Digital Assets Weekly: September 1st

For a full copy of this report in PDF format please click HERE

Market Analysis

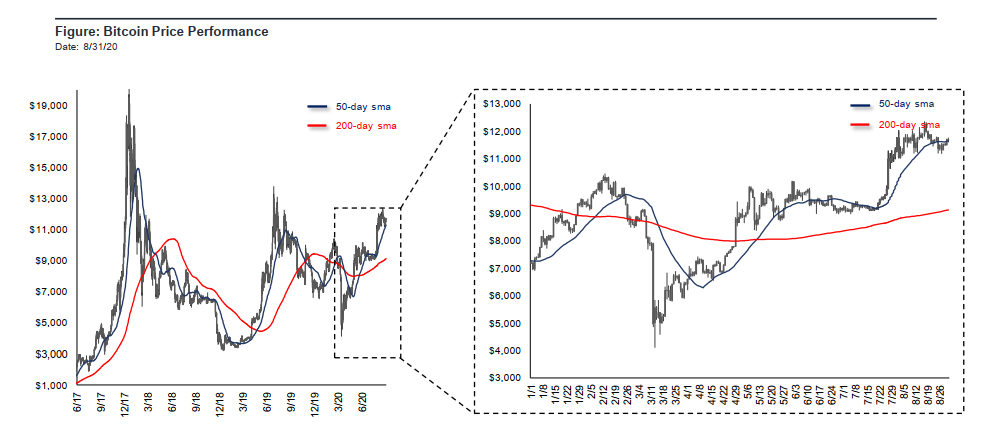

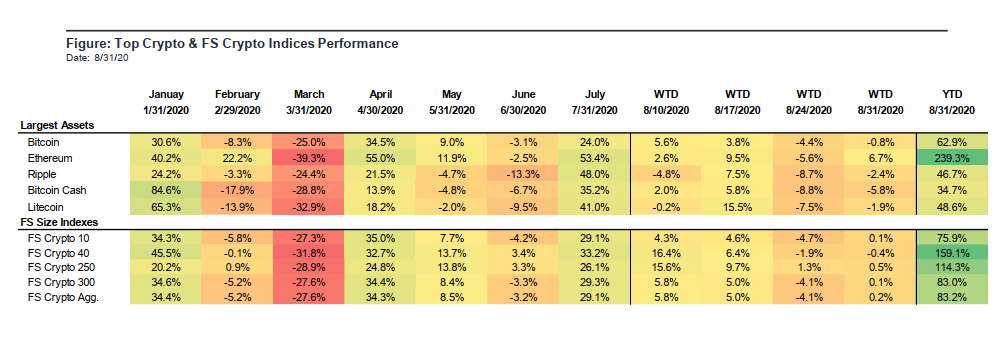

Early in the week, Bitcoin dipped testing $11,000 as support before rebounding and ending the week only slightly down

(-0.8%) from the week prior at $11,678. August is only the second month in Bitcoin’s history that it traded above $10,000

for the entire month.

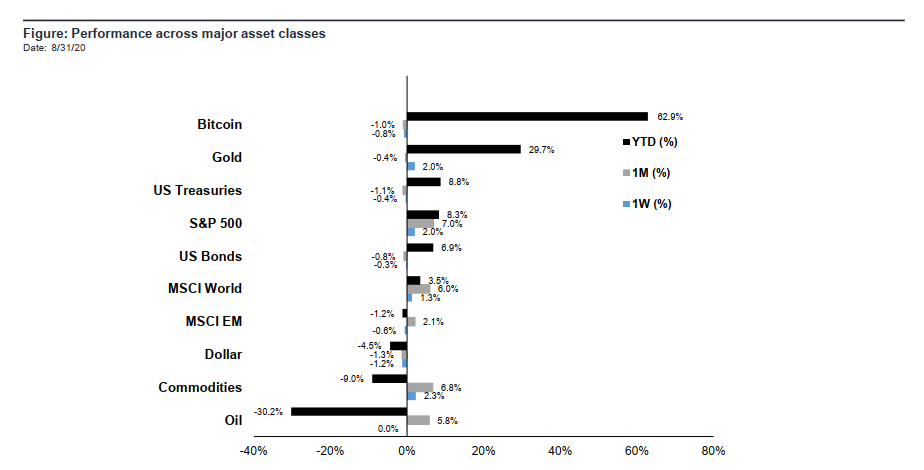

Bitcoin continues its 2020 outperformance compared to all major asset classes. Notably, equities reached new all-time highs

this week and the Dollar continued its decline as investors expressed their appetite for risk-on assets.

