Digital Assets Weekly: April 28th, 2020

Please see important disclosures at the bottom of this report

Portfolio Strategy

Bitcoin and crypto markets have had a very strong week. We expect the strength could very likely continue over the next week and a half as we approach the Bitcoin halving on May 12th.

If you are a longer term investor without crypto exposure, this is still not a bad time to be dipping your toe in the water and gaining that initial allocation, but be comfortable with potential volatility risk and be able and willing to get more aggressive if prices find more attractive levels.

On the other hand, if you are a long-term investor with a proper allocation to crypto, as we have discussed in prior notes, I wouldn’t be jumping in too heavily and chasing the market here to gain added exposure. These run ups usually take breathers and offer the opportunity for more attractive levels.

While I’m not recommending investors sell here, if you’re a nimbler trader who caught most of the recovery since we started recommending clients buy aggressively near the sell-off bottom, I wouldn’t blame you for lightening up and taking some profits over the coming days and weeks.

To be clear, we remain affirmatively bullish over the next 12 months. But in the immediate days before and weeks after the Bitcoin halvening, we will be keeping a very watchful eye on how the market dynamics unfold. As we have discussed, we are looking to see how the near-term risks play out with miner economics and the potential for coin liquidations.

If the market can sustain current or higher levels for the days and weeks following the halvening, we will gain much greater comfort in the medium-term sustainability of these price levels and may adjust our already long term bullish stance more aggressively within our crypto allocations by moving down the caps and towards more cyclical assets.

But if the market experiences a pull back, especially one that lasts over a prolonged period of a month or more, depending on the sharpness and severity, we may become more warry of risks to miner balance sheets medium term.

We believe our current recommended market positioning remains ideal for balancing between the risk and reward of these two scenarios until time passes. There is no answer I can give you today on how this will play out, nor an affirmative view how to position if it happens just yet. But as we approach the halvening, and we gain more market data, I believe the picture of what to do when we get there will become clearer and the optimal path forward will present itself.

Market Recommendations

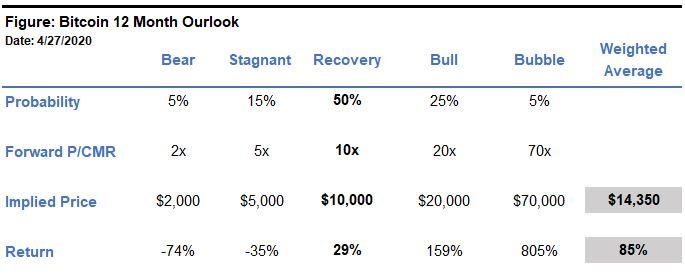

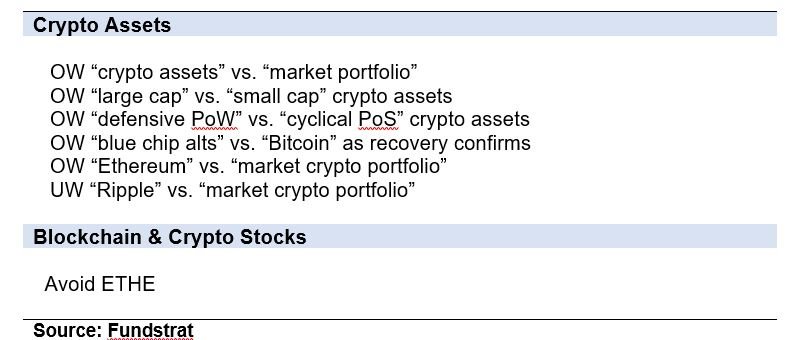

Our outlook for Bitcoin over the next 12 months and investment themes are shown below:

