Ethena Expands to Solana, Grayscale Launches TAO and SUI Trusts

Crypto Market Update

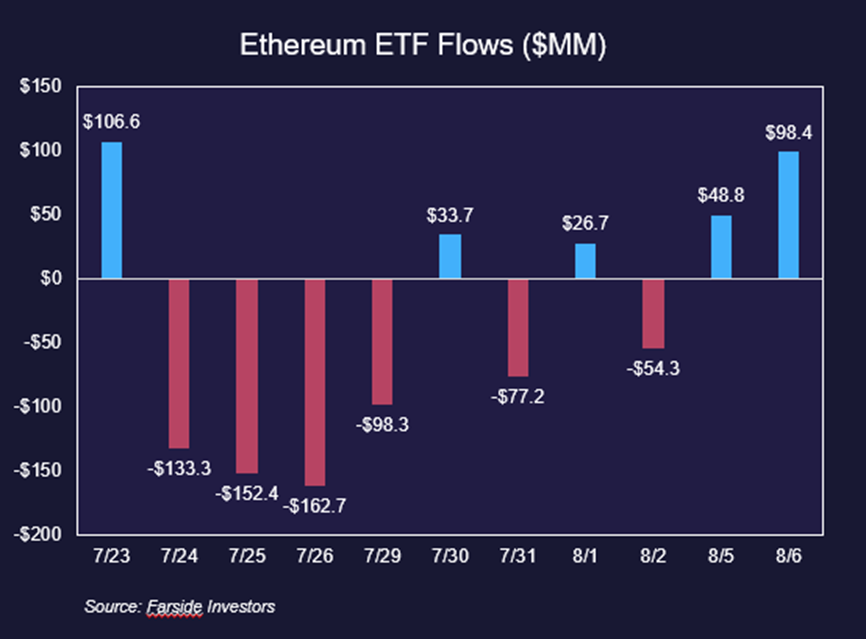

Equities have continued to find relief after the BOJ’s comments assured investors that they won’t continue raising rates if markets are unstable. The SPY -0.06% and QQQ -0.39% have both gained over 0.6%, while small-caps are underperforming, with the IWM -1.82% roughly flat. Crypto was gaining with equities this morning but has since turned lower. BTC -2.78% is trading slightly below $56k, while ETH -5.86% has decreased to below $2,400 after on-chain data showed Jump preparing to sell another ~$80 million in ETH. Despite the fears, Ethereum ETF flows have been positive, taking in $98.4 million yesterday and marking the second consecutive day of inflows. The leading performer in the top-100 tokens today is WIF -4.95% , gaining over 16% as it builds off Solana’s recent strength. SOLETH has made a new all-time high, eclipsing the 0.06 level.

Ethena Expands to Solana

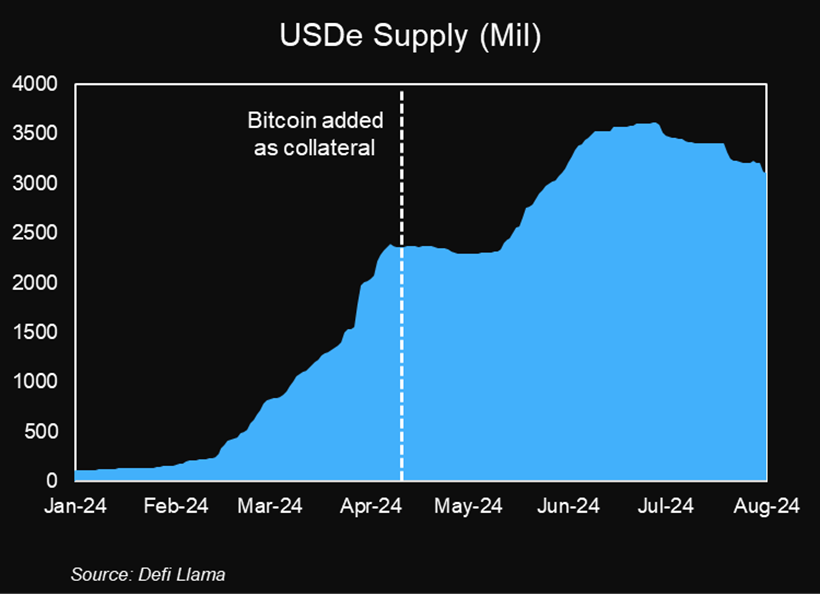

Ethena, a stablecoin protocol leveraging crypto basis trades, has added support for USDe on Solana. Until now, USDe has only been available on Ethereum Mainnet, but with the help of Layer Zero, USDe on Solana should expand its adoption to a new cohort of blockchain users. Ethena has also added SOL -6.69% as a backing asset, marking the third backing option behind Ethereum and Bitcoin. Since adding Bitcoin as a backing asset, USDe supply has grown by over $1 billion, and Ethena hopes its Solana integration will have a similar effect on its scaling efforts. USDe supply has steadily increased since launching eight months ago, reaching 3.1 billion and becoming the fourth largest stablecoin, only lagging long-standing competitors Tether, Circle, and Maker.

Grayscale Launches Individual Trusts for TAO and SUI

Grayscale has announced the creation of the Grayscale Bittensor Trust and the Grayscale Sui Trust. The two new trusts will respectively focus on singular assets, with The Bittensor Trust solely investing in TAO -5.50% , the utility token of the Bittensor network, and the Sui Trust investing in SUI -6.11% , the gas token of the Sui Network, a high-performance L1. Grayscale believes Bittensor is at the center of the growth of decentralized AI, whereas Sui is redefining smart contract platforms. The new trusts are open for daily subscriptions to accredited investors and operate like most of Grayscale’s existing trusts. TAO -5.50% has been one of the strongest tokens following this weekend’s drawdown, gaining 16.55% thus far this week, and SUI -6.11% is one of the top gainers today following the news.

Technical Strategy

DOGE has now fallen more than 50% since late March and has neared an area of attractive technical support on this decline. As weekly charts show, DOGE -8.18% looks to in its final wave of the pullback from late March and its selling pressure has resulted in price returning to the area of the prior breakout Pivot point. this area at $0.08 should prove important as support before this begins to turn higher. While a move down to $0.07 can’t be ruled out, such a decline would make this even more appealing from a technical risk/reward perspective. Only a weekly close back under $0.056 would serve to postpone a larger rebound and turn the technical structure more negative. At present, following a nice February-March rally, this subsequent decline has now finally reached levels that make DOGE technically attractive.