FTX Looks to Sell Assets, dYdX Rises

Market Update

- Crypto and equities are falling today despite the buzz around impressive Nvidia earnings. The S&P is down 0.77%, while the Nasdaq has lost 1.28% at writing. Investors are focused on what may be a pivotal speech from Chair Powell regarding the Fed’s stance on further rate hikes tomorrow at Jackson Hole. U.S Treasury yields are rising, with the 10-year up three basis points at 4.22%, below the 4.35% 16-year high reached earlier this week. Both $BTC and $ETH have followed equities lower, losing 1.8% and 2.0%, respectively. Distributed GPU token $RNDR is the top gainer among a sea of red in the top 100 alts, rising 3.0% over the last day. Nvidia’s robust earnings likely renewed optimism for the outlook on demand for GPU processing, which serves as the backbone of many AI applications.

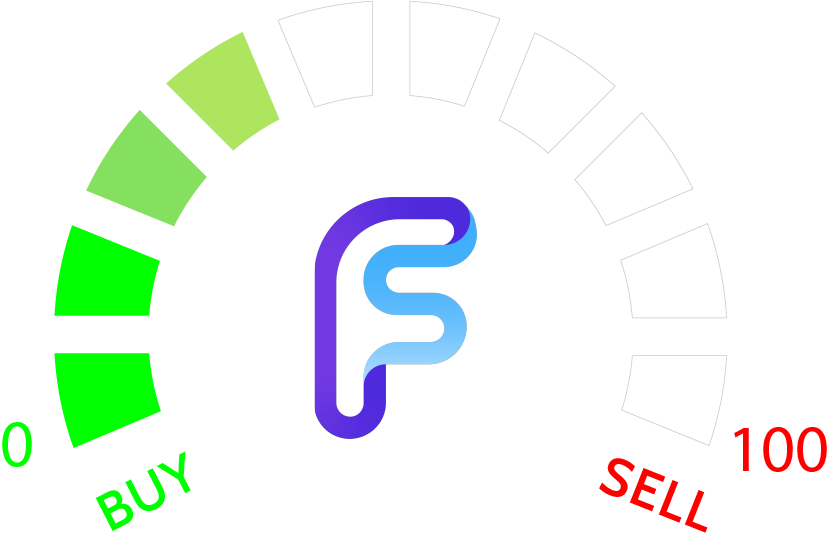

- The token of the decentralized derivatives exchange $DYDX, which is gearing up to launch its new appchain, saw a 9% surge in value in the past week. dYdX is the leading decentralized crypto derivatives market. The exchange is close to launching its new Cosmos-based blockchain by the end of September. The current version of dYdX operates on Ethereum using zero-knowledge rollups. The project's migration to an independent blockchain built with Cosmos software developer kit was announced last year, and its second testnet version recently went live on schedule. A Nansen report notes a bullish accumulation trend in the token's ownership over the previous three months, with influential entities like Wintermute Trading, Cumberland, CMS, and Sigil involved. There's also speculation about potential investor activity, indicating an upcoming investment round. Smart Money wallets holding dYdX have consistently increased their exposure, reaching a record high of over 47.8 million tokens.

- Crypto exchange FTX aims to hire Galaxy Digital as an investment manager to restructure and monetize its digital assets. Pending bankruptcy court approval, Galaxy would manage and trade assets for conversion into fiat currency or stablecoins while hedging FTX's exposure to cryptocurrencies. FTX believes Galaxy's expertise can facilitate the sale of significant holdings without market disruptions. Additionally, FTX seeks court authorization to establish asset sale guidelines, allowing weekly sales of up to $100 million (temporarily up to $200 million) to optimize sales and reduce volatility. They also seek court approval for hedging and staking idle assets for passive yield, aiming to minimize market risk for creditors. While the exact amount FTX would liquidate is unknown, estimates indicate between $2 - $3 billion in digital assets available to be sold as FTX looks to repay creditors.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Monero's 4%+ decline on Thursday is closing in on intra-day lows made last Thursday when $XMR had tested an important area of trendline support. This area intersects at $134.61 and proved important as an area to cushion prices last week. As daily XMR charts illustrate, this area lined up with an area of downtrend line support stemming from February 2023 highs connecting a trend of lower highs. While last week's intra-week spike low of $134.61 has importance, a retest likely won't hold on the next attempt given the quickness of this retest and ongoing structure. Areas of importance now lie at $127-$130, which if reached in the next 1-2 weeks, likely could allow for some support and stabilization to this recent decline. To have confidence of a rally starting to get underway, gains back over $150 will be necessary in the months ahead. Such a development would argue for a rally up to challenge and likely exceed $173 on its way to $189. At present, the big high to low range in Thursday's trading should lead a bit lower in the days ahead. However, the area near June 2023 lows should provide some structural support on weakness.

