Flows Return, Senate Nullifies SAB 121

Crypto Market Update

- Today, we are seeing some minor consolidation in the crypto market coinciding with the slight bounce in the rates and DXY N/A% . BTC -0.54% is trading just north of $65k, while ETHBTC continues to struggle, with ETH 0.55% moving lower for the 5th consecutive day and still trading below the $3k mark. Despite the market consolidation, SOLBTC is still green on the day as SOL 1.25% works to regain the $160 level. Top outperformers in the top 100 include CORE -0.75% , the native token of EVM-compatible BTC L2, and ZBC -0.39% , the native token of the payment streaming application Zebec Network, following its integration with Ondo. Equities are also mixed today, with the ^SPX and QQQ -0.39% , both virtually flat.

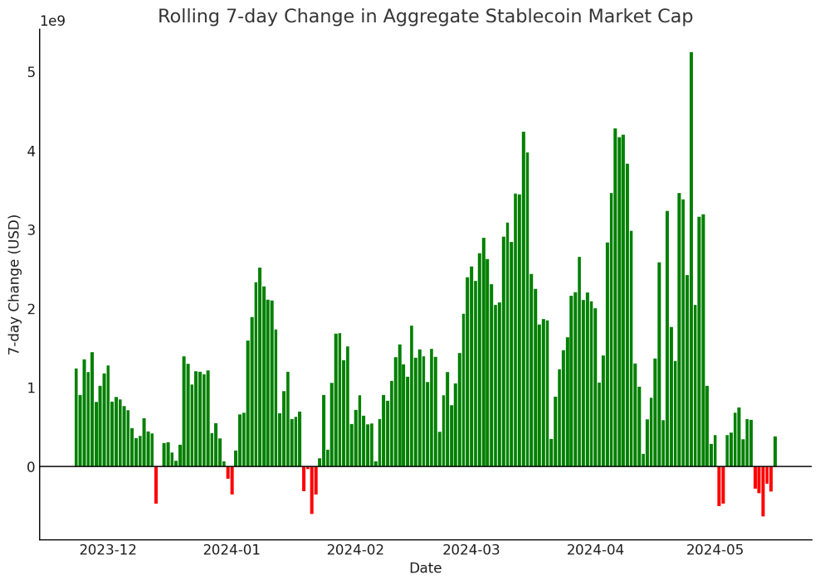

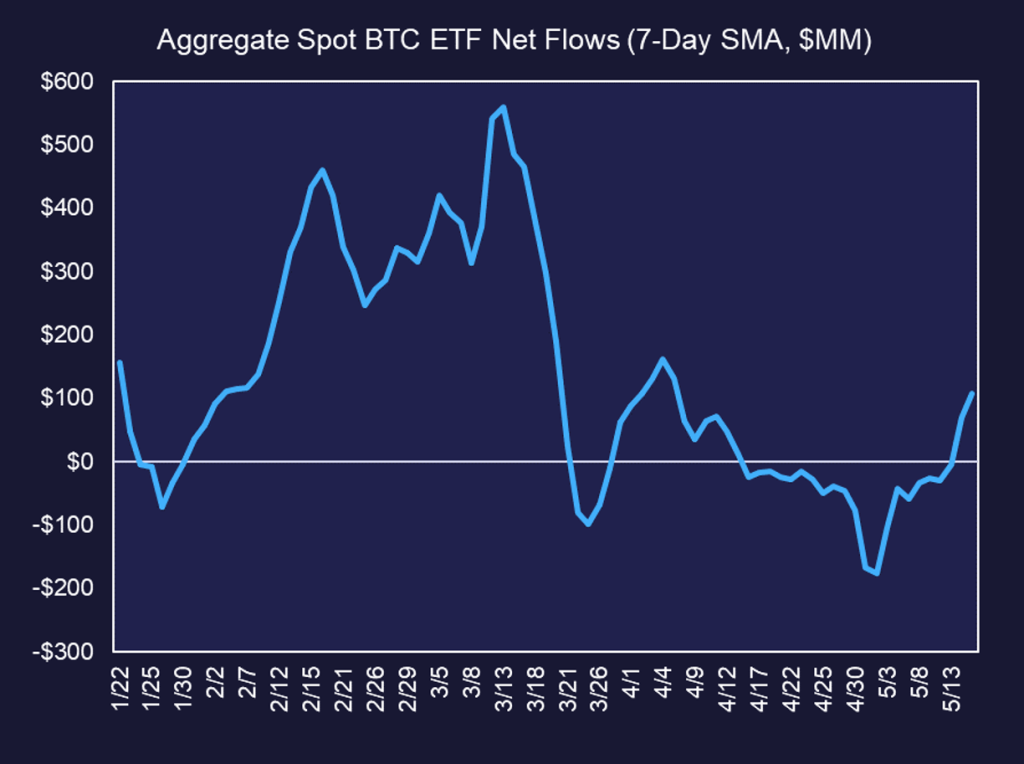

- Yesterday’s CPI release brought significant flows back into the market, which is evident through substantial ETF inflows, a large uptick in CME open interest, and a strong move higher in stablecoin creations. Nearly $1.4 billion in BTC Open Interest was added on the CME, while over $300 million flowed into Bitcoin spot ETFs, marking the highest level in over two weeks and pushing the 7-day moving average well into positive territory. Additionally, more than $600 million was added to the total stablecoin market cap since yesterday. These developments suggest investors viewed the CPI as convincing evidence of continued dollar weakness.

Source: DefiLlama, Fundstrat

Source: Farside Investors, Fundstrat

- On Wednesday, a number of institutional investors filed their quarterly 13F reports, revealing significant Bitcoin ETF holdings as of March 31st. Millennium Management disclosed around $2 billion in spot Bitcoin ETF exposure, including $844 million in BlackRock’s iShares Bitcoin Trust, $800 million in Fidelity’s Bitcoin Fund, and $202 million in Grayscale’s Bitcoin Trust. Paul Singer’s Elliott Capital reported a $12 million stake in BlackRock’s ETF, while Apollo Management disclosed a $53.2 million stake in ARK/21’s fund. Other investors, such as Aristeia Capital and Hudson Bay Capital, also participated last quarter. This early institutional involvement increases the likelihood of further adoption among other traditional investors.

