Crab Season

Key Takeaways

- Despite another week of sideways price action, one of our key 2022 crypto catalysts gained momentum. The Central African Republic was the second country to officially adopt bitcoin as legal tender, and Panama passed legislation to bring crypto into its regulatory framework.

- A decline in bitcoin options and futures volumes signals a decrease in interest from speculative traders and corresponds with compressed implied volatilities. Given these historically low implied volatilities, those who wish to hedge with near-term puts (or purchase long-dated calls) can do so at a relatively affordable price.

- The previously noted upward trend in realized cap has stalled, pointing toward an evident lack of sustained demand for storing value in the bitcoin network.

- Despite a supply setup that we have previously classified as a “powder keg,” bitcoin still requires increased traction on the demand side of the equation to light the proverbial match. We have yet to see conclusive increases across most major wallet activity metrics.

- Strategy - It is reasonable to expect downside volatility around continued rate increases and QT. We think purchasing near-term (1-3 months) put protection on long crypto positions and reducing exposure to more speculative altcoins are valuable measures to mitigate this risk. Despite this, we remain constructive on cryptoasset prices for 2022 and expect tides to shift in early 2H.

Weekly Recap

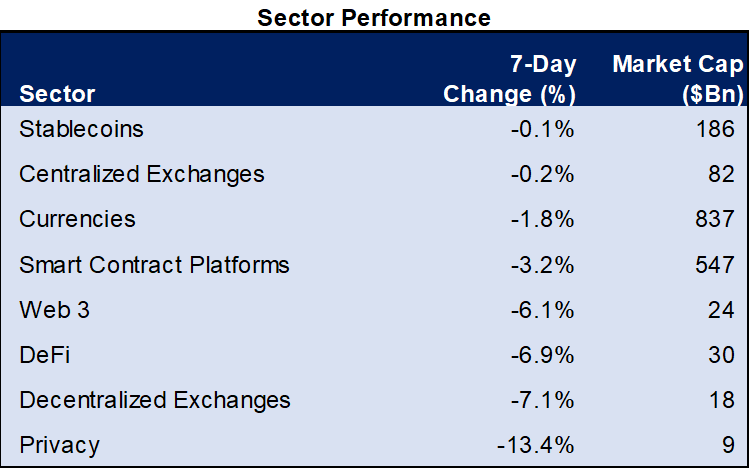

This week’s price action left much to be desired by those trading in either direction as most major cryptoassets continued to exhibit sideways price action. After briefly falling below $38k on Tuesday, BTC found a bid and has since recovered, sitting around $40k at the time of writing. Similarly, ETH is below $3.8k but recovered alongside bitcoin and is once again challenging the $3k level. The rest of the crypto market followed this pattern, but its recovery has lagged. It is clear we are in the midst of a full-fledged crab market[1].

Bitcoin did outperform more speculative alts this week, as web3 and DeFi sectors dipped more than 6%, while currencies fell a mere 1.8%. As discussed, this environment is challenging for altcoins and will continue to be until the macro clouds start to clear.

Catalyst Check – Adoption in Central Africa & Central America

In recent weeks, we have become slightly more risk-averse than usual, primarily due to the impending actions of the Federal Reserve and the near-term uncertainty that it brings risk assets. Thus far, this choppy price action is in line with our expectations for this calendar year, so we are not overly concerned.