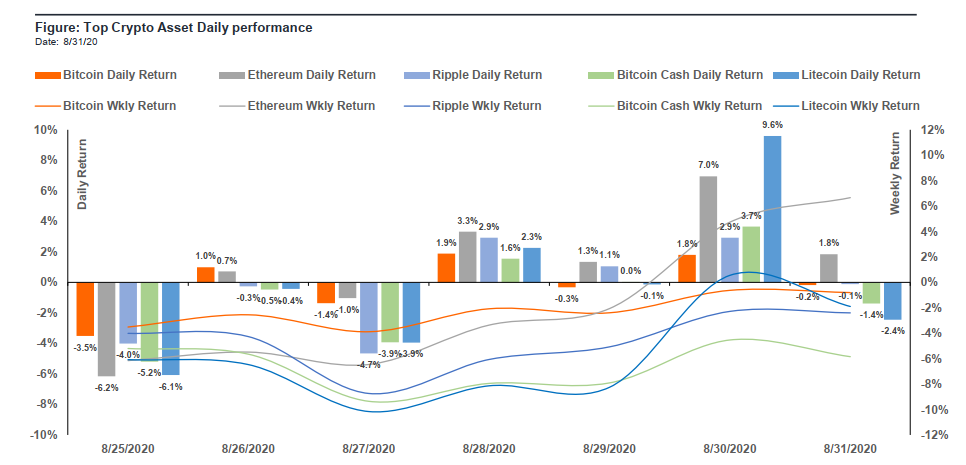

Amongst all the majors, Ethereum was the only asset that was positive this week (+6.7%), largely driven by the growth of

the nascent DeFi space which broke above $8 billion in total value locked this week.

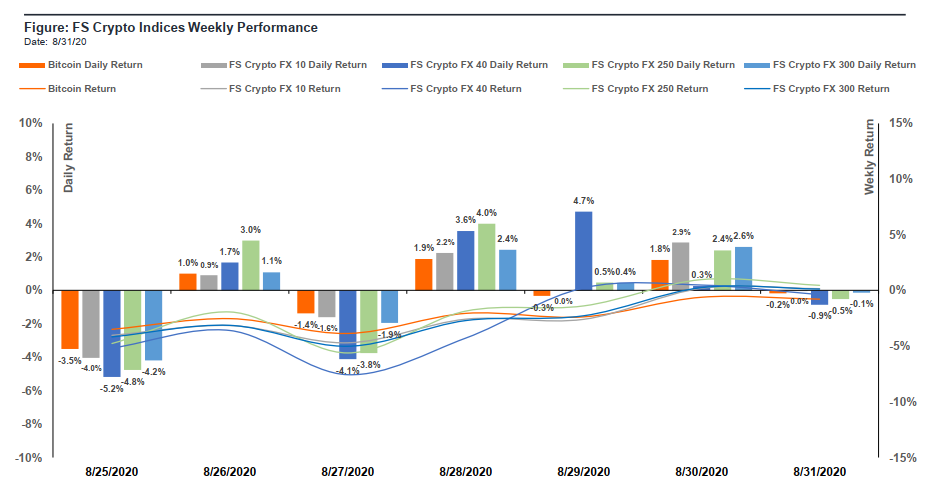

When Bitcoin dipped earlier in the week, it dragged the rest of the market down with it, but all the FS indices bounced back

and ended the week flat compared to the week prior.