Investment Themes

Market Analysis

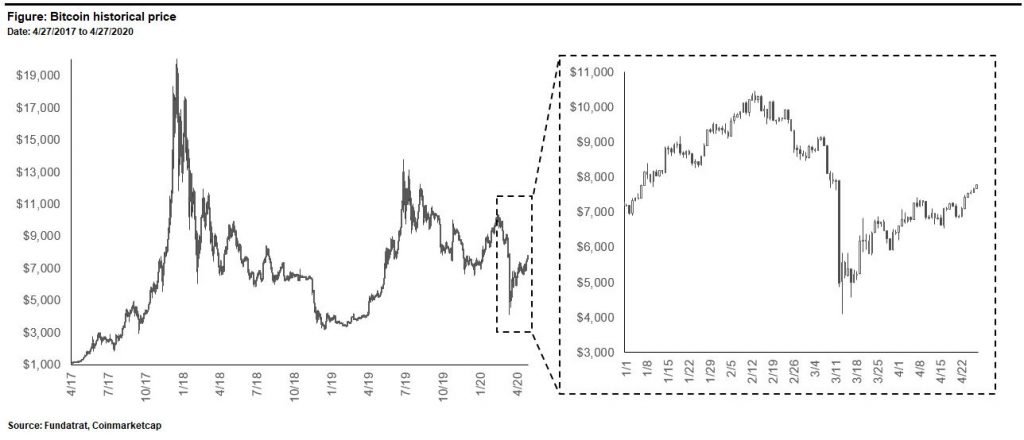

After closing around $6,880 last Tuesday, Bitcoin quickly broke through its $7,000 resistance level on Thursday eventually recording a full recovery from its 37% plunge on March 12th. Momentum was strong throughout the remainder of the period with Bitcoin closing around $7,680 on Monday.

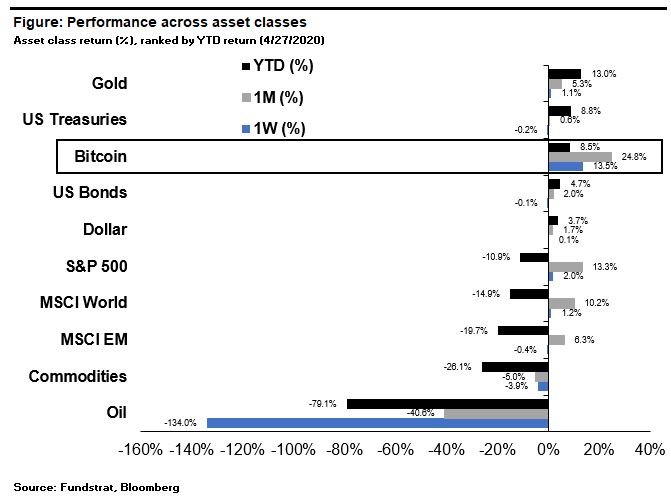

Bitcoin’s strong price performance over the past week pushed up its YTD performance into 3rd place compared to 5th place according to our performance ranking below. Strong grains this week pushed it ahead of both bonds and the dollar on a YTD basis and established BTC as the strongest performing asset this month.

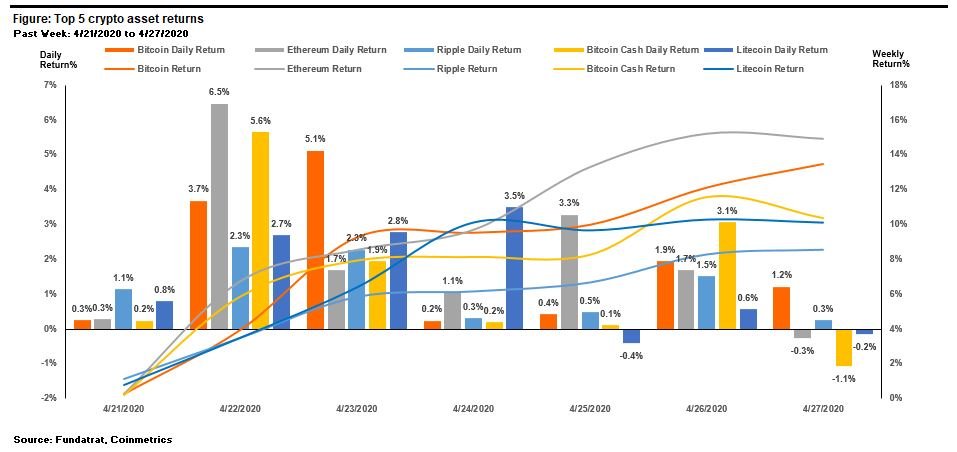

All major crypto assets had a big week. Ethereum, was the best performing asset this week, climbing up 14.9% on the week on top of its 8.8% gain last the week.