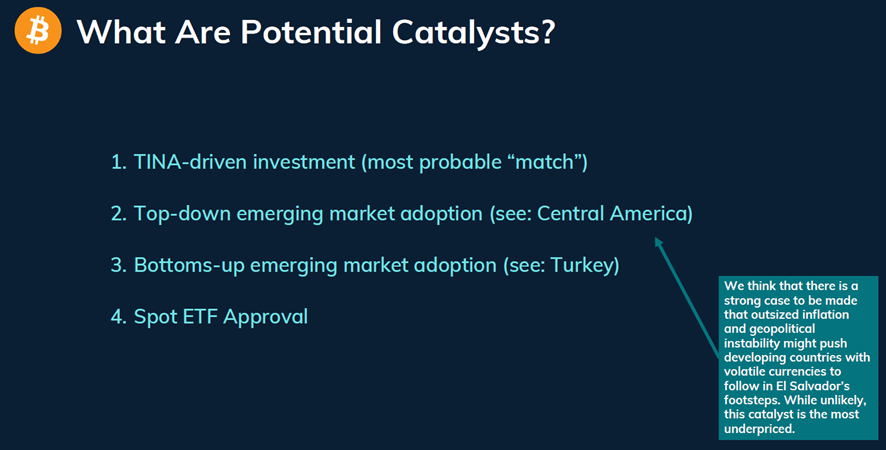

This week, several events beyond on-chain developments and price action have provided us with confidence that we are positioned for a constructive latter half of the year. The latest encouraging news came this week in the form of legislation drawn up by two tiny nations.

On Wednesday, reports confirmed that the Central African Republic (CAR), an underdeveloped country of nearly 5 million people, announced that it passed a bill making bitcoin legal tender in the country. CAR is landlocked between Sudan, South Sudan, Cameroon, DR Congo, Republic of Congo, and Chad. Like many of its neighbors, it is a product of European colonialism that lasted well into the 20th century. It’s an economically downtrodden state with a poor level of internet adoption and has been embroiled in violent internal conflict since its inception.

Given its level of civil unrest, checkered human rights record, and economic standing, it is obvious why CAR would like to adopt the bitcoin standard. Like the notoriously violent state of El Salvador, Bitcoin provides nations more sovereignty, an asset base that is set to grow faster than most other macro assets and allows a country to use its plentiful natural resources (hydropower is the current preferred method of energy production in the country) to build out energy infrastructure, using any excess power not consumed by the populace to mine bitcoin.

Additionally, similar to how El Salvador’s monetary policy was subject to the whim of the USD (it is a dollarized state), adopting bitcoin as a legal tender provides more autonomy over the country’s own economic future. CAR currently uses the Franc of the Financial Community of Africa (CFA), which is a remnant of French colonialism and is centrally controlled by the French government. For a deeper dive into how the CFA works and the ways in which it holds many African nations back, we point you to Alex Gladstein’s excellent essay in Bitcoin Magazine.

To be clear, adoption for CAR will not come easy. There are rumors that this law was pushed through CAR legislative bodies by corrupt entities with ulterior motives. Additionally, the infrastructure to build out a bitcoin ecosystem in CAR is extremely limited, as internet penetration in CAR is estimated to be 4%. But regardless of how effective or well-intentioned this might be, the passing of this law will still lead to more conversations about nation states adopting bitcoin , will generate interest in a small African nation largely ignored by the global economy, and could potentially lead to incremental adoption elsewhere in the region.

Turning our attention to Central America, El Salvador is no longer the only country in the neighborhood that can be considered crypto-friendly. Panama, the bridge between North and South America, approved a bill this week aimed at regulating crypto. The law stops short of declaring bitcoin (or any cryptoasset for that matter) legal tender, but it brings clarity to people and companies that wish to operate and use crypto in the country.

According to Gabriel Silva, the Congressman that introduced the legislation, the bill’s purpose is to “give legal stability to crypto assets in Panama and develop the crypto industry in the country to attract more investments and generate more employment.”

While “legal tender” was not part of the bill, this is in many ways a better route for adoption. Many citizens in Panama might be persuaded by the new economic sovereignty of their neighbors in El Salvador and start to integrate bitcoin and crypto into their society in similar ways. This dynamic might result in more effective, bottoms-up adoption among the people as compared to a top-down declaration from the government.

Regardless of the near-term implications, this indisputably adds momentum to the narrative surrounding nation-state adoption. As we have discussed before, we think game-theoretical adoption by governments will be a key catalyst for crypto, particularly bitcoin, over the coming years.

