A Framework for Positioning Around Tightening Monetary Policy

Key Takeaways

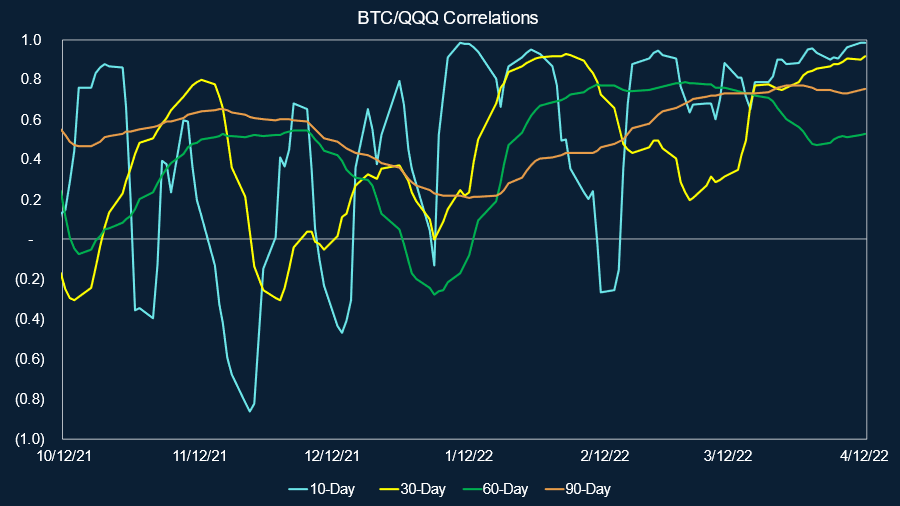

- Recent market distress has caused an increase in bitcoin’s correlation to tech stocks. We can see that the 10-day and 30-day correlations between BTC and QQQ have essentially reached 1.

- We review the price action of QQQ during the prior tightening cycle to inform positioning around rate increases and QT.

- Last week, the SEC approved the fourth futures-based bitcoin ETF under the Securities Act of 1933, poking a hole in one of the SEC’s main arguments against approving a spot-based ETF. We discuss the implications.

- According to reliable sources on the matter, the Merge will not be taking place by June, but the door is still open for a Q3 transition from PoW to PoS.

- Bottom Line: Despite a tumultuous week, we remain constructive on cryptoasset prices in the immediate term. That said, applying the framework highlighted below, it is reasonable to expect downside volatility around QT, and buying 3-month put protection could be a useful way to mitigate this risk.

Weekly Recap

It was yet another choppy, risk-off week for crypto, as investor concerns over inflation and the impending Fed response grew. Last week, we discussed how the March FOMC meeting minutes discussed an expeditious plan for rate hikes and a roadmap for quantitative tightening starting as early as May. This clearly reverberated throughout both traditional and crypto markets over the past week.

On Tuesday, March CPI figures were released, the first numbers to reflect the impact of the war in Ukraine. While the headline figure of 8.5% came in slightly above analyst expectations, Core CPI met expectations, thus marginally reducing rate hike expectations and leading to a partial recovery in risk assets.

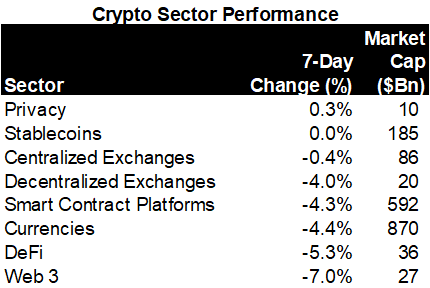

As one might expect, Web3 and DeFi names have underperformed over the previous seven days. Smart contract platforms performed surprisingly well, following closely behind currencies.

A Framework for Positioning Around The Fed

In Q4 2021 and early Q1 2022, we frequently discussed how bitcoin was trading like an overpriced tech stock, falling precipitously as the US 10-year started to move higher. It was clear to us that as the macro outlook turned bearish, and as investors ran for cash/commodities, bitcoin and other risk assets traded in tandem with each other.

In February and March, shorter-term correlations between bitcoin and tech stocks started to move toward zero as several tailwinds appeared for bitcoin including geopolitical strife, increased cross-chain adoption, and general seller exhaustion. We think it is likely that many of the “paper-handed” macro funds that entered the fold in 2021 and exited in early 2022 perhaps started to build on their positions again during this period.

As demonstrated by the chart below, we have clearly entered another period of market distress in which bitcoin is once again trading like a tech stock. We can see that the 10-day and 30-day correlations between BTC and QQQ have essentially reached 1.