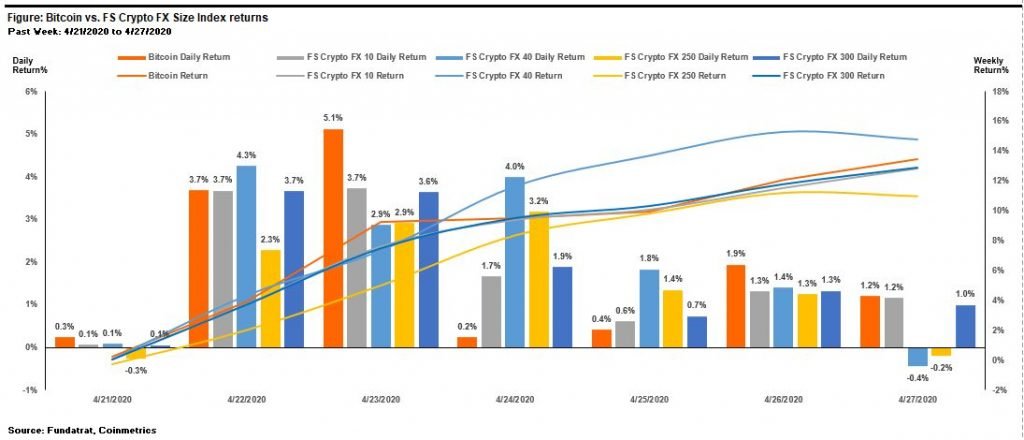

Performance was strong across all size based indices this week and the FS Crypto FX 40 retained its leadership with a 14.7% weekly gain compared to a 10% – 13% gain for other size-based indices.

Ethereum has been the strongest large cap 5 performer coming out the market sell off, while among the size-based indexes, the Crypto 40 have been performing the best over the same period.

