DXY Rally Weighs on Crypto, ZK Airdrop Announced

Crypto Market Update

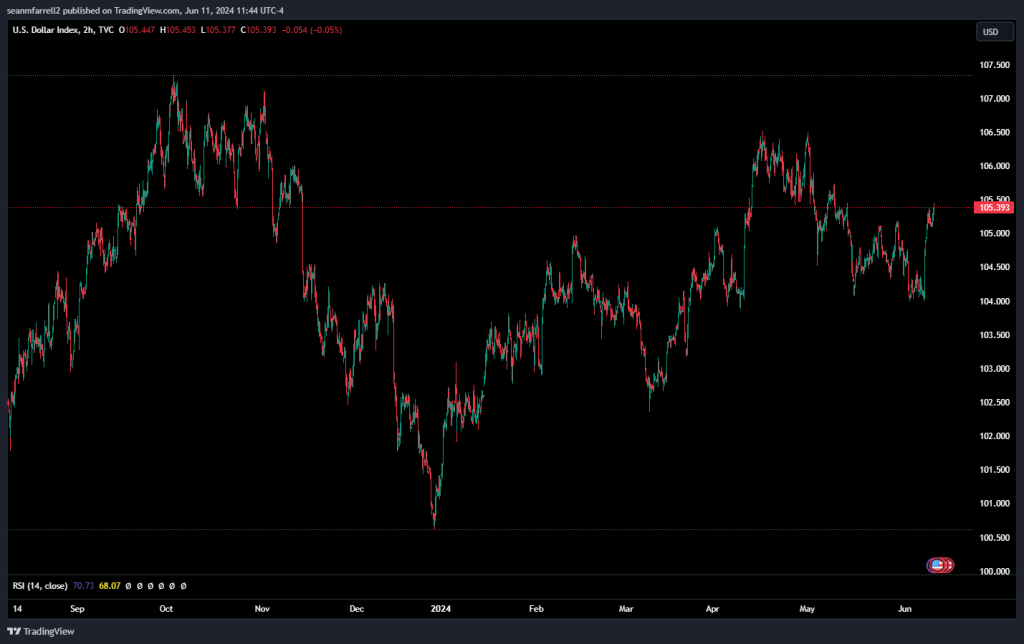

Despite rates moving lower today, the DXY is surging higher due to weak economic data from Europe. This is a major driver behind the move lower in crypto, with BTC 1.55% breaking below $67k, ETH 3.57% finding support around $3500, and SOL 3.87% hovering near $152 after bouncing off $150 this morning. Investors are treading carefully ahead of tomorrow’s CPI and FOMC announcements, where headline inflation is expected at 3.4% and core at 3.5%. The market uniformly expects the Fed funds rate to remain unchanged, but the key takeaway will be Chair Powell’s tone and the revised economic projections from the Fed. Equities are mixed, with most sectors in the red except for tech, which is up nearly 1% on major outperformance from Apple today. Bitcoin ETFs broke a 19-day streak of inflows yesterday, experiencing minor outflows amidst the current rally in the DXY. However, the 5-day moving average of inflows remains elevated at just over $330 million.

Metaplanet Buys More Bitcoin

Tokyo-listed investment firm Metaplanet Inc. (TSE: 3350) saw its stock rise 9.88% after purchasing an additional 23.351 BTC for 250 million yen ($1.58 million), bringing its total bitcoin holdings to over 141 BTC. This latest purchase, at an average price of $65,300 per BTC, aligns with Metaplanet’s strategic shift towards a Bitcoin-centric investment approach in response to Japan’s economic challenges. Since announcing its bitcoin investment focus in April, Metaplanet’s stock has surged from 19 yen to 89 yen per share. This move is part of a broader trend of public companies adopting bitcoin as a treasury reserve asset, led by firms like Microstrategy Inc. (NASDAQ: MSTR).

