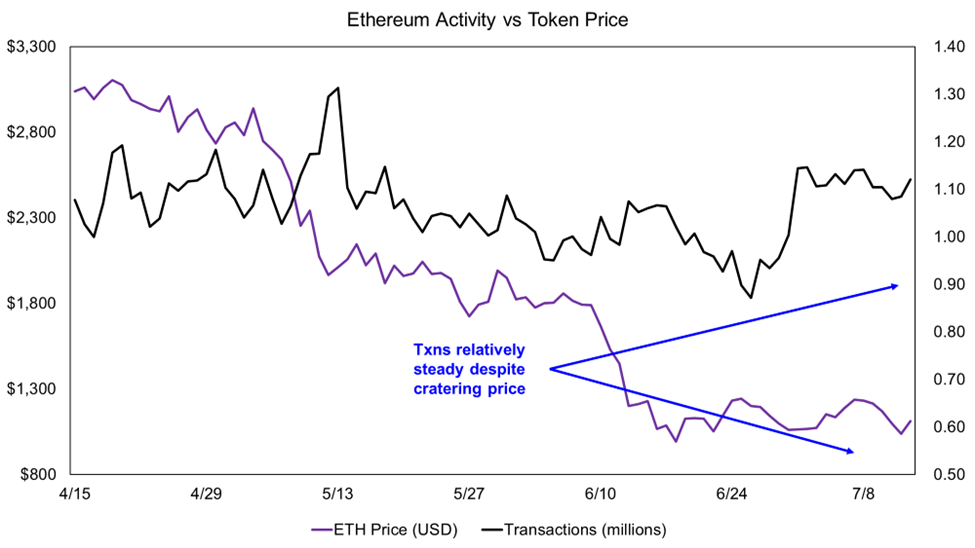

As mentioned above, network activity that sustains itself irrespective of native token price is great to see because it means that even though the speculative capital has exited, users still find value in the platform or applications built atop that network. For example, below, we can see that despite ETH falling precipitously over the previous few months, Ethereum is still seeing relatively consistent network activity levels, as demonstrated by the number of daily transactions. This is expected, given the maturity of the platform and the robustness of the dApp ecosystem built on Ethereum.

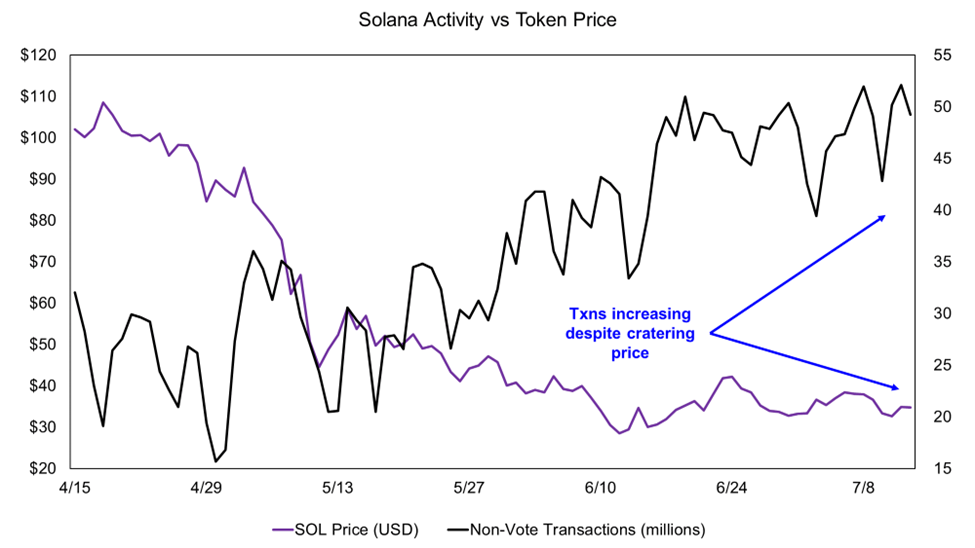

In a similar, perhaps more encouraging light, activity on the Solana network has substantially increased over the previous 90 days, even as SOL drew down over 90% from its all-time high of $262 in November. As we think about where to deploy capital in the long-term, we like to find projects with user activity cemented in fundamental user experience rather than just speculative trading and peer-to-peer transfers. Thus, this is an encouraging chart that gives us confidence in the fundamental growth trajectory of the network.

