Mining Companies May Be Catching a Bid

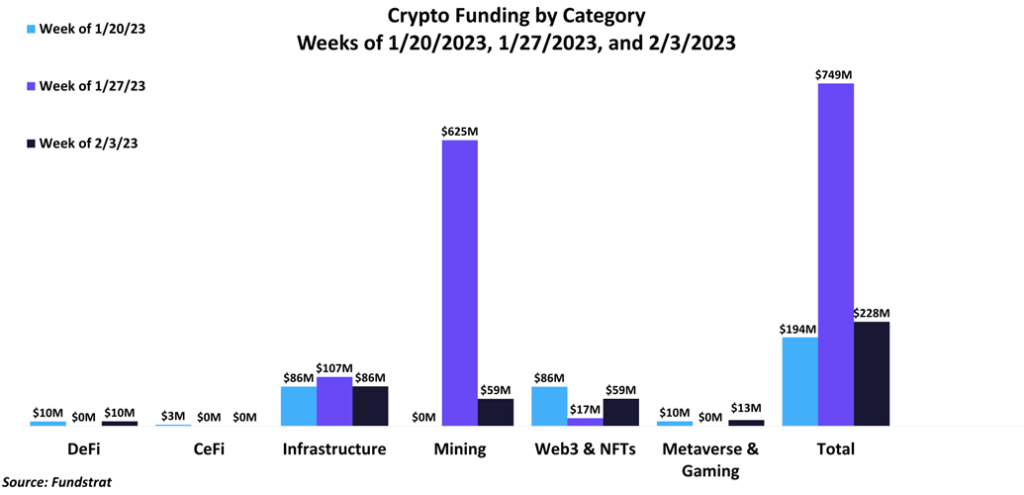

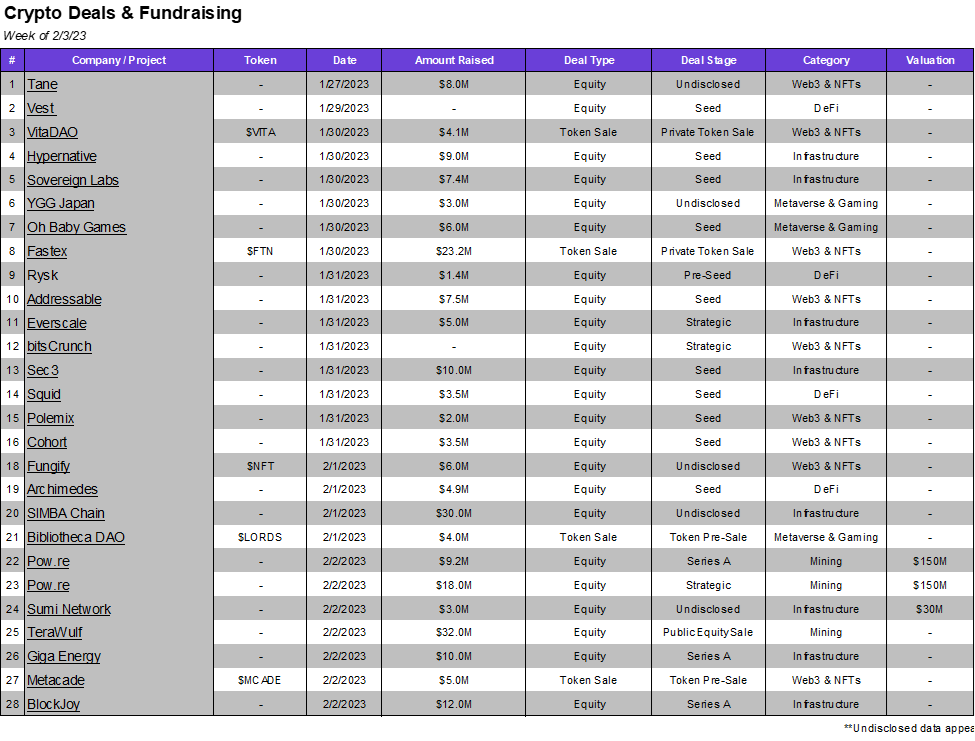

After an impressive $749 million was raised last week, funding totals came back down to earth to $228 million. Zero-carbon Bitcoin mining company TeraWulf completed a $32 million public equity sale, representing the largest deal of the week. Additionally, mining company Pow.re completed both a Series A and Strategic fundraising round this week, valuing the company at $150 million. The uptick in mining deals over the last two weeks may be indicating an increased appetite for mining exposure following decreased demand over the past year.