- To the surprise of many, particularly those in the White House, the Democrat-led U.S. Senate voted 60 to 38 to overturn the SEC’s SAB 121, which sets accounting standards for firms that custody crypto, requiring them to hold customer crypto holdings as assets on their balance sheet. The measure, previously passed by the House, now goes to President Biden, who has already stated that he will veto it, with both chambers lacking the two-thirds majority needed to override the veto. This represents a significant shift from both House and Senate Democrats, who went against President Biden’s veto promise. This is an encouraging regulatory development for the crypto space.

Technical Strategy

- Bitcoin’s move back over $65.5k was important yesterday towards breaking out of the minor downtrend since mid-April which should allow for a rally back to new all-time highs in the weeks ahead. The fact that early May intra-day peaks near $65.5k was exceeded helped to enhance the short-term technical structure, and likely helps to jumpstart a move back to $72k in the weeks ahead. However, it’s not expected that former all-time highs from March might offer too much resistance, and above $72k should result in BTC -0.54% rallying straight up to near $80k into mid-June before consolidation gets underway. Overall, BTC’s pattern since March has not been negative structurally speaking but has been choppy and overlapping which gives some real technical confidence that a push back to new highs should be underway. While some minor backing and filling could happen in the days ahead, it’s not expected to undercut $60k, and might find support at $63-$64.5k before turning back higher to challenge April highs. Bottom line, i suspect that the correction from March has run its course and it’s right to be bullish for a move back to new all-time high territory.

Daily Important MetricsAll metrics as of 2024-05-16 17:57:36 All Funding rates are in bps Crypto Prices

All prices as of 2024-05-16 13:48:59 Exchange Traded Products (ETPs)

News

|