Rates Lower and BTC Higher Post-PMI, Ethena Standing Out Among Stablecoins

Crypto Market Update

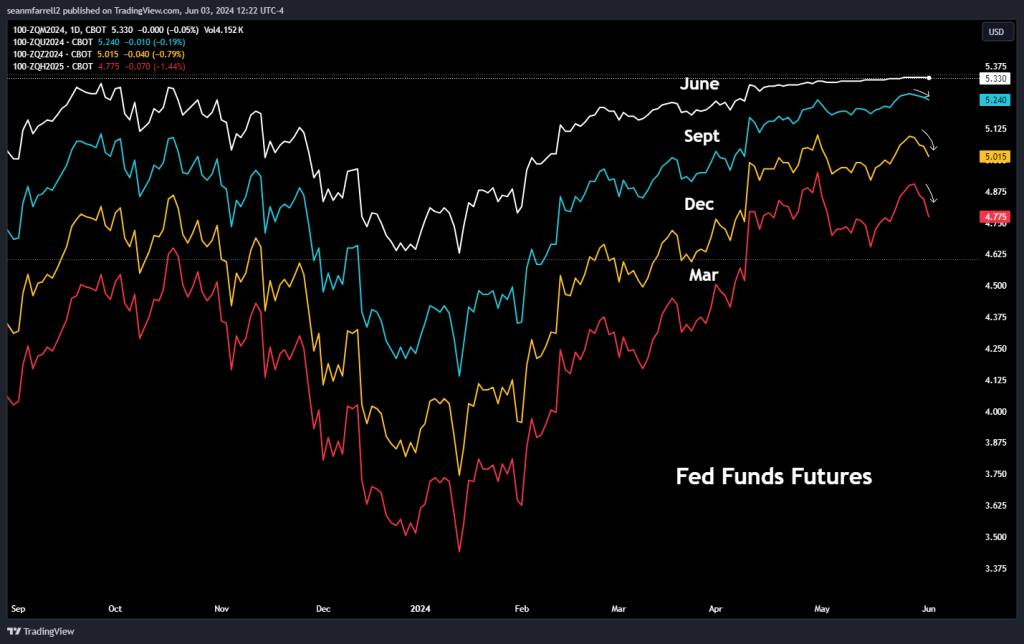

BTC -0.32% has retraced a portion of its early morning gains but remains decisively green on the day, now trading back above $69k. ETH -0.08% and SOL -0.65% are lagging, with ETH -0.08% stalling around $3,780 and SOL -0.65% trading just under $164. Equities are mixed after starting the day hot, with only three sectors currently positive. This comes amidst a constructive rates backdrop, with the US 10Y moving sharply lower, now trading around 4.41%, and the DXY N/A% challenging 104 as support once again. Additionally, the Fed funds futures market is moving back toward May levels. This move in rates was supported by an ISM Manufacturing PMI report released today, suggesting continued economic contraction in manufacturing, with PMI coming in at 48.7, below the consensus forecast of 49.6. However, prices paid were 57, lower than the forecasted 60, and employment came in at 51.1, well above the forecasted 48.5. Thus, the market seems to have avoided another stagflation narrative emerging. It is an action-packed macro week with JOLTs on Tuesday, ISM Services PMI on Wednesday, a forecasted ECB rate cut on Thursday, and more jobs data on Friday.

Biden Issues Veto

President Biden vetoed a resolution to overturn the SEC’s controversial Staff Accounting Bulletin 121, which requires financial institutions holding crypto for customers to include these assets on their balance sheets. This mandate can make it too costly for federally regulated banks to offer crypto custody services due to the need to maintain capital ratios. Biden emphasized the need for “appropriate guardrails” to protect consumers and investors while leveraging the benefits of crypto-asset innovation. Despite bipartisan support in Congress, Biden argued that repealing the bulletin would weaken the SEC’s ability to maintain a comprehensive financial regulatory framework, leading to financial instability and market uncertainty. Critics, including many in the industry, believe SAB 121 imposes unfair standards on crypto, potentially preventing banks from safeguarding digital assets and placing customers in the more risky unsecured creditor group in the event of bankruptcy. While Biden’s veto aligns with his previous commitments, it could damage the recent perception that Democrats are softening their stance toward crypto and further galvanize the industry ahead of the upcoming election.

