Geopolitical Tensions are High, Liquidity is Low, and Bitcoin is a Reserve Asset

Key Takeaways

- Markets continue to experience turbulence in the face of growing geopolitical tensions and full-scale war between Russia and Ukraine.

- We examine recent growth in spreads on major exchanges, highlighting a persistent low-liquidity environment.

- Option volumes point to the likelihood that many investors are maintaining long positions while hedging risk with derivatives.

- The market is already questioning the ability of the Fed to raise rates as indicated by a decline in projected rate hikes.

- We discuss the Terra (LUNA) blockchain’s adoption of bitcoin as a reserve asset and discuss the resulting implications on algorithmic stablecoins, regulation, and bitcoin as the ultimate reserve asset.

Bottom Line: Consistent with last week, we think it is wise to maintain long positions with time horizons beyond six months and be prepared to buy on dips. We believe that continued headline-driven volatility will likely present opportunities to add on long positions at favorable prices. We will continue to monitor the temperature surrounding rate increases as the Fed starts to gain justifiable reasons not to raise rates as much as initially anticipated.

Continued Turbulence

Last week, despite relatively robust price performance, we discussed a continued lack of provable increases in demand for bitcoin and throughout the broader crypto ecosystem, leading us to believe that we were headed for continued choppy price action.

This week, the market continued to trade at the whim of major headlines, as Russia officially invaded Ukraine and sanctions were issued by major Western nations. Bitcoin and ether sold off alongside equities as uncertainty continued to mount.

Crypto-natives continued to demonstrate risk-off behavior, with centralized exchange tokens outperforming the market and currencies outperforming other more speculative altcoins.

Source: Messari (As of 2/23/2022)

Spot Market Inactivity

We have recently stressed the overwhelming lack of activity on the Bitcoin network (low wallet growth, flat transaction growth, etc.), indicating a tepid level of demand. This is indicative of a consolidating market, in which we are more likely to see sideways/choppy price action.

Our Head of Research Tom Lee recently noted a “buyers strike” across legacy markets, as uncertainty from the Fed, inflation, and geopolitics continues to rear its ugly head. Substantial bids in the spot market appear to be just as rare in the crypto ecosystem.

Below we see that rolling 30-day daily volumes on Coinbase failed to eclipse the $1 billion mark despite hitting an all-time high in November and are now tumbling towards levels last witnessed during the turbulent summer months.

Despite the lack of spot market activity, options volumes have not dropped quite as precipitously. This is emblematic of the trading environment we have witnessed over the past six months. Despite intermittent bursts of increased spot activity, price action has primarily been driven by active derivatives market in a low liquidity environment. We think that a common strategy employed by investors is staying long spot while using derivatives to hedge their positions to the downside.

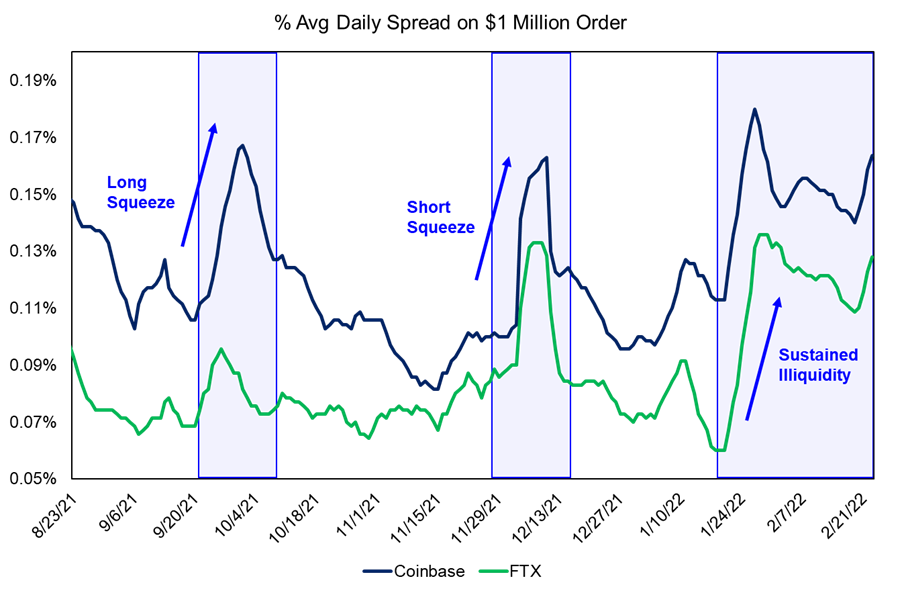

On the topic of low liquidity and volatility, below, we can see that this lack of spot volume has started to manifest in sustained increases in exchange spreads.

