Bloomberg Increases BTC ETF Odds, Curve Debt Remains a Risk

Market Update

- A proposed increase in long-term treasury issuance coupled with Fitch's downgrade of U.S. government debt has caused upward pressure on long-term rates today, with the U.S. 30-year rate moving to 4.2%, the highest since November of last year. Major equity indices have experienced a concurrent pullback alongside a 15% spike in the VIX. Meanwhile, the DXY has surged to 102.6, reaching its highest level in nearly a month. Among the majors, BTC has retraced some gains from its run to $30k yesterday evening, dropping to $29.3k, while ETH remains range-bound, currently trading around $1840. Many alts are facing pressure, possibly due to the ongoing Curve drama, which we will delve into further below. However, amidst this turbulence, SNX stands out as a DeFi token showing considerable strength, recording a 5% increase over the previous 24 hours.

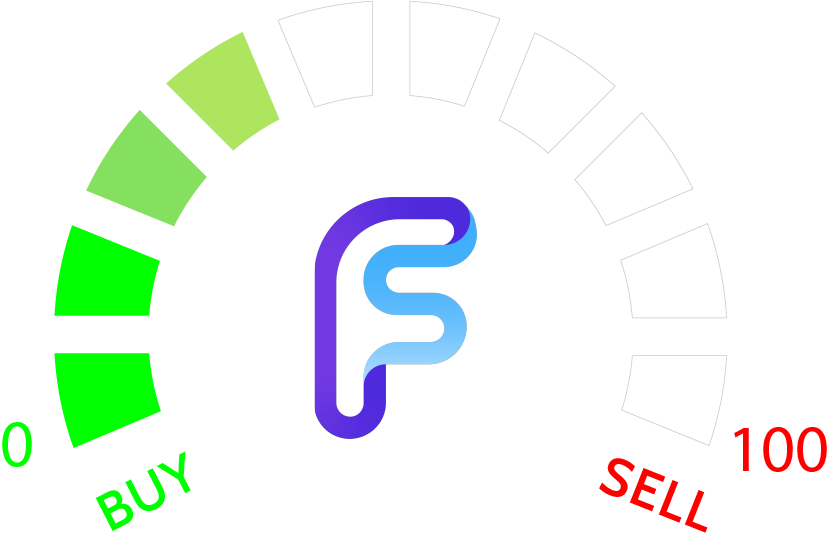

- In addition to the macro headwinds this morning, market participants likely remain concerned about Michael Ergorov, the founder of Curve, and his loans across Aave, Fraxlend, and Abracadabra, which are at risk of being liquidated. While we don't anticipate long-term systemic issues from this event, this situation could pose challenges for a number of altcoins until resolved. Yesterday, we discussed Ergorov's OTC sales aimed at reducing his outstanding debt and lowering the liquidation threshold on his loans. The main risk for the borrow/lend protocols (Aave, Fraxlend, Abracadabra), and the broader ecosystem, is the potential for bad debt resulting from a liquidated Ergorov. To address this, the DAO controlling Abracadabra proposes raising the interest rate on Ergorov's loan to 200% for prioritized repayment or liquidation. If this passes, it could stimulate a chain of liquidations. As of this morning, Ergorov's Aave loan's liquidation threshold was approximately $0.37, while his loans across Fraxlend and Abracadabra ranged from $0.31 to $0.32, with CRV's current spot price at around $0.56 (see chart below for reference).

- Bloomberg ETF analysts Eric Balchunas and James Seyffart have raised their odds of approval for a spot Bitcoin ETF to 65%, a substantial increase from 50% a couple of weeks ago and just 1% a few months ago. This upward revision in probability aligns with our positive outlook on the likelihood of the ETF being approved. This optimistic perspective is attributed to recent developments in the crypto market, such as the filing of an ETF application by BlackRock and the ongoing Grayscale case against the SEC in Federal court. Should Grayscale secure a victory, it could lead to simultaneous approvals for all spot Bitcoin ETF filings as early as the end of Q3.

- Alongside this favorable forecast for a BTC spot ETF, a total of 6 issuers, including Volatility Shares and Bitwise, have submitted applications for ETH futures ETFs, with the potential for the first ETH futures ETF to launch on October 12th if approved by the SEC. Although we would place less probability of approval for ETH futures ETF approval, the warming climate for crypto ETFs and the recent Ripple ruling make us optimistic about an ETH futures ETF hitting the market by October. Overall, the increasing likelihood of a BTC spot ETF and the emergence of ETH futures ETF applications support our rationale for longing both GBTC 4.09% and ETHE 2.46% .

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Following its sharp 200%+ rally in a span of three weeks in late June, Bitcoin Cash has slowly been coming Back to Earth of late, dropping about $100 from late June highs. Price managed to find support and stabilize near the 38.2% Fibonacci retracement area of its prior run-up. However, the minor neutral consolidation over the last three weeks looks to be giving way as of Wednesday's trading. Daily closes under $232 would constitute a support violation, suggesting that additional weakness down to $210 could be underway. This area lines up roughly with a 50% retracement of its prior low to high advance from mid-June and should provide an excellent technical level of support which would make BCH 2.36% attractive to buy dips. Overall, the act of regaining $210 would serve to add more confidence in BCH as this would help to regain the former range and argue that its pullback is complete. Resistance lies at $260, and then $295 which should have importance on future rallies.

