Regulatory Landscape Front and Center, ACX Gets Boost from Token Proposal

Crypto Market Update

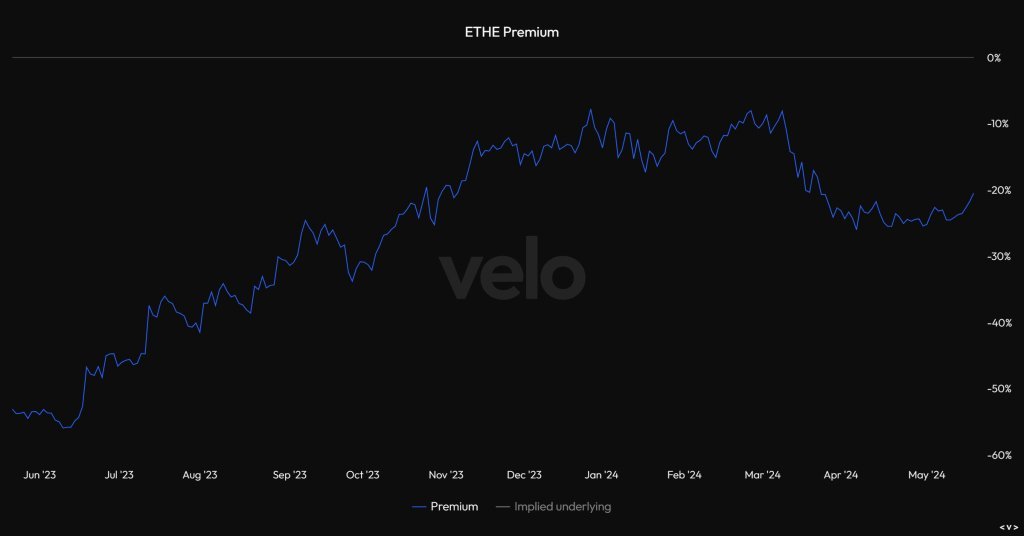

- Despite yields moving higher, risk assets are generally faring well today. BTC -0.54% briefly moved above $67,000 again in the morning hours and is now hovering just above that level. ETH 0.55% remains in a holding pattern, trading around $3,000 as it awaits a likely denial from the SEC this week on spot ETFs. The ETHE N/A% discount did compress slightly last week, possibly driven by longshot bets that the SEC approves. SOL 1.25% continues its upward trajectory toward reclaiming the $200 level, currently trading around $180. Among the major outperformers, PYTH -0.65% is experiencing a significant short squeeze amid a major unlock, suggesting much of the supply-driven selling pressure had been priced in. ACX -0.62% is up over 10% after issuing a joint proposal with Uniswap (UNI N/A% ) on a new intents-based token standard. In traditional markets, major equity indices are up on the day, led by gains in the technology sector. Gold also continues to show strength, adding to the positive performance across liquidity-sensitive assets.

- Despite a dearth of macro data, this week is packed with potential catalysts. Key events include the first round of final decisions on spot ETH 0.55% ETFs, with VanEck on May 23rd and Ark Invest/21Shares on May 24th. Nvidia (NVDA -4.02% ) will report Q1 earnings on Wednesday. Additionally, numerous crypto-related discussions are expected on Capitol Hill, highlighting the ongoing regulatory focus on the sector (more on this below).

- This week is set to be another significant one for crypto regulation. In addition to the spot ETH 0.55% ETF decisions on Thursday, several key rulemaking decisions are expected from the White House and Congress. The bill overturning SAB 121, which precludes federally-regulated depository institutions from participating in crypto as custodians, is now with the White House. President Biden, who has promised to veto the bill, has 10 days from Congressional approval to take action. Additionally, the FIT21 Act, which aims to provide regulatory clarity for digital assets by delineating the jurisdictions of the SEC and the CFTC while introducing robust consumer protection measures, is expected to be brought to the House floor for a vote. The House will also consider the CBDC Anti-Surveillance State Act, which prohibits the Federal Reserve from issuing a central bank digital currency (CBDC) directly or indirectly to individuals, using a CBDC for monetary policy, and requires Congressional authorization for any future CBDC issuance to protect financial privacy and prevent government surveillance. While this act is less market-moving, it is significant in the fight for individual privacy rights.

