Supply Overhang Weighs on Prices, Investors Brace for CPI and Possible ETH ETF Clarity This Week

Crypto Market Update

The market remains fixated on the supply overhang from the German government and the Mt. Gox estate, as the Germans chose an illiquid holiday weekend to accelerate the sales of their 50,000 BTC -1.92% seized in a criminal investigation. Over the past five days, BTC -1.92% is down about 7%, ETH -2.53% about 10%, and SOL -4.83% about 2%. The drawdowns over the weekend have cleared a considerable amount of leverage out of the market, with ETH -2.53% open interest now down to levels seen before traders started pricing in the ETF. Beyond the supply-related issues, this week is consequential for both crypto and macro. In crypto, we expect more clarity on the timing of the ETH -2.53% ETF launch, with potential S-1 approvals by Friday. On the macro front, the latest CPI release is scheduled for Thursday, which, combined with continued weak jobs data, could expedite discussions about rate cuts. Equities are mixed to start the week, with tech leading and major equity indices flat as the DXY trades slightly higher.

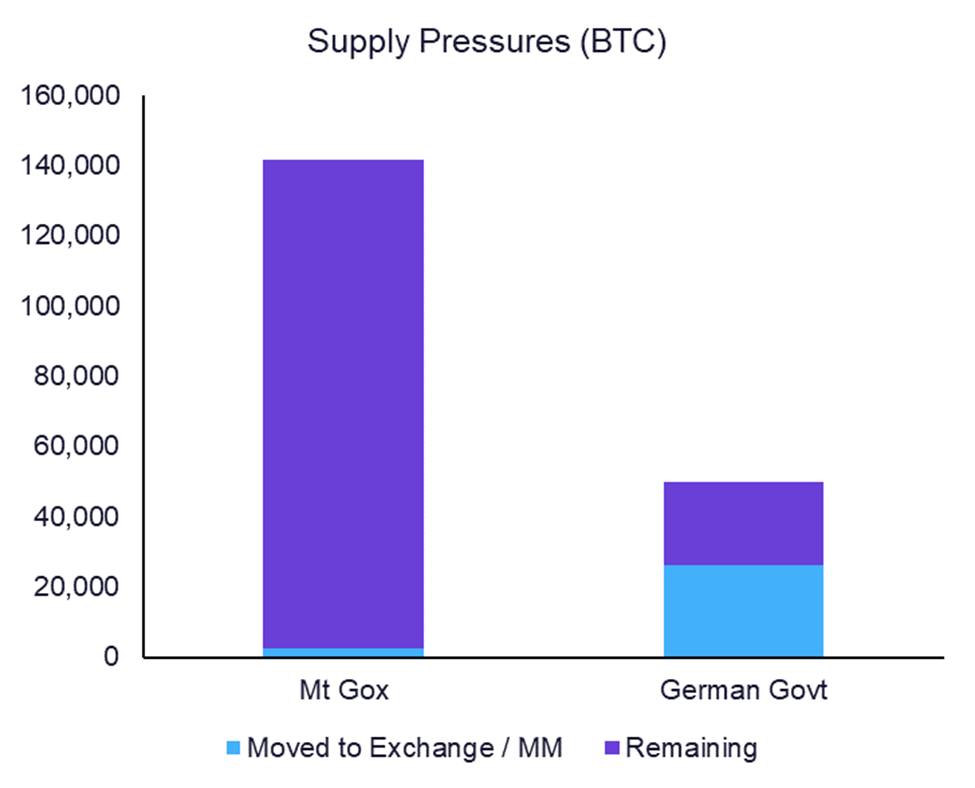

Germans Continue to Offload BTC

The German government accelerated its disbursement of seized BTC -1.92% over the weekend, sending large amounts to various market makers and crypto exchanges, including Cumberland DRW, Kraken, B2C2 Group, Coinbase, Bitstamp, and Flow Traders. In total, they have moved approximately 26k BTC -1.92% from their cold wallets, putting them just over halfway through their entire holdings, with about 24k BTC -1.92% left to offload. This selling pressure, coupled with less liquid market conditions, has weighed on crypto prices since around last Wednesday. You can track the German government wallet activity here.

