Markets Drop to Start Q4, EigenLayer Token Goes Live

Market Update

Markets are selling off in the first day of Q4, fueled by geopolitical fears as tensions rise in the mid-east. The SPY 1.10% and QQQ 0.88% have dropped 1.14% and 1.92%, respectively, while the VIX has surged over 17%. XAU and DXY are gaining as investors move towards safe-havens. Crypto assets have also sold off, with BTC -0.61% briefly dropping below $62k and ETH -0.95% below $2.5k. Among altcoins, SUI -0.20% is showing resilience, gaining approximately 2% as its TVL has eclipsed the $1 billion mark, passing other networks, including POL, BLAST N/A% , TON -1.77% , and APT -4.13% . In terms of economic data releases today, job openings came in higher than expected (8.04M vs 7.65M), while ISM Manufacturing was mixed, with prices and employment reading below expectations and new orders beating estimates.

EIGEN Launch

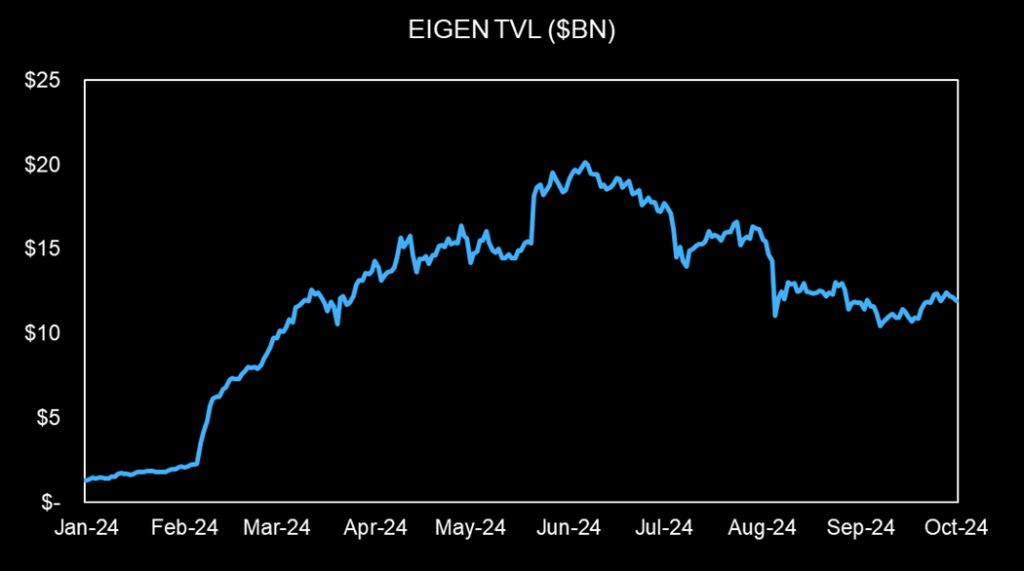

EigenLayer, an Ethereum restaking protocol, lifted trading restrictions on its native token EIGEN -1.22% , allowing for DEX trading and transfers. EigenLayer enables users to stake their Ether which can then be used to secure other protocols or networks, called Actively Validated Services (AVS). EigenLayer already supports seventeen different AVSs, including its data availability solution, EigenDA. EigenLayer has accumulated $11.75 billion in TVL, making it the third largest protocol in TVL terms, behind only LDO 0.67% and AAVE 3.77% . At its peak, when users were focused on farming points for the EIGEN airdrop, EigenLayer boasted over $20 billion in TVL. EIGEN -1.22% debuted at $4.1 and is currently trading at approximately $3.8, giving it a fully diluted valuation of about $6.4 billion.

FTX Reorganization Plan Receives Broad Creditor Approvals

The restructuring administrator of FTX has disclosed the voting results of the bankrupt exchange’s reorganization plan, with 94% of FTX Dotcom class clients voting in favor of the plan. The total value of claims from creditors who voted in favor of the plan represents about $6.83 billion. Additionally, 89% of creditors in the U.S. customer entitlement category and about 96% of creditors in the dotcom convenience class voted in favor of the plan, collectively representing approximately $285 million worth of claims. Under the reorganization plan, about 98% of creditors will receive at least 118% of their claim value in cash. The claims were marked to market previously, and creditors will not receive their claims in-kind, which would likely be worth significantly more now. The reorganization plan’s hearing is scheduled for October 7th, when a judge will decide on the plan, paving the way for creditor distributions.

Technical Strategy

Bitcoin failed to break out of its ongoing consolidation this week, as prices were repelled right at key consolidation resistance formed by the trendline from this Summer’s peak. While many might have suspected that a move above the 200-day moving average (m.a.) might have been important, these kinds of developments are rarely effective trading signals, and trend matters more than a moving average cross in either direction. Given that cycles are positive for Bitcoin between now and early December, it’s likely that this pullback doesn’t gain much traction but could find support either at current levels near $61.5, or below near $59.5k before turning back higher. Resistance at $66.5k will be necessary to exceed in BTC -0.61% before being able to weigh in confidently that a breakout has occurred. Movement above $66.5k should lead initially to $73.6k. At present, recent weakness represents an attractive opportunity given BTC’s improved momentum and bullish cycles.

Daily Important MetricsAll metrics as of 2024-10-01 13:49:12 All Funding rates are in bps Crypto Prices

All prices as of 2024-10-01 12:04:35 Exchange Traded Products (ETPs)

News

|