Ethena Outshines Other Stables

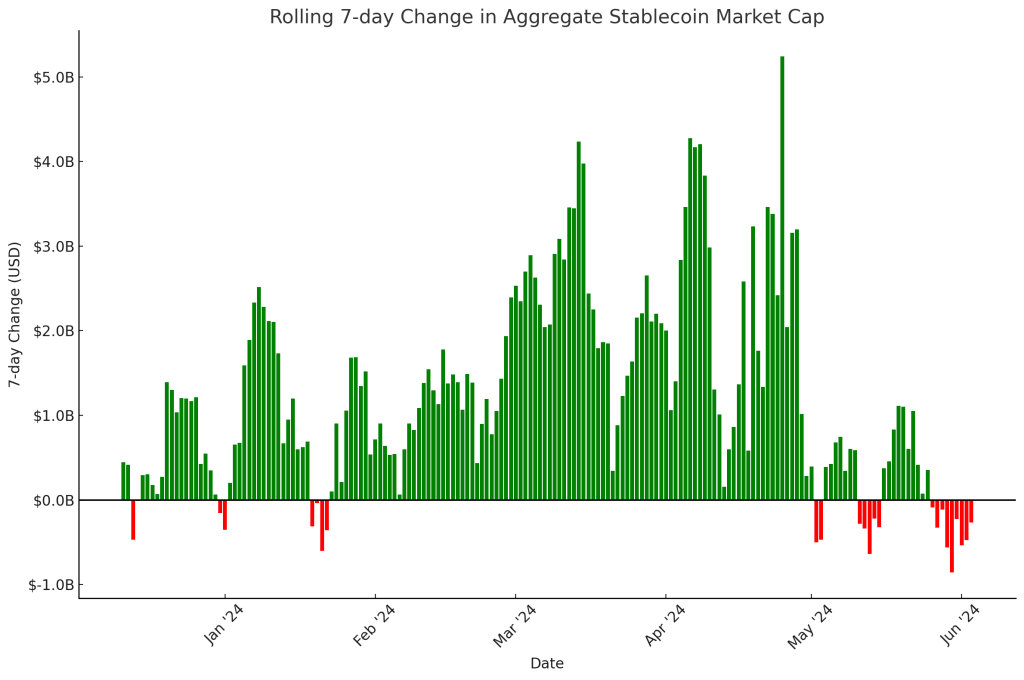

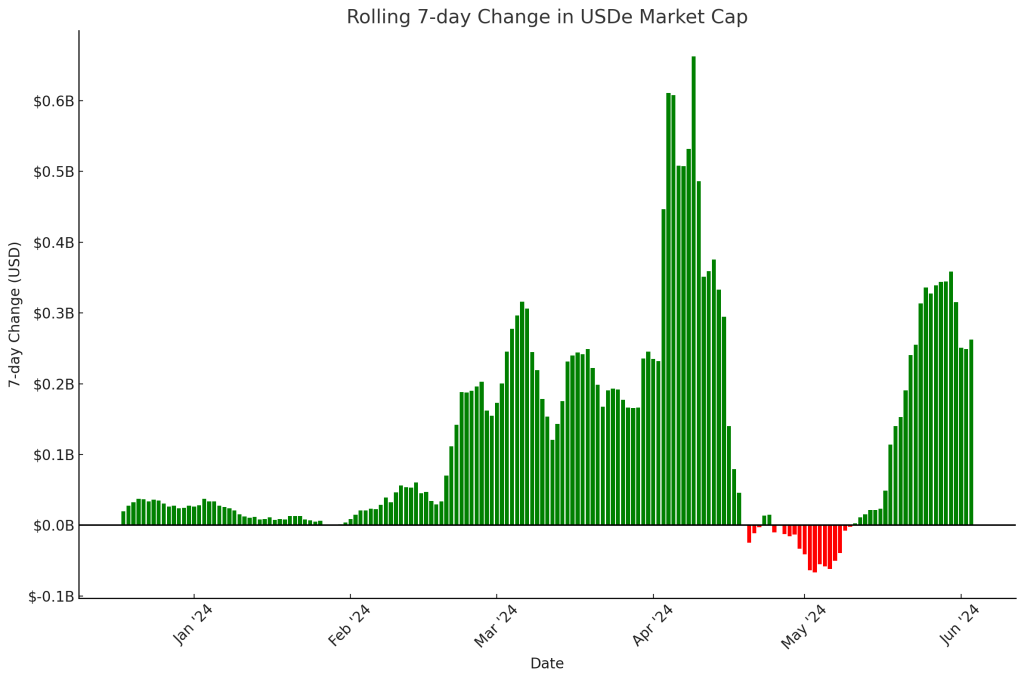

Flows from ETFs continue to be positive, and volumes are rebounding. If there is one data point that suggests a mixed flows story, it’s the stablecoin outflows the market has witnessed over the past couple of weeks, with the lion’s share of outflows attributable to USDC 0.01% . One stablecoin that has not had any issues with flows is USDe, the synthetic dollar issued by Ethena Labs (ENA 1.37% ). USDe recently has reached a $3 billion supply, a mere four months after its public launch in February. As a reminder, USDe maintains its peg through arbitrage mechanics and a yield-returning cash-and-carry trade. It is essentially a tokenized basis trade. Currently, USDe comprises only a small fraction of the overall stablecoin market, ranking fourth behind USDT 0.03% , USDC 0.01% , and DAI 0.03% . However, its early parabolic growth has been nothing short of impressive.

Source: DefiLlama, Fundstrat

