Consumer Sentiment Data Shakes Market, Eigen Claims Go Live

Market Commentary

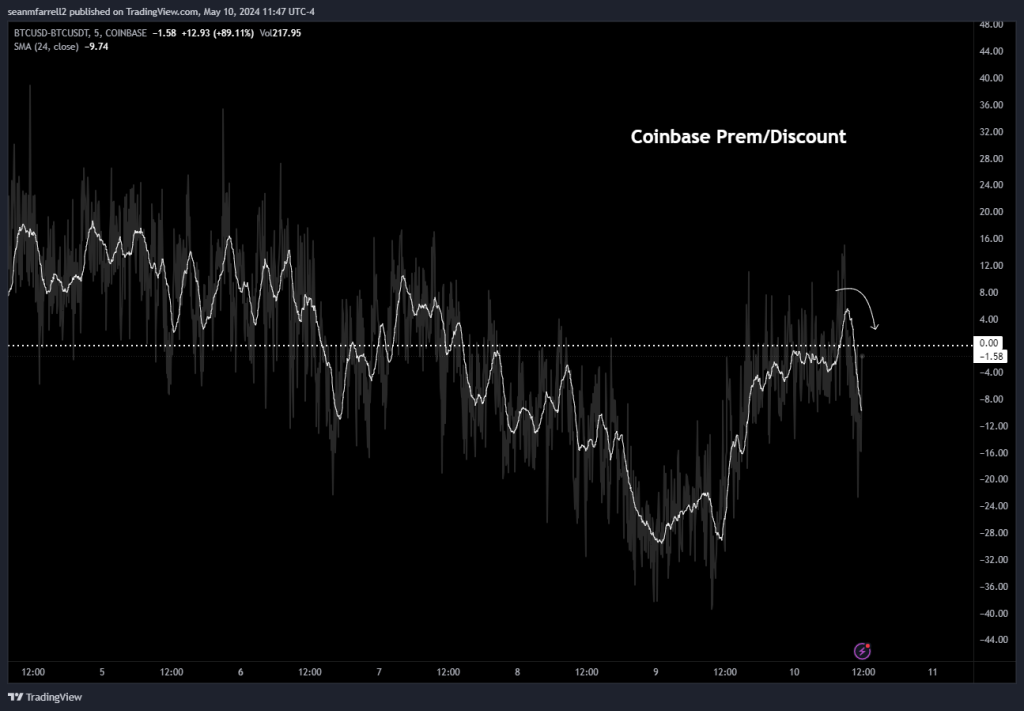

- A pretty sizeable miss in today’s consumer sentiment survey reversed most of the gains experienced in the crypto market over the past 24 hours. Consumer sentiment came in at 67.4, well below market expectations of 77.2. 1Y inflation expectations came in at 3.5%, well above the market forecast of 3.2%. We saw the DXY N/A% turn sharply higher on the move, and most risk assets sold off. BTC -2.25% fell from $63k down to retest $60k, while ETH -2.73% and SOL -4.69% followed similar paths, moving down to $2,900 and $146, respectively. Most alts have moved lower since the sentiment figures were released, but a few of yesterday’s outperformers like AKT 1.38% and RNDR have preserved some gains. We noted in today’s flash insight that the Coinbase discount had turned to a premium, a good sign that demand is heating up, but this has since returned to discount territory. Equities were not exempt from the selloff, but were less affected, with the ^SPX and QQQ 0.13% both essentially flat on the day. Rates are broadly higher, with the US 10-Year yield moving back to 4.5%. Investors are gearing up for what will be a big week of macro data next week, with the most important release being the April Consumer Price Index (CPI) report, a much more important piece of data than survey results.

- EigenLayer’s native token claims will open today, marking the commencement of the distribution and “stakedrop” plan announced by the project last month. Following the claim, the tokens will remain non-transferable until the end of the third quarter, with the expected release date for token transfer functionality set for September 30th. Despite this restriction, users can immediately begin staking and delegating tokens to EigenDA operators, the platform’s native data availability solution. EigenLayer has garnered over $15 billion in ETH deposits since its inception in 2023. The Eigen token introduction introduces inter-subjective forking, enhancing the security of the AVS ecosystem. Regarding tokenomics, the Eigen Foundation allocated 45% of the token supply for the network’s community and ecosystem, with 15% earmarked for stakedrops, including a minimum allocation of 110 tokens to eligible users. Additionally, investor tokens will begin vesting upon token transferability.

- Marathon Digital (MARA 9.38% ), one of the larger bitcoin miners and a feature in our recommended equities basket, fell short of consensus revenue expectations for the first quarter due to operational challenges, mining only 2,811 bitcoin during the period, marking a 34% decrease from the previous quarter. The company attributed this shortfall to unexpected equipment failures, transmission line maintenance, and weather-related curtailments at various sites. The company did report an EPS of $1.26, significantly surpassing the consensus estimate of $0.02, but the figures were skewed due to the adoption of newly-approved fair value accounting rules. Marathon maintains its 2024 guidance of reaching 50 exahash per second (EH/s) and anticipates further growth next year.

Technical Commentary

Fantom is on the verge of exceeding two different areas of trendline resistance, and deserves some focus given its technical strength on an otherwise poor day for many cryptocurrencies. Its daily chart shows the sharp 50% absolute retracement from its March highs where this fell from $1.20 down to $0.60 before stabilizing last month. The last couple days of gains, however, have proven impressive towards helping this begin to mount a more impressive rebound which i expect is likely over the next few months. The act of regaining $0.75 on a closing basis will be important towards allowing FTM to exceed its three-week downtrend along with the ongoing two-month downtrend. A technical breakout of this sort would allow this to push up to $0.79 and above that would jumpstart the rally back to $0.89, then $0.97 which both look like attainable targets in the months ahead. Near-term, this area near $0.75 does look like short-term resistance, but any consolidation into next week should prove minor and not undercut $0.68 before turning back higher to exceed $0.75.

Daily Important MetricsAll metrics as of 2024-05-10 16:36:09 All Funding rates are in bps Crypto Prices

All prices as of 2024-05-10 13:48:22 Exchange Traded Products (ETPs)

News

|