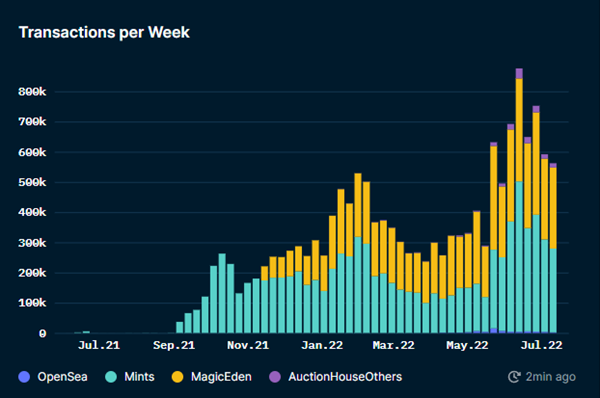

Consistent Growth in NFT Scene

Much of this growth comes from the burgeoning NFT scene on Solana. While Ethereum is still the king of the NFT market, and most blue chip NFT “grails” are found on Ethereum, Solana has emerged as a unique home for NFTs that require lower relative transaction fees – such as NFTs used in gaming, social networks, DeFi. Below, we can see that NFT transactions have exploded over the past couple of months, with much of the activity taking place on the NFT exchange MagicEden.

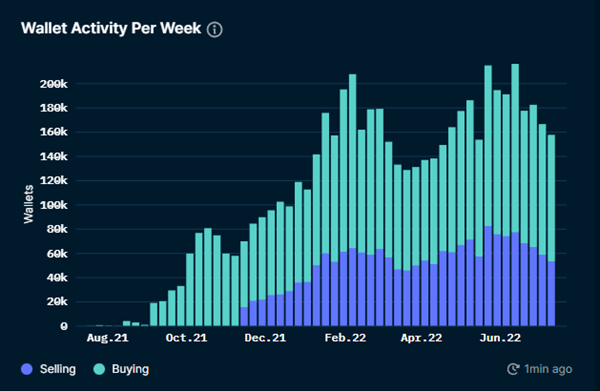

The chart below provides useful added context and suggests that a lot of the NFT activity is not derived from a select group of whales but from a large and consistently expanding number of users, as indicated by the growth in active wallets per week. And yes, we realize that entities can create and use multiple wallets, but we posit that unique user growth is predicated on wallet growth. Thus it is reasonable to assume that many of the new wallets are new entrants into the market.

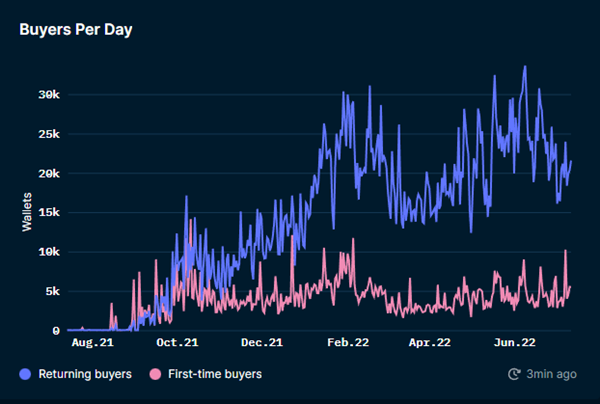

We see plenty of newcomers to the network, as demonstrated by the consistent introduction of 3k-10k new wallets daily. But we also see strong retention, as indicated by the blue line below, which has largely remained above the 15k mark since the start of this year.

While many people outside of crypto associate NFTs with monkey JPEGs, there are a lot of potential use cases and implementations of the NFT standard. Thus, we view such a solid user base built on Solana as incredibly bullish for the ecosystem.