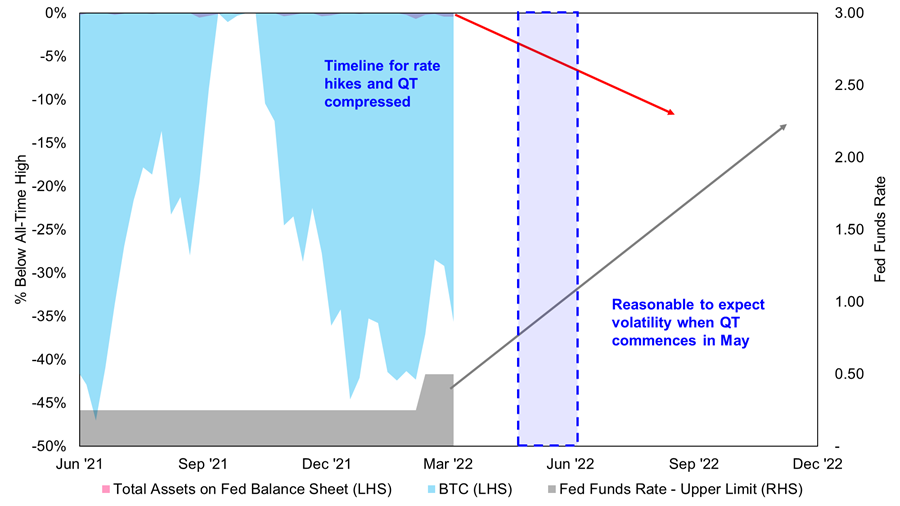

Understanding that bitcoin trades like a tech stock during times of market distress gives us a useful framework for thinking about how to position around a compressed monetary tightening cycle.

Comparing how bitcoin behaved during the last rate hikes and quantitative tightening is a useful exercise but, in our opinion, falls short since bitcoin was not as widely adopted at the time and therefore was not as direct of an analog to tech stocks. In fact, during the last wave of Fed tightening, correlations between bitcoin and QQQ were largely trending downwards.

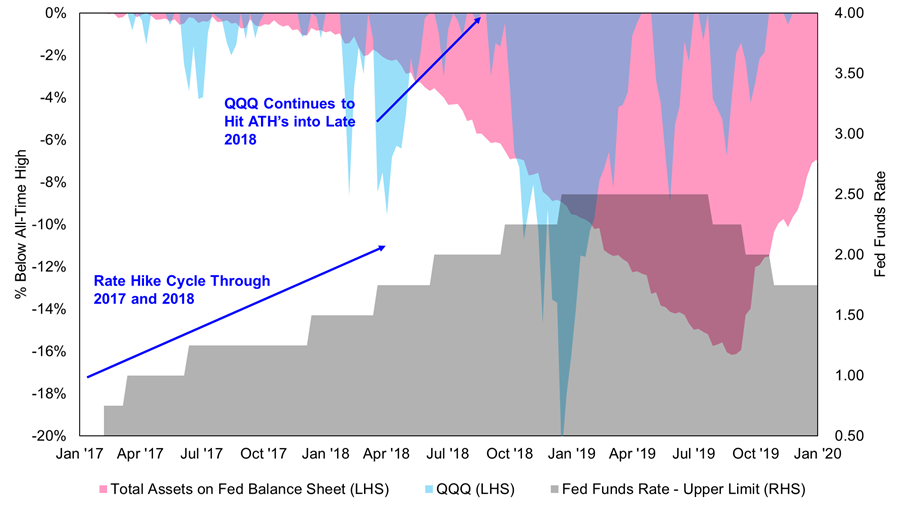

With that in mind, we can view Nasdaq’s performance during the last Fed tightening cycle as a proxy for bitcoin’s performance during this upcoming tightening cycle. Obviously, this is not meant to be a precise forecast. We do not know how rate hike expectations will progress nor the degree to which reduced liquidity from bond sales will affect the market. But the charts below could serve as a useful guide for positioning around the uncertainty facing us in the next few months.

The first chart compares QQQ drawdowns against rate increases and decreases in assets on the Fed’s balance sheet. We can observe that rate increases had little effect on the price of tech stocks. Despite stair-stepping higher throughout 2017 and 2018, QQQ continued to march higher, consistently marking new all-time highs. The takeaway? Since they were priced into the market, rate increases had little to no effect on asset prices. As we discussed last week, we think that bitcoin and the wider crypto market should continue to be less responsive to projected rate increases as the market becomes more effective at the pricing in future rate hikes.

