Digital Assets Weekly

Please see important disclosures at the bottom of this report

Portfolio Strategy

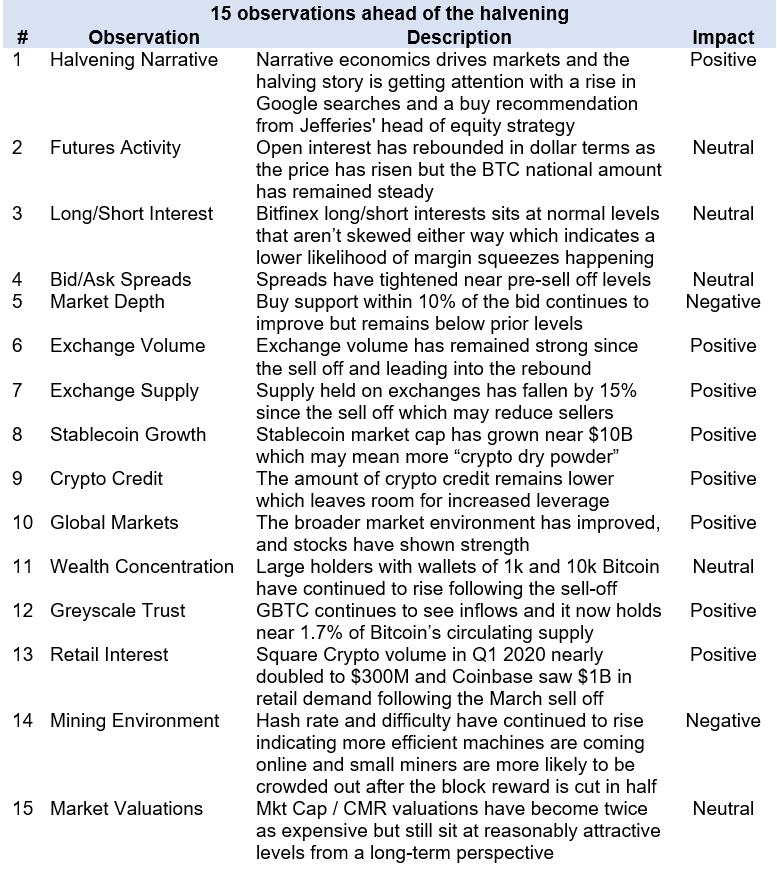

In our prior note, we indicated that markets could likely see continued strength leading up into the Bitcoin halvening and that’s what we got this week. While my view has not changed since last week, this week I will offer investors 15 observation ahead of the halving.

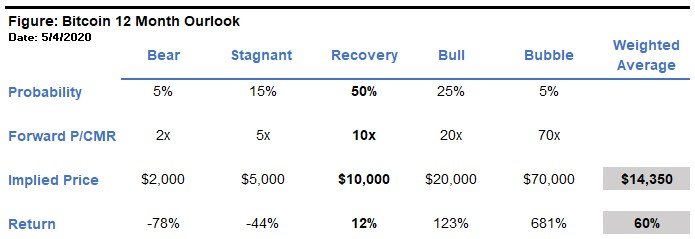

The picture is not conclusive, but it paints an on balance positive story. Bitcoin still has room to go before reaching our weighted average 12-month price outlook of $14,350, but there’s a good chance the path there is not straight in my view.

We are still looking for prices to rally up into the halvening and will start to look more critically at the market in the immediate days before and weeks after for any signs of weakness. Based on current market conditions, we would not be surprised to see Bitcoin reach the $10k level before the event, and possibly have some retracement after.