One of the First “Mainstream” Web3 Applications

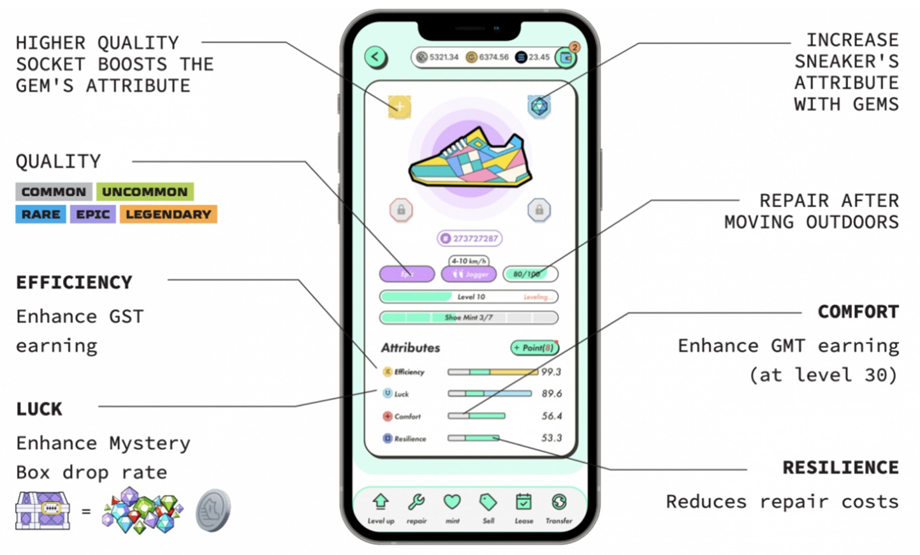

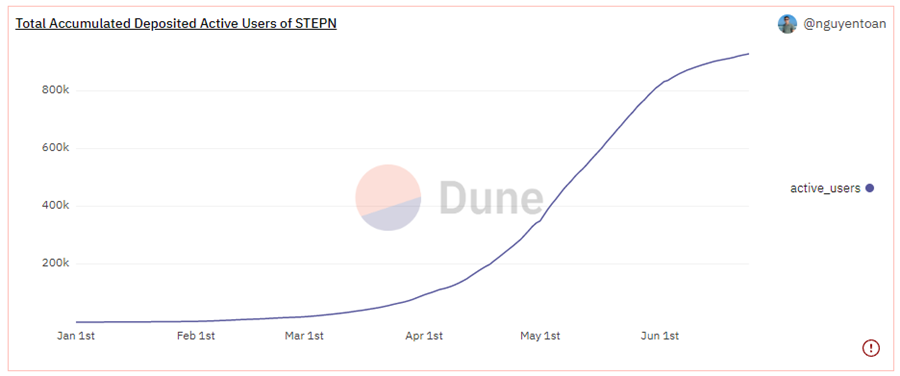

Solana was also the breeding ground for one of the first “mainstream” web3 applications, Stepn. Stepn, known colloquially as a Move-to-Earn app, billed itself as the “Strava for Web3.”

There are many moving pieces with how the token model works with Stepn, but in short, the app allows users to buy into the network via sneaker NFTs and rewards users with tokens as they walk, jog, or run.

The app became wildly popular across the globe as people were able to monetize an act they were already doing. At the same time, some were even encouraged to adopt a more active, healthier lifestyle.

Depending on what data you review, the app procured over 1 million users in just the first few months of its life.

This is anecdotal, but I personally know people who were not very immersed in crypto prior to Stepn but used the app and enjoyed it quite a bit. In addition to the monetary rewards, the network created an inherent positive externality through exercise.

In recent weeks, the app has struggled to maintain stability in its native token prices (GST and GMT), but the team has a long-term vision of forging partnerships and creating ways to spend the native token in the real economy. Regardless of where this specific app goes from here, it was a prominent example of the possibilities that a highly scalable blockchain with a developer-friendly culture like Solana enables.

As an aside, we highly recommend clients check the app out – it is an exciting insight into the potential value of having crypto-native apps on mobile.