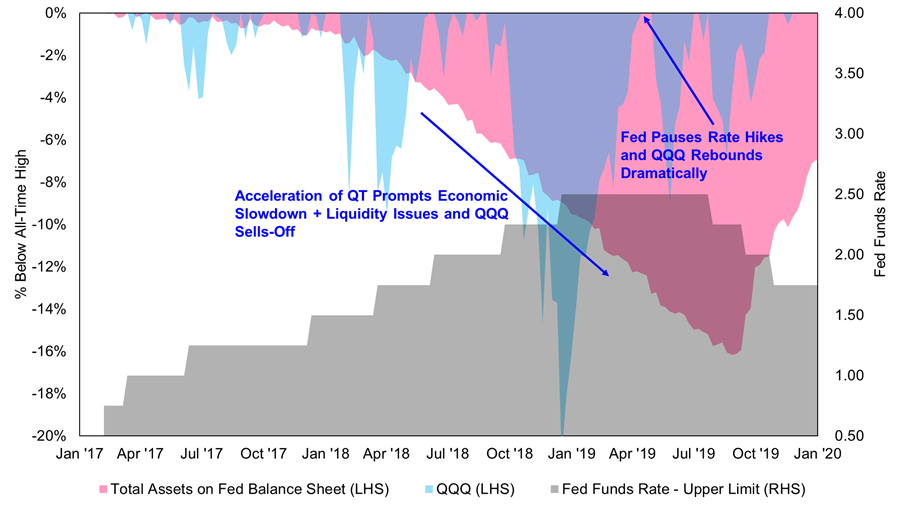

It was when rate increases were coupled with acceleration of quantitative tightening that QQQ experienced a massive drawdown. The economy showed its cracks, liquidity started to become an issue throughout the market, and the Fed needed to intervene (the “Fed put”). When the Fed paused rate hikes, the market responded quite favorably.

Therefore, it is reasonable to anticipate similar downside volatility when the Fed starts to reduce the balance sheet. Regardless of how this actually manifests, we think the uncertainty is enough to necessitate some medium-term hedging. We think 3-month put protection is a reasonable measure for crypto investors to combat this risk.

We think that a similar scenario could take shape where this heightened response by the Fed could break something in the market, causing them to take their foot off the gas (exercising the “Fed put”). Or alternatively, we could see inflation, while still elevated, start to roll over in a couple of months, reducing the pressure on the Fed to tighten, which could also result in risk assets pumping. Either way, since this tightening cycle is compressed, the downside pressure could be more fleeting than last time, and the V-shaped recovery could be steeper.

And for those asking, “what if the Fed is able to perfectly execute its soft-landing?”, well then, we are in a scenario where commodities are still expensive, inflation is high, and real yields are negative. This is the classic “TINA” scenario in which bitcoin, coupled with its strong secular tailwinds, is poised to reap inflows from bonds.

Catalyst Update – Spot-based Bitcoin ETF

Below we provide brief updates on two of our major projected catalysts for 2022. The first update pertains to the quest for a spot bitcoin ETF approval.

Last week, the SEC approved the fourth futures-based bitcoin ETF. We are not going to wade deep into the technical mechanics that make a futures-based ETF less consumer-friendly than a spot-based ETF. We have discussed this extensively in prior publications. But, in short, a spot ETF would be an extremely consumer-friendly option that would attract loads of new capital.

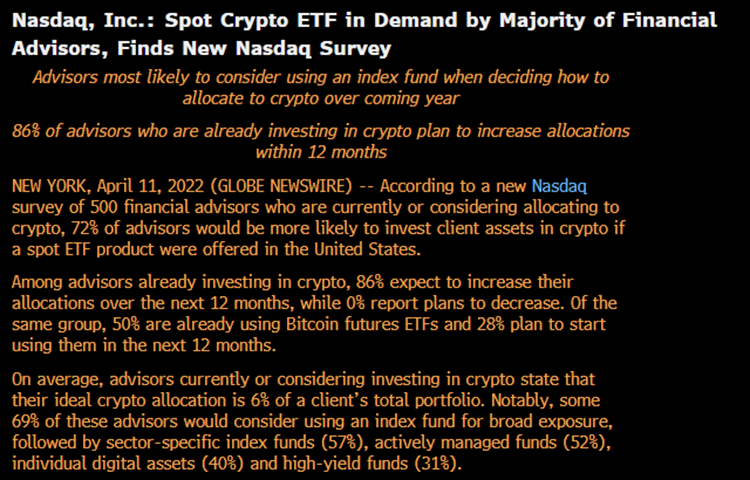

In fact, a Nasdaq survey released this week reported that of the 500 financial advisors surveyed, 72% would be more likely to invest client assets into crypto if a spot ETF was available.

