ETH ETFs See Net Inflows, Ethena Gets Some Competition

Crypto Market Update

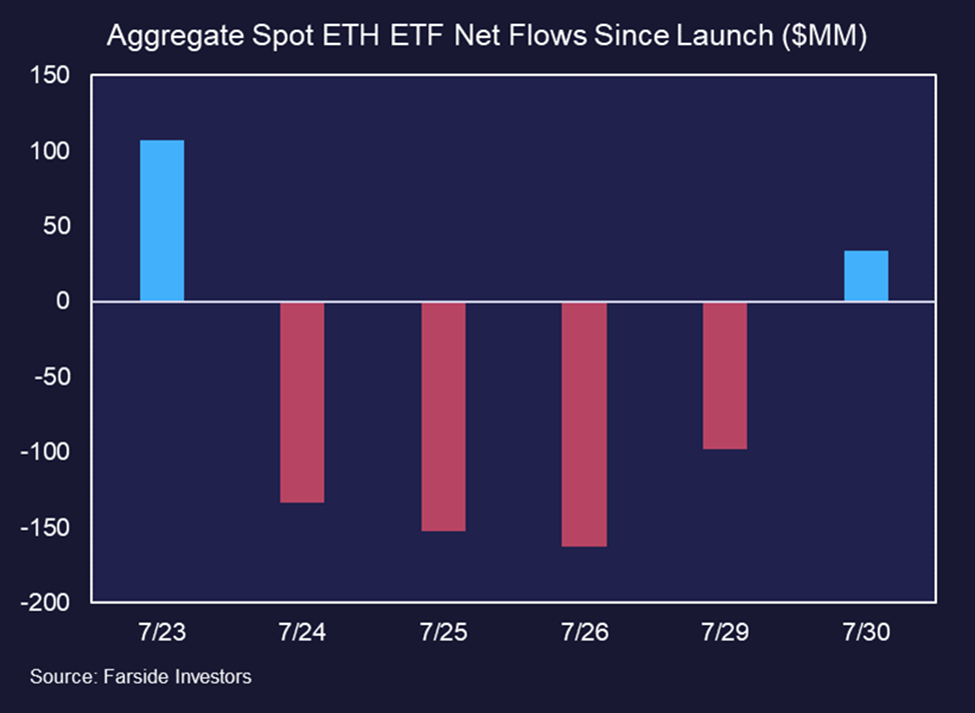

BTC 2.02% has bounced back above $66k in the past 24 hours, likely supported by a sinking DXY and a rebound in equities. ETH 0.20% is slightly outperforming again, following a day of net ETF inflows—the first since the ETH ETFs launched—and is now trading just north of $3,300. Meanwhile, SOL 3.48% is lagging, dropping below $180. Notably, AAVE 3.18% , a constituent of our Liquid Ventures basket, has been the top performer over the past seven days, driven by momentum from the recent fee switch proposal. Major equity indices are up today, with a significant bounce in tech names and broad participation across most sectors. The main event today is the FOMC press conference, where we will gain more insight into the pace and extent of future interest rate cuts. The DXY is moving lower, likely due to factors external to the FOMC. The Bank of Japan raised rates to 0.25% and reduced scheduled JGB purchases, causing the JPY to strengthen against the USD. Additionally, the Employment Cost Index report revealed soft job data and cooler wage growth once again. The Treasury also announced the second part of their quarterly refunding, with no significant changes to coupon sizes but an increase in the treasury buyback program limit from $15 billion to $30 billion.