It starts with the smaller countries with “less to lose” that wish to remove the handcuffs placed on them by their larger counterparts with strong reserve currencies. Eventually, we this momentum will start to permeate larger, more stable countries, and ultimately it will become a strategic disadvantage to not adopt bitcoin in some form or another.

Derivatives Volumes & Implied Volatilities Continue to Decline

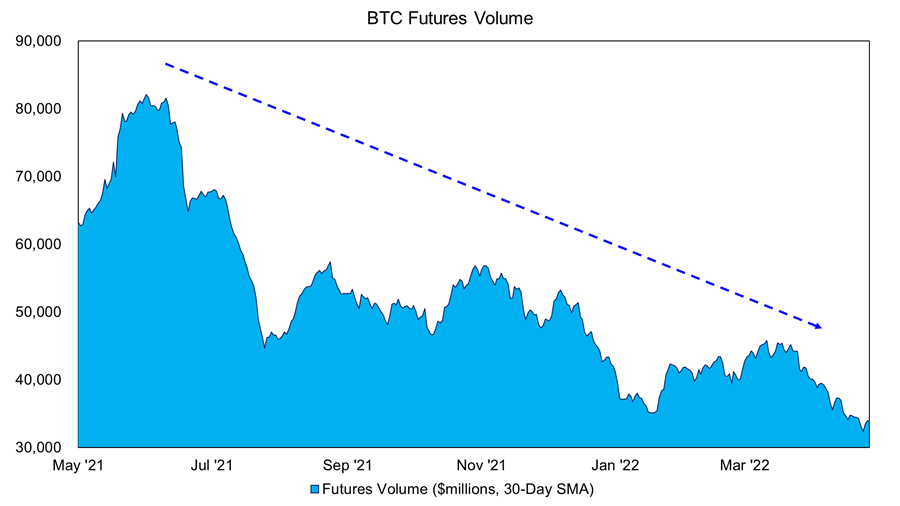

We continue to see low volumes in the spot market. This is something often discussed in the context of wild swings driven by illiquidity and an active derivatives market. However, what is also becoming evident is how much futures and options volumes have dropped off over the past 6-12 months.

Below we can see the structural decline in futures volume (denominated in USD) since May 2021.

