Capital Inflows Surge, Crypto Consolidates Ahead of Major Econ Data Releases

Crypto Market Update

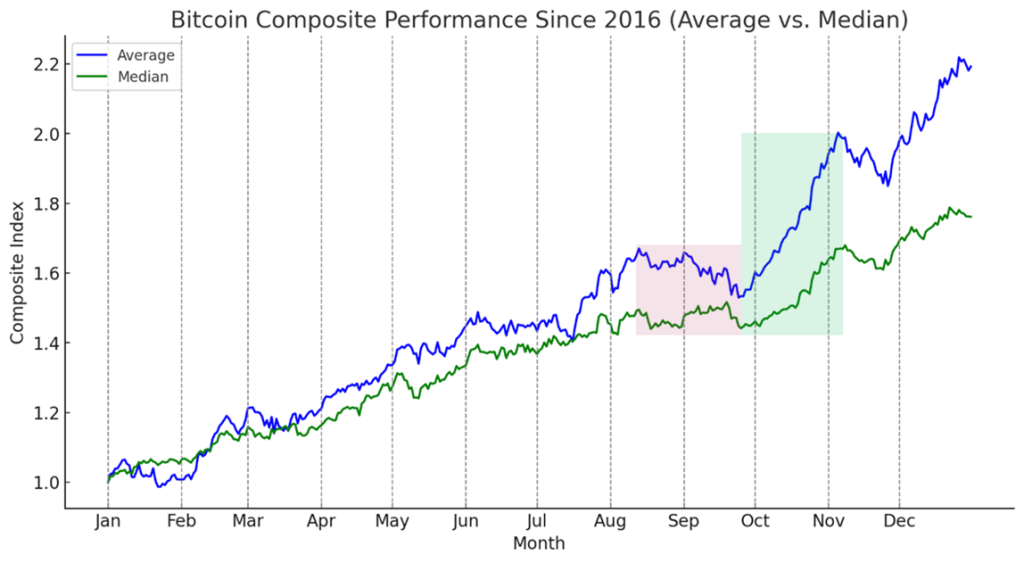

Crypto markets have broadly moved lower over the past 24 hours, though there are notable pockets of resilience. BTC -0.78% is testing its 200-day moving average, just below $64,000, while ETH -0.41% is showing relative strength, trading above $2,600. SOL -1.34% has outpaced both majors, trading just above $156. Among the top 100, standout performers include BONK -0.96% , BEAM 0.68% , WIF 1.03% , AR 1.82% , and TAO 0.43% . Meanwhile, US equity markets are rebounding from a negative start, while Chinese stocks extended their rally with the CSI300 jumping another 9% during Monday’s session. Investors are preparing for a significant macro week ahead, featuring extensive Fedspeak and key data releases: ISM Manufacturing PMI and JOLTs data on Tuesday, ISM Services PMI on Thursday, and Nonfarm Payrolls (NFP) along with unemployment data on Friday. Tomorrow also marks the beginning of October, historically the most favorable month for crypto prices.

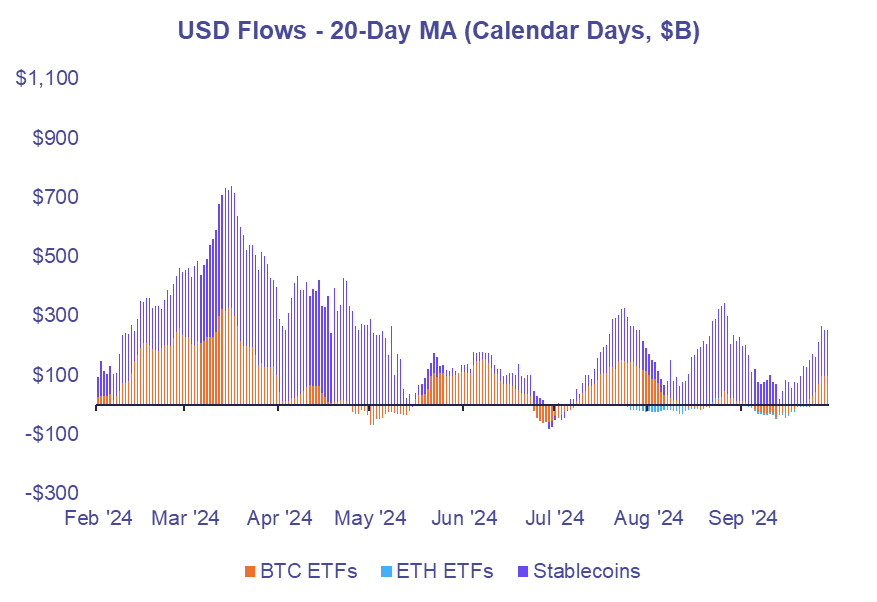

Stablecoin/ETF Flows Increase

Last week, spot Bitcoin ETFs saw over $1.1 billion in aggregate net inflows, pushing the 5-day moving average to $221 million in net inflows—the highest level since mid-July. BlackRock’s IBIT led the way with nearly $500 million in net USD inflows. Spot ETH ETFs also posted a strong week, with $85 million in net inflows, lifting the 5-day moving average to a daily net inflow of $17 million, the highest since mid-August. Meanwhile, stablecoins saw a slight slowdown in aggregate market cap growth but still recorded significant inflows of over $400 million for the seven days ending Sunday, 9/29. Overall, it remains clear that capital inflows are trending positively, as indicated by the 20-day moving average chart below.

Japan Contemplating Friendlier Crypto Regulation

According to a Bloomberg report, Japan is reviewing its crypto regulations, focusing on potentially lowering taxes for digital assets and facilitating the introduction of token-based ETFs. The Financial Services Agency (FSA) will assess whether the current Payments Act framework adequately protects investors, considering crypto’s primary use as an investment. This review could lead to reclassifying crypto under the Financial Instruments and Exchange Act, strengthening investor safeguards and possibly reducing the tax rate on crypto gains from up to 55% to 20%, similar to stocks. The FSA’s review, which may extend through winter, reflects Japan’s broader aim to adapt its regulatory landscape to foster the digital asset market. Meanwhile, major companies such as Sony and Mitsubishi UFJ are exploring blockchain and stablecoin projects, demonstrating growing interest in the space despite regulatory uncertainties.

Technical Strategy

DIA has begun to show meaningful signs of bottoming out given its 42% gain last week that carried DIA -0.88% up to the highest levels since June. Volume expanded meaningfully on this rise, so following nearly two years of range-bound trading, DIA looks poised to start trending higher to challenge and exceed March 2024 peaks in the months ahead. Charts began to shape up following the downtrend line breakout from mid-August. Subsequently, we’ve seen momentum hit overbought levels for the first time since February as DIA managed to retrace 61.8% of its pullback since March. In the short run, the ability to surpass $0.60 on a daily close should help this start to turn higher to test $0.81 which is the first real target on the upside. However, getting over this argues for a near doubling in price to $1.59 which looks to be a meaningful initial target above $0.81. Dips likely encounter support near $0.46-$0.47 and prove temporary.

Daily Important MetricsAll metrics as of 2024-09-30 16:14:59 All Funding rates are in bps Crypto Prices

All prices as of 2024-09-30 16:14:41 Exchange Traded Products (ETPs)

News

|