Fundamental Valuations

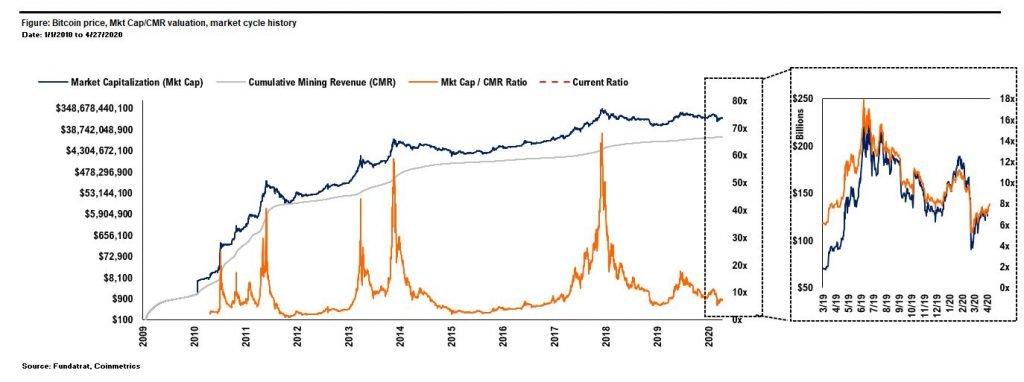

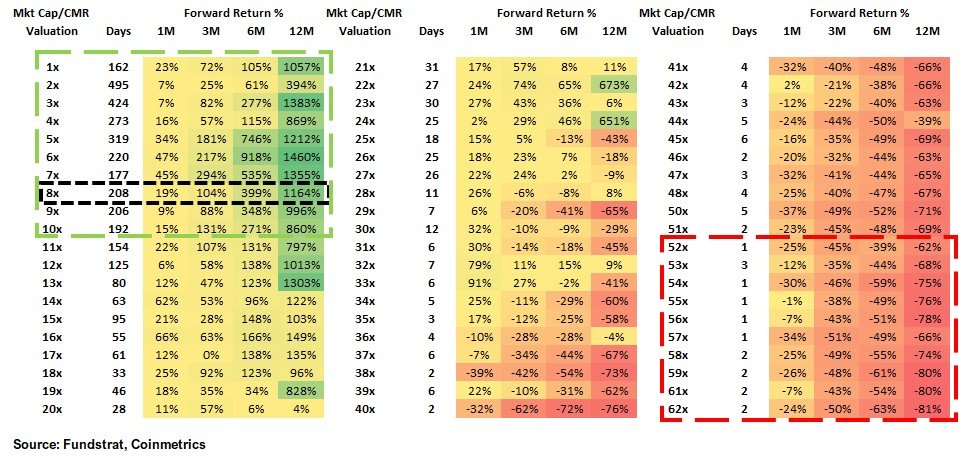

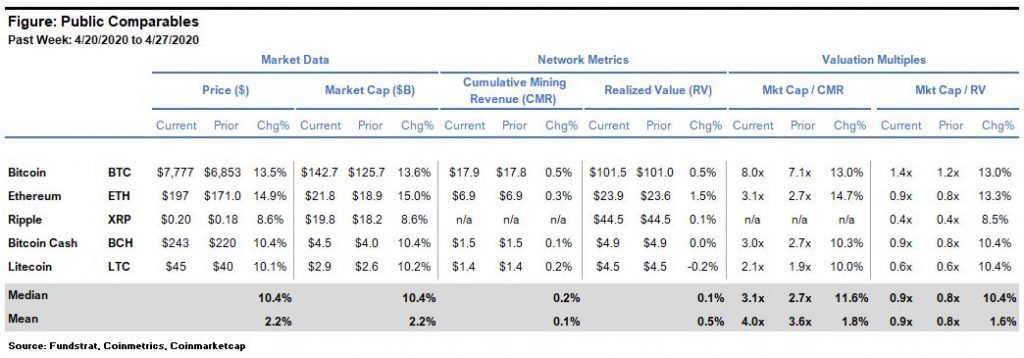

Bitcoin’s P/CMR valuation stood at 8.0x as of 4/27 vs 7.1x as of last week. This value is remains slightly below the levels from Mar-19 through present.

While not as enticing as prior weeks, the 1M, 3M, 6M & 12M risk/reward still looks attractive here based on historical average forward returns of 19%, 104%, 399% & 1164%, respectively.

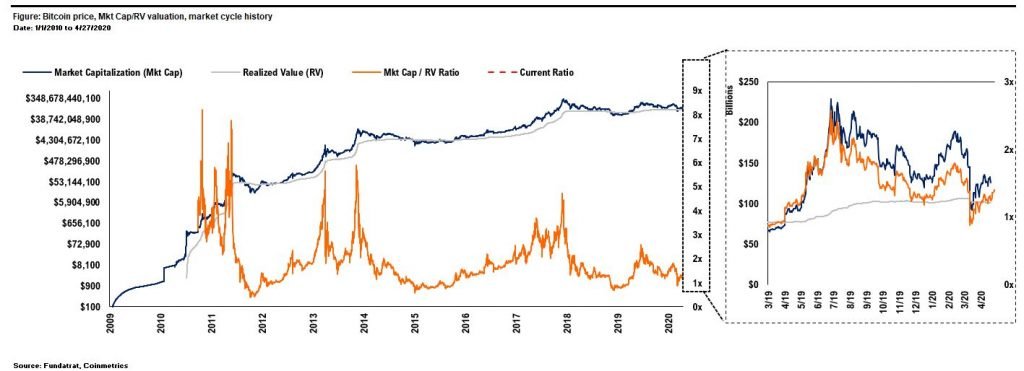

Bitcoin’s market cap to realized value (MV/RV) multiple was 1.2x as of 4/27.

The comp table for large cap crypto asset prices and fundamental valuations is shown below.