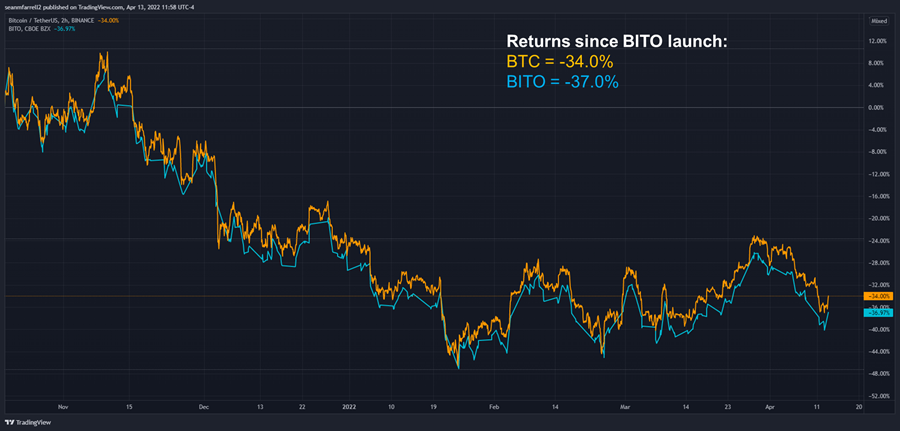

For added context, we turn to the chart below that uses returns as a succinct way to demonstrate why a futures-based ETF is an insufficient product. We can see that in a matter of 6 months, there has been a significant drift between the ProShares futures-based ETF (BITO -4.59% ) and the bitcoin price. Extrapolate this over a full year and we could see a difference of 5-6%.

With that in mind, we return to the approval of the most recent futures-based ETF.

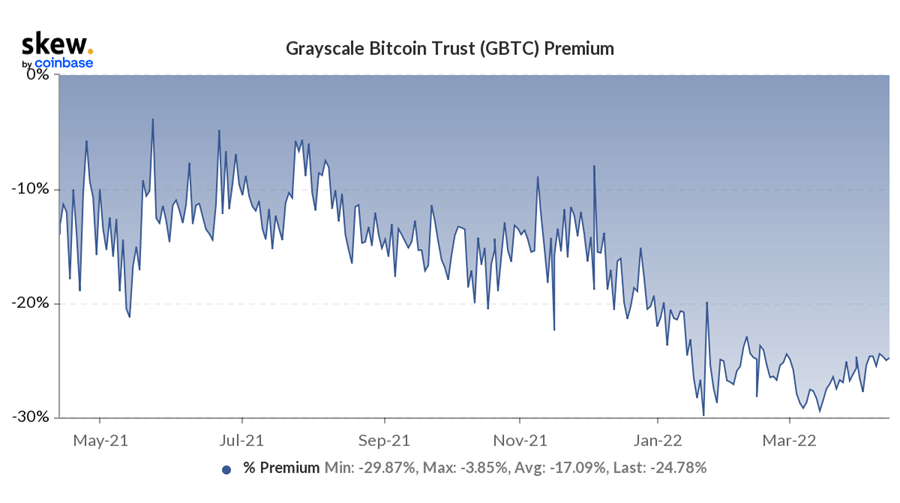

Grayscale, a leading digital asset manager, and the manager of the publicly traded GBTC -4.70% bitcoin trust has been at the forefront of dismantling the SEC’s criticisms of a spot-based bitcoin ETF. They are currently on a mission to convert GBTC into an ETF, which would effectively solve the current dislocation from NAV. (As discussed before, we think that GBTC is a good long-term play for the patient investor willing to wait for the discount to NAV to close. It essentially provides a leveraged position on bitcoin without the risk of margin call).