Daily Important Metrics

All metrics as of August 24, 2023 2:33 PM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $506B | $26,007 | ↓ -1.69% | ↑ 57% | |

ETH ETH | $198B | $1,644 | ↓ -2.08% | ↑ 37% | ↓ -20% |

ADA ADA | $9.3B | $0.2646 | ↓ -0.82% | ↑ 7.18% | ↓ -50% |

DOGE DOGE | $8.8B | $0.0627 | ↓ -1.89% | ↓ -11% | ↓ -68% |

SOL SOL | $8.5B | $20.93 | ↓ -2.11% | ↑ 111% | ↑ 54% |

DOT DOT | $5.4B | $4.41 | ↓ -1.95% | ↑ 1.44% | ↓ -56% |

MATIC MATIC | $5.1B | $0.5432 | ↓ -3.22% | ↓ -29% | ↓ -86% |

LINK LINK | $3.3B | $6.07 | ↓ -4.91% | ↑ 9.30% | ↓ -48% |

NEAR NEAR | $1.1B | $1.19 | ↓ -2.01% | ↓ -6.66% | ↓ -64% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -24% | $17.75 | ↓ -2.42% | ↑ 114% | ↑ 57% |

| BITW | ↓ -50% | $11.00 | ↓ -3.08% | ↑ 105% | ↑ 48% |

| ETHE | ↓ -33% | $10.46 | ↓ -3.74% | ↑ 120% | ↑ 63% |

| BTCC | ↑ 0.45% | $4.76 | ↓ -2.86% | ↑ 57% | ↑ 0.10% |

News

QUICK BITS

CoinDesk FTX Taps Galaxy to Sell, Stake and Hedge Its Crypto Billions The bankrupt exchange wants to return funds to creditors in dollars without denting value. |

MARKET DATA

CoinDesk Bitcoin, Ether Trade Below 'Maximum Pain' Levels Ahead of $2.7B Options Settlement A lot of put options are in-the-money, crypto options exchange Deribit's Lin Chen said. |

Decrypt.co DeFi Exchange Token Powering dYdX Soars 9% Overnight dYdX's imminent launch of its newest blockchain appears to have fueled continued speculation, with investors scooping up its token. |

CryptoSlate Bots net $2M in profits on decentralized platform Friend.tech amid rising user activity Maximal extractable value (MEV) bots on the decentralized social media application Friend.tech have profited more than $2 million from the platform. Dune analyt... |

THOUGHTS AND OPINIONS

CryptoSlate Pantera predicts 322% Bitcoin price surge to $148k after halving in 2024 Bitcoin has experienced its longest stretch of negative year-over-year returns in its history, 15 months extending from Feb. 2022 to June 2023. This record-brea... |

NFTS

CoinDesk Major NFT Collections Post Double-Digit Monthly Losses as Floor Prices Drop Losses in the NFT markets have exceed ether’s decline, which is down 9.6% on-month. |

CoinDesk Donald Trump NFTs Surge After Tucker Carlson Interview As of European afternoon hours, the Polygon-based Trump Digital Trading Cards were selling for over 0.13 ether (ETH), or just over $215, up from 0.1 ETH, or $15... |

Reports you may have missed

MARKET COMMENTARYA PRETTY SIZEABLE MISS IN TODAY'S CONSUMER SENTIMENT SURVEY REVERSED MOST OF THE GAINS EXPERIENCED IN THE CRYPTO MARKET OVER THE PAST 24 HOURS. Consumer sentiment came in at 67.4, well below market expectations of 77.2. 1Y inflation expectations came in at 3.5%, well above the market forecast of 3.2%. We saw the DXY 0.00% turn sharply higher on the move, and most risk assets sold off. BTC 0.74% fell from...

U.S. equity indices are showing modest gains today following weekly jobless claims coming in higher than expected, showing 231k versus 212k estimated, putting downward pressure on the DXY 0.00% (-0.21%) and rates. The $SPY has gained 0.36%, approaching the $520 mark, while the $QQQ has risen 0.14% to the $440. Crypto assets are showing larger gains, with BTC 0.74% (+1.57%) rising above $62k and ETH 0.86% (+1.05%) surpassing $3,000. The Render Networkâs mobile app, OctaneX, was featured in Appleâs keynote presentation earlier...

The crypto market declined overnight, with BTC 0.74% dropping from $63k to $61k, SOL -1.12% from $150 to $145, and ETH 0.86% dipping below the $3k mark once again. The likely cause of the drawdown was upward pressure on the DXY 0.00% and a lack of follow-through in flows. Among the few outperformers of the day were RUNE -2.92% , the native token of the cross-chain swapping protocol Thorchain, and Ethereum Classic (ETC -0.19% ), possibly driven by...

Rates are broadly lower again on Tuesday, with the US 10Y nearing 4.4%, down from 4.7% just under a week ago. Risk assets are on the rise, with both the $SPX and $QQQ showing gains today. Crypto performance is mixed so far, with BTC 0.74% retesting the $63k level after US market open, following a rally to just over $64k in the early morning hours. Meanwhile, ETH 0.86% is still hovering just...