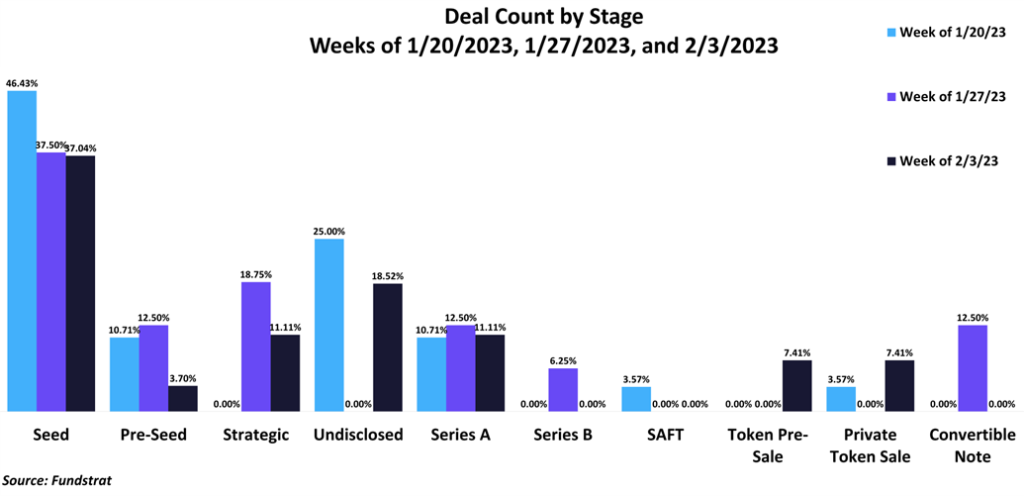

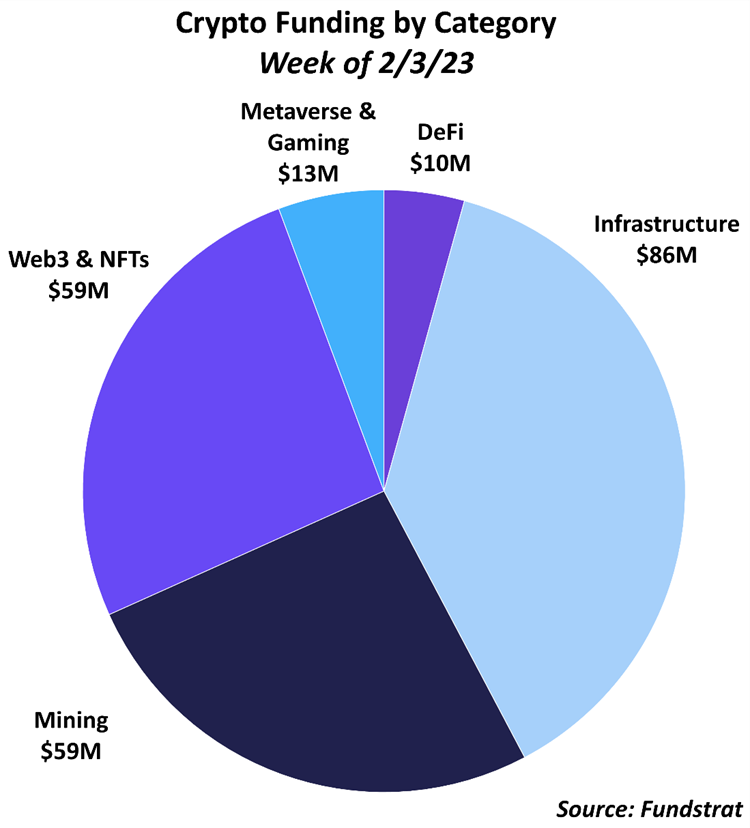

Although the total funding amount decreased week over week, the number of deals completed rose 69%, totaling 27. Most of the deal count was concentrated in the Infrastructure and Web3 & Gaming categories which accounted for 64% of total fundraising and 63% of total deals. In terms of deal stages, 37% of deals were seed rounds while Series A and Strategic rounds both represented 11% of the total count.

Deal of the Week

Crypto security startup, Hypernative, raised $9M in seed funding in a round led by boldstart ventures and IBI tech fund, with strategic investments from Blockdaemon, Borderless, and CMT Digital, among others. Hypernative was founded by Sagie and Dan Caspie, who previously worked at IBM, Google, and Microsoft and have backgrounds in cloud infrastructure, large-scale distributed systems, and security. Hypernative aims to prevent crypto exploits and secure digital assets. Hypernative’s product monitors on and off-chain data sources to predict threats before they occur. It can monitor protocols, contracts, and wallets and provides an interface where users can see all potential risks.

Why is this the Deal of the Week

Hacks and other security breaches have been an issue in crypto since its inception but have gotten increasingly problematic in the past two years as more money has come into the ecosystem. 2022 was the largest year ever for hacking, with $3.8 billion stolen, up from $500M in 2020 and $3.3B in 2021. Crypto has used security audits to attempt to prevent these hacks, but these audits fail to cover all the bases. They don’t account for operational mistakes, private key theft, or 3rd party vulnerabilities, and also have had plenty of “misses” in the past of bugs and possible exploits. Hypernative’s founders saw this gap in the market between the significant amount of digital assets on blockchains and the lack of useful tools to protect those assets. Hypernative seeks to fill that void and is targeting a broad potential client base, including traders, hedge funds, market makers, blockchains, and protocols. Hypernative’s founders say that they have helped to save tens of millions of dollars for its users.

Selected Deals

