GME Squeeze Ignites Speculative Fervor, MetaPlanet Adopts BTC Reserve Strategy

Crypto Market Commentary

- Bitcoin rebounded over the weekend, with prices fully recovering from Friday’s drawdown by Monday morning. BTC -2.69% is now trading just below $63k. Meanwhile, both ETH -4.46% and SOL -4.95% have lagged, trading at $3950 and $146, respectively. Altcoin flows seem to have shifted towards memecoins, which are outpacing the rest of the market today, with gains exceeding 5% from BONK -7.92% , DOGE -4.42% , and PEPE. This interest in memecoins likely stems from the ongoing short squeeze in GME N/A% . Traders are probably betting on the return of speculative fervor among retail market participants. Equities are mixed, with technology stocks carrying most of the weight today. The ^SPX is slightly in the red, while the QQQ -0.39% is up about 0.15%. The DXY N/A% has edged lower, moving down to retest the 105 level, influenced by lower yields. Investors are bracing for another pivotal Consumer Price Index (CPI) release on Wednesday, where analysts currently expect a headline rate of 3.4% and a core inflation rate of 3.6%.

- The market is currently fixated on the ongoing GameStop (GME -0.08% ) short squeeze. If this serves as a precursor to broader short-covering across the market, crypto-related equities stand to benefit, as they happen to be a heavily shorted area. Our crypto equities basket is filled with names that have short interest levels near or exceeding 20% of their respective floats: MSTR -2.92% (21%), MARA 6.51% (23%), RIOT -4.81% (20%), and CLSK (18%).

- Metaplanet Inc., a Tokyo-based publicly listed firm specializing in crypto, has announced its adoption of bitcoin as a strategic reserve asset, attributing the decision to ongoing fiscal challenges in Japan, including high government debt levels and a weak yen. With Japan grappling with economic difficulties, marked by a staggering government debt-to-GDP ratio and the yen’s recent plunge to a 34-year low, Metaplanet views bitcoin as a non-sovereign store of value that offers stability amid fiat currency depreciation. The company plans to expand its bitcoin reserves using various capital market instruments, currently holding 117.7 BTC valued at $7.2 million as of May 10.

Technical Strategy

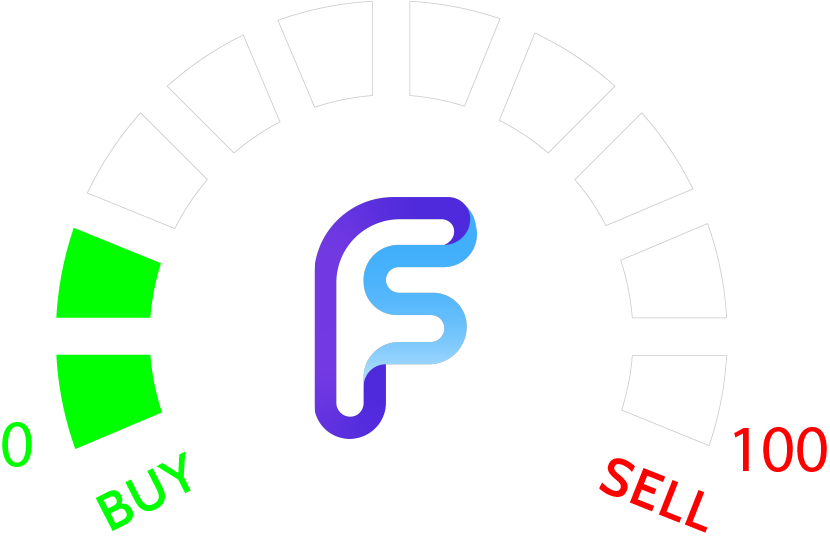

- SAFE has begun to show more convincing evidence of bottoming out following its 17% gains over the last four of five trading sessions. Price has reached the highest levels since early May and should rally to initial targets near $2.04 with additional levels found at $2.17 which look more important before consolidation sets in. Overall, a push back to new highs is very possible on movement over $2.17 which equates to over 40% from current levels. Pullbacks, if/when they occur should prove short-lived and buyable given the lack of any counter-trend exhaustion along with the strong upward acceleration of momentum of late. Support should materialize anywhere from $1.82-$1.85 on near-term consolidation.

Daily Important MetricsAll metrics as of 2024-05-13 14:49:40 All Funding rates are in bps Crypto Prices

All prices as of 2024-05-13 13:48:47 Exchange Traded Products (ETPs)

News

|