Crypto Rallies on Political Optimism, South Korea Proposes Crypto Tax Delay

Crypto Market Update

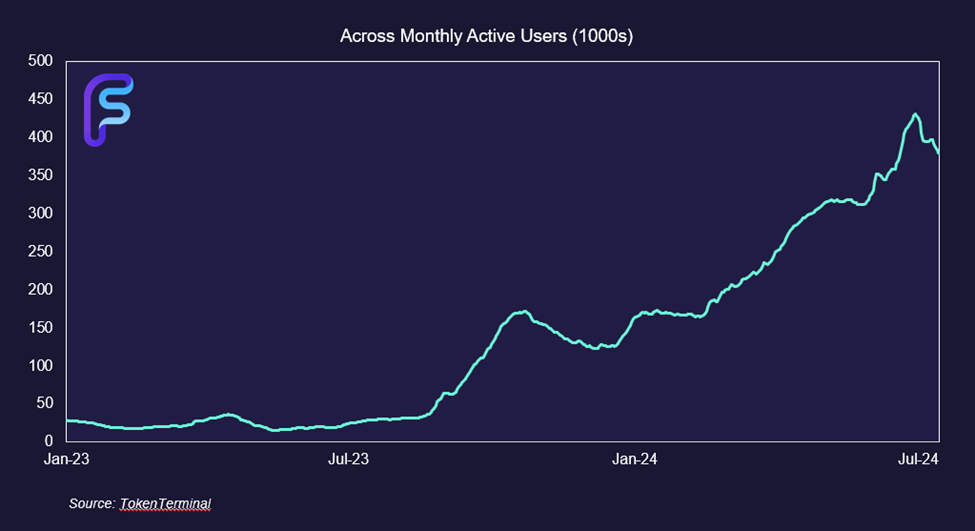

Crypto assets rallied over the weekend following an assassination attempt on former President Trump, galvanizing his political campaign and, in turn, optimism around his pro-crypto stances. BTC 0.95% has eclipsed $63k and ETH 0.92% is approaching $3,400. Small-cap assets are seeing some risk appetite return with ACX 3.42% , one of our Liquid Ventures constituents, making a new all-time high on the back of its Blast integration and consistent trend of adding new users. Equities continue to march upwards with the SPY -0.07% and QQQ 0.13% both gaining more than 0.70%, while the DXY remains flat near $104. Macroeconomic data releases for this week include retail sales tomorrow, housing starts on Wednesday, and the Leading Economic Index and Philadelphia Fed Manufacturing Survey on Thursday.