Mt. Gox Distributions Have Interesting Timing Wrinkle

The defunct crypto exchange Mt. Gox also began repaying creditors in BTC -1.92% and BCH -3.15% as part of its rehabilitation plan on July 5th. The trustee announced that repayments will be made promptly to eligible creditors through designated crypto exchanges, provided certain conditions are met. Last week, Mt. Gox moved 1,545 BTC -1.92% to a hot wallet on Bitbank, the first of the disbursements to partner exchanges. Unlike the German BTC -1.92% , which is essentially guaranteed to be sold within a short timeframe, Mt. Gox distributions have more uncertainty over how much will actually be sold and the timing of the distributions. Repayments are being handled by five exchanges with varying distribution timelines: Kraken (90 days), Bitstamp (60 days), BitGo (20 days), and both SBI VC Trade and Bitbank (14 days). These are the maximum timelines each party has agreed to meet and not necessarily the projected timeframe for distribution to customers. You can track Mt. Gox wallet activity here.

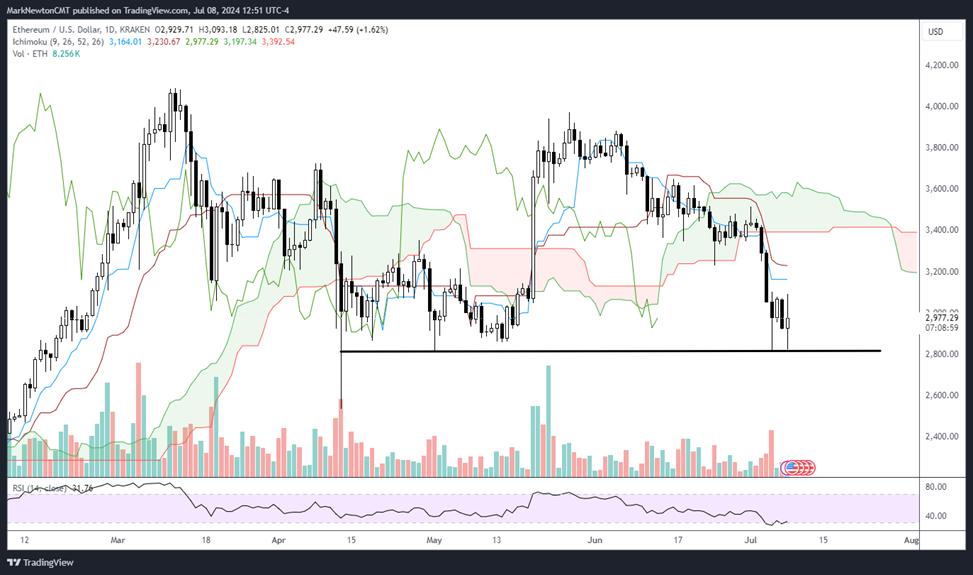

Technical Strategy

Ethereum’s decline in recent weeks now looks to have found initial support in an area that appears significant as support to this current decline. The area at $2800 marked support back in May on pullbacks and also held on a closing basis to the steep slide back in April. Following three straight days of holding $2800, ETH -2.53% also successfully held this morning ahead of a bounce which has occurred on both an absolute basis as well as on its Market dominance chart. Overall, the ability to reclaim $3200 will be important before growing too confident that ETH has bottomed. Conversely, it’s important that ETH also not violate 2800 in the week to come as this would postpone the rally and allow for a deeper correction to happen into late July before a larger rally can commence. While 4/13 intra-day lows at $2537 proved important, any break of $2800 would point to a good likelihood of $2100-$2200 being tested which would signify a very attractive area of intermediate-term support for long-term buyers.

Daily Important MetricsAll metrics as of 2024-07-08 12:00:46 All Funding rates are in bps Crypto Prices

All prices as of 2024-07-08 11:51:22 Exchange Traded Products (ETPs)

News

|