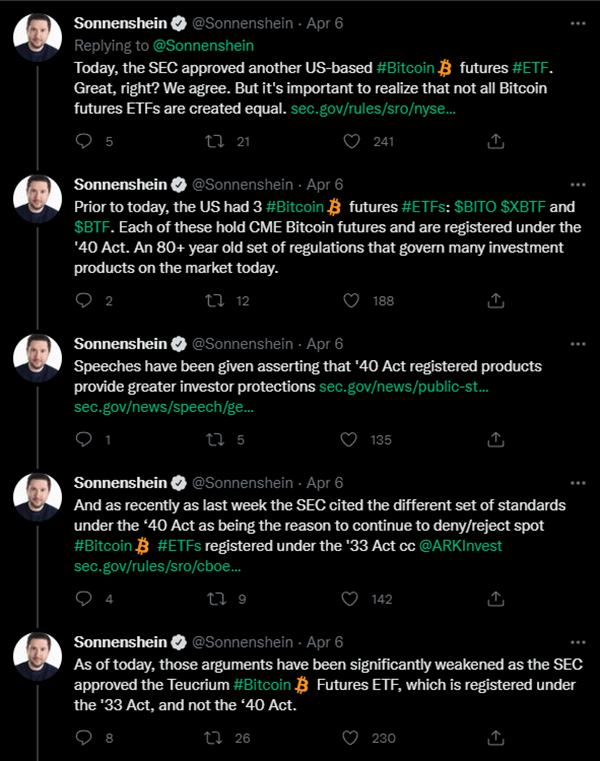

Michael Sonnenshein, CEO of Grayscale, took to Twitter last week to brief constituents on the approval of the latest ETF (issued by Teucrium), and its relative significance on the bitcoin ETF landscape.

You can read the thread in its entirety here. To summarize the key points:

- A major reason that Gary Gensler and the SEC refuse to approve a spot-based product is that a physically-backed spot ETF falls under the Securities Act of 1933 (the “33 Act”), which affords investors less robust protections than the Investment Company Act of 1940 (the “40 Act”).

- All prior futures-based bitcoin ETFs were approved under the 40 Act since the CME futures market is a fully regulated and surveilled market.

- The Teucrium ETF, however, was approved under the 33 Act, thus poking a hole in one of Gensler’s main arguments.

While this does not necessarily mean that a spot ETF approval is imminent, we think that this is an encouraging incremental step toward a spot-based ETF. At the very least, this puts Grayscale in a better position to pursue legal action if its application to convert GBTC to an ETF is denied at or prior to its July deadline.

Catalyst Update – The Merge

Optimism surrounding the transition of Ethereum from proof-of-work (PoW) to proof-of-stake (PoS), via a process being affectionately called the “Merge,” has increased in recent weeks. In our conversations with those in the Ethereum community, there seemed to be a lot of momentum around the Merge and confidence that it would be completed by the end of Q2.

However, according to Ethereum core developer Tim Beiko, a reliable source on the matter, the Merge will not be taking place by June. He took to Twitter to deliver the news.

While this is presumably a setback, Beiko did leave the door open for a Q3 Merge date, which means that the ETH merge could still serve as a sizeable catalyst for 2022.

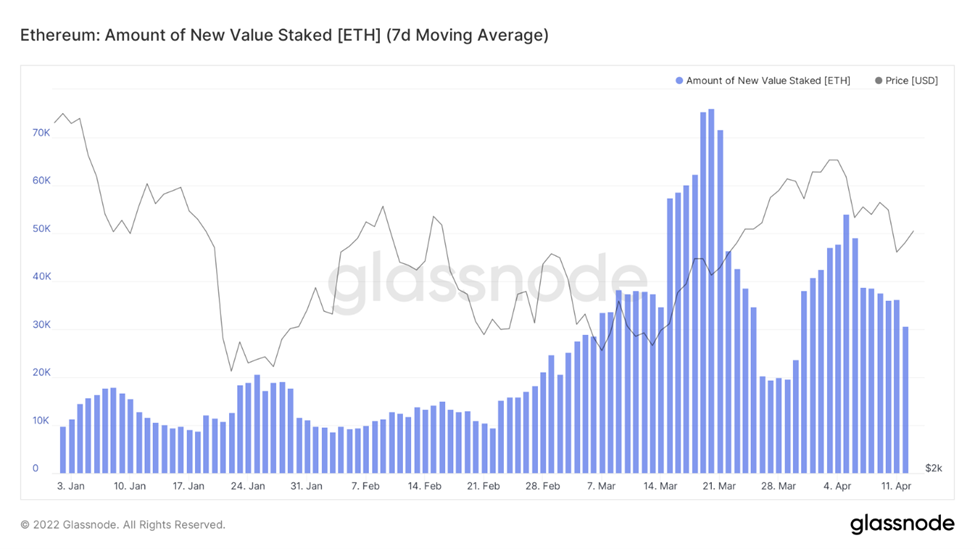

We can see below that while the rapid growth in ETH staked to the Beacon Chain has partially slowed, the amount of ETH being staked on a daily basis is still elevated relative to the preceding few months.