ZK Airdrop Details Revealed

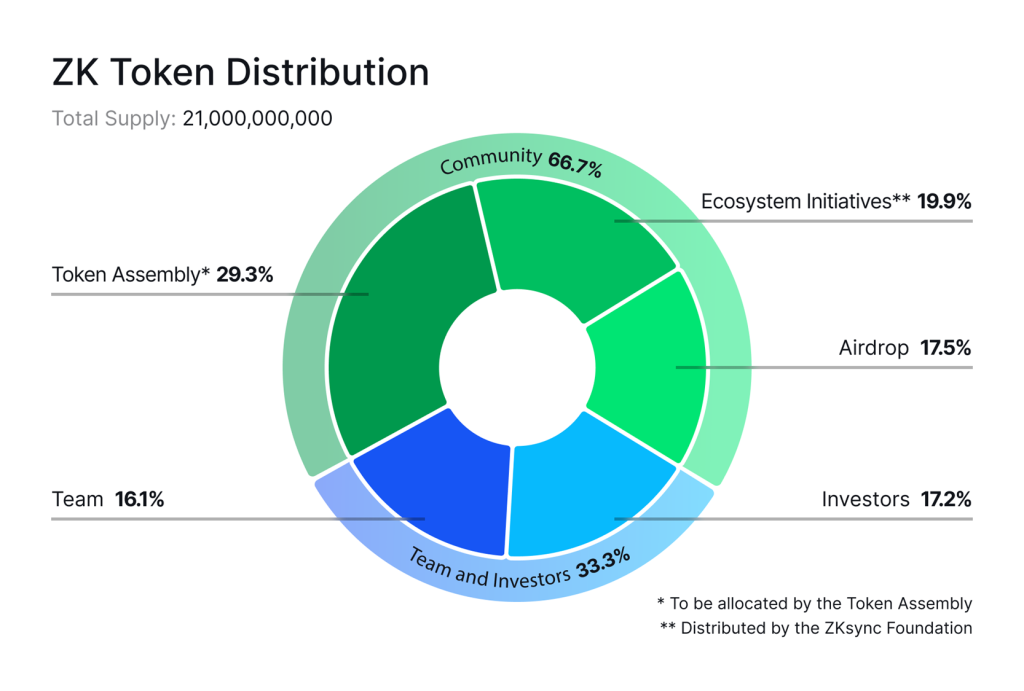

Matter Labs, the developers behind the L2 network ZKsync Era, have officially disclosed the distribution schedule for their highly-anticipated ZK token airdrop. The airdrop will consist of 3.675 billion ZK tokens, representing 17.5% of the total 21 billion supply, to 695,232 eligible wallets next week. Designed to prioritize “real people,” 89% of the tokens will go to users who met specific activity thresholds on ZKsync, while 11% will go to ecosystem contributors. The tokens will be fully liquid with no lock-up periods, aiming to encourage community governance participation. The remaining supply will be distributed through ecosystem initiatives, with substantial allocations to investors and the Matter Labs team, who will have their tokens locked for a year and gradually unlocked over three years

Technical Strategy

Today’s breakdown in Bitcoin is a short-term technical negative which likely will bring about additional consolidation before any rally back to new highs can occur. BTC 1.55% has violated the uptrend from early May which could result in a pullback to test $64,600 in the days ahead with additional support found at $62,400. While i do suspect that weakness proves short-lived and not too damaging, Tuesday’s decline looks like a short-term warning following the run-up in May. Its Elliott-wave pattern appears like a possible ABC formation which began back on 5/20 when BTC closed just above $71.4k. Following a 50-62% retracement of May’s rally, BTC should be able to turn back higher towards all-time highs, which might also coincide with Treasury yields beginning a more material breakdown.

Daily Important MetricsAll metrics as of 2024-06-11 12:00:51 All Funding rates are in bps Crypto Prices

All prices as of 2024-06-11 11:51:59 Exchange Traded Products (ETPs)

News

|