Mapping out bid-ask spreads for orders over $1 million on FTX and Coinbase, we can see that during times of cascading liquidations, there are often liquidity crunches, resulting in parabolic moves in these spreads. However, following the most recent major price action in January, spreads increased and have not regressed to their mean. We think this further enforces the fact that investors are largely still on the sidelines (similar to those in legacy markets).

What Do Recent Events Mean for Rates?

Of course, a significant reason for sidelined investors is the Fed and questions around what they will do with rate hikes in March and beyond. There is a lot of fear around how much the Fed will raise, when it will tighten, and what effects this will have on asset prices. Recently, outsized inflation prints have caused investors to price in more rate hikes in March than anticipated at the start of the year. People thought that raging inflationary pressure would force the Fed into a hawkish pivot.

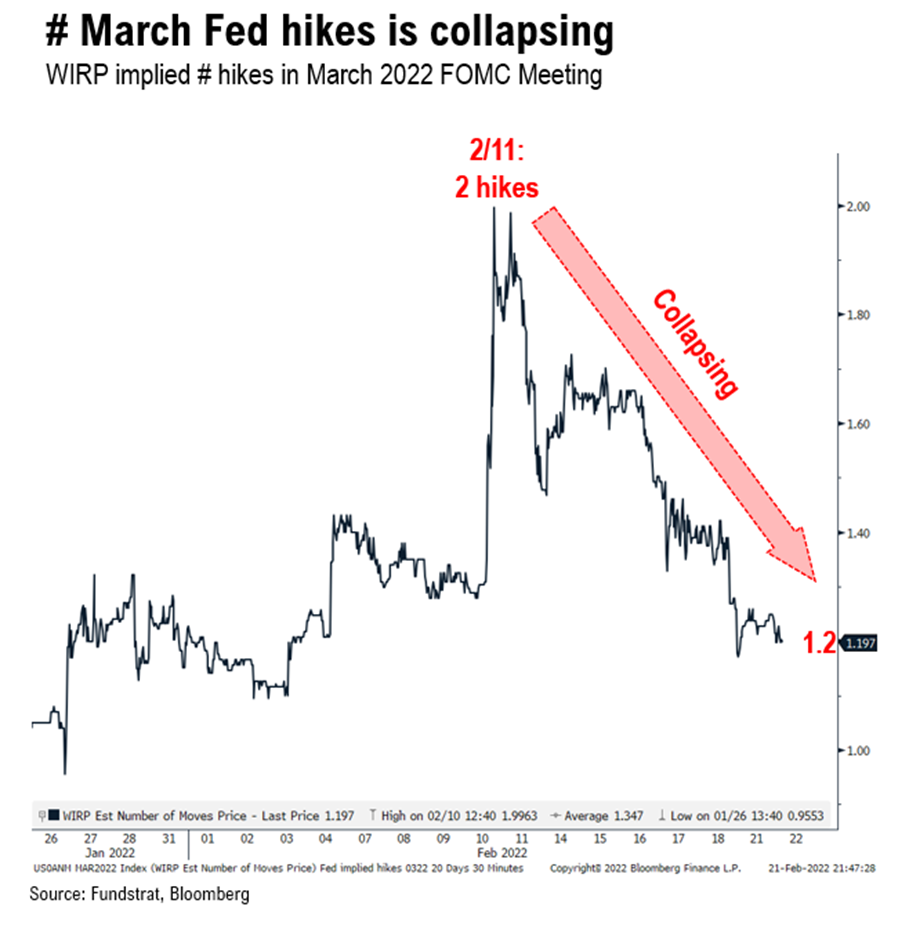

However, recent asset price declines coupled with geopolitical strife have already put a damper on rate increase expectations. Per the chart below, the probability of a 50 bps increase in March has declined dramatically since the start of the Russia-Ukraine conflict.

Could this be the excuse that the Fed uses to sidestep monetary tightening? We don’t know for sure, but it is essential to remember that we are debating the effects of a mere 25-50 bps increase in the cost of capital amidst this recent market chaos.

The system is reacting in an undeniably fragile manner, as one would expect following a decade of effectively free money. This is an important concept to remember as one allocates around the Fed’s decisions. We think that there is a non-negligible chance of Fed undershooting its desired rate increases by the end of this year.