Strong Developer Growth

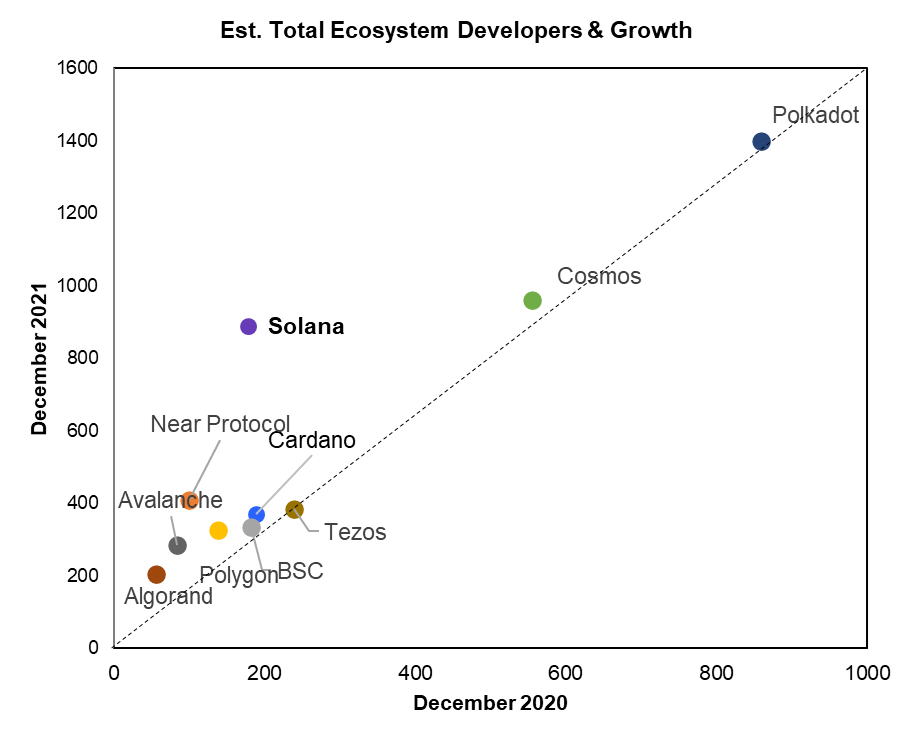

As we alluded to above, despite us being a mere two years removed from mainnet launch, there is an incredibly strong developer community building on Solana. Below, we leverage data compiled by Electric Capital, which plots ecosystem developer growth from 2020 to 2021 among leading layer 1 smart contract platforms (excluding Ethereum).

While Solana does not have the greatest absolute number of developers, it is the clear winner from a growth perspective, as the farther above the dotted line, the greater the relative growth from one year to the next was.

In technology investing, technical expertise often leads capital as those who want to work on challenging problems will find them before a venture capitalist or growth investor does.

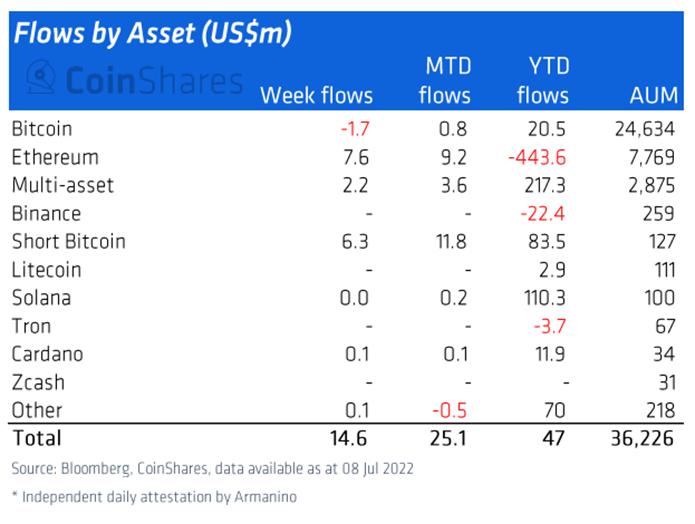

Fund Flows

Finally, we are not alone in observing the potential long-term growth prospects for the network. Digital asset fund flow data suggests an increased interest in allocating to SOL this year. With the lone exception of multi-asset funds, Solana-focused funds have the most significant inflows YTD.