Valuation Methodology Description

The P/CMR ratio is a fundamental valuation method I invented in December 2017 that has historically been a strong predictor of price movements. It functions like a Price/Book (Crypto P/B) ratio by telling investors if a crypto asset is relatively cheap or expensive. It’s calculated by comparing the Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR). The ratio can be calculated on a per coin basis (P/CMR) by adjusting the Mkt Cap and CMR by outstanding supply. Read more.

The MV/RV ratio is another method later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved. Read more.

The P/CMR and MV/RV metrics gives an approximate measure of unrealized profit, and therefore an investors incentive to sell or hold. The P/CMR ratio gives a measure closer to the absolute floor value of sunk costs for all investors while the MV/RV ratio gives the highest end of the range. It’s best to take multiple approaches when valuing any asset. These two have been the best for crypto assets in my experience, and the answer probably lies in the middle.

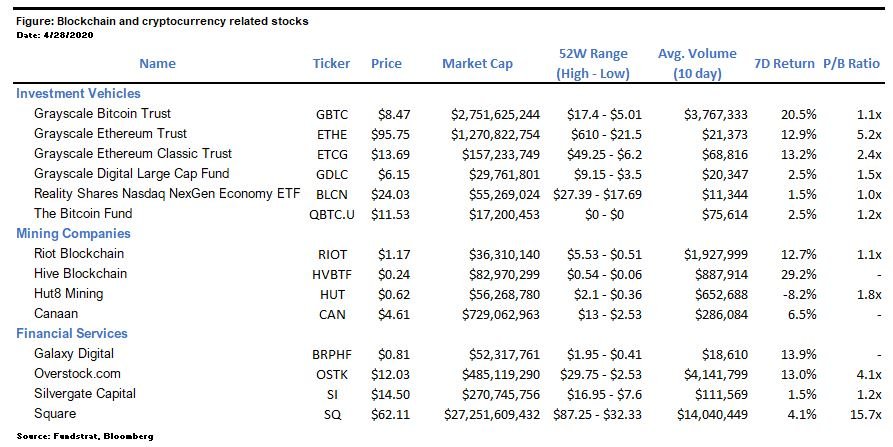

Blockchain & Crypto Stocks

The table above shows publicly traded blockchain and crypto related stocks, which offer a vehicle for investors who are constrained from owing underlying crypto assets themselves.

Winners & Losers

Winner: Libra – Checkout.com, a London-based payments processing platform, joined the Libra Association last week. This is the first payment processor to join the association after Visa, Mastercard and Stripe all withdrew from the stablecoin project last October.

Loser: The Maltese Crypto industry – The Maltese Financial Services authority (“MFSA”) published the names of 57 blockchain companies which applied for a financial services license but who did not complete the process by November 2019. According to the MFSA, only 26 startups of an original 340 applicants are still contenders in the application process and, Binance is not of them. The Company fully withdrew from this waning crypto hotbed in February.

Financing Activity

tZERO – Overstock’s blockchain arm, tZERO, raised $5MM in an equity financing round led by GoldenSand Capital, a Beijing based venture capital firm.

Applied Blockchain – The London-based enterprise blockchain company backed by oil giant Shell raised $2.5MM from Hong Kong-based venture capital firm QBN capital. The fresh capital is expected to be deployed to continue further developing the Company’s privacy-focused platform.

Blockgration Global Corp – Zoompass Holdings Inc., a SaaS provider for the web 3.0 space, announced it will acquire Blockgration Global Corporation (BGC) for an undisclosed sum. Blockgration is a Toronto based digital wallet platform connecting blockchain platforms with payment ecosystems and traditional banking.

Recent Research

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight.

- David Grider subbing in for Tom this week: Tom’s Take on Crypto: What Are the Risks?

- Robert Sluymer: Crypto Technical Analysis: BTC recaptures its 50-dma – ALTs beginning to move to the upside

- Ken Xuan: Crypto Quant: Benchmark Crypto Indices Weekly Performance Review

- David Grider: Digital Assets Weekly: April 21st, 2020