Odds Of 50 Bps Cut Jumps After Hours, MSTR Buys More BTC

Crypto Market Update

The most notable market development over the past 24 hours has been the sharp increase in rate cut probabilities for next week’s FOMC meeting. After falling to just a 14% likelihood of a 50bps cut, the odds jumped to over 40% in after-hours trading following a large trade betting on two cuts. This shift may be linked to the optimism around the potential for two cuts conveyed in an article by Nick Timiraos published yesterday afternoon. Crypto assets are rallying alongside traditional risk assets, with BTC 2.97% climbing back to yesterday’s intraday high of around $58.5k, though SOL 6.42% and ETH 3.61% are lagging, trading just below $2340 and $135, respectively. Altcoins are mixed, with top performers among the top 50 including MATIC 2.78% , LINK 3.15% , UNI N/A% , and TON -8.50% . Equities reflect soft landing expectations today, with IWM 1.04% and KRE -0.13% leading major indices like QQQ 1.03% and ^SPX. The VIX is down to its lowest level this month, just under 17, while the MOVE 5.56% index has fallen below 100 for the first time since July. Additionally, consumer sentiment came in at 69 this morning, slightly above expectations, with 1-year inflation expectations dropping to 2.7%, the lowest since 2020.

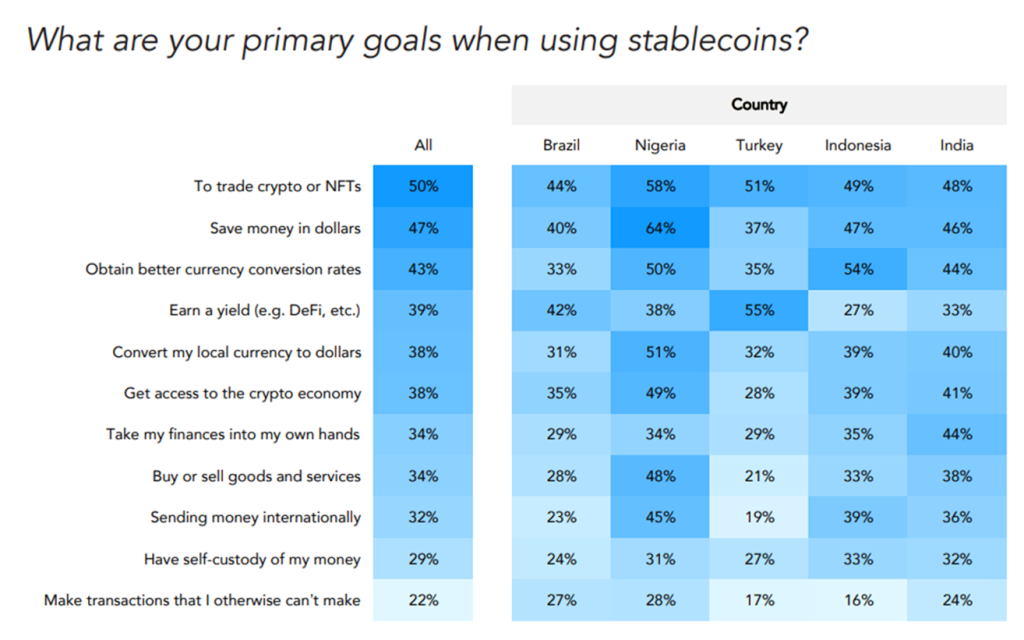

EM Stablecoin Study Reveals Non-Speculative Adoption

The report titled Stablecoins: The Emerging Market Story, produced by Visa in collaboration with Castle Island Ventures, Brevan Howard Digital, and Artemis, highlights the increasing importance of stablecoins in emerging markets, extending beyond their traditional role in crypto trading. The study surveyed 2,541 existing crypto users across Nigeria, Indonesia, Turkey, Brazil, and India, revealing a significant rise in stablecoin adoption, with more frequent transactions and deeper integration into users’ financial portfolios. Key motivations for using stablecoins beyond access to crypto include accessing US dollars (47%), generating yield (39%), and facilitating transactions. Stablecoins are favored over traditional banking in USD due to their higher efficiency, yield opportunities, and resistance to government interference. Notably, 57% of users reported increased stablecoin usage in the past year, with 72% expecting further growth this year. Tether is often preferred due to its strong network effects, trust, and liquidity. Ethereum emerged as the leading blockchain among users, followed by Binance Smart Chain, Solana, and Tron, while popular wallets include Binance, Trust Wallet, and Metamask. We highly recommend checking the whole report out. Definitely worth the read.

MSTR Issues Equity, Buys More BTC

MicroStrategy (MSTR 0.75% ) has bought more Bitcoin, purchasing 18,300 BTC for approximately $1.11 billion at an average price of $60,408 per coin between August 6th and September 12th, according to an SEC filing. This acquisition brings the company’s total Bitcoin holdings to 244,800 BTC, now valued at around $14 billion. The firm’s total Bitcoin purchases have cost $9.45 billion at an average price of $38,585 per coin. The latest purchase was funded through the sale of 8.05 million MicroStrategy shares, part of a larger $2 billion ATM stock offering initiated in August. This follows the company’s acquisition of 12,222 BTC in August for $805 million. While the Company is not obligated to sell the entirety of the $2 billion offering, it is worth noting that there still remains $900 million of capacity remaining.

Technical Strategy

Similar to US Equities, Bitcoin has been rising in recent days as part of a larger triangle formation that began in late July. Its gains have more closely correlated with the rise in SPX than any new fundamental developments, so it remains necessary to keep a close eye on both markets for signs of short-term guidance for BTC 2.97% . In the short run, the area at $61,300 has importance, and the ability to exceed this would give confidence that a larger rally is underway with initial targets at $65k near late August highs, then $70k near July peaks. Overall, while the near-term trend has turned bullish, BTC will face its first real test heading into next week’s FOMC meeting. Momentum has improved in the short run, but a break above $61.3k will be the technical test which either allows for follow-through, or causes some near-term resistance. Seasonality and cycles both start to turn more positive for BTC into October, making dips post FOMC likely buyable, and unlikely to get back under $52.5k right away.