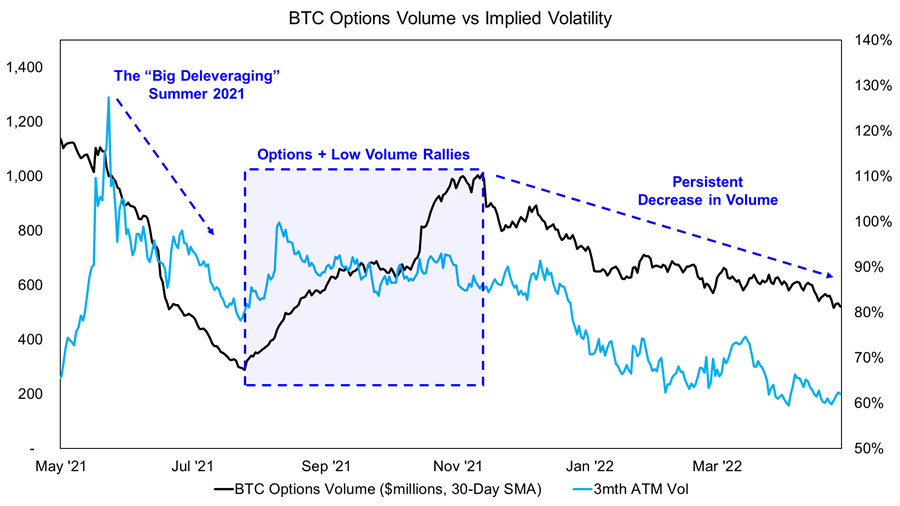

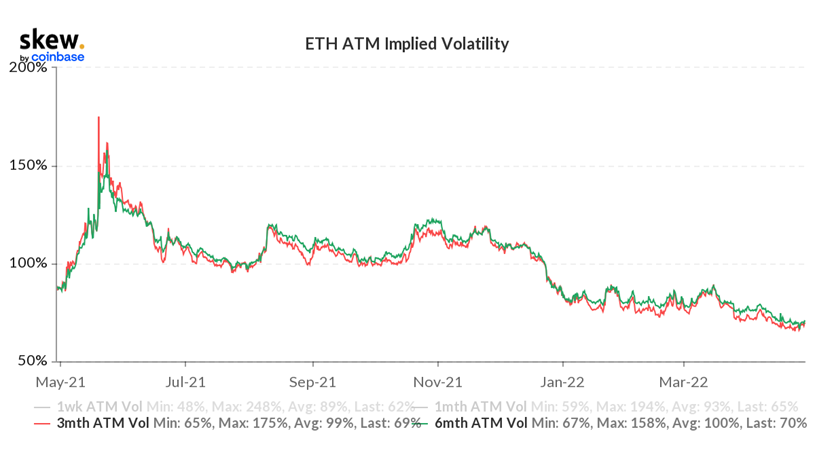

Similarly, options volumes have also fallen off. Naturally this corresponds to compressed implied volatilities. Clearly the demand for traders to speculate on bitcoin and ether’s price is decreasing.

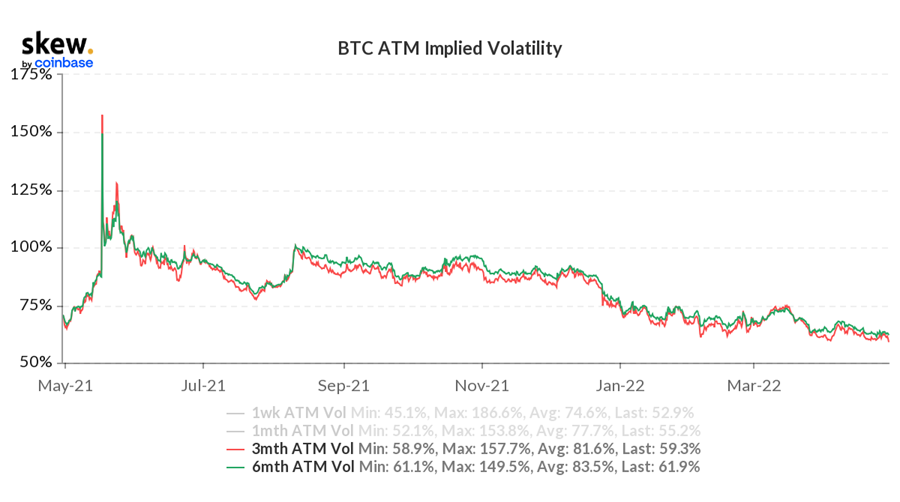

It is worth noting that 3 and 6-month implied volatilities for both BTC and ETH are challenging 12-month lows.

This is important, as we think it is wise, given the macro backdrop for risk assets to protect any long positions with some near-term (1-3 month) puts.

Given these historically low implied volatilities, those who wish to purchase near-term puts can do so at a rather affordable price, relatively speaking.

