Crypto Moving Lower as Market Prices in a 50 bps Cut, Flows Register a Positive Week

Crypto Market Update

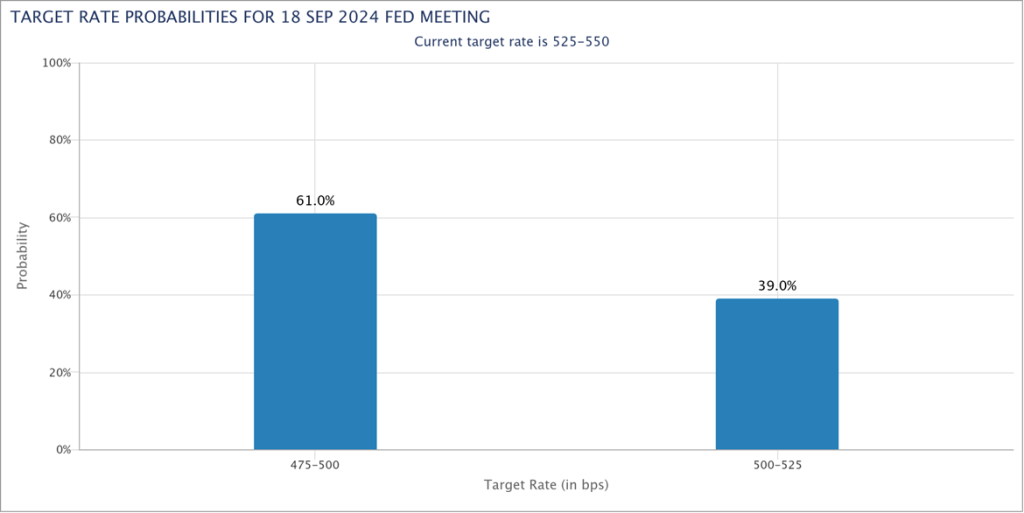

The crypto market has moved lower over the past 24 hours, with BTC 3.51% dropping back near the $58k level, ETH 5.45% just below $2,300, and SOL 8.33% once again testing the $130 mark. Yields have started the week lower ahead of the upcoming FOMC meeting, where investors are currently anticipating a 50 bps rate cut, according to the Fed funds futures market. Equities started the morning broadly in the green, except for the tech sector, which is weighing on major indices. Meanwhile, gold remains near all-time highs but has slightly declined since the US market opened. This is a critical week for investors, with the main event being the FOMC press conference on Wednesday. Chair Powell is expected to announce either a 25 or 50 bps rate cut, but more importantly, he will provide an updated outlook on the economy and the broader rate-cutting cycle. Investors will also receive a revised Summary of Economic Projections (SEP), which will help gauge the pace of cuts through year-end. Additionally, Japanese inflation data will be released on Thursday, followed by the Bank of Japan’s interest rate decision on Friday.

