Crypto Holding Strong Post-BLS Revisions, Consolidation in Mining Industry Continues

Crypto Market Update

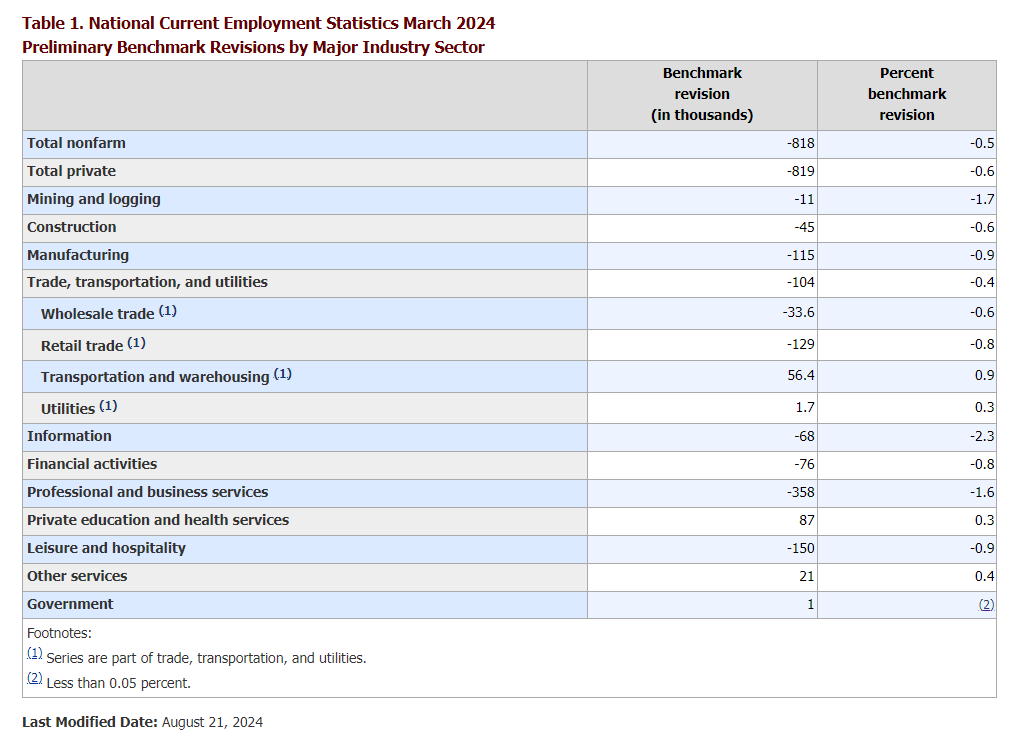

This morning’s big news came from the BLS, which revised payrolls down by 818k for the 12 months ending in March. In response, the DXY turned negative as yields fell and market confidence in upcoming Fed cuts grew. Price action continues to suggest that the market views a soft landing as possible, with risk assets rallying in tandem with Treasuries. BTC -0.07% spiked to $60k following the U.S. market open, settling around $59.5k, a positive sign that its upside beta may be returning, potentially signaling the end of recent government sales. ETH 0.22% slightly outperformed since the open, now trading just above $2,600, while SOL 0.13% is lagging behind the other two majors, struggling to hold the $140 level. AAVE -2.73% , a Liquid Ventures constituent, continues to outperform the broader market ahead of possible major updates to its tokenomics. In traditional markets, IWM 0.03% and RSP 0.49% are both outperforming the ^SPX.

