Debate-Specific Crypto Weakness Remains Unclear, Markets Digest CPI

Crypto Market Update

CPI came in slightly above market expectations, primarily driven by persistent shelter costs, though these were partially offset by deflationary energy prices. As a result, rate cut expectations for next week’s FOMC meeting have dropped to 25 basis points. Following the CPI release, crypto markets, along with other risk assets, initially sold off as the market digested the data. However, prices have since rebounded, with BTC 0.89% trading just above $57k, ETH 1.25% around $2,350, and SOL 2.09% holding above the $130 level. Among the top 50, AAVE -5.60% , UNI N/A% , and ICP 1.20% have been the strongest performers in the past 24 hours. On the equities side, the QQQ 0.88% has turned positive on the day, and the ^SPX is almost unchanged, led by the rebound in tech stocks. Meanwhile, yields have bounced for the first time in over a week, with the 10-year Treasury yield slightly higher on the day.

Debate-Specific Crypto Weakness Remains Unclear

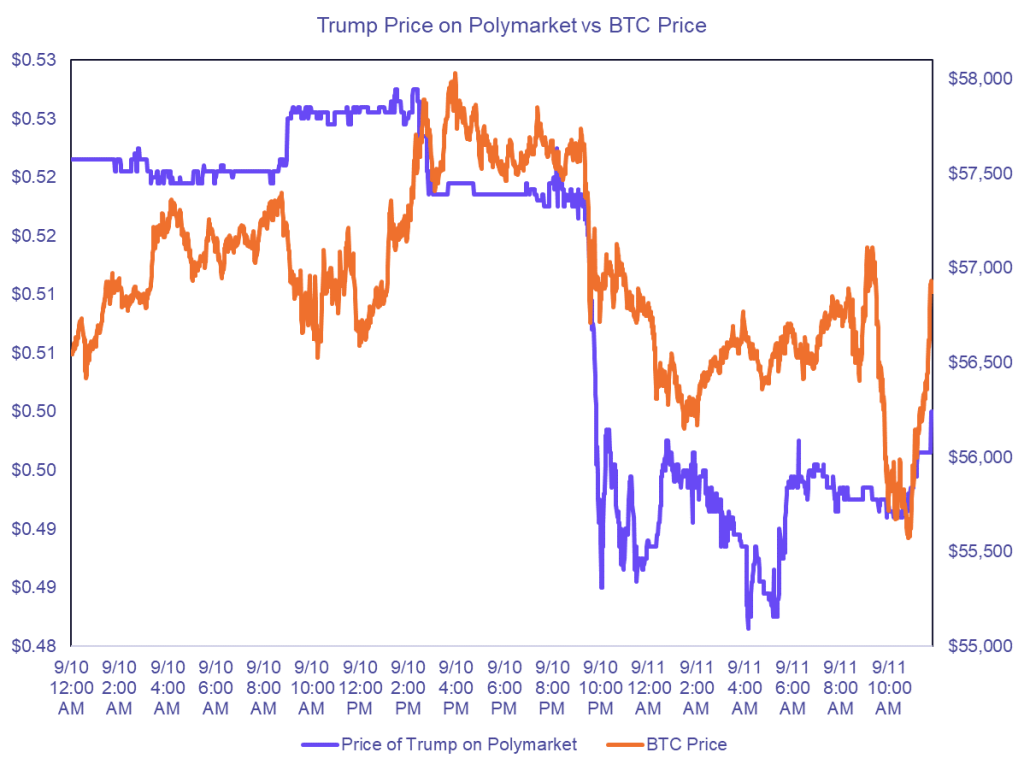

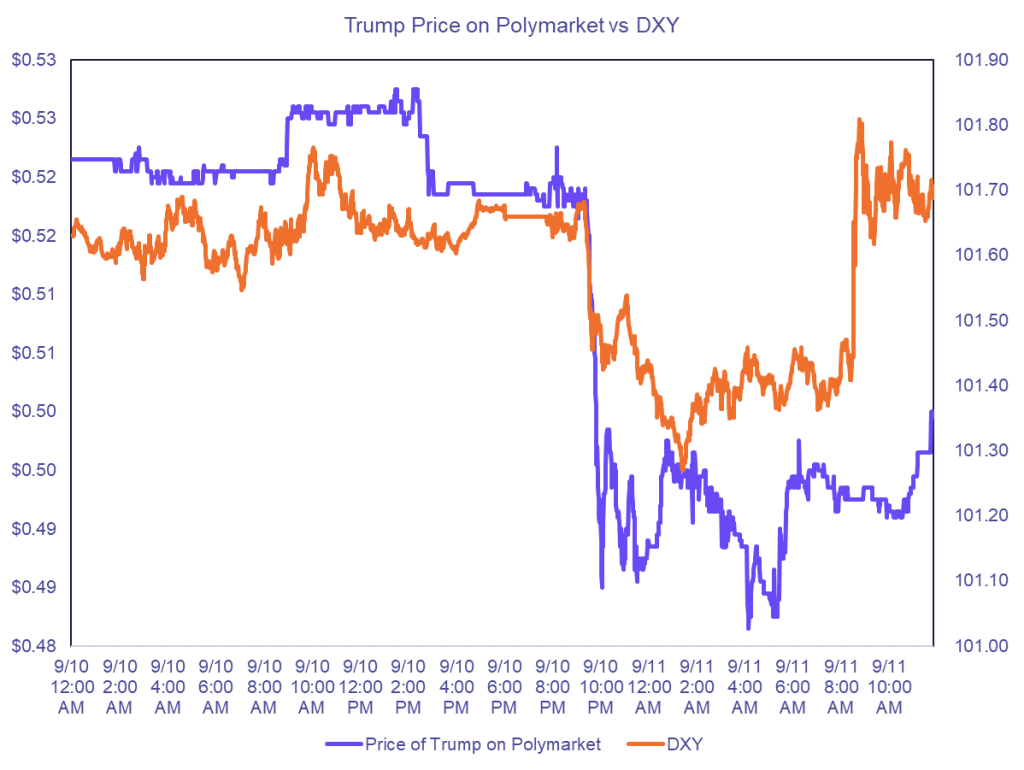

The recent presidential debate between Harris and Trump is another factor affecting the markets. Prediction markets indicated Harris as the clear winner, which coincided with a dip in Trump’s election odds and a subsequent decline in BTC’s price. However, it’s important to consider that broader market factors were also at play. The dollar weakened, while yields and futures markets moved lower, indicating a general risk-off environment. This suggests the sell-off wasn’t entirely specific to BTC or Trump-related trades. As the November elections approach, monitoring the strength of this relationship will be crucial. Our current perspective is that a “Trump premium” is influencing the market, rather than a lasting “Harris discount.”

CleanSpark Acquires More Mining Facilities