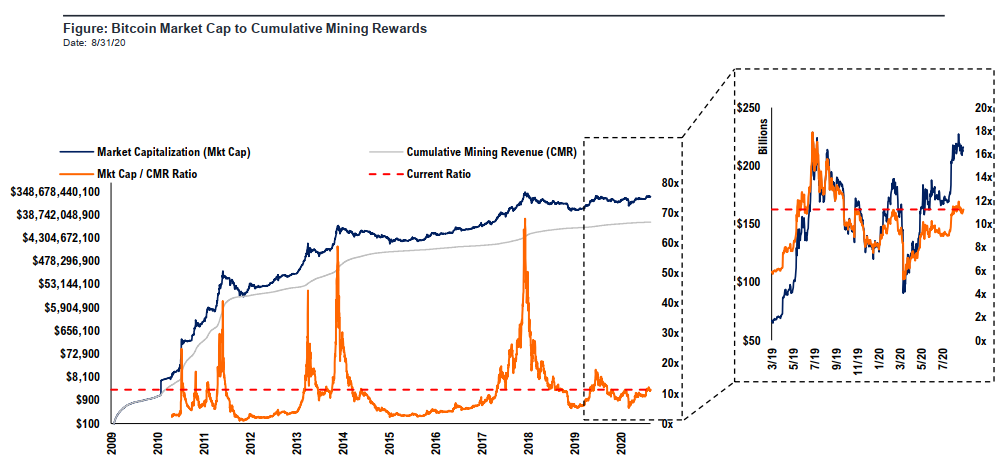

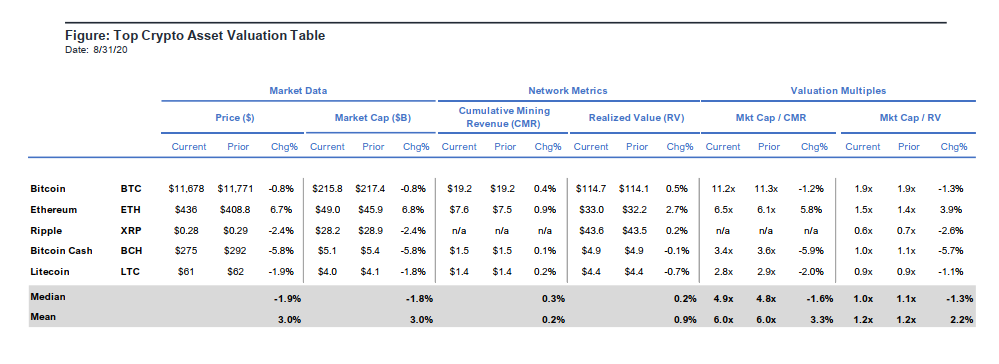

Bitcoin’s Mkt Cap/CMR ratio decreased 1.2% week over week from 11.3x to 11.2x.

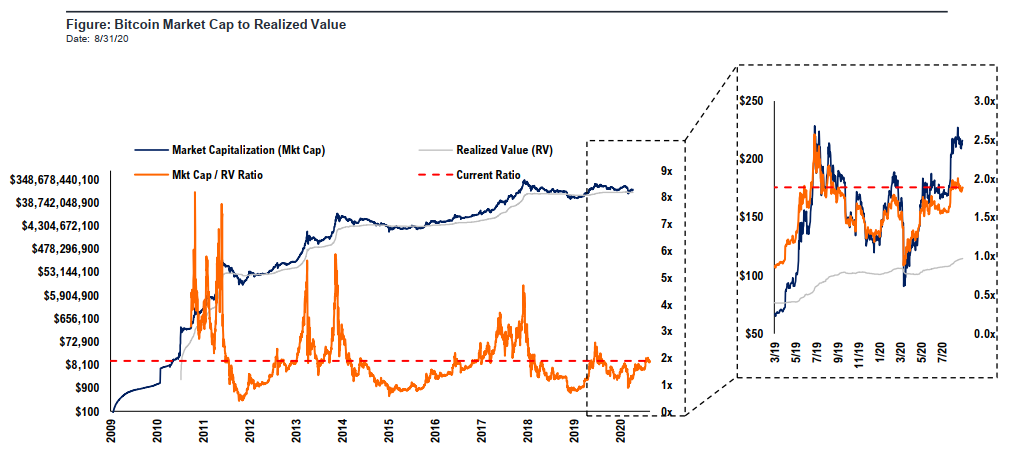

Bitcoin’s Mkt Cap/RV ratio was flat on the week and remained at 1.9x.

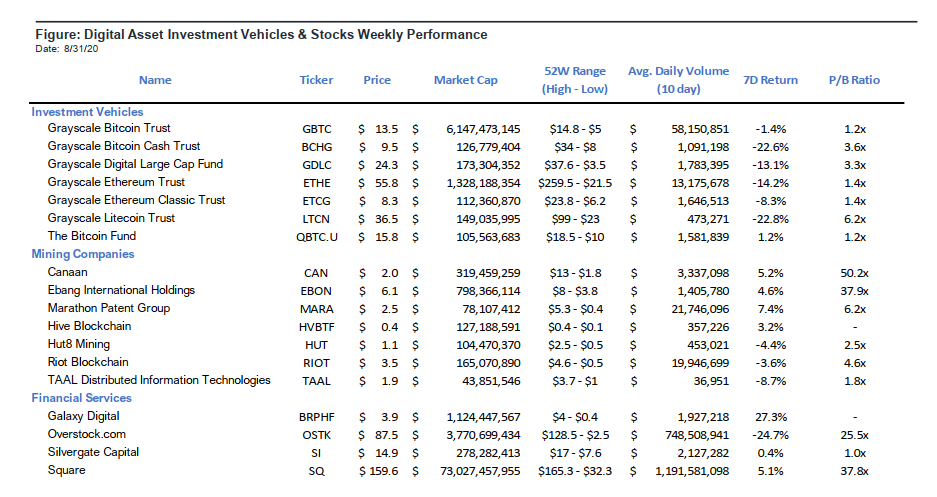

Digital Asset Investment Vehicles & Stocks

Noteworthy this week:

Canaan (NASDAQ: CAN): Canaan Inc., a provider of high-performance computing solutions reported on Tuesday a Q2 net loss of 0.11 yuan ($0.02) per American depositary shares, compared with a net loss of 1.88 yuan per ADS in the same period last year. Revenue totaled 178.1 million yuan ($25.2 million) for the June quarter, down from 241.5 million yuan for the prior-year period.