Flows Increase, CB Discount Suggests a Stall

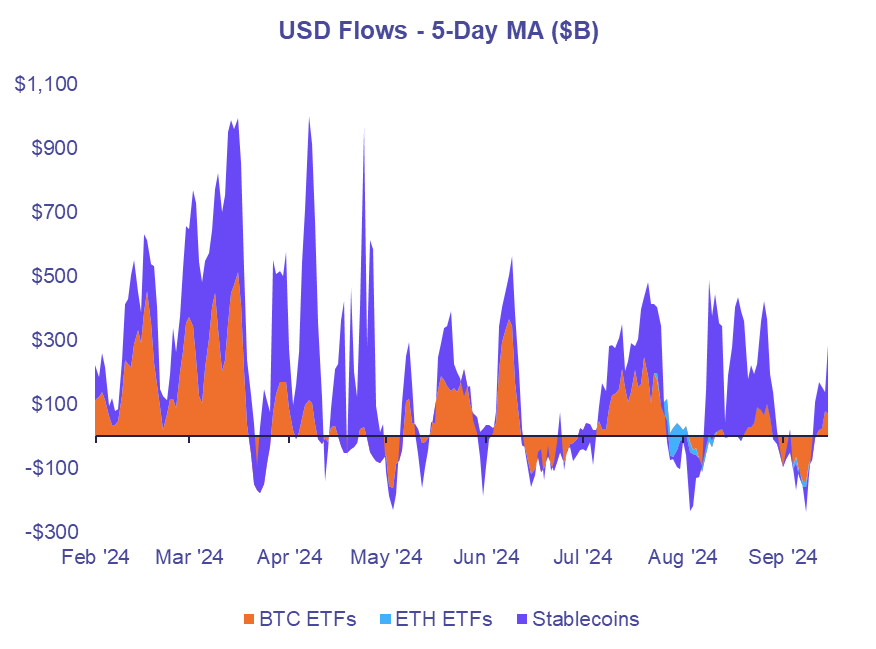

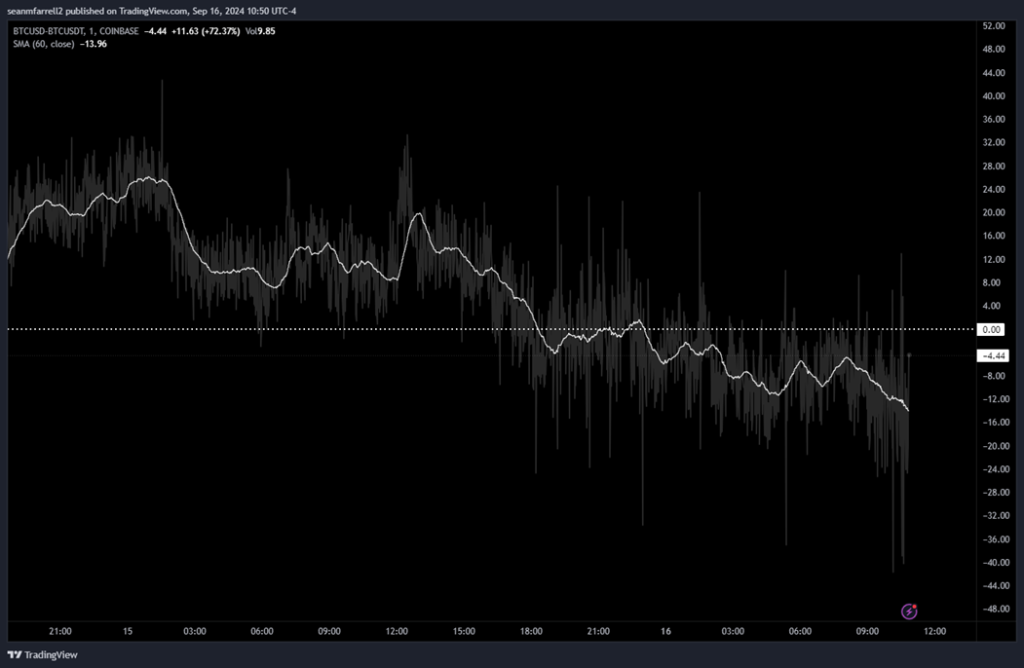

Crypto flows turned net positive last week, with over $400 million in inflows into spot BTC ETFs. The largest influx occurred on Friday, when BTC ETFs saw over $260 million in USD inflows. On the other hand, ETH ETFs continued to experience net outflows, though the pace has slowed since their initial post-launch drop, with just under $13 million in outflows last week. Stablecoins saw some significant outflows late in the week, but for the seven days ending September 15th, the aggregate stablecoin market cap increased by over $1.7 billion. Notably, the Coinbase premium/discount, a reliable indicator of US spot demand, has moved into a discount for the first time in several days this morning, indicating a possible stall in capital inflows.

IREN Expands AI Cloud Services Capacity

Iris Energy Limited (IREN 7.22% ) has announced the purchase of 1,080 NVIDIA H200 GPUs for $43.9 million to enhance its AI Cloud Services business, with delivery expected in Q4 2024. This acquisition increases IREN’s total GPU count to 1,896 units and is projected to boost the AI Cloud Services’ share of earnings to approximately 10% by year-end, with further growth anticipated into 2025. Meanwhile, IREN’s Bitcoin mining capacity currently stands at 18.8 EH/s and is on track to reach 30 EH/s by Q4 2024. At that level, the estimated electricity cost per Bitcoin mined is $20,000, with an all-in cash cost of $31,000. By the end of 2024, IREN expects AI Cloud Services to generate $33 million in annualized revenue, while Bitcoin mining is projected to contribute $460 million.

Technical Strategy

Fantom has made two impressive technical accomplishments which put this back on the radar ahead of an impending upside breakout. FTM charts show the breakout of the downtrend from March into August, which makes this a lot more technically appealing. Second, FTM managed to rise rapidly back to test the area of late August highs following a higher low than early August. This is also constructive price action as it forms a reverse Head and Shoulders pattern. Daily close back above 0.5348 represents a confirmed breakout of the downtrend which should lift this up to 0.748, then 0.86, both of which look to be important upside levels. Overall, this recent technical improvement makes FTM quite attractive ahead of a likely breakout in the weeks to come.

Daily Important MetricsAll metrics as of 2024-09-16 15:23:52 All Funding rates are in bps Crypto Prices

All prices as of 2024-09-16 12:09:30 Exchange Traded Products (ETPs)

News

|