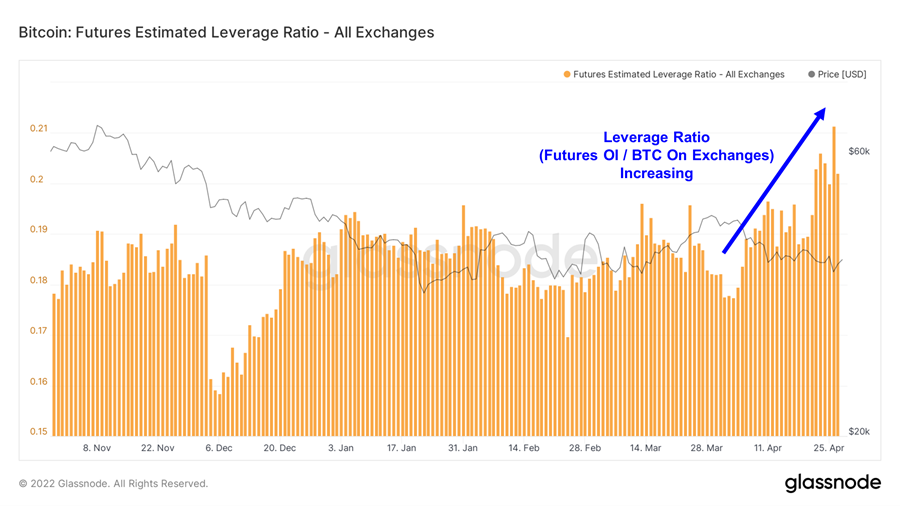

Leverage Ratio Increasing But Not Due to More Leverage

Despite our noting that derivatives volumes have been declining for the better part of a year, we would like to briefly discuss the chart below, which indicates that the leverage ratio for bitcoin (Open Interest divided by BTC on exchanges) is actually increasing.

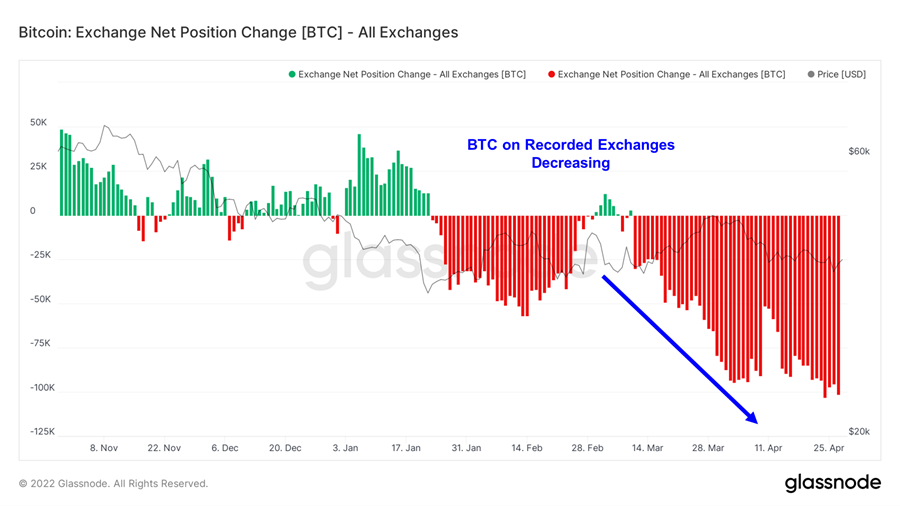

Normally we look to this metric for a sign that the market might be getting somewhat frothy. However, total futures open interest has declined in concert with volumes, and thus the spike in leverage can be attributed to the denominator in the leverage ratio – BTC on exchanges.

The next chart shows an extremely steep decline in BTC on exchanges since the start of this year. We think that this points to an increase in investors moving their BTC to non-custodial wallets and perhaps even using in DeFi, as BTC starts to stick its nose into more parts of the crypto ecosystem.

Certainly, a high leverage ratio increases the probability of a squeeze in either direction. But, a higher leverage ratio that results from the BTC supply side of the equation points to an overall healthier trading environment than a higher leverage ratio that is elevated due to overly ambitious traders putting on more leverage than they should.

