Encouraging Move in CB Discount at US Market Open, CORZ announcement leads HPC Miner Cohort Higher

Crypto Market Update

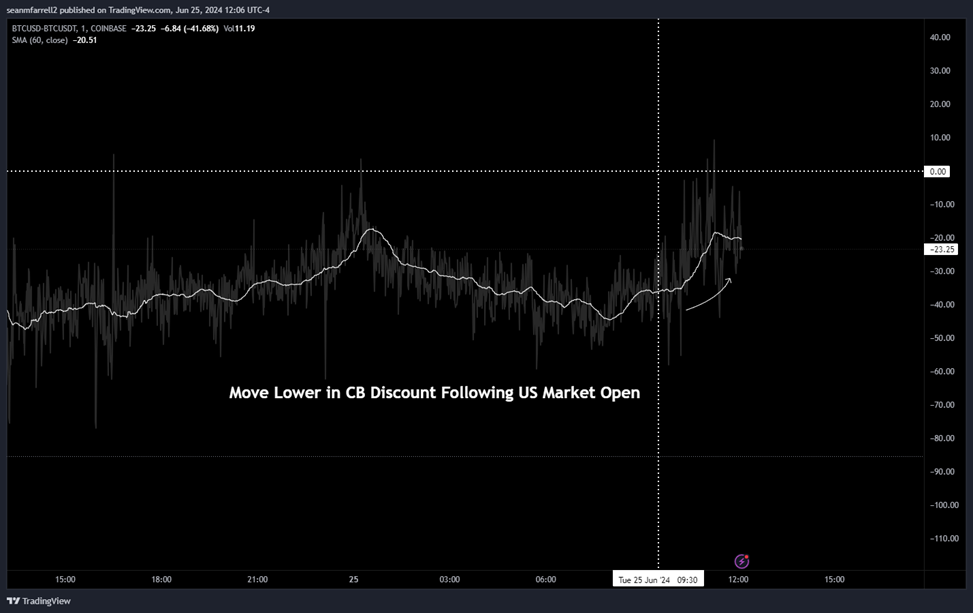

Crypto is rebounding nicely today following an intense Bitcoin-led selloff yesterday, catalyzed by idiosyncratic sell pressure from fears over Mt. Gox supply coming to market. It was a somewhat rare occurrence to have such a significant selloff in BTC -4.55% but an overall positive day for altcoins. BTC -4.55% is attempting to reclaim $62k, while ETH -4.76% hovers just above $3400, and SOL -4.14% tries to break through $140 again. Interestingly, we saw the BTC discount on Coinbase compress following the US market open, which is a positive sign that US investors are coming back into the fold at current levels. The crypto market is seeing broad participation in the current rally. Crypto equities are also participating, with our HPC miner basket outperforming other publicly traded miners as the market continues to reprice these names higher. Today’s move was likely catalyzed by the announcement from Core Scientific that they would be adding hosting capacity for their partner CoreWeave, further diversifying their revenue streams. This crypto bounce comes despite a rise in rates and the DXY and a pullback in many macro-sensitive indices we discussed last week as being correlated to BTC -4.55% . Tech is back to leading equities, with both the QQQ -1.17% and ^SPX marching higher despite most sectors being down on the day.

CORZ Allocates More Capacity to CoreWeave

Core Scientific announced a new contract with CoreWeave for an additional 70 MW of infrastructure to support high-performance computing (HPC) operations, increasing their total allocated infrastructure for HPC hosting to 270 MW. This agreement, part of a previously established 200 MW, 12-year hosting contract, involves modifying 100 MW of Core Scientific’s existing infrastructure to host CoreWeave’s NVIDIA GPUs. The modifications are set to begin in late 2024, with operational status expected by late 2025. This contract is anticipated to add $1.225 billion in revenue over its duration, enhancing Core Scientific’s earnings power and shareholder value. CoreWeave will fund the necessary capital investments, credited against hosting payments, and retain options for further expansion and renewal. This demonstrates a continued push by miners to diversify into HPC as they leverage prebuilt infrastructure and existing energy contracts.

Solana Foundation Launches Actions / Blinks

The Solana Foundation is introducing tools, called “Actions” and “blinks,” that enable any website, app, social media platform, or QR code to facilitate crypto transactions on the Solana blockchain. “Actions” allow on-chain transactions directly from various digital platforms, while “blinks” create shareable links for these transactions, making blockchain interactions more accessible beyond specialized dapps. These innovations aim to drive mainstream adoption by simplifying blockchain access, similar to Farcaster’s Frames but with broader applicability. Early adopters of these tools include various crypto and web3 projects, emphasizing the potential for diverse applications from NFTs to staking.

Technical Strategy

Hut 8 is showing some constructive upside follow-through today after a big push higher in recent weeks to challenge its intermediate-term trendline extending down from last July’s peaks. Today’s 16% surge is helping HUT break this downtrend and outperform many Crypto-miners as this now trades at the highest levels since January. Following a lengthy period of consolidation throughout much of 2024, it’s June rally has helped this to begin a more intermediate-term rise which should initially find short-term resistance at $15.62 with more meaningful levels found at December 2023 peaks at $18.42. While this recent rally over the past six of seven weeks has helped HUT’s weekly momentum, it could show a possible Weekly TD Sell Setup (DeMark exhaustion signal) as early as next week which might cause a short-term stallout before this can push higher to $18.42. Overall, this looks bullish, but short-term overbought, and pullbacks would afford the opportunity to buy dips near support at a zone of support from $11.40-$12.40. Thereafter, a possible rise to $18.42 looks possible into August.

Daily Important MetricsAll metrics as of 2024-06-25 12:00:11 All Funding rates are in bps Crypto Prices

All prices as of 2024-06-25 12:06:55 Exchange Traded Products (ETPs)

News

|