BitDigest April 17 · Issue #639

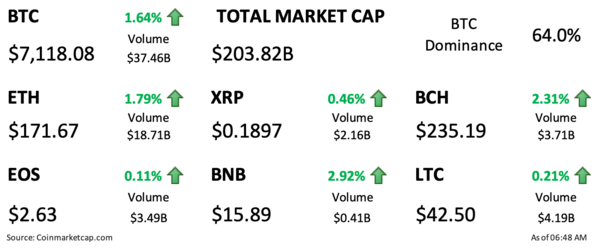

- Bitcoin (BTC) and ether (ETH) end week on high note with crypto marketcap at $200 billion

- Congress reintroduces digital dollar to facilitate payment of additional COVID-19 assistance payments

- Libra revises white paper introducing individual currency linked stablecoins and improved compliance framework

Still No Coverage on China

I wrote about my thoughts on the lack of news reports on the issuance of the Chinese DCEP yesterday so I won’t repeat myself, but there is still no media coverage on this monumental subject. Quoting the headline from this week’s Economist, “Is China Winning?”

Will US Crypto Companies Receive Government Assistance

I have spent a considerable amount of time during my work from home hiatus trying to assist our portfolio companies. In late March, these discussions turned to efforts to assist companies to receive money from the Small Business Association (SBA). We originally believed small companies (limited to less than 500 employees) could benefit from the Economic Injury Disaster Loan (EIDL) program, an SBA program that would lend up to $2 million at 4% over 30 years, or the Payroll Protection Program (PPP or “7a”) a program established to offer forgivable loans based on 2.5 times a company’s average monthly payroll – the loans are forgivable if the employee payroll figures remain constant in late June. At a time business was coming to a halt, these programs were viewed as a needed life line.

Unfortunately a month later, we have learned that the EIDL program has been capped at $15,000 per company and although $349 billion was allocated to the PPP, I do not know of a single company in the digital currency and blockchain business that has received any funds among the 100+ companies we are either invested in directly or through our portfolio companies. Today I am concerned because although most of these company have filed the necessary paperwork and many of them have been told they have been approved, 100% of the $349 billion has been allocated (approximately 2 million loans) and none of the companies I am watching has received a single dollar.

There is definitely a lesson learned in this experience. Most of the start-ups and early stage companies we invested in received their funding from VCs and private investors, not a local bank or credit union. When the time came for them to apply for the PPP loans they needed an approved SBA firm to process the application. We worked with our crypto partners to identify additional funding sources, but this delay may have been costly. Since they lacked an approved financial partner, they were unable to be the first in line and were not prioritized by the firms they were able to file through. Latest SBA statistics show there are 27.9 million small businesses; ≈2 million approved loans (7%) is not enough. We are still working to help our portfolio companies and rumors from Washington are that the amount of this program will be increased, but in the future we need to make sure all of our portfolio companies work to develop a banking relationship – as I was reminded this week, its better to fix your roof when its sunny than when its raining.

Bringing US Blockchain Trade Associations Together

The US digital currency and blockchain industry needs to have one voice spreading the crypto gospel. Today this is more important than ever. Unfortunately, there are too many organizations competing for time with congressional lawmakers and regulators.

Whether it’s the Chamber of Digital Commerce,Blockchain Association, Digital Dollar Project, The American Blockchain and Cryptocurrency Association, etc.. I have found they all touch on similar objectives but are doing things on their own without adequate discussion amongst their peers.

There was no better example of this competitiveness than during last summer’s biannual Congressional Fly-in and Education Day hosted by the Chamber of Digital Commerce. The Global Blockchain Business Council decided to hold their own congressional education summit the same day as the Chamber’s event.

I realize that these organizations represent the desires of their largest supporters, but as an industry everyone need to come together with one voice and message on the Hill and there is no better time than now to do this than now. The US needs to respond to the Chinese national blockchain and DCEP and the coffers of many different supporting members are shrinking as companies look to reduce their expenses. Let’s combine these dollars and focus on spreading the same message.

Next Chapter in Wright – Kleiman Case Coming

Today is the deadline for Craig Wright to provide the court documents proving he has access to the bitcoin in the so-called Tulip Trust. I highly doubt Wright will provide what the judge requested. What happens next?

The Headlines

New COVID-19 Assistance Package Brings Back Idea of Digital Dollar

Libra Reissues Whitepaper

House Finance Committee Believes Reissued Libra Did Not Address Bipartisan Concerns

Singapore Blockchain Bodies Merge to Form New Association

BitGo Acquires Lumina and Introduces Improved Portfolio Management and Tax Tools

Ant Financial Introduces SME Focused Blockchain

Amazon Bitcoin Facilitator, Purse.io to Shut Down

Market Data

Grayscale Releases Q1 Investment Report

Exchange, Custody and Product News

Discover all the ways you can earn crypto in one place

Binance Introduces Parallel Smart Contracts Blockchain and Venezuelan Bolivar P2P Trading

Anchorage to Offer Custody and Staking for Celo

Reports you may have missed

MARKET COMMENTARYA PRETTY SIZEABLE MISS IN TODAY'S CONSUMER SENTIMENT SURVEY REVERSED MOST OF THE GAINS EXPERIENCED IN THE CRYPTO MARKET OVER THE PAST 24 HOURS. Consumer sentiment came in at 67.4, well below market expectations of 77.2. 1Y inflation expectations came in at 3.5%, well above the market forecast of 3.2%. We saw the DXY 0.00% turn sharply higher on the move, and most risk assets sold off. BTC 0.65% fell from...

U.S. equity indices are showing modest gains today following weekly jobless claims coming in higher than expected, showing 231k versus 212k estimated, putting downward pressure on the DXY 0.00% (-0.21%) and rates. The $SPY has gained 0.36%, approaching the $520 mark, while the $QQQ has risen 0.14% to the $440. Crypto assets are showing larger gains, with BTC 0.65% (+1.57%) rising above $62k and ETH 0.86% (+1.05%) surpassing $3,000. The Render Networkâs mobile app, OctaneX, was featured in Appleâs keynote presentation earlier...

The crypto market declined overnight, with BTC 0.65% dropping from $63k to $61k, SOL 0.48% from $150 to $145, and ETH 0.86% dipping below the $3k mark once again. The likely cause of the drawdown was upward pressure on the DXY 0.00% and a lack of follow-through in flows. Among the few outperformers of the day were RUNE 6.75% , the native token of the cross-chain swapping protocol Thorchain, and Ethereum Classic (ETC 1.19% ), possibly driven by...

Rates are broadly lower again on Tuesday, with the US 10Y nearing 4.4%, down from 4.7% just under a week ago. Risk assets are on the rise, with both the $SPX and $QQQ showing gains today. Crypto performance is mixed so far, with BTC 0.65% retesting the $63k level after US market open, following a rally to just over $64k in the early morning hours. Meanwhile, ETH 0.86% is still hovering just...