Investors will recall that $10k was the highest probability market outlook scenario we published for Bitcoin back on March 17th after the sell off when prices sat around $5,400. While we’ve gotten here quite quickly:

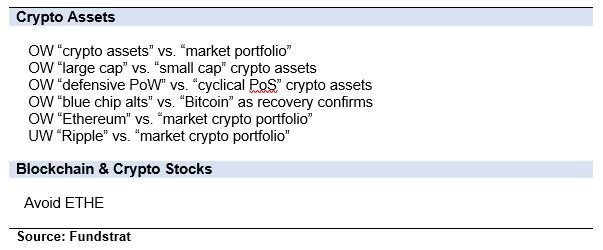

Market Recommendations: With all of this in mind, our outlook for Bitcoin over the next 12 months and recommended investment themes are shown below

Investment Themes

Market Analysis

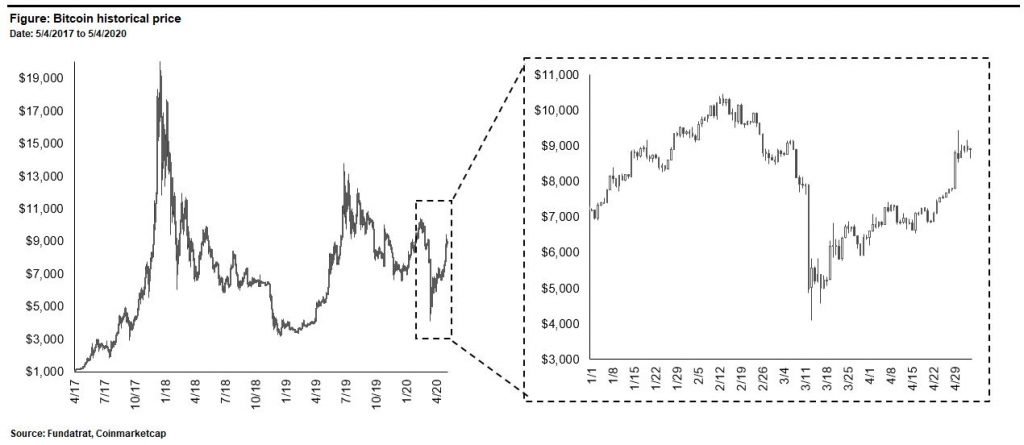

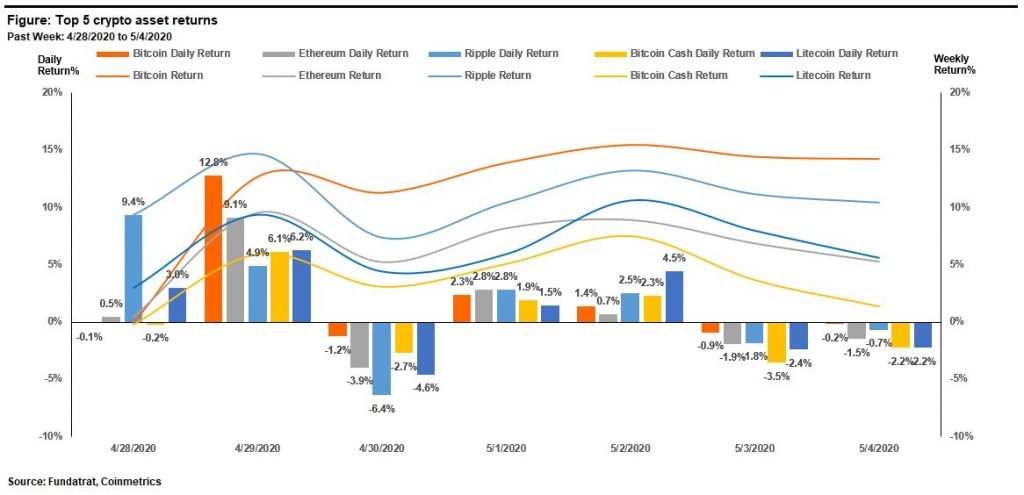

After closing around $7,800 last Monday, Bitcoin staged a big breakout this week with a 12.8% gain on Wednesday and climbed as high as $9,400 on Thursday. Bitcoin finished the period closing around $8,900 on Monday, posting a massive 14% gain on the week.