Grayscale Investments: This week, the GBTC premium to NAV ticked up back above 20% while the ETHE premium fell to its all-time low of 39%. The ETHE decline is notable as it listed at a premium of >1,000% and has an average historical premium of ~260%. Grayscale’s newly listed products BCHG and LTCN kept their high premiums finishing the week with premiums of 265% and 525%, respectively.

Square, Inc. (NYSE: SQ): Square rallied 3.2% premarket Tuesday after Wedbush analyst Moshe Katri wrote that shares could reach $250-$300, citing a call the firm hosted with the mobile payment solution’s former global head of sales. That call provided a “bull case” assuming CashApp grows to 200m users from 30m today and a recovery in the seller segment.

TAAL (CSE: TAAL): TAAL, a verticially integrated blockchain infrastructure and service provider announced its financial results for Q2 2020. The Company reported a net loss of $2,425,520 as compared to a net loss of $139,743 for the comparable period in 2019. Additionally, it reported gross revenue of $1,604,452 for the three-months ended June 30, 2020, as compared to $4,304,627 for the same period in 2019, a 62.7% decline that reflects the termination of hashing operation in May 2020, which resulted in gross revenue of $7,608,956 for the six months ended June 30, 2020, as compared to $4,304,627 for same period in 2019.

Winners & Losers

Winner

Fidelity – Fidelity Investments is launching its first bitcoin fund, adding its establishment name and star power to the fledgling and often controversial asset class. Two years ago, it started Fidelity Digital Assets, a unit meant to manage these products for hedge funds, family offices and trading firms. The Boston-based money manager said in a filing to the SEC that it will begin to offer the Wise Origin Bitcoin Index Fund I through a new business unit called Fidelity Digital Funds. Fidelity’s latest foray into the world of crypto is welcome news for fans who have long sought greater acceptance of digital currencies and blockchain by Wall Street mainstays.

Loser

Mongolian Miners – A document issued by the Department of Industrial and Information Technology of the Inner Mongolia Autonomous Region. The suspension means these mining farms will no longer be able to enjoy electricity discounts that come from a liquid energy marketplace provided by the Inner Mongolia Power Group, a state-owned energy trading firm in the region.

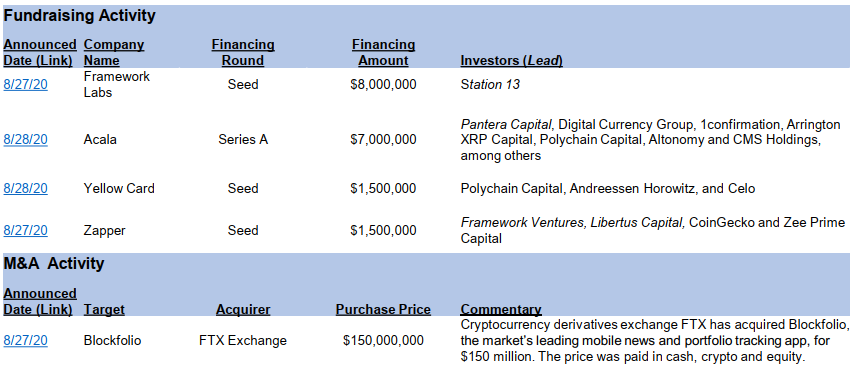

Financing and M&A Activity

Noteworthy this week:

Blockfolio – Hong Kong-based crypto exchange FTX acquired crypto portfolio tracker Blockfolio for $150 million and is said to be one of the biggest acquisitions in the digital asset industry. FTX settled its acquisition using a combination of stock, crypto, and cash. The move signals FTX’s intention to enter the retail end of the industry.

Acala – Acala, a decentralized finance project building on top of the Polkadot blockchain network, has raised $7 million in Series A through a simple agreement for future tokens (SAFT) sale. Acala is building various DeFi products, including a decentralized stablecoin called aUSD, a decentralized exchange and a staking derivative.

Recent Research & Events

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight:

• Tom Lee & David Grider: If you missed it, view a recording of the Business Use Cases of the BSV

Blockchain Webinar

• FS Digital Strategy Team: Bitwise: Leading Crypto Index Funds & New Alpha Opportunity

• David Grider: Digital Assets Weekly: August 25th