MetaMask Adds Off-Ramp Feature, Coinbase Enters the Institutional Lending Market

Market Update

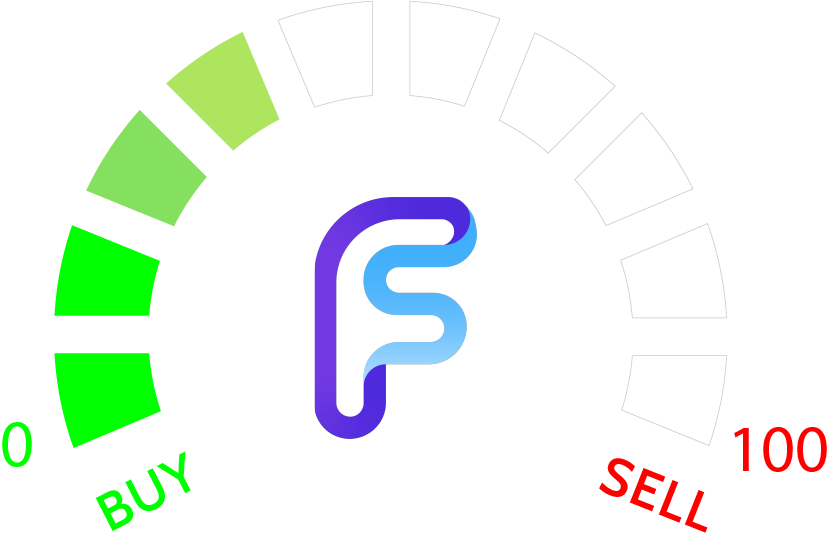

- Markets are falling today in response to higher-than-expected non-manufacturing PMI data (54.5 actual vs. 52.5 expected). The S&P 500 and Nasdaq 100 have both dropped over 1% while the DXY (+0.19%) continues its rise, briefly surpassing $105, the highest level since March. BTC and ETH are following equity markets, both falling approximately 1.10% at the time of writing. Synthetix Network (SNX), a defi liquidity layer, is one of the top weekly performers, rising 17.8% as excitement over Synthetix V3 has begun to circulate. According to DefiLlama, Synthetix has seen an approximate $100 million increase in TVL since the beginning of September, likely contributing to the token’s appreciation.

- Crypto wallet provider MetaMask is rolling out a new feature within their portfolio management product called “Sell”. Sell will enable users to quickly convert digital assets to fiat and cash out to their bank account or PayPal balance. The Sell feature is currently available to U.S., U.K., and some European customers but will eventually be added for more regions. Additionally, the only conversion currently supported is Ether on the Ethereum network to USD, EUR, or GBP. MetaMask is working with various crypto off-ramps, such as MoonPay and Transak, to offer its customers the best quote on their conversion. Combined with the “Buy” feature, MetaMask completely alleviates the clunky process of moving funds through a centralized exchange to fund or withdraw from a self-custodial wallet. Although asset conversion is limited to start, MetaMask plans to expand to layer-2 networks and support native network tokens.

- Crypto exchange Coinbase has launched a crypto lending service for institutional investors in the United States. The crypto lending market has been dysfunctional over the past two years as firms such as Genesis, Voyager, Celsius, and others have gone bankrupt. Coinbase’s new product falls under Coinbase Prime, a full-service prime brokerage platform allowing institutions to trade, custody assets, and now lend digital assets. Institutions can lend digital assets to Coinbase with standardized terms and under an exemption of Regulation D. The lending product is operated via Coinbase Credit, the same entity managing Coinbase Borrow. According to an SEC filing, five Coinbase customers have invested $57 million in the lending program in the few days since launching. Coinbase continues to diversify its product offerings and is quickly becoming a one-stop shop for all crypto services.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Synthetix's gains this week look to be directly coinciding with a meaningful breakout of its downtrend line from Mid-July highs. The act of having regained $1.95 has led to nearly a 25% gain in just the last three days. As daily SNX charts show, the last couple years have traded largely within the range of the two-month rally from June 2022. Following a couple successful tests of resistance and support, its trading range has gradually constricted in the last year. While this week's breakout definitely appears like a short-term positive, SNX requires a break above $3.00 to help exceed resistance of the entire consolidation range from last Summer. Such a development would be very encouraging towards the thought of additional intermediate-term gains to test and exceed last year's highs. Pullbacks likely should occur on lesser volume than gains this past week, setting up for attractive risk/reward opportunities if/when SNX reaches $2.13-$2.15. Any Wednesday close near the upper quadrant of today's range should help the rally extend a bit more in the short-run, despite having gotten near-term overbought.

