Strong September End

Weekly Recap

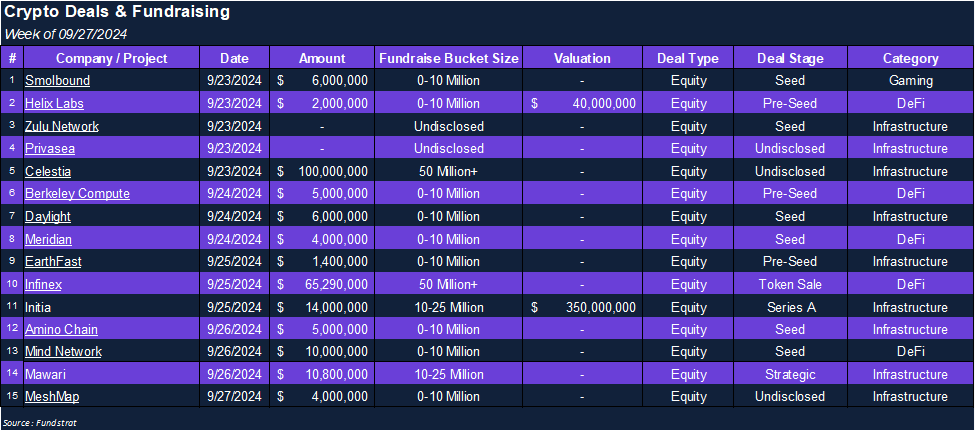

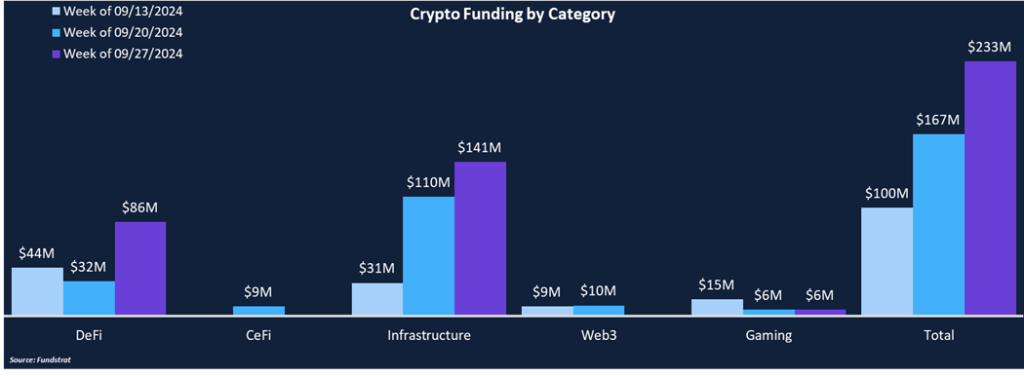

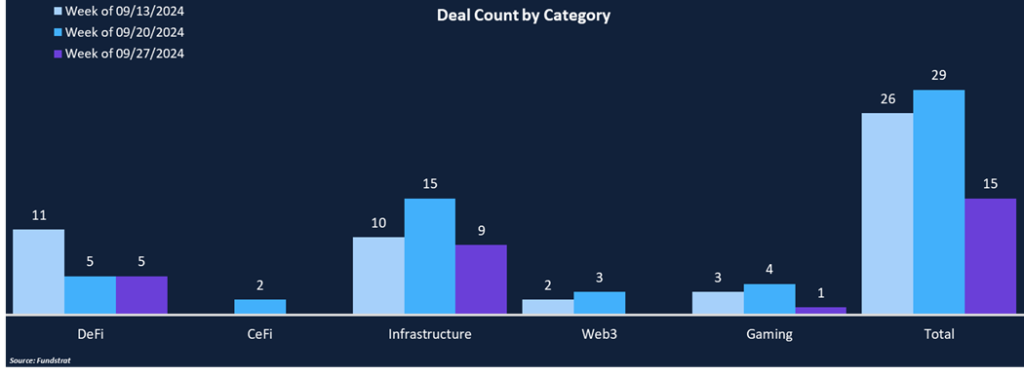

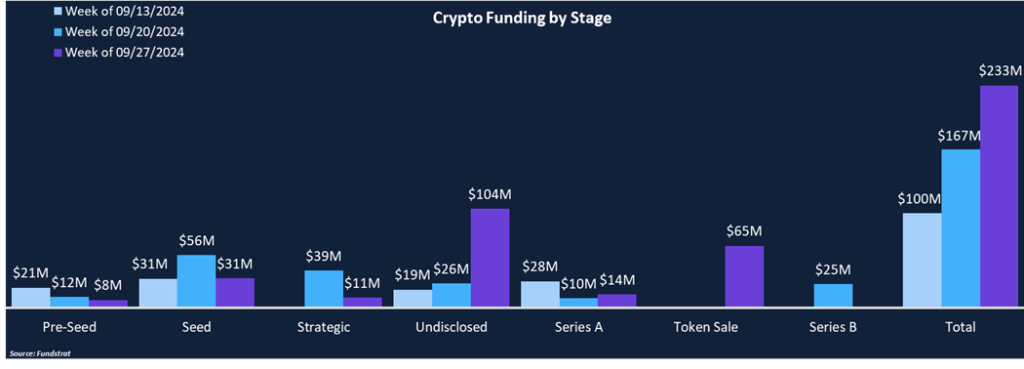

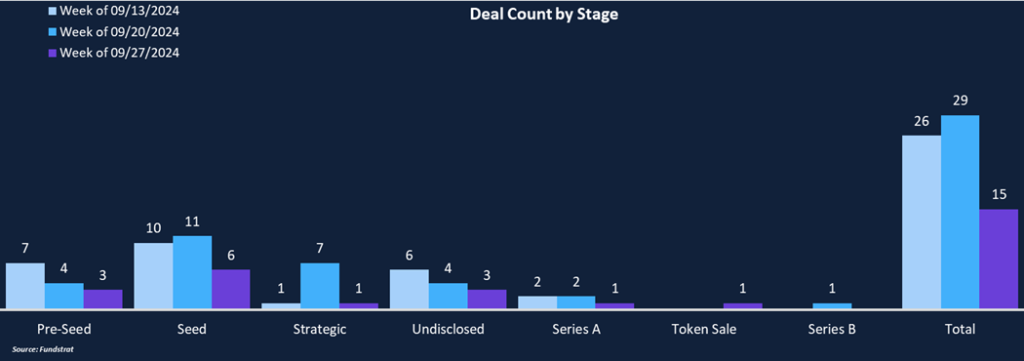

In the last full week of September, crypto funding rose 40% from $167 million to $233 million despite the deal count falling by almost half from 29 to 15 deals. This week was a relatively unique week for funding, 97% of funding and 93% of deals falling within the Infrastructure and DeFi categories. CeFi and Web3 saw no deal flow, and Gaming had just one deal for $6 million. The week’s largest deal was the Celestia Foundation (TIA -1.50% ), raising $100 million from Bain Capital Crypto, marking the largest investment