Daily Important Metrics

All metrics as of August 2, 2023 12:32 PM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $565B | $29,073 | ↑ 0.47% | ↑ 75% | |

ETH ETH | $222B | $1,832 | ↓ -0.10% | ↑ 53% | ↓ -23% |

ADA ADA | $11B | $0.3002 | ↓ -1.28% | ↑ 22% | ↓ -54% |

SOL SOL | $9.3B | $23.01 | ↓ -1.21% | ↑ 132% | ↑ 57% |

MATIC MATIC | $6.3B | $0.6800 | ↓ -0.21% | ↓ -11% | ↓ -86% |

DOT DOT | $6.1B | $5.05 | ↓ -0.88% | ↑ 16% | ↓ -59% |

LINK LINK | $4.0B | $7.40 | ↓ -0.75% | ↑ 33% | ↓ -42% |

NEAR NEAR | $1.3B | $1.40 | ↑ 0.45% | ↑ 9.69% | ↓ -66% |

DOGE DOGE | $0.0000 | $0.0001 | ↓ -2.29% | ↓ -100% | ↓ -175% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -29% | $18.81 | ↓ -1.21% | ↑ 127% | ↑ 51% |

| BITW | ↓ -50% | $12.53 | ↑ 0.80% | ↑ 133% | ↑ 58% |

| ETHE | ↓ -42% | $10.66 | ↑ 2.15% | ↑ 124% | ↑ 48% |

| BTCC | ↓ -0.05% | $5.32 | ↓ -0.75% | ↑ 76% | ↑ 0.08% |

News

QUICK BITS

Decrypt.co Kenya Suspends Worldcoin Operations Amid Privacy Concerns Worldcoin faces further scrutiny over its iris-scanning project, despite over 2 million sign-ups worldwide. |

CoinDesk Litecoin Undergoes Third 'Halving,' in Milestone for 12-Year-Old Blockchain The blockchain's "halving," where the pace of new issuance of cryptocurrency gets cut in half every four years, took place Wednesday, when it reached data block... |

DOSE OF DEFI

CoinDesk CRV Gets Plunge Protection on Binance as Market Makers Add Bid-Side Liquidity Market makers stepped in to arrest CRV's slide that threatened liquidation of a large CRV-collateralized crypto borrowing and market-wide contagion. |

CoinDesk DeFi Protocol Abracadabra Wants to Charge 200% Interest on Curve Founder’s $18M Loan All proceeds from such a strategy will be kept in Abracadabra’s treasury and be used to reduce the DAO risk associated with the liquidity conditions associated ... |

CoinDesk Called Streaming Swaps, the feature is designed to improve capital efficiency for decentralized finance users who want to execute large trades. |

CRYPTO INFRASTRUCTURE

Decrypt.co Coinbase Mulling Best Ways to Integrate Lightning Network for Bitcoin Coinbase CEO Brian Armstrong has reiterated the crypto exchange’s intention to add support for Bitcoin’s Layer-2 scaling solution. |

WEB 3.0

The Block Mysten Labs’ Sui adds native liquid staking with network upgrade Mysten Labs' Layer 1 blockchain Sui Network's latest network upgrade has added support for liquid staking of its native token. |

INVESTMENT PRODUCTS

Coin Telegraph Ether ETFs pending - Grayscale, VanEck and others file SEC applications A handful of United States asset managers have filed fresh applications to launch Ethereum Futures ETFs. ... |

Coin Telegraph ETF analyst raises spot Bitcoin ETF approval chances in the US to 65% The ETF analyst predicted that recent developments in the Ripple vs SEC case and the upcoming Grayscale lawsuit would ... |

Reports you may have missed

CRYPTO MARKET COMMENTARYBITCOIN REBOUNDED OVER THE WEEKEND, WITH PRICES FULLY RECOVERING FROM FRIDAY'S DRAWDOWN BY MONDAY MORNINg. BTC -1.66% is now trading just below $63k. Meanwhile, both ETH -2.50% and SOL 0.49% have lagged, trading at $3950 and $146, respectively. Altcoin flows seem to have shifted towards memecoins, which are outpacing the rest of the market today, with gains exceeding 5% from BONK 0.22% , DOGE -29.02% , and PEPE. This interest in memecoins likely stems from...

MARKET COMMENTARYA PRETTY SIZEABLE MISS IN TODAY'S CONSUMER SENTIMENT SURVEY REVERSED MOST OF THE GAINS EXPERIENCED IN THE CRYPTO MARKET OVER THE PAST 24 HOURS. Consumer sentiment came in at 67.4, well below market expectations of 77.2. 1Y inflation expectations came in at 3.5%, well above the market forecast of 3.2%. We saw the DXY 0.00% turn sharply higher on the move, and most risk assets sold off. BTC -1.66% fell from...

U.S. equity indices are showing modest gains today following weekly jobless claims coming in higher than expected, showing 231k versus 212k estimated, putting downward pressure on the DXY 0.00% (-0.21%) and rates. The SPY -0.04% has gained 0.36%, approaching the $520 mark, while the QQQ 0.20% has risen 0.14% to the $440. Crypto assets are showing larger gains, with BTC -1.66% (+1.57%) rising above $62k and ETH -2.50% (+1.05%) surpassing $3,000. The Render Networkâs mobile app, OctaneX, was featured in Appleâs keynote presentation earlier...

The crypto market declined overnight, with BTC -1.66% dropping from $63k to $61k, SOL 0.49% from $150 to $145, and ETH -2.50% dipping below the $3k mark once again. The likely cause of the drawdown was upward pressure on the DXY 0.00% and a lack of follow-through in flows. Among the few outperformers of the day were RUNE -6.69% , the native token of the cross-chain swapping protocol Thorchain, and Ethereum Classic (ETC -3.62% ), possibly driven by...