Ethena Competitor Launches

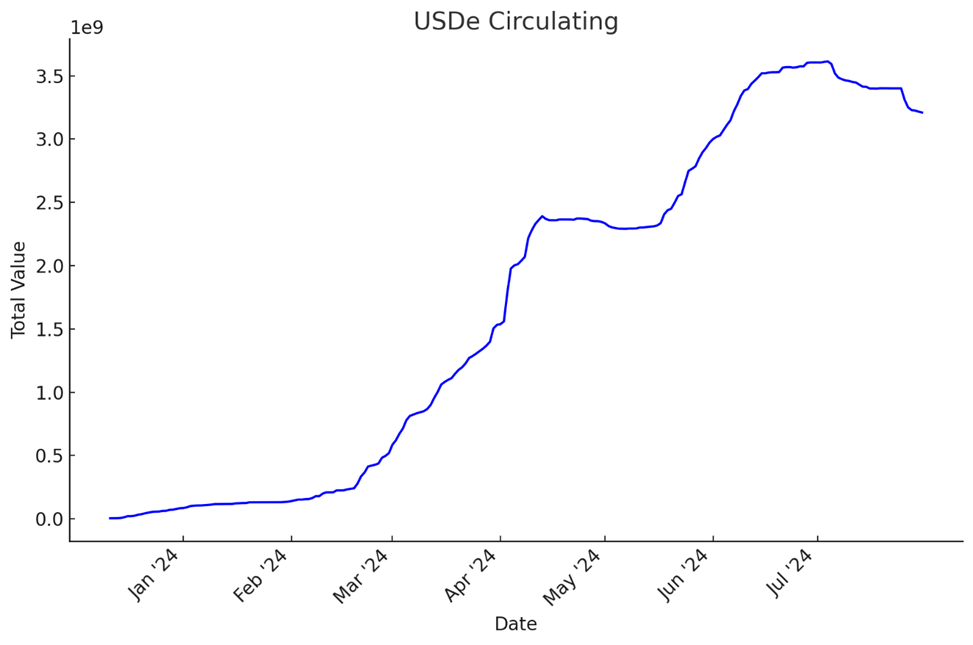

Elixir has launched a new synthetic dollar asset, deUSD, aiming to compete with Ethena’s USDe. Both stablecoins are fully collateralized and operate within the DeFi ecosystem, with deUSD using #stETH as collateral to short ether in a delta-neutral position. Elixir claims deUSD offers a truly decentralized alternative with verifiable on-chain proofs, transparency, and resilience, not reliant on centralized entities. The project has $1 billion in liquidity support and has partnered with DeFi platforms like Pendle, which tokenizes Elixir’s Apothecary initiative. This initiative, which tracks user contributions, has accumulated over $300 million in total value locked since March. Elixir recently completed an $8 million Series B funding round, bringing its valuation to $800 million ahead of its September mainnet launch. The is clearly a strong indication of demand for yield bearing stablecoins, as USDe has amassed a circulating supply of over $3 billion after just launching to the public in February.

Details on Lummis BTC Reserve Bill Emerge

According to media outlets that have viewed a draft of the bill, U.S. Senator Cynthia Lummis’s proposed legislation aims to establish a Strategic Bitcoin Reserve in the United States. The draft bill outlines a “Bitcoin Purchase Program” to acquire up to 200,000 BTC annually over five years, totaling 1 million BTC. This initiative would be financed by setting aside $6 billion from net earnings remitted by the Federal Reserve to the Treasury and reducing the Federal Reserve banks’ discretionary surplus funds. Additionally, it would be partially funded by revaluing the Federal Reserve’s gold certificates to reflect their market value. The purchased Bitcoin would be stored in a decentralized network of secure facilities across the U.S. and held for at least 20 years, with strict limitations on future sales. The plan also includes using existing U.S. government Bitcoin holdings from criminal forfeitures as part of the reserve’s core. The strategic reserve’s primary goal is to provide a secure, diversified asset base for the U.S. government, with potential uses limited to paying off federal debt.

Technical Strategy

Some encouraging gains out of Stellar which looks to be starting its next leg higher, following through on its breakout back in early July. Just as the rise above $0.089 was important earlier this month, the move back over $0.1010 was also significant in breaking this minor downtrend that had been in place since 7/17. Movement to test $0.112 looks likely and moving over this level should result in XLM 1.53% pushing up to $0.133, representing a 100% extension of the initial rally off the July lows. Eventual intermediate-term targets lie near $0.163 from March 2024 as part of a gradual bottoming out process that has been ongoing since 2022. Overall, the July progress in XLM has been constructive towards expecting additional gains back to this year’s highs, and it’s thought that today’s rally is yet another part of this process.

Daily Important MetricsAll metrics as of 2024-07-31 12:38:37 All Funding rates are in bps Crypto Prices

All prices as of 2024-07-31 11:59:31 Exchange Traded Products (ETPs)

News

|