Bitcoin As a Reserve Asset in DeFi

While many in the Bitcoin ecosystem wait for nation-states to adopt bitcoin as a reserve asset, some developers in Web3 are moving full speed ahead in utilizing BTC as the superior store-of-value it is.

Terra (LUNA) is a proof-of-stake layer 1 platform centered on algorithmic stablecoins. The most popular and widely used Terra stablecoin is UST 0.04% , which is pegged to the US dollar. In contrast to centralized stablecoins like USDC and USDT, which are backed by tangible assets, Terra’s native token LUNA is used to maintain the 1:1 peg of Terra stablecoins to their respective base assets. UST and LUNA act as counterbalancing forces that seesaw depending on UST demand.

When the demand for UST increases and the token starts to lose its peg to the upside, users will mint additional supply of UST by “burning” an equivalent amount of LUNA. Conversely, UST is burned, and LUNA is minted when the peg is below $1.

One major (and fair) criticism of UST and other algorithmic stablecoins is their inherent reflexivity. A vast market selloff can cause significant downward pressure on the 1:1 peg. This downward pressure could incite further exit from UST positions, resulting in additional minting of LUNA, and so on, until users find themselves amid a quasi “bank run.”

Source: Fundstrat

We think this is a useful mental exercise to conduct given UST’s mechanics. Ultimately, once sufficient economic activity is built around Terra, the risk of such a “bank run” should be de minimis. That said, there is a particular chicken and egg problem at play, as incentivizing developers to build additional economic activity around Terra requires confidence in UST.

One way to mitigate this risk is by introducing a reserve asset. With that in mind, Singapore-based non-profit Luna Foundation Guard (LFG) has elected to create a bitcoin-denominated reserve for the platform to lessen UST fluctuations during episodes of market volatility. LFG raised $1 billion through a private token sale to purchase the BTC reserve. The funding round was led by Jump Crypto and Three Arrows Capital. The price of LUNA popped on the news as confidence around the platform’s stability grew overnight.

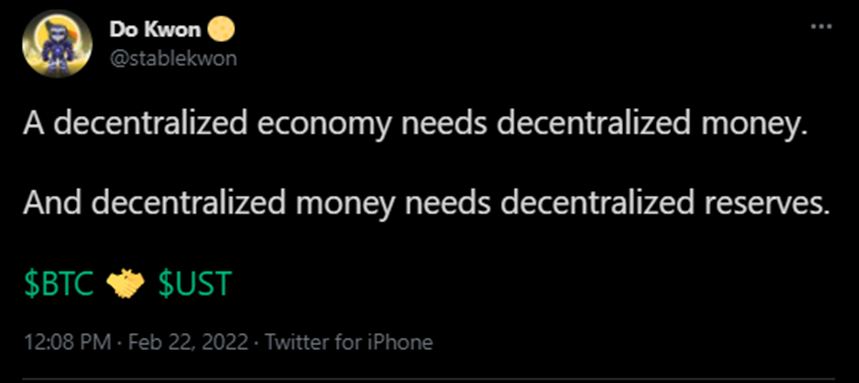

We think this is a perfect marriage of the innovative web3 solutions that are pushing to boundaries of interoperability and composability with the ultimate bastion of decentralization in bitcoin. We often discuss how smart contract platforms are similar to decentralized economies governing value creation, storage, and transfer. Well, we think Do Kwon, the founder of Terra, articulated the beauty of this combination quite well.

Source: Twitter

A decentralized economy should have decentralized money, and that decentralized money needs to anchor its value to a decentralized reserve asset. Had Terra decided to employ US dollars or gold as the reserve asset, any stablecoins built on its platform would likely maintain their respective pegs. Still, it would also suffer from centralization risk.

We think there are two major takeaways from this development:

- While many are concerned about government overreach regarding stablecoins, developers have proceeded to find creative ways to launch decentralized stablecoins, which can be used across different platforms in the same way that the popular USDC or USDT are. This is why we think regulation can only slow or geographically divert innovation, not stop it.

- Bitcoin is the ultimate reserve asset and is starting to be used as such. We expect to see BTC used similarly across DeFi in the years to come. At some point, nation-states will follow in the steps of El Salvador and Terra and increasingly build a bitcoin position in their respective country’s reserves.

Bottom Line

Consistent with last week, we think it is wise to maintain long positions with time horizons beyond six months and be prepared to buy on dips. We believe that continued headline-driven volatility will likely present opportunities to add on long positions at favorable prices. We will continue to monitor the temperature surrounding rate increases as the Fed starts to gain justifiable reasons not to raise rates as much as initially anticipated.