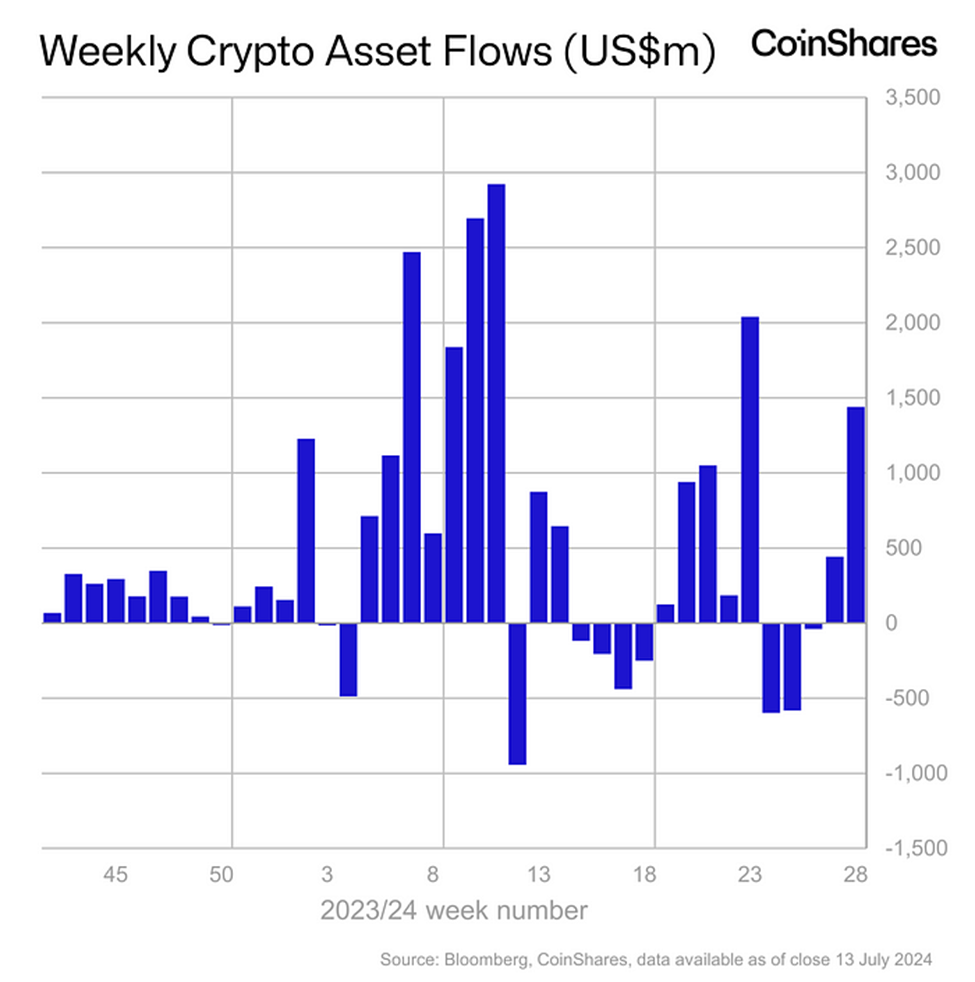

Weekly ETP Inflows Total $1.44 Billion

Crypto ETP products saw their fifth largest weekly inflows on record, totaling $1.44 billion and bringing year-to-date totals to $17.8 billion. Compared to 2021 – which represented the peak of the last bull market – flows are far more impressive (clearly helped by spot ETFs). 2021 saw full-year flows of $10.6 billion, while this year’s totals are on pace for over $30 billion. Bitcoin-related products made up the majority of weekly flows at $1.35 billion, while Short-Bitcoin products saw outflows of $8.6 million, the largest amount since April. Beyond Bitcoin, Ethereum products tallied $72.1 million in inflows, the largest weekly total since March. Other altcoins saw relatively small inflows, with SOL 4.30% , AVAX 3.30% , and LINK 2.42% seeing $4.4m, $2.0m, and $1.3m, respectively.

South Korea Proposes Delaying Crypto Taxation

South Korea’s People’s Power Party has proposed pushing the taxation of crypto capital gains from 2025 to 2028. The rationale for the proposal is predicated on the current negative sentiment of digital assets within the country. Industry advocates believe that further taxation on a higher risk asset, combined with negative sentiment, could be enough to push investors away from the asset class altogether. The tax in question is a 20% tax on all crypto gains, and was initially proposed in 2022, but has already been delayed to 2025. Despite the cited negative sentiment, the South Korean crypto market remains the most active globally, with the Korean Won being the most used fiat currency for crypto trading in the first quarter of 2024, and approximately 12.5% of South Korean citizens reporting using crypto as of the end of 2023. The South Korean Ministry of Economy and Finance is expected to disclose tax code amendments at the end of July which may include a final decision on the crypto tax issue.

Technical Strategy

Bitcoin made a much needed rebound following its steep pullback from early June. Prices managed to largely stabilize near May lows into early July, and subsequently have risen to exceed the downtrend from early June peaks. This represents a constructive near-term development for BTC 0.95% and should help prices push higher to test $64888, which approximates the 61.8% Fibonacci retracement area of its recent decline. The ability to exceed $65k would help BTC start a larger push back to test all-time highs. However, there does remain some concern about the months ahead not proving to offer a linear rally given the cyclical potential for a decline sometime in August. Therefore, continued strength will be needed to help momentum improve following a choppy couple of months. Overall, BTC remains largely neutral technically since March as part of its intermediate-term uptrend. The ability to surpass $72k would allow this structure to turn more bullish, which can’t be projected just yet at this time. Any minor selling will need to hold $54k which is thought to be important support on any pullback.

Daily Important MetricsAll metrics as of 2024-07-15 12:00:20 All Funding rates are in bps Crypto Prices

All prices as of 2024-07-15 11:51:08 Exchange Traded Products (ETPs)

News

|