Crypto Starts July With a Bounce, ETH ETF Launch Likely Pushed to Next Week

Crypto Market Update

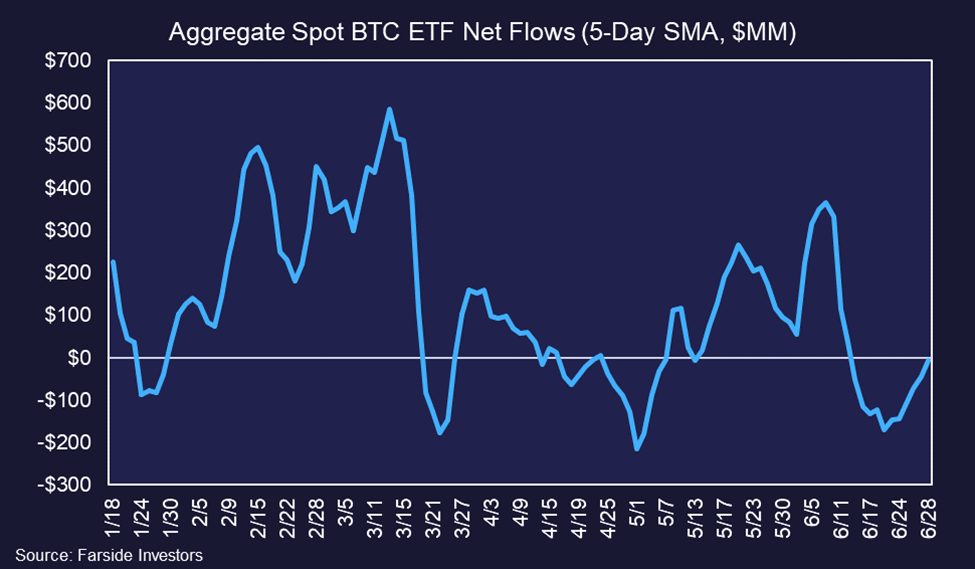

BTC is up 5% since market close on Friday, hovering just above $63k, while ETH -1.27% is lagging, currently trading below $3500. This ETH underperformance further supports the idea that market expectations for the ETH -1.27% ETFs are relatively muted. Meanwhile SOL -1.88% is nearly back to the level it traded at on Thursday following VanEck’s application to list a SOL -1.88% ETF, now trading around $148. While we have yet to see volumes or a Coinbase premium return, the BTC -1.38% ETFs have quietly racked up four consecutive days of aggregate net inflows, bringing the 5-day moving average close to positive territory. The big piece of data this morning was the ISM manufacturing PMI, which came in at 48.5, below the expected 49.1, providing additional support that the economy is slowing. Importantly, the prices paid component of the PMI report came in at 52.1, well below the consensus forecast of 55.9, a good sign for inflation. Despite the soft economic data, rates are higher on the day, with the US 10Y moving back toward 4.5%. Meanwhile, the DXY demonstrated some whipsaw price action around the PMI release and is now slightly higher on the day. Major equity indices are in the green, with tech leading the way higher once again. Despite it being a holiday week, it will certainly be a consequential one, with more significant macro data released tomorrow in the form of JOLTS numbers. Perhaps more importantly, Fed Chair Powell is scheduled to speak as well.

ETH ETF Launch Likely Delayed Until Next Week

While we had anticipated the ETH ETFs to go live by the 4th, it appears we will have to wait until at least next week. According to a report, the SEC has returned the S-1 forms to prospective Ethereum ETF issuers with minor comments, requesting revisions and a refile by July 8th. This iterative process means issuers must go through at least one more round of filings before the ETFs can begin trading. The S-1 forms are the second step in the approval process, following the approval of 19b-4 forms in May.

