Bitfarms Approves Potential Issuance to Deter Riot’s Takeover, Fidelity International Tokenizes MMF with Onyx Digital Assets

Market Update

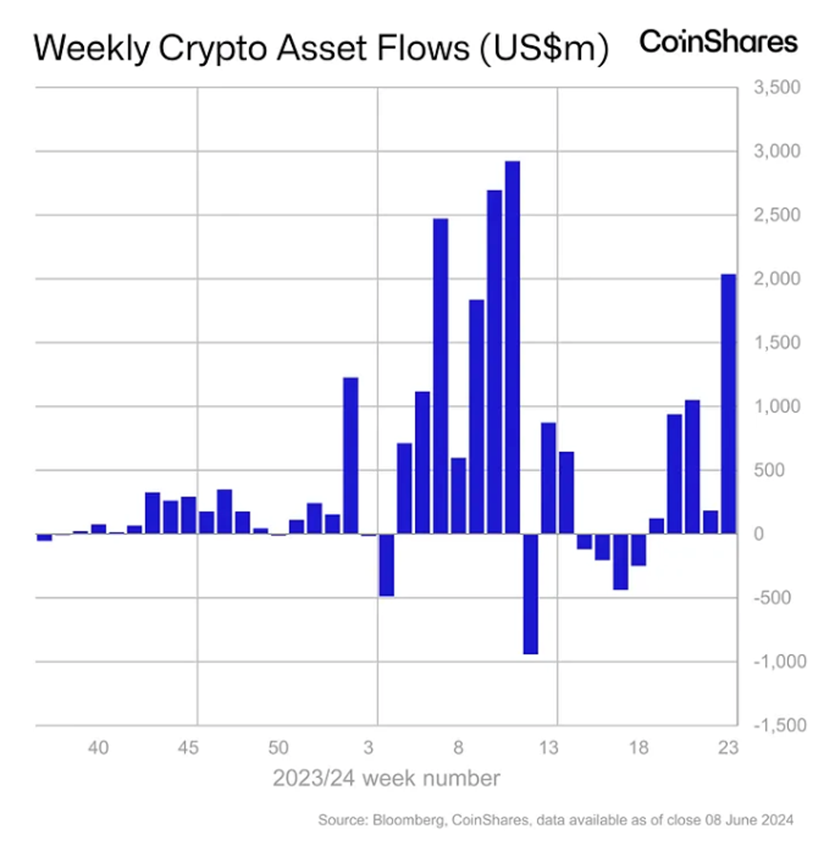

Equities are gaining to start the week, with the ^SPX rising above $5,350 and the NDQ -4.47% above $19,060, as the market prepares for an eventful macroeconomic week. May CPI data and a FOMC meeting are slated for Wednesday, followed by PPI on Thursday and consumer sentiment data on Friday. Rates spiked aggressively on Friday after higher-than-expected non-farm payrolls, but a soft CPI report could result in a dovish Fed meeting, providing fuel for a more significant deterioration in rates. Late on Friday afternoon, crypto assets saw sharp declines, with Bitcoin dropping from $71k to $68k and Ethereum falling from $3,800 to slightly below $3,600. BTC -0.32% and ETH -0.02% have since regained some of the losses as they are trading at $69.9k and $3.7k, respectively. Last week was strong for crypto ETPs, which saw over $2 billion in inflows, matching that of the entire month of May. Ethereum products had their best week of inflows since March, totaling $68.9 million.

Bitfarms Approves Potential Issuance to Deter Riot’s Takeover

Bitcoin miner Bitfarms is attempting to block a hostile takeover from competitor Riot Platforms through a “poison pill” strategy. In April, Riot proposed an acquisition of Bitfarms at a 24% premium, which Bitfarms ultimately rejected. Riot then accumulated approximately 12% of the BITF N/A% shares over the last two weeks, making them the largest shareholder, with intentions of calling a special shareholder meeting to introduce independent directors to the Bitfarms board. Riot believes that Bitfarms’ board members are not acting in the best interests of shareholders. To preserve the integrity of Bitfarms’ strategic alternatives review process, the Bitfarms board has approved a poison pill strategy. Under the plan, if a single entity accumulates more than 15% of the company between June 20th and September 10th, the company will issue additional stock, diluting the entity’s stake. Bitfarms hopes the new issuance plan will deter Riot from acquiring more shares and allow them to pursue their own directives.

Fidelity International Tokenizes MMF with Onyx Digital Assets.

Fidelity International has selected JP Morgan’s Onyx Digital Assets as its partner to tokenize one of its money market funds. Fidelity International is a subsidiary of Fidelity Investments based in London, and Onyx is JP Morgan’s private blockchain network that supports its Tokenized Collateral Network (TCN). TCN is an application that connects JP Morgan’s transfer agent and financial institutions, allowing for instant tokenization and transfer of collateral. JP Morgan completed its first tokenized collateral settlement last year, transferring tokenized shares of one of Blackrock’s money market funds to Barclays to serve as collateral for an OTC derivatives trade. Banks and asset management firms continue adopting tokenization strategies to unlock capital efficiency and lower costs. Most tokenization activities have focused on MMFs as collateral, but the goal for Onyx and other tokenization companies is to expand into equities, fixed income, real estate, and other assets to transform how finance is facilitated.

Technical Strategy

Friday’s Solana decline directly coincided with a setback in many crytocurrencies in response to Treasury yields spiking dramatically higher following Friday’s bullish Jobs data. SOL 0.19% declined under the lows from late May which might result in a 3-5 day period of consolidation before price starts to rally back. Importantly, this doesn’t look like the start of a larger decline, but yet just a short-term period of minor weakness. However, the uptrend from early May was broken on Friday’s weakness, so this will be an area at $168 which will need to be recouped to have confidence that the decline has played its course. Near-term areas of support to consider attractive support for SOL lies between $145-$150 on any further weakness in the days ahead. Conversely, any rise back over $175.62 would allow for a push back above $200 which seems likely in the months ahead.

Daily Important MetricsAll metrics as of 2024-06-10 13:51:05 All Funding rates are in bps Crypto Prices

All prices as of 2024-06-10 11:54:46 Exchange Traded Products (ETPs)

News

|