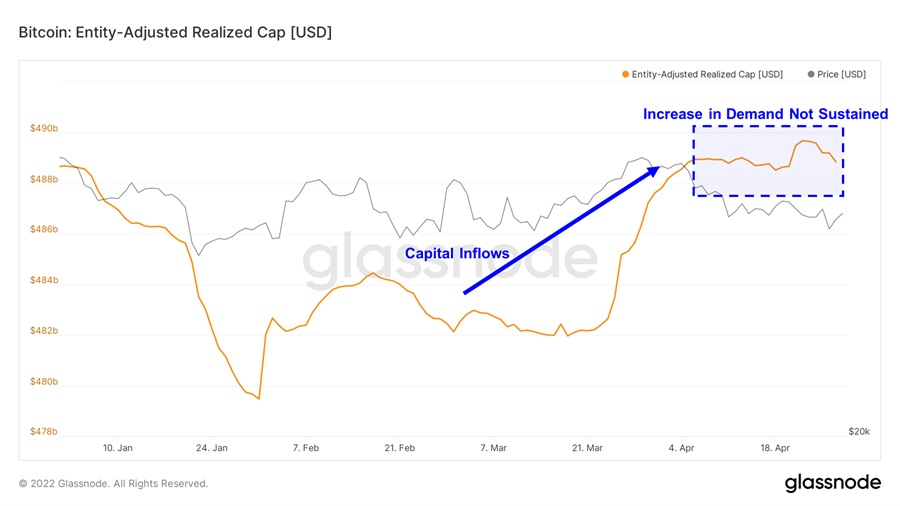

Bitcoin Inflows Stall Big Time

A popular metric to gauge the level of investor demand is realized cap. This serves as the closest proxy for fund inflows as it tracks the on-chain cost basis of the entire outstanding supply. When both price and realized cap are increasing, that means new money is buying into a rally. We witnessed a brief episode of this in late March and into early April following the LFG catalyst discussed a few weeks ago.

As one might expect given the recent price action, realized cap has stalled, pointing towards a clear lack of sustained demand for bitcoin.

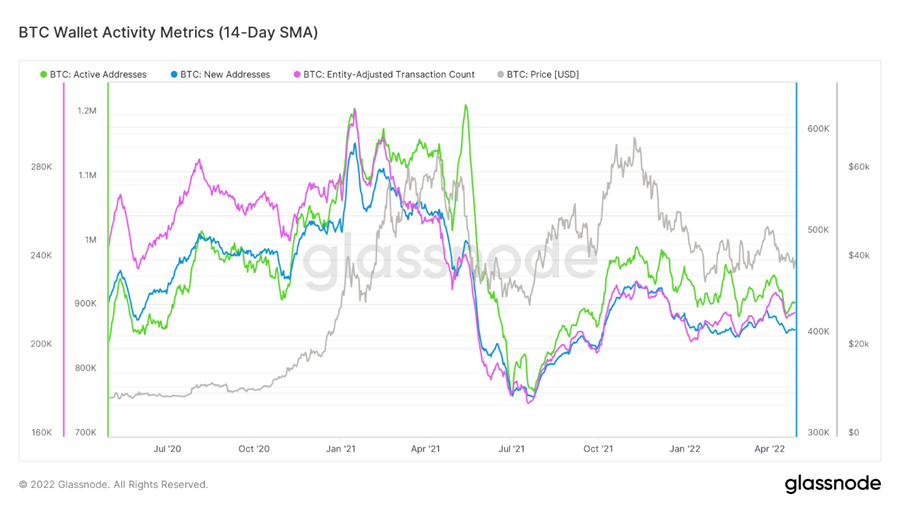

Bitcoin Activity On-Chain Remains Subdued

Despite a supply setup that we have previously classified as a “powder keg,” bitcoin still requires increased traction on the demand side of the equation to light the proverbial match.

In concert with the lack of inflows highlighted above, we have also yet to see conclusive increases in on-chain activity, as it appears most major wallet activity metrics continue to oscillate around a defined range since hitting an ATH in November.

Strategy – It is reasonable to expect downside volatility around continued rate increases and QT. We think purchasing near-term (1-3 months) put protection on long crypto positions and reducing exposure to more speculative altcoins are valuable measures to mitigate this risk. Despite this, we remain constructive on cryptoasset prices for 2022 and expect tides to shift in early 2H.

[1] A market in which assets exhibit choppy, sideways price action over a prolonged period.