Huge Jobs Miss Pummels Risk Assets, COIN Beats Topline Expectations

Crypto Market Update

This morning’s big market mover was a significant miss in the jobs report, with NFP coming in at 114k, well below market expectations of 175k, and the unemployment rate rising to 4.3%. This triggered concerns among investors, with some invoking the “Sahm Rule.” As a result, yields have naturally fallen, with the 10-year Treasury yield approaching 3.8%. The DXY also took a sharp hit, now hovering just above 103. Meanwhile, the VIX has surged, nearing 30, which is over a 50% increase from yesterday, indicating heightened market volatility. Equities continued their sell-off, with ^SPX down 2.5% and QQQ 0.13% down 3%. Initially, it seemed crypto might be spared as Bitcoin opened the day in the green, mirroring gold price action. However, correlations have since risen, leading to some intraday weakness in crypto, with BTC 3.62% now around $63k, ETH 5.31% approaching $3k, and SOL 7.90% just below $160. On the bright side, this market turmoil increases the likelihood of less restrictive monetary policy coming sooner rather than later – a good thing for crypto.

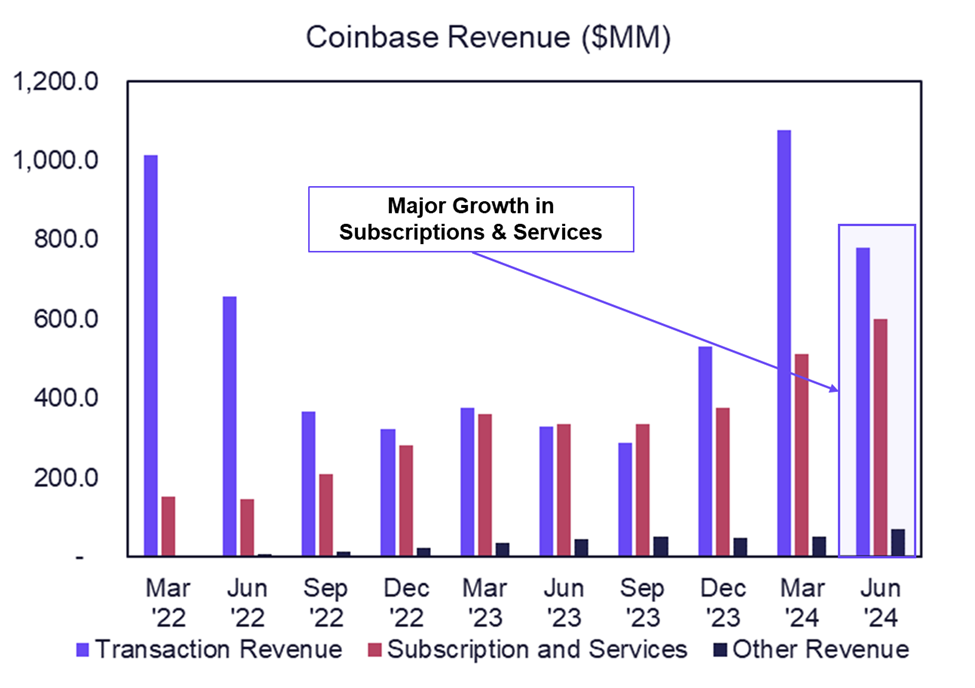

Non-Transaction Revenue Helps COIN Beat Topline Expectations in Q2

Coinbase (COIN 17.12% ) posted another solid quarter in Q2, despite a decline in overall transaction volumes compared to Q1. The company reported $1.45 billion in total revenue, surpassing market consensus of $1.4 billion, and achieved $596 million in adjusted EBITDA, marking their sixth consecutive quarter of positive adjusted EBITDA. They continued to diversify their revenue streams, generating $600 million from subscriptions and services, which accounted for 40% of their total revenue. Higher USDC 0.02% balances and a favorable interest rate environment significantly boosted their stablecoin revenues, and they also benefited from increased blockchain rewards revenue. Additionally, Coinbase strengthened its balance sheet, with USD resources increasing by $733 million to $7.8 billion. A major highlight of their earnings report and a key point during their earnings call was the significant progress made towards achieving regulatory clarity.

MSTR Announces $2 Billion ATM Equity Offering

In its Q2 earnings call, MicroStrategy (MSTR 8.83% ) provided significant updates on its Bitcoin strategy and financial performance. The company acquired 12,222 Bitcoins for $805.2 million, bringing its total holdings to 226,500 BTC, with an average acquisition cost of $36,821 per Bitcoin as of July 31st. A new key performance indicator, BTC Yield, was introduced to measure the percentage change in the ratio of Bitcoin holdings to diluted shares outstanding, which stands at 12.2% year-to-date. Despite positive developments in their cloud-powered BI and AI software business, MicroStrategy reported a quarterly loss of $5.74 per share on sales of $111.40 million, missing analyst expectations. Operating expenses surged by 134% to $280.8 million, primarily due to $180.1 million in impairment losses on digital assets. The company also discussed their upcoming 10-for-1 stock split, set to take effect on August 7th. Notably, the company plans to initiate a $2 billion at-the-market equity offering program, presumably to acquire more Bitcoin.

Technical Strategy

Solana’s recent $30 selloff has erased around 16% off prices in the last five trading days. At current levels, this has some technical significance both from the downtrend from prior March peaks which had been exceeded, along with an area lining up with early July highs. (Prior technical resistance can often become support when retested) Thus, $150-$154 area is thought to be important to hold in the days ahead for SOL 7.90% . Any break of this likely results in a quick move to 137 before this stabilizes. Ideally this can hold and start to turn back higher. However, some stabilization in the broader risk asset marketplace is thought to be important before expecting that Cryptocurrencies break back out to new highs. For SOL, it’s doubtful that July lows are broken, which lies near $121. Movement back above $189 will be key towards helping this rally eventually extend. At present, this decline of the last week will need to stabilize at current levels, and it does appear like an important area of support.

Daily Important MetricsAll metrics as of 2024-08-02 16:44:54 All Funding rates are in bps Crypto Prices

All prices as of 2024-08-02 16:44:36 Exchange Traded Products (ETPs)

News

|