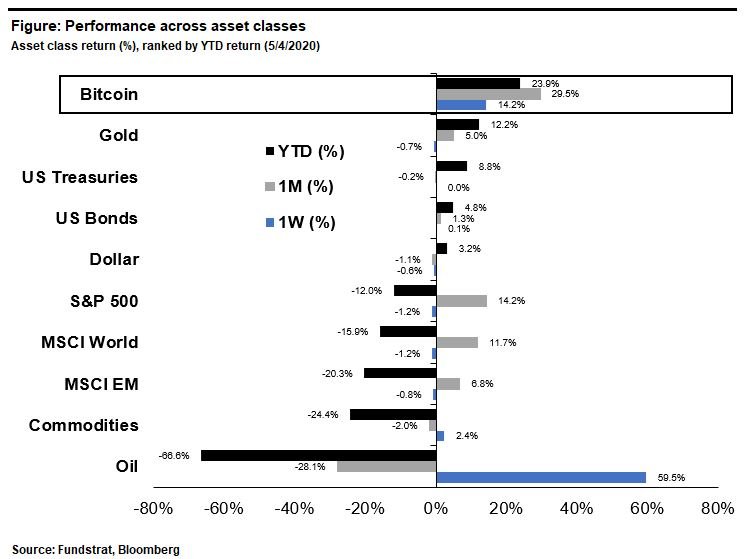

Bitcoin’s strong price performance over the past week pushed up its YTD performance into 1st place compared to 3rd place last week according to performance ranking of major asset classes.

Top crypto assets had a strong week and were led by BTC which was up 14% and Ripple which was up 10%. Bitcoin Cash was the biggest underperformer this week with a 1% gain.

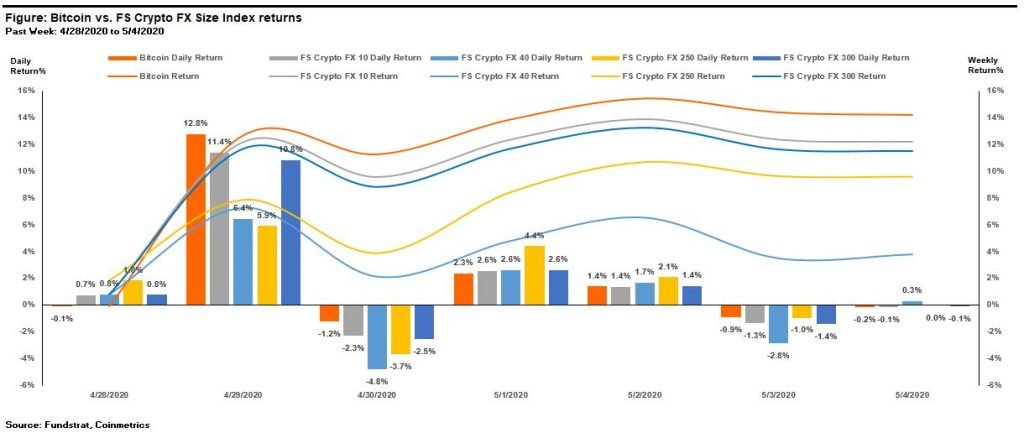

Performance was strong across all size based indices this week. FS Crypto FX 10 was the best performing index driven by strong BTC returns while FS Crypto FX 40 lagged substantially with major contributors Monero (XMR), Chainlink (LINK) and Cardano (ADA) all posting low single digit gains.

The table below shows the returns of the largest assets and the FS Size Indexes over the year.