Source: DefiLlama, Fundstrat

Technical Strategy

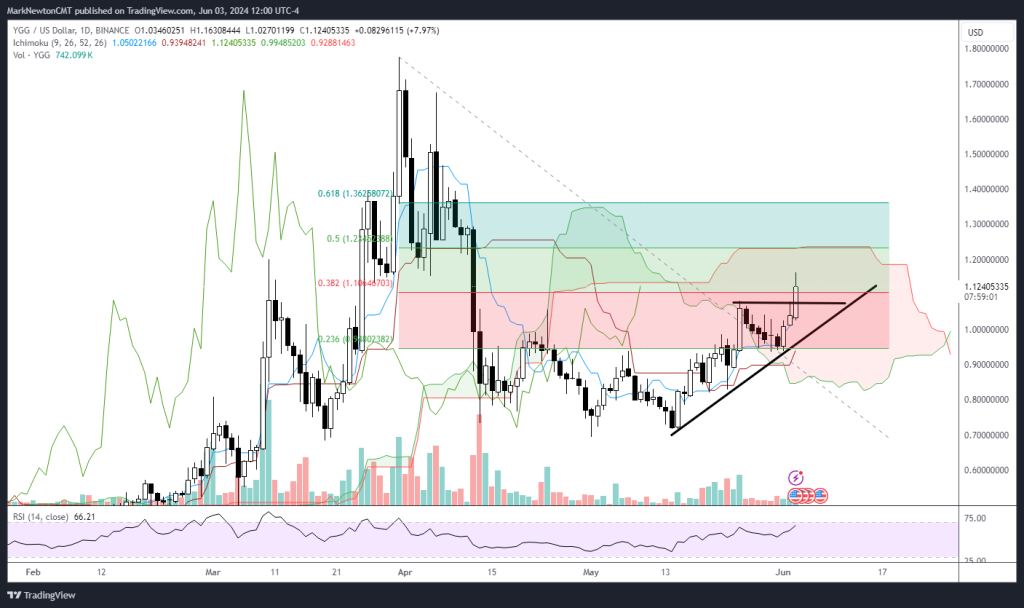

Yield Guild Games has started off the week with a bullish breakout of May highs, bringing prices up to the highest levels since mid-April. Daily YGG -6.58% charts show today’s breakout above $1.075, which should have little to no resistance until $1.24, with additional short-term levels near $1.36. Only in the event of a move back over $1.36 would YGG begin its push to test all-time highs at $1.77, which looks likely sometime this Fall. Near-term, Monday’s minor breakout is an encouraging technical development, and volume is picking up to the highest levels in nearly two months. Pullbacks, if/when they occur, should find solid support near $1.03 with solid uptrend line support at $1.00 before pushing higher.

Daily Important MetricsAll metrics as of 2024-06-03 16:11:47 All Funding rates are in bps Crypto Prices

All prices as of 2024-06-03 11:50:57 Exchange Traded Products (ETPs)

News

|