Powell Completes His Pivot, MakerDAO Officially Proposes Redenomination of MKR Token

Crypto Market Update

Risk assets are surging following Fed Chair Jerome Powell’s dovish pivot at Jackson Hole, signaling a shift in policy aimed at addressing potential weaknesses in the job market through rate cuts. The DXY has dropped significantly, reaching a new year-to-date low and approaching the 100 mark. Cryptoassets are rallying, with BTC 0.64% nearing $62,000 as it works to break through its 50-day moving average, which has provided significant resistance. While ETH -0.78% and SOL 1.59% are lagging slightly, both remain in positive territory, trading near $2,700 and $146, respectively. Altcoins are seeing a broad-based rally, with AI-related tokens like FET -2.16% , TAO -6.00% , and NEAR -0.50% among the top 50 standout performers, likely driven by anticipation of NVDA 0.07% earnings next week. In equity markets, soft landing indices are leading the charge, with IWM 0.24% , KRE -0.21% , and RSP -0.19% outperforming QQQ -0.38% and ^SPX.

Token Split Coming to MKR

MakerDAO has proposed an optional redenomination of its MKR governance token into 24,000 NewGovToken (NGT) tokens as part of its strategic Endgame plan. This plan aims to broaden governance participation by allowing more users to hold meaningful amounts of NGT. Alongside this, MakerDAO is launching a new stablecoin called NewStable (NST), providing users with the choice to continue using the original DAI -0.02% and MKR -2.41% tokens or transition to the new counterparts. The proposal emphasizes user choice and flexibility, with the potential for DAI and NewStable to serve different use cases, from crypto-native applications to broader mass adoption. Maker’s Endgame initiative is a key reason MKR remains a constituent in our Core Strategy, as efforts to boost attention on Maker and increase the DAI supply are likely to positively impact its price. In terms of the redenomination itself, the benefits are akin to a stock split. While there are no index inclusion considerations, which are a common reason for corporate stock splits, this quasi-stock split is expected to increase liquidity and focus on MKR, driven primarily by the psychological effects of unit bias.

Sony Launches an Ethereum L2

Sony, in collaboration with Startale Labs, is launching its own layer-2 blockchain network called Soneium, built on Ethereum using optimistic rollup technology through the Optimism blockchain ecosystem’s OP Stack. Initially targeting Web3 users, Soneium aims to offer cheaper transaction options and connect with other networks within the ecosystem via the “Superchain.” Over the next two years, Sony plans to integrate Web3 and blockchain technology into its products, including Sony Bank, Sony Music, and Sony Pictures, with the long-term goal of onboarding enterprises and general decentralized apps onto the platform.

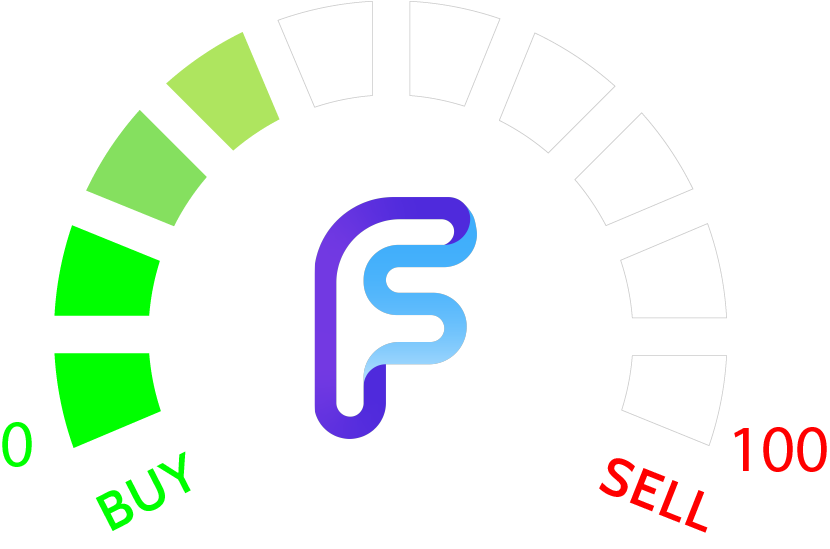

Technical Strategy

Following a very choppy August, Bitcoin has just successfully achieved a minor breakout to the highest levels since 8/1 with Friday’s gains. This is a minor positive and bodes well for additional upside follow-through into next week. Unfortunately, it’s difficult at this time to project a larger breakout of the current five-month range, but it’s likely that BTC 0.64% does rally to challenge $69,500 which is considered an Equal-leg extension and resistance to this rise. To have conviction that a larger rally can happen, BTC requires a weekly close back over $70k which approximates the peaks from late July along with an area of five-month channel resistance. However at present, Friday’s move is a definite technical positive for the next 3-5 days of additional gains.

Daily Important MetricsAll metrics as of 2024-08-23 18:23:06 All Funding rates are in bps Crypto Prices

All prices as of 2024-08-23 18:22:45 Exchange Traded Products (ETPs)

News

|