Vest is a decentralized exchange aiming to increase the standard for trading perpetual futures. The platform plans to accomplish this by providing access to attractive trading opportunities across various markets. The company has secured an undisclosed amount of funding through its seed round. The round included investor participation from QCP Capital, Big Brain Holdings, Jane Street, Infinity Ventures Crypto, and others.

Giga Energy is an infrastructure-based platform that focuses on manufacturing natural gas generators designed to mine Bitcoin (BTC). The platform also generates revenue from selling rack space and its mining operation. The company has secured $10M in funding through its Series A round from an undisclosed group of investors. Giga Energy intends to use the capital raised to grow its operations in the United States and expand internationally.

Squid is a decentralized finance (DeFi) based platform aiming to provide its users with a reliable source of liquidity. The platform plans to accomplish this by serving as a router that connects decentralized exchange liquidity across chains. The company has secured $3.5M in funding through its seed round led by North Island Ventures. In addition, the funding round included investor participation from Athabasca Capital, Distributed Global, Node Capital, Fabric Ventures, and others.

Pow.re is a mining-based platform that utilizes hydroelectric power to mine digital assets. The company has secured $9.2M in funding through its Series A round at a $150M valuation. Haru Invest led the round with investor participation from RDP Capital and Trinito. In addition, the firm secured $18M in funding through a strategic round also from Haru Invest. Pow.re intends to use the capital raised for expanding its mining operations into Paraguay.

VitaDAO (VITA) is a decentralized autonomous organization aiming to fund research projects that focus on longevity science. The platform has already backed Turn Biotechnologies, a firm created at Stanford University that develops mRNA medicines. In addition, the company has secured $4.1M in funding through a private token sale. The funding round included investor participation from Pfizer Ventures, L1 Digital, Shine Capital, and others. VitaDAO intends to use the capital raised towards funding additional research projects and creating a biotech startup.