Markets Surge on CPI Release, Circle Moving HQ to U.S.

May 15, 2024

Author

Market Commentary

- Investors welcomed this morning’s slightly softer than expected CPI data and a large downside miss on U.S. retail sales, alleviating inflation concerns and helping to propel stock indices to new intraday all-time highs. The SPY -1.04% and QQQ -1.17% have gained over 1% to surpass $528 and $451, respectively, while US treasury rates have turned significantly lower, with the US10Y dropping below 4.34%. Crypto is responding in similar fashion with BTC -4.34% surging 5.55% to $65k and ETH -4.96% gaining 3.54% to just under $3k. AI-related tokens are some of the best performers today, with TAO -1.45% , FET -3.24% , and OCEAN -3.84% all gaining over 10% so far today.

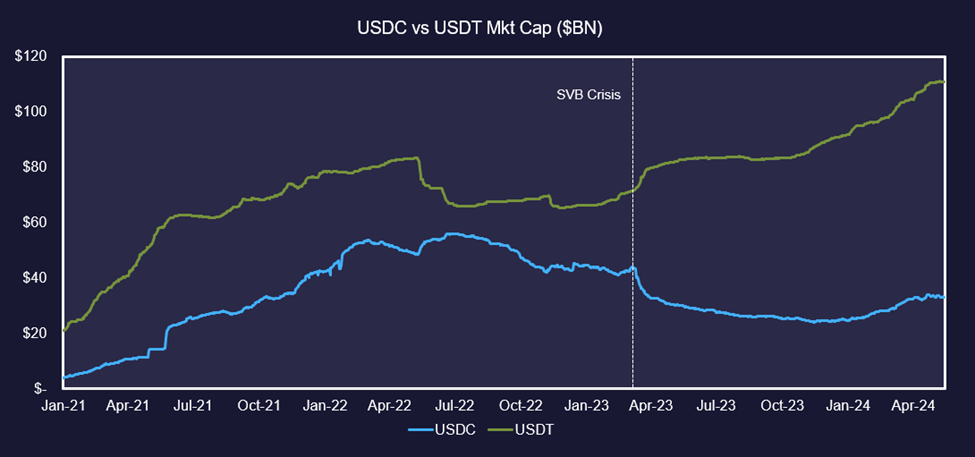

- Stablecoin issuer Circle is planning to shift its legal headquarters from Ireland to the United States. Circle’s parent company filed the necessary paperwork with the Ireland government to redomicile, with many speculating it is a strategic move ahead of an IPO in the United States. Circle confidentially filed for an IPO in January, submitting its S-1 statement to the U.S. SEC, and allowing them to set future plans privately. Circle had initially planned to go public via a SPAC merger in 2021 but it did not go according to plan, and it appears Circle has been waiting for better market conditions since then. Circle is the issuer behind USDC, the second largest stablecoin by market capitalization (behind tether), at $32.9 billion. They have been losing market share to Tether over the past year, but an IPO could bring fresh attention to USDC.

- El Salvador continues to serve as a global leader in Bitcoin adoption. They announced that they have successfully mined approximately 474 bitcoin since 2021 (~$30.5 million) using their geothermal volcanic powerplant. The use of clean energy to mine bitcoin and fund government projects is a novel use case for bitcoin mining that can potentially be adopted by other energy-rich countries across the globe. El Salvador’s “Bitcoin Office,” an official government agency, has also disclosed a new treasury website where anyone can verify the country’s Bitcoin holdings. As of this morning, El Salvador holds nearly 5,751 Bitcoin, equivalent to approximately $370 million. El Salvador’s transparency and success with Bitcoin will likely serve as a case study for other nation states looking to find alternative funding sources or diversify their treasury strategies.

Technical Strategy

- Today’s 8% gains in Solana aren’t too technically meaningful, but SOL -6.13% has demonstrated an impressive ability to bottom out without having violated the 50% retracement of its rally from last October lows. Price dipped down to challenge $118 into early May which lined up just above this key retracement area, along with an area near two prior swing highs going back since last December. Its ability to have scaled higher from $118 to $159 into May 7th was important in helping SOL’s larger pattern turn a bit more constructive towards thinking this is bottoming, technically speaking. A rally back to test and exceed 159.18 looks to have begun, and any weekly close above $159 should help drive prices back to former all-time highs. Overall, two areas look important initially on the move over $159. Initially, $178 could hold as short-term resistance given it being a projection target of the prior rally. Above that should lead back to $210 which likely could also prove significant. Bottom line, SOL looks attractive here and would gain more appeal over $159.