round since May. From a deal stage perspective, seed rounds were the most popular, representing 40% of the deal count and comprising 13% of funding. There was one token sale completed by Infinex, which raised $65 million via its NFT patron sale.

Funding by Category

Funding by Stage

Deal of the Week

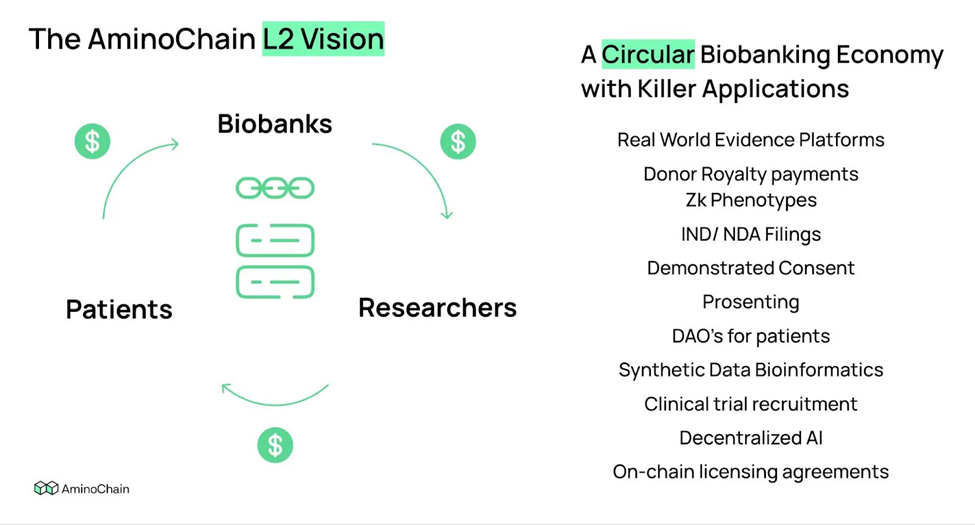

Amino Chain, a layer-2 network and decentralized biobank, raised $5 million in a Seed round led by a16z, representing a16z’s first investment into the decentralized science (deSci) sector. The fresh capital brings Amino Chain’s total funding to $7 million. Amino Chain’s layer-2 network aims to connect worldwide inventories of bio-sample and research data, powering the next generation of pre-clinical research economies.