Fundamental Valuations

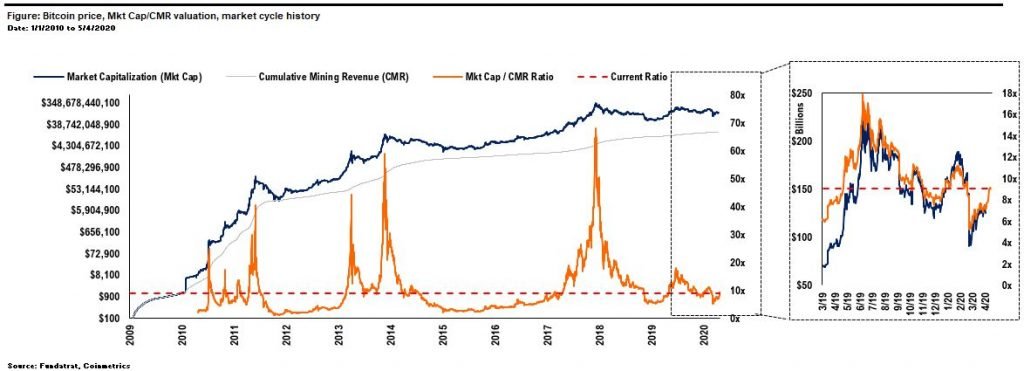

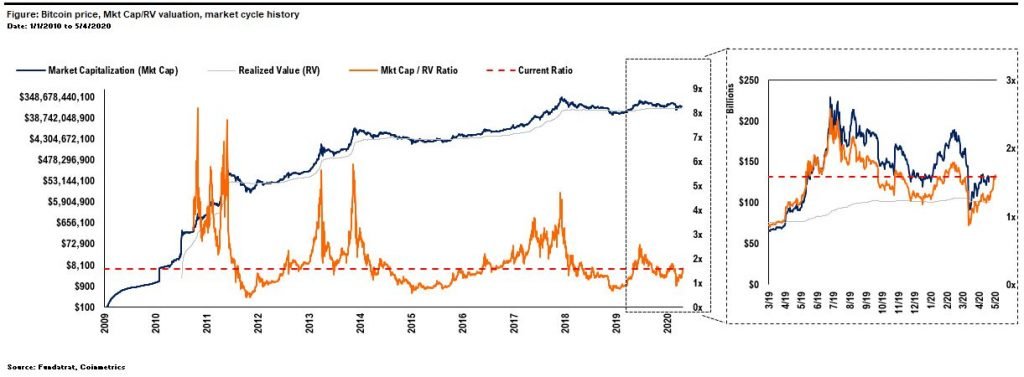

Bitcoin’s P/CMR valuation stood at 9.0x as of 5/4 vs 8.0x as of last week. This value remains slightly below the levels from Mar-19 through present.

Bitcoin’s market cap to realized value (MV/RV) multiple was 1.6x as of 5/4.

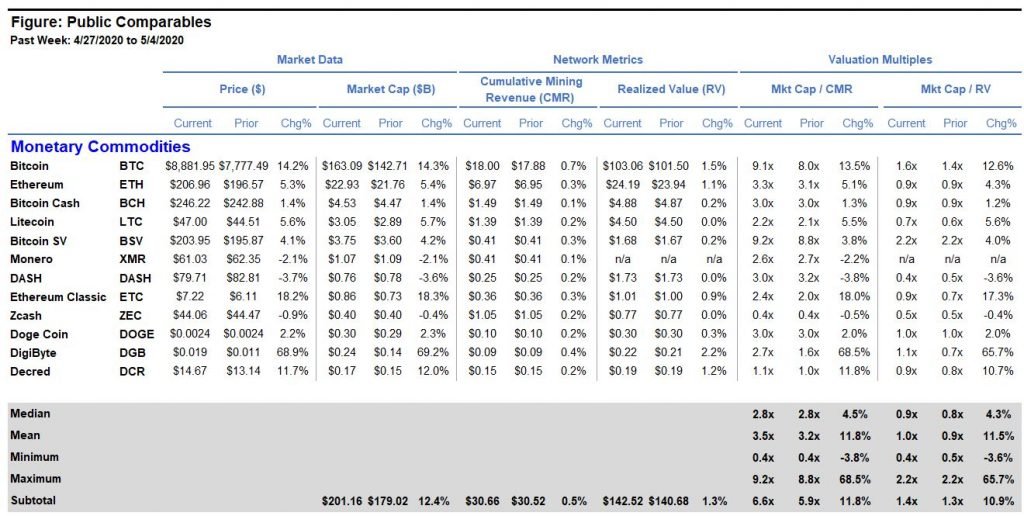

The comp table for large cap crypto asset prices and fundamental valuations is shown below.

This week we’ve grouped our valuation comp table by asset economic type and included an expanded list of the PoW minable monetary commodities. We view this list of assets as very important to understanding the overall market movements given, they represent ~85% of the total crypto market capitalization. We’ll include the other asset types in later weeks note and provide more insights into thinking about using this data for investment decisions.