Areas for Improvement

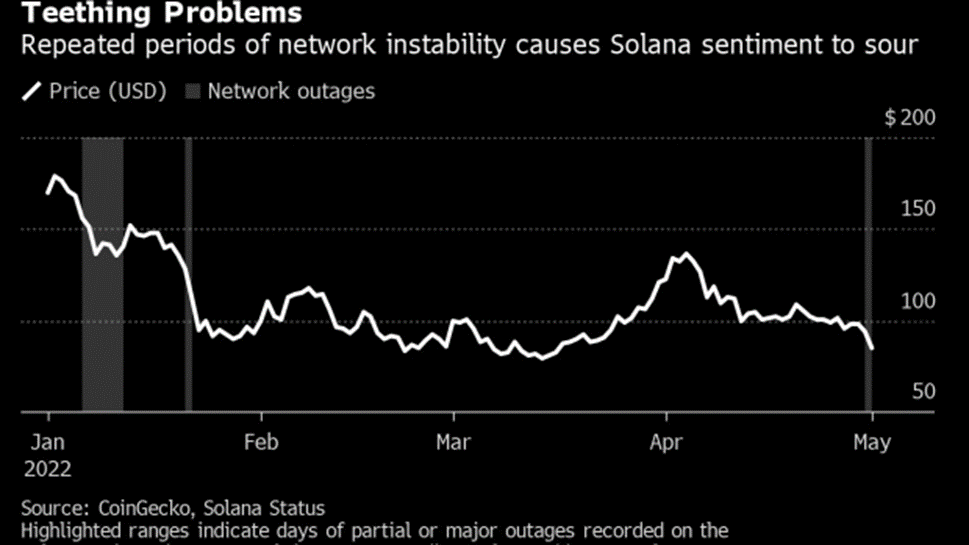

Now to level set with everyone, Solana is still a nascent project that has experienced some very public missteps. In just the last 12 months, the network has experienced an estimated seven outages as the network fell victim to various spamming attacks.

Thus, although we are constructive on the token price over the long term, we think that there are scalability issues that developers will need to address. Users should be cognizant of the risk assumed in keeping funds on Solana DeFi applications. While the smart contract risk might be on par with the smart contract risk on any other network, one must be aware that in the instance of market volatility, there may be cases where the network goes down, and you are unable to access your funds for a short period of time.

There are also scalability issues as it pertains to validation. Currently, there are 1,852 validators on Solana mainnet, validating transactions. This is a substantially lower figure than the 407k validators on the Ethereum network. This is something that Solana developers will need to work on improving, as ultimately, if Solana is aiming to build an immutable, permissionless information network, it will need to enable the storage of as many copies of the blockchain as possible.

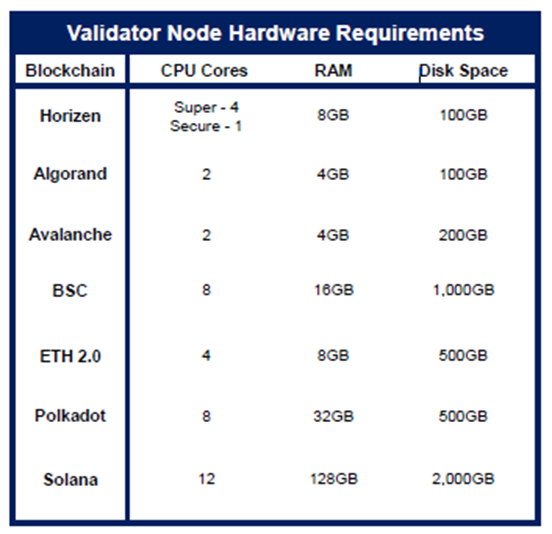

A major limiting factor currently is the hardware costs required to run a validator node, which, as demonstrated below, far exceed the hardware costs required on other networks. There are ways in which Solana developers expect to mitigate this issue over time, but those initiatives fall outside the scope of this note.

Summary

While the near-term macro outlook remains uncertain, we view Solana as one of the best risk/reward opportunities on the other side of this bear market. There will undoubtedly continue to be growing pains for the network, but a combination of (1) impressive adoption metrics, (2) a differentiated user experience, and (3) a rapidly growing developer base present a bullish outlook for the platform.

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In bd9fc8-8cf1b4-19ab04-1b354e-8433e6

Already have an account? Sign In bd9fc8-8cf1b4-19ab04-1b354e-8433e6