Why is This Deal of the Week?

Every year, thousands of people donate blood, saliva, or tissue samples to medical communities to advance research and support the development of life-saving medicines. The current structure of medical data collection is a one-way street. Patients are asked for consent to donate their records or samples to research facilities, and they immediately lose insight into where their data is going and whether or not it’s shared beyond what they consented to. Consent rates at major institutions have become a problem, dropping towards 25% in some instances. Beyond the lack of data provenance for users, medical institutions lack insight into what samples may be out there and suffer from slow processing times, putting a drag on improving patient outcomes. On average, it takes eight weeks for researchers to find the samples they are looking for, followed by signing licensing agreements, and shipping.

Amino Chain is striving to revolutionize the medical industry by improving ownership, transparency, and consent in medical data collection while preserving patient privacy. Amino Chain’s nodes will integrate with medical institutions’ tech stacks to keep data custody within institutional servers but make it available in a standardized interoperable format on-chain. Web3 developers can then build patient-centric applications and source data directly from medical companies.

Amino nodes integrate with medical institutions legacy technology stacks, allowing data to remain on institutional servers. Amino nodes standardize medical data, making it interoperable and composable across the Amino Chain network, allowing developers to build patient-centric applications leveraging legitimate medical data.

The first application built on Amino Chain is the Specimen Center, a peer-to-peer marketplace for biomedical samples. The Specimen Center will allow medical institutions to unify sample procurement from end-to-end. In a single platform medical professionals can search for samples, reach agreements, and handle payments. There are numerous other use cases that Amino Chain can support including DAOs for patients, clinical trial recruitment, and on-chain licensing agreements. Amino Chain hopes to grow to become the world’s first HIPAA and GDPR compliant blockchain for the entire healthcare industry.

Selected Deals

Infinex, a DeFi abstraction platform, raised $65.3 million in a token sale which included participation from Wintermute, Framework Ventures, Solana Ventures, Variant, and others. Infinex conducted a four-wave sale of “patron NFTs, ” entitling holders to future tokens. They sold 41.25k NFTs, raising $65 million in 14 days. Purchase options included three tiers: a liquid option upon TGE, a 12-month linear vesting option, and a 12-month lock followed by 24-month linear vesting. Infinex is built to optimize the user experience, allowing users to transact on five EVM chains and Solana without bridging or gas. The Infinex app is a one-stop-shop for DeFi users that vastly improves the user experience while remaining non-custodial and protecting users’ funds. Infinex accounts are secured with a passkey and locked with biometrics. Users only need their mobile device to access their accounts and can recover them without a seed phrase. Infinex is striving to disintermediate centralized digital asset service as the primary point of interaction for crypto users.

Initia, a rollup aggregation layer, raised $14 million in a Series A round led by Theory Ventures, with participation from Delphi Ventures and Hack VC. The funding round was structured as a SAFE agreement with token warrants, bringing Initita’s FDV to $350 million. Initia completed a $7.5 million seed round earlier this year and a pre-seed round from Binance Labs last October. Initia is developing an L1 and an interoperability solution for interwoven optimistic rollups. Initia L1 is designed to work in conjunction with other L2’s as it believes in a rollup-centric future. Rollups built on Initia’s tech stack are EVM compatible, MoveVM compatible, and wasmVM compatible, positioning Initia to be interoperable with almost any blockchain ecosystem. Initia currently has 12 projects building their L2s on Initia’s tech stack. Initia’s public testnet ended last month with over 125k transactions and 3 million unique addresses. Initia’s token and mainnet are expected to launch before the year ends.

Grass, a decentralized internet platform, raised an undisclosed amount in a Series A round led by Hack VC with participation from Polychain Capital, Delphi Digital, Brevan Howard Digital, and Lattice. Grass allows users to lend their unused internet to the protocol, which scrapes data for AI training. Grass democratizes open-source contributions to AI models by rewarding users who provide unused internet services. Grass nodes also verify where metadata is scraped from and permanently store it in every dataset so developers have transparency into what/where they are training their models. Grass is in its incentivized testnet phase and has over 2 million user-run nodes, and is scraping petabytes of data for AI models.