CleanSpark (CLSK -2.04% ) has announced the acquisition of seven bitcoin mining facilities and associated land in Knoxville, Tennessee, for $27.5 million, equating to approximately $324,000 per megawatt. The deal, expected to close by September 25, will add 85 megawatts (MW) of capacity, increasing CleanSpark’s hash rate by over 22%, with an additional 5 exahashes per second (EH/s). According to CEO Zach Bradford, the added capacity will be operational in the coming weeks and will help the company achieve its target of 37 EH/s by the end of 2024. Bradford noted that Tennessee’s political and energy environment aligns well with Georgia’s, where CleanSpark has invested nearly $1 billion. This acquisition follows CleanSpark’s recent expansion in Wyoming and its $155 million purchase of GRIID’s stock in June.

Technical Strategy

Bitcoin Cash seems to be making repeated attempts at bottoming near the 61.8% retracement zone of its former 6/23-4/24 runup which makes it important to watch carefully for evidence of further strength. At present, this area of recent stabilization in the last two months has occurred right near prior swing highs from late June 2023, and following five straight days of gains, BCH 1.69% is now at the highest levels since 8/27, having successfully exceeded the minor downtrend from late July on this week’s strength. However, a bit more progress is necessary before suggesting that a larger bottom is at hand, and initial upside targets lie near $368.87, which will be important to exceed to have much confidence. Above that level allows for a quick move up to this Summer’s highs near $457. Conversely, weekly closes under $287 would postpone the rally, allowing for a final flush down to $227 which should create a very appealing area to consider BCH after the sharp pullback over the last five months.

Daily Important MetricsAll metrics as of 2024-09-11 17:31:50 All Funding rates are in bps Crypto Prices

All prices as of 2024-09-11 13:41:34 Exchange Traded Products (ETPs)

News

|