MiCA Goes into Effect, Circle Capitalizes

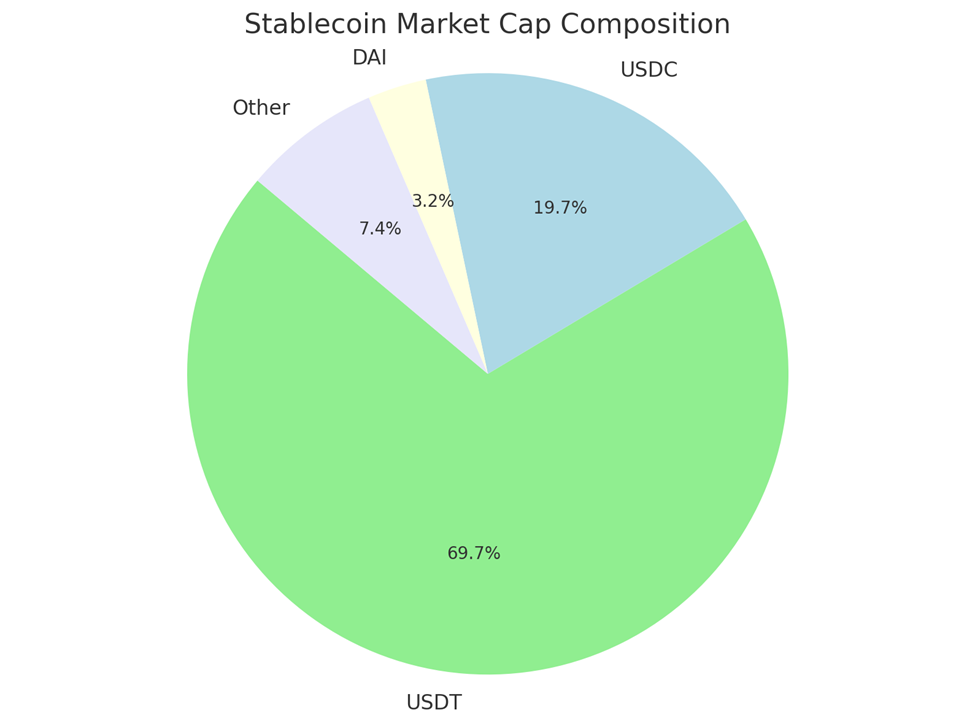

Circle has become the first global stablecoin issuer to be licensed and approved under the European Union’s Markets in Crypto Assets (MiCA) regulatory framework, effective July 1st. This approval allows Circle to issue its stablecoins, USDC 0.00% and EURC -0.09% , within the EU, marking a significant step in its compliance efforts. Circle had previously secured a digital asset regulatory license in France and established a French entity to manage its MiCA-compliant operations. MiCA, which aims to standardize crypto regulations across EU member states, requires increased regulatory compliance for stablecoin issuers, with full adherence expected by the end of the year. However, there are ongoing concerns and confusion regarding MiCA’s implementation and its impact on stablecoin issuers, as expressed by industry leaders like Tether CEO Paolo Ardoino. As of today, USDT still commands a remarkable 70% of the total stablecoin market cap, ahead of USDC in second place at 20%.

Technical Strategy

Ethereum Name Service has successfully broken out above the highs of a five-month technical base that had been building since January of this year. The act of ENS -5.87% rising back above $28 was thought to represent a breakout of the minor one-month triangle pattern, but has rapidly led ENS to surpass the highs of this recent consolidation which lies near $29.75. This is a bullish technical development and bodes well for the possibility of additional near-term gains. Price has now reached the highest levels since early 2022 and has resistance near $40, and then $49.73, representing the peak from late 2021. Volume has been rising since May when ENS started to show better technical strength and this recent breakout looks quite attractive technically based on the bullish resolution of this pattern since early this year.

Daily Important MetricsAll metrics as of 2024-07-01 12:00:22 All Funding rates are in bps Crypto Prices

All prices as of 2024-07-01 13:14:08 Exchange Traded Products (ETPs)

News

|