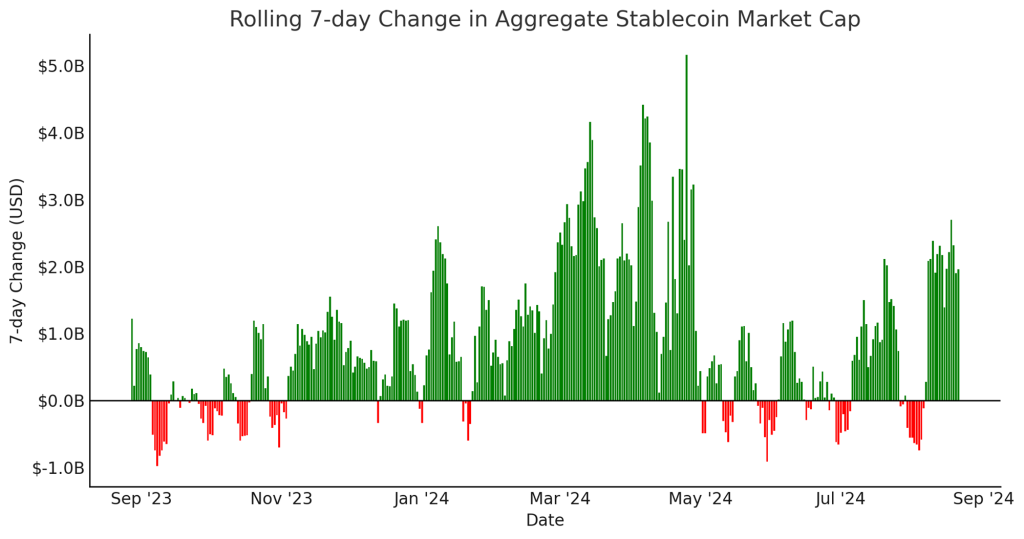

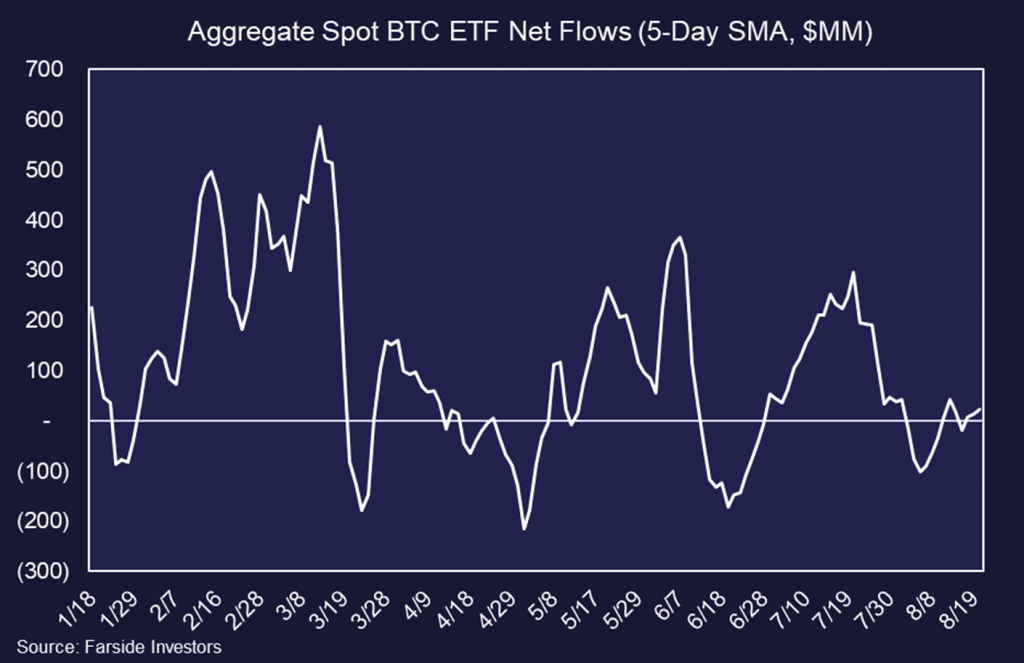

Stablecoin and BTC ETF Inflows Positive

Stablecoin inflows remain robust, with the aggregate market cap increasing by nearly $2 billion over the past week and $375 million just since yesterday. Excluding algorithmic stablecoins, the total stablecoin market cap is now only $800 million away from reaching a new all-time high. Meanwhile, Bitcoin ETFs have quietly posted their fourth consecutive day of inflows, pushing the 5-day moving average back into positive territory. BlackRock’s IBIT 0.74% has led the BTC ETF surge, with $93 million in inflows on Monday and another $55 million yesterday. In contrast, ETH ETFs continue to see little movement, with a slight outflow of $7 million yesterday.

More Consolidation in Mining Industry

Bitfarms (BITF -2.88% ) has agreed to acquire rival Stronghold Digital (SDIG) for $175 million in stock and assumed debt as part of its strategy to diversify revenue streams beyond crypto mining. The offer values Stronghold at $6.02 per share, significantly higher than its recent closing price of $2.93, and represents a 71% premium to Stronghold’s 90-day volume-weighted average price. This acquisition is seen as a pivotal move for Bitfarms as it seeks to integrate power generation and expand into high-performance computing (HPC) and AI processing. Meanwhile, Bitfarms is fending off unwanted attention from Riot Platforms $(RIOT -3.33% ), which now owns nearly 19% of the company after abandoning a previous takeover bid.

Technical Strategy

Numeraire is higher by nearly 14% today, following through on a recent pattern of strong gains on above-average volume. As daily NMR -1.50% charts show, NMR broke out of its intermediate-term downtrend from March peaks and has been making steady progress this week in turning higher. Near-term, a rally to $20 looks likely which would roughly align with its prior lows from April/May along with the highs of its current Ichimoku Cloud. However, this recent strength is seen as constructive and should allow for upside to over $26.50, or near its 38.2% Fibonacci retracement area. Overall, NMR appears like an attractive risk/reward following what appears to be a successful bottoming out this past month.

Daily Important MetricsAll metrics as of 2024-08-21 15:38:52 All Funding rates are in bps Crypto Prices

All prices as of 2024-08-21 14:59:39 Exchange Traded Products (ETPs)

News

|