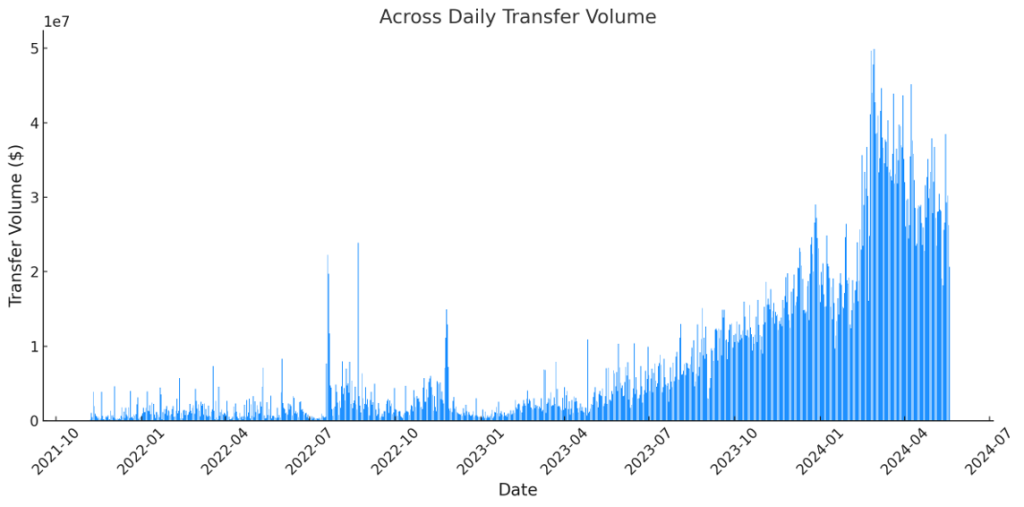

- Across (ACX -0.62% ), the cross-chain bridge protocol and liquid ventures constituent utilizes an intent-based system to transact between different chains. Intent-based systems abstract away the complexities and time constraints of traditional bridges, providing a more user-friendly experience. Uniswap Labs and Across have proposed a new ERC standard for cross-chain trade execution, aiming to enhance interoperability and efficiency. This standard introduces a unified framework for cross-chain actions, allowing different intent-based systems to share infrastructure and improve liquidity access. By adopting this standard, users can expect lower costs, shorter wait times, and a more reliable cross-chain trading experience, ultimately making DeFi more accessible and efficient.

Source: TokenTerminal, Fundstrat

Technical Strategy

- FTM 12% gains today have helped to recoup nearly 60% of the prior drawdown from late March in a period of six trading days and are setting up for a coming test of former March highs near $1.23. This relative strength following a minor trend breakout is always important to pay attention to, technically speaking, and should drive further momentum in FTM over the next month. Neither daily nor weekly momentum (as per RSI) are back at overbought levels, and weekly MACD has just made a bullish crossover of the signal line given the strength of the recent move off the April lows. It’s likely that any move back over $1.23 should lead to $1.827, approximating a 50% retracement level of the entire drawdown since Fall 2021. Overall, it’s always worth concentrating on coins that are making strong acceleration to multi-week highs following a prolonged period of consolidation, and FTM is attractive for prospects of intermediate-term gains. Targets over $1.82 lie near $2.22 while any minor consolidation from current levels likely finds strong support between $0.76-$0.84 before pushing back higher.

Daily Important MetricsAll metrics as of 2024-05-20 16:21:00 All Funding rates are in bps Crypto Prices

All prices as of 2024-05-20 11:50:17 Exchange Traded Products (ETPs)

News

|