Daily Important Metrics

All metrics as of September 6, 2023 1:11 PM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $497B | $25,539 | ↓ -0.72% | ↑ 54% | |

ETH ETH | $194B | $1,618 | ↓ -1.10% | ↑ 35% | ↓ -19% |

ADA ADA | $8.9B | $0.2543 | ↓ -0.89% | ↑ 3.03% | ↓ -51% |

DOGE DOGE | $8.9B | $0.0630 | ↓ -1.28% | ↓ -10% | ↓ -64% |

SOL SOL | $7.9B | $19.35 | ↓ -4.25% | ↑ 96% | ↑ 41% |

DOT DOT | $5.1B | $4.20 | ↓ -1.18% | ↓ -3.31% | ↓ -57% |

MATIC MATIC | $5.1B | $0.5470 | ↓ -2.18% | ↓ -28% | ↓ -82% |

LINK LINK | $3.3B | $6.15 | ↑ 1.05% | ↑ 11% | ↓ -43% |

NEAR NEAR | $1.0B | $1.11 | ↓ -1.10% | ↓ -12% | ↓ -67% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -20% | $18.41 | ↓ -0.75% | ↑ 122% | ↑ 68% |

| BITW | ↓ -44% | $12.19 | ↓ -0.50% | ↑ 127% | ↑ 73% |

| ETHE | ↓ -31% | $10.80 | ↓ -0.37% | ↑ 127% | ↑ 73% |

| BTCC | ↓ -0.01% | $4.69 | ↓ -0.21% | ↑ 55% | ↑ 0.62% |

News

QUICK BITS

Coin Telegraph India G20 confirms 'active discussions' around global crypto framework Sitharaman said crypto was a “threat as well as an opportunity” while confirming that the G20 members are working towa... |

CoinDesk SOMA Finance to Issue the First Retail Compliant Digital Security The SOMA token will be a non-cumulative, participating preferred stock of SOMA.finance and will pay a dividend of up to 10% of profits. |

CryptoSlate Coinbase-backed Base restores block production after more than 40 minutes outage Coinbase-backed layer2 network Base suffered a temporary outage that led to a stalled block production on Sept. 5. The blockchain network, however, has “identif... |

DOSE OF DEFI

CryptoPotato Lido on Solana Seeks $1.5 Million Financial Aid to Continue Operations The Lido on Solana project risks shutting down die to financial strain, after the winding down of Lido on Kusama and Polkadot. |

CRYPTO INFRASTRUCTURE

Decrypt.co MetaMask Introduces Bank and PayPal Cash-Out Options "Ensuring a way for users to enter and exit crypto freely is important," the company said. |

MINING

Coin Telegraph Marathon’s Bitcoin mining rate fell 9% in August The company still mined five times more Bitcoin than in August 2022, producing 1,072 last month, and said unfavorable ... |

HIRING

Bitcoin.com Another Executive Exits Binance Amid Regulatory Scrutiny Mayur Kamat, head of product at Binance, is leaving the crypto exchange which has seen several executive exits in recent months. His and the other departures co... |

PRODUCT UPDATES AND PARTNERSHIPS

Decrypt.co Circle Joins Forces with Legend Trading to Broaden International Reach of USDC Legend Trading serves over 800 institutions, processes more than $1 billion a month, and aims to bring USDC to its clients. |

INVESTMENT PRODUCTS

CryptoSlate Grayscale legal team seeks SEC meeting over proposed Bitcoin ETF conversion Top executives at Grayscale have asked to meet with the U.S. Securities and Exchange Commission (SEC) to discuss a planned spot Bitcoin ETF. The company’s legal... |

Reports you may have missed

CRYPTO MARKET COMMENTARYBITCOIN REBOUNDED OVER THE WEEKEND, WITH PRICES FULLY RECOVERING FROM FRIDAY'S DRAWDOWN BY MONDAY MORNINg. BTC -2.22% is now trading just below $63k. Meanwhile, both ETH -2.35% and SOL -3.49% have lagged, trading at $3950 and $146, respectively. Altcoin flows seem to have shifted towards memecoins, which are outpacing the rest of the market today, with gains exceeding 5% from BONK -4.44% , DOGE -16.39% , and PEPE. This interest in memecoins likely stems from...

MARKET COMMENTARYA PRETTY SIZEABLE MISS IN TODAY'S CONSUMER SENTIMENT SURVEY REVERSED MOST OF THE GAINS EXPERIENCED IN THE CRYPTO MARKET OVER THE PAST 24 HOURS. Consumer sentiment came in at 67.4, well below market expectations of 77.2. 1Y inflation expectations came in at 3.5%, well above the market forecast of 3.2%. We saw the DXY 0.00% turn sharply higher on the move, and most risk assets sold off. BTC -2.22% fell from...

U.S. equity indices are showing modest gains today following weekly jobless claims coming in higher than expected, showing 231k versus 212k estimated, putting downward pressure on the DXY 0.00% (-0.21%) and rates. The SPY 0.07% has gained 0.36%, approaching the $520 mark, while the QQQ 0.35% has risen 0.14% to the $440. Crypto assets are showing larger gains, with BTC -2.22% (+1.57%) rising above $62k and ETH -2.35% (+1.05%) surpassing $3,000. The Render Networkâs mobile app, OctaneX, was featured in Appleâs keynote presentation earlier...

The crypto market declined overnight, with BTC -2.22% dropping from $63k to $61k, SOL -3.49% from $150 to $145, and ETH -2.35% dipping below the $3k mark once again. The likely cause of the drawdown was upward pressure on the DXY 0.00% and a lack of follow-through in flows. Among the few outperformers of the day were RUNE -7.00% , the native token of the cross-chain swapping protocol Thorchain, and Ethereum Classic (ETC -3.79% ), possibly driven by...