Valuation Methodology

The P/CMR ratio is a fundamental valuation method I invented in December 2017 that has historically been a strong predictor of price movements. It functions like a Price/Book (Crypto P/B) ratio by telling investors if a crypto asset is relatively cheap or expensive. It’s calculated by comparing the Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR). The ratio can be calculated on a per coin basis (P/CMR) by adjusting the Mkt Cap and CMR by outstanding supply. Read more.

The MV/RV ratio is another method later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved. Read more.

The P/CMR and MV/RV metrics gives an approximate measure of unrealized profit, and therefore an investor’s incentive to sell or hold. The P/CMR ratio gives a measure closer to the absolute floor value of sunk costs for all investors while the MV/RV ratio gives the highest end of the range. It’s best to take multiple approaches when valuing any asset. These two have been the best for crypto assets in my experience, and the answer probably lies in the middle.

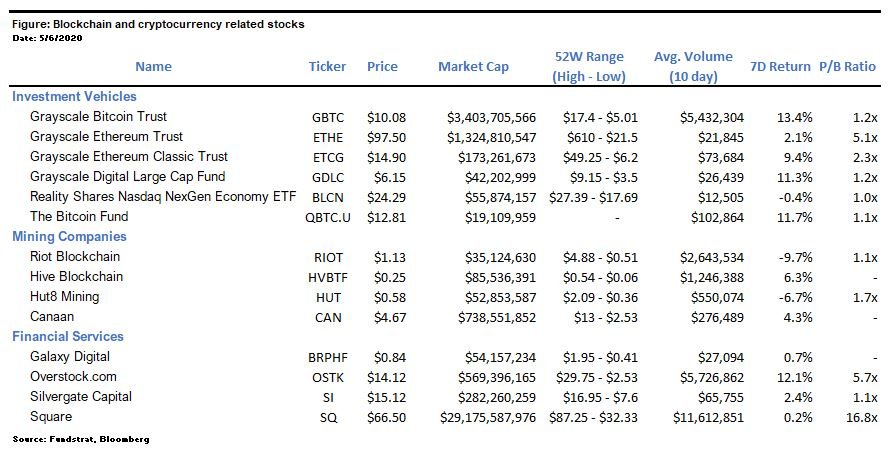

The table shows publicly traded blockchain and crypto related stocks, which offer a vehicle for investors who are constrained from owing underlying crypto assets themselves.

Winners & Losers

Winner: Stablecoin Issuers – The combined market cap of all stablecoins currently stands at about $9.7Bn and will likely surpass $10Bn in short order. Tether remains dominant with an 84% share of the total market cap.

Loser: Telegram– Last week, Telegram further delayed the launch of its blockchain project by one more year to April 2021, after a U.S. judge ruled that the project could not launch until its case with the SEC is resolved. The Company is now requesting that U.S. investors leave the project by taking refunds that cover about 70% of their initial investment.

Financing Activity

Crypto Fund II – Andreesen Horowitz, the Silicon Valley based venture capital firm raised $515MM for its second cryptocurrency focused investment vehicle (Crypto Fund II). The amount exceeds the firm’s $450 million target and represents a large increase over its $300MM fund which launched in the summer of 2018.

NEAR Protocol – The San Francisco based dApp platform, raised $21.6MM via token sale led by Andreesen Horowitz. Other deal participants include Pantera Capital, Libertus and Blockchange. The token sale is the network’s second financing round following a $12.1MM raise last July led by Metastable Capital and Accomplice.

skew. – The London-based data analytics firm raised $5MM in an equity financing round led by Octopus Ventures, a European venture capital firm.

Recent Research

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight.

- Tom Lee: Tom’s Take on Crypto: The Ten Rules of Bitcoin Investing: Part 1

- Robert Sluymer: Crypto Technical Analysis: BTC surges > 200-dma toward resistance at 9K – Daily RSI overbought

- Ken Xuan: Crypto Quant: Benchmark Crypto Indices Weekly Performance Review

- David Grider: What’s Going on With Cryptocurrencies: The Big Picture