ETH ETFs Get the Greenlight, Flows Remain Net Bullish

Crypto Market Update

Crypto assets are broadly moving higher again after some post-ETF approval consolidation. BTC -1.55% is back above $68K, while ETH -2.47% is hovering around the $3.7K level. SOL -3.74% is underperforming today, possibly as a side effect of the last of the FTX auction taking place yesterday. Pantera and Figure led the $2.6 billion auction, purchasing the locked tokens at $102 per SOL -3.74% . We often find that the market can be weak leading into these auctions as buyers exchange their liquid exposure to SOL -3.74% for the locked tokens (net sell pressure). As this is the last of the estate sales, it sets up a structural supply tailwind moving forward. Among the top 100 coins, ONDO -3.79% is leading the pack, up 14% over the past 24 hours, followed by LDO -6.80% , possibly due to its association with ETH -2.47% and the potential for broader liquid staking adoption from ETFs down the road. Major equity indices are also moving higher, with participation from all sectors. Rates are broadly moving lower today, with the US 10Y rejecting the 4.5% level, and the DXY is sharply lower after briefly moving above 105. The market is responding positively to overall positive consumer sentiment survey revisions, with sentiment coming in at 69.1, above the consensus expectations of 67.5. The 1-year inflation expectations are at 3.3%, below the consensus forecast of 3.5%.

ETH ETFs Receive Approval from SEC

To cap off what might have been the most bullish regulatory week in the history of the crypto industry, we received approval of the 19b-4 rule change application for exchanges to list spot ETH -2.47% ETFs. Unfortunately, the vote was done under delegated authority to the trading and markets division of the SEC, so we won’t be seeing any details behind a commissioner vote. The SEC still needs to review the issuer S-1 filings and approve those, which, based on popular estimates, could take a few weeks to finalize. This not only opens the door for a new cohort of investors into ETH -2.47% , but is constructive for any assets currently affiliated with SEC regulatory actions such as UNI N/A% and COIN 3.07% . ETH -2.47% is currently consolidating after an extremely volatile 24 hours, mostly due to the massive leverage built up around the SEC decision.

The Flows Story Remains Net Bullish

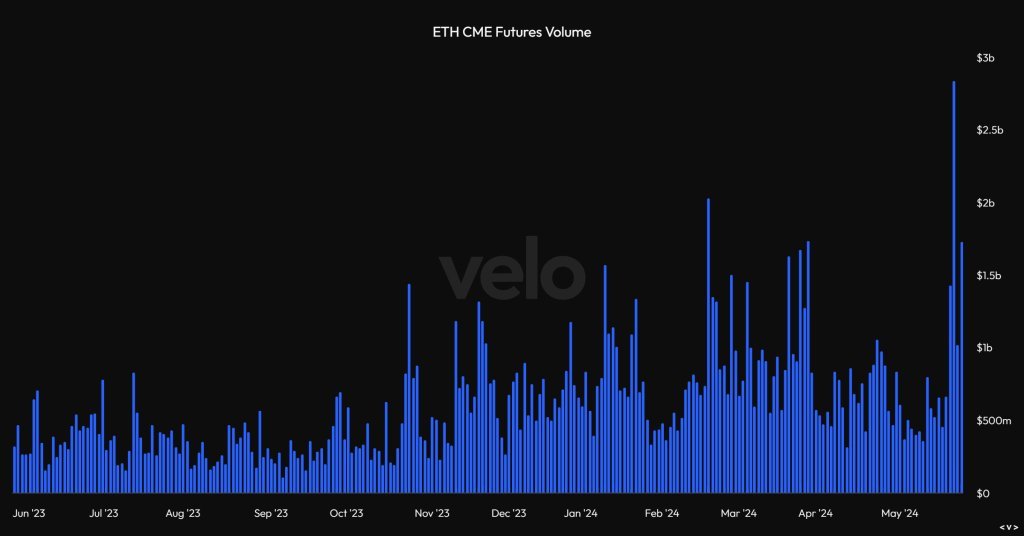

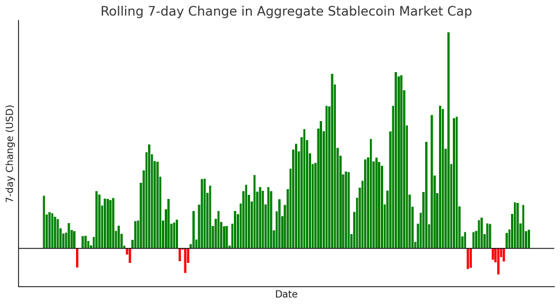

Despite the consolidation over the past couple of days, the flows story remains net bullish for crypto relative to April. CME futures volumes for both ETH -2.47% and BTC -1.55% are elevated compared to several weeks ago, with ETH -2.47% futures open interest doubling over the past few days. The aggregate trend in stablecoin market cap remains on an upward trajectory, albeit slightly less pronounced than a week ago. The rolling 7-day change in aggregate stablecoin market cap is still in the green, meaning investors are moving capital into the crypto ecosystem on a net basis. BTC -1.55% ETF flows have also posted nine consecutive days of net inflows across all spot products. Thursday showed another net inflow day of over $100 million, with substantial participation from IBIT investors.

Source: DefiLLama, Fundstrat

Technical Strategy

LDO -6.80% ’s acceleration this week has helped to successfully exceed the downtrend which had connected highs in this downtrend since March, over two months ago. This is a bullish development which likely results in LDO -6.80% pushing higher to $2.57 initially, then $2.82. Momentum has begun to turn sharply higher, and RSI is not yet in overbought territory. The ability to surpass $2.82 should result in LDO getting back to test $3.62 and likely break out above this level. However, the larger weekly pattern (Not shown) shows lots of resistance between $3.62-$3.85 which could be initially important ahead of an eventual push back to all-time highs near $5.20. Bottom line, this week’s price activity is bullish for LDO, and should help this begun to trend back higher after a difficult couple months.

Daily Important MetricsAll metrics as of 2024-05-24 12:00:31 All Funding rates are in bps Crypto Prices

All prices as of 2024-05-24 17:56:49 Exchange Traded Products (ETPs)

News

|