BitDigest April 20 · Issue #640

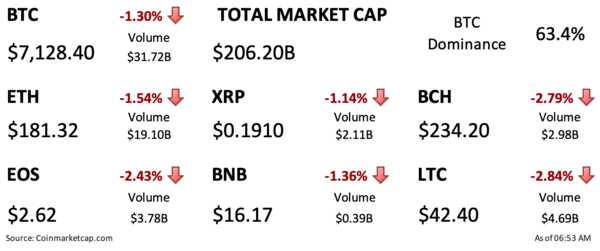

- Crypto pricing inches down overnight

- The People’s Bank of China acknowledged trialing its digital currency program during a segment on state-run television

- Jim Simons’ Renaissance Technologies flagship fund will be permitted to trade in bitcoin futures

Central Bankers Focus on Development of Digital Payment System Over Need for Central Bank Digital Currency

On Friday, the Chamber of Digital Commerce and the Reinventing Bretton Woods Committee hosted a discussion headed by James Bullard, the President of the Federal Reserve Bank of St. Louis, Olli Rehn, the Governor or the Bank of Finland, and Benoît Coeuré, Head of Innovation Hub, Bank for International Settlements on “The World Economy Transformed: Reflections on Policy Responses & The Future Post Pandemic Monetary Architecture.”

All three agreed with Coeuré’s statement that the COVID-19 virus has exposed the values of technology as the pandemic has accelerated the development of central bank digital currencies and digital monetary payments. Bullard questioned the US’ ability to provide assistance checks to all citizens, suggesting that if all Americans had bank accounts at the Fed, this would be easy to do, but he stressed that while this would be very “easy to legislate, [it would be] hard to implement.” Rehn diverted from the question on digital currencies and said central bankers need to be “more practically focused and need to support real time mobile payments.” Coeuré repeated his previous statements that we need global cooperation around interoperability, financial inclusion and cross border payments.

When questioned about the introduction of the Chinese DCEP, they all said they were actively watching the developments with an open mind, and Rehn quoted a fellow economist and joked, it would be better if a “non-systemic country” like neighboring Sweden tried it first.

The Headlines

PBoC Confirms DCEP Trials

South Africa Releases Regulator Framework for Crypto Assets

Cybercrime Has Jumped 4X During Coronavirus

Renaissance Looking in to Bitcoin Futures

Facebook to Hire for Calibra Wallet

Market Data

Ethereum 2.0 Mines Genesis Block

Economist Survey on Evolution into Cashless Society

$3 Billion in 'Dry Powder' Waiting for Crypto Moves

Exchange, Custody and Product News

Microbt Launches New Industry Leading Mining Rig

Thoughts on the Ecosystem

Nassim Taleb Urges Lebanese to 'Use Cryptocurrencies!'

Reports you may have missed

MARKET COMMENTARYA PRETTY SIZEABLE MISS IN TODAY'S CONSUMER SENTIMENT SURVEY REVERSED MOST OF THE GAINS EXPERIENCED IN THE CRYPTO MARKET OVER THE PAST 24 HOURS. Consumer sentiment came in at 67.4, well below market expectations of 77.2. 1Y inflation expectations came in at 3.5%, well above the market forecast of 3.2%. We saw the DXY 0.00% turn sharply higher on the move, and most risk assets sold off. BTC 0.86% fell from...

U.S. equity indices are showing modest gains today following weekly jobless claims coming in higher than expected, showing 231k versus 212k estimated, putting downward pressure on the DXY 0.00% (-0.21%) and rates. The $SPY has gained 0.36%, approaching the $520 mark, while the $QQQ has risen 0.14% to the $440. Crypto assets are showing larger gains, with BTC 0.86% (+1.57%) rising above $62k and ETH 0.36% (+1.05%) surpassing $3,000. The Render Networkâs mobile app, OctaneX, was featured in Appleâs keynote presentation earlier...

The crypto market declined overnight, with BTC 0.86% dropping from $63k to $61k, SOL -0.54% from $150 to $145, and ETH 0.36% dipping below the $3k mark once again. The likely cause of the drawdown was upward pressure on the DXY 0.00% and a lack of follow-through in flows. Among the few outperformers of the day were RUNE 5.86% , the native token of the cross-chain swapping protocol Thorchain, and Ethereum Classic (ETC 0.73% ), possibly driven by...

Rates are broadly lower again on Tuesday, with the US 10Y nearing 4.4%, down from 4.7% just under a week ago. Risk assets are on the rise, with both the $SPX and $QQQ showing gains today. Crypto performance is mixed so far, with BTC 0.86% retesting the $63k level after US market open, following a rally to just over $64k in the early morning hours. Meanwhile, ETH 0.36% is still hovering just...