Polymarket Considers Token Launch, Bitfarms and Riot Reach Settlement.

Market Update

Equities are gaining following the People’s Bank of China announcing the largest stimulus package since the pandemic. China-related names are surging, with FXI -0.85% and KWEB 0.21% gaining more than 8%. The SPY -0.07% and QQQ 0.13% have gained 0.22% and 0.67%, respectively. Crypto is mixed, with altcoins outperforming the majors. BTC -0.98% has declined modestly to $63k, and ETH -3.66% is trading just above $2,600. TIA -4.35% has been one of the top gainers over the last 24 hours, rising more than 18% after the Celestia Foundation announced that it raised $100 million in an investment round led by Bain Capital Crypto. Twenty rollups have launched leveraging Celestia’s data availability solutions, and the funding should help them scale towards processing 1GB blocks.

Polymarket Considering Token Launch

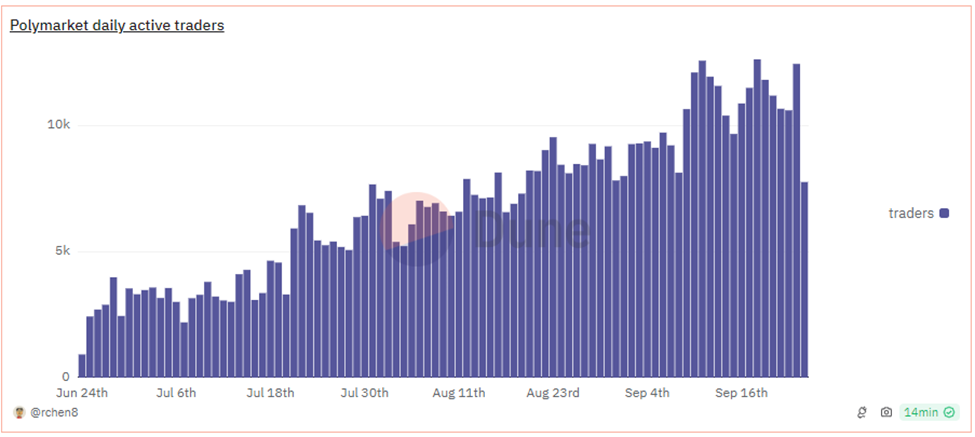

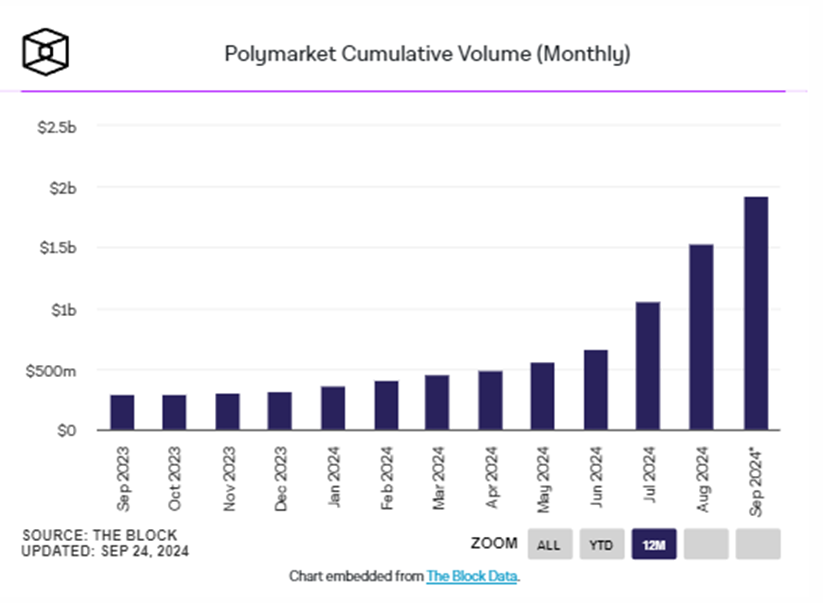

Polymarket, a leading prediction market platform, is considering launching a token to raise capital and support its platform. Polymarket is reportedly seeking to raise more than $50 million via token warrants. Polymarket raised $45 million in a Series B round in May, but a token launch could accelerate the platform’s growth. A token could also be integrated within the platform to offer unique features or perhaps be utilized to move the platform away from its no-fee structure. Prediction markets have been becoming increasingly popular, especially as election season heats up, with Polymarket’s political markets notably being integrated directly into Bloomberg’s terminal as a method to monitor election odds. Daily active traders on the platform have risen rapidly, with more than 10,000 people wagering on Polymarket daily and monthly volumes approaching $2 billion.

Bitfarms and Riot Reach Settlement

After months of ongoing disputes, Bitfarms and Riot Platforms have come to a settlement that puts an end to Riot’s hostile takeover attempt of Bitfarms. The two mining companies released a joint statement outlining the terms of the settlement, resulting in changes to the Bitfarms board of directors and Riot withdrawing its requisition. Bitfarms has provided Riot with the right to purchase shares of Bitfarms as long as they hold more than 15% of outstanding common shares. Bitfarms stated they are pleased with the agreement and look forward to shifting its focus back towards executing its growth strategy and diversifying its business beyond Bitcoin mining and into other areas, including HPC, AI, energy trading, and heat recycling. BITF 3.38% has gained approximately 1% following the settlement.

Technical Strategy

Conflux’s breakout to the highest levels since early August looks to be coinciding directly with China’s latest stimulus efforts, and CFX -2.76% has now traded up to the highest levels since early August. The success last week in recapturing $0.14 managed to exceed a minor downtrend in CFX going back since May of this year. That was instrumental in helping the trend starting to slowly improve following its huge pullback since early this Spring. Today’s rally looks to be helping momentum and structure turn quickly more positive and likely helps CFX extend up to $0.21 initially, then $0.275 which represents the 38.2% Fibonacci retracement area of the pullback from March into August 2024. While CFX is higher by +11.9% today, momentum has still not reached overbought levels and is thought to be the start of a larger rally that could take prices higher into October. Minor pullbacks down to $0.14, while not expected right away, would represent an attractive area to buy dips as part of this new rally, and Conflux looks attractive at current levels on a risk/reward basis.

Daily Important MetricsAll metrics as of 2024-09-24 14:18:28 All Funding rates are in bps Crypto Prices

All prices as of 2024-09-24 